California Medicare Options - Step by Step Guide to California Medicare

Step by Step Guide to Medicare in California in Six Pieces

You're new to Medicare and you need a straight-forward guide so you

can wrap your head around the entire thing.

Hello!

We're going to take 1000's of conversations we've had over 25+ years about entering the world of Medicare and condense it down so you can get up and running fast. And affordably!

Here's our credentials first:

No pushy sales...we'll present the options and how's and when's.

That's it. That's the deal.

Hopefully, you'll work with us but either way, you're going to have a really good understanding of this brave new world (with lots of letters and codes!!)

Here's the game plan:

- What is Medicare and what does it cover

- How and when to enroll - a

planned attack

- Advantage plans versus Medicare supplements (or medigap)

- Part D for medication

- How to quote your Medicare options

- How to enroll in a plan to work around Medicare

Let's get started!

What is Medicare and what does it cover

Don't let all the jargon confuse you...Medicare is actually pretty simple.

Traditional medicare (as it's called) is comprised of two pieces:

- Part A - hospital or facility - usually automatic from paying all your

life through payroll

- Part B - doctor - requires separate enrollment and monthly premium which is based on prior income

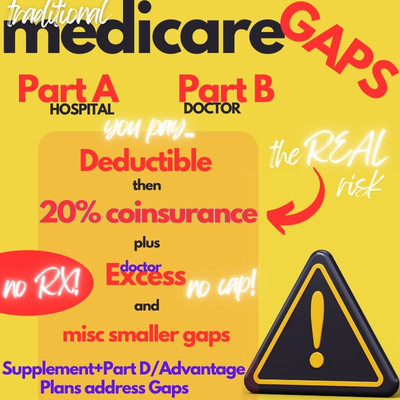

At its core, Medicare works like an 80/20 plan with deductibles built in for Part A and B (around $1600 and $230 respectively...goes up a bit each year).

Once these deductibles are met, you then pay 20% of the charges for covered benefits, in-network.

That's the real risk of Medicare by itself (more on that here).

You don't want to be on the hook for 20% of $100K! Do you want to write a check for $20,000?

Many people are like, "Well I'm healthy. Never go to the doctors".

That's fine but 65+ is the absolute worse time to assume this continues...especially after Covid.

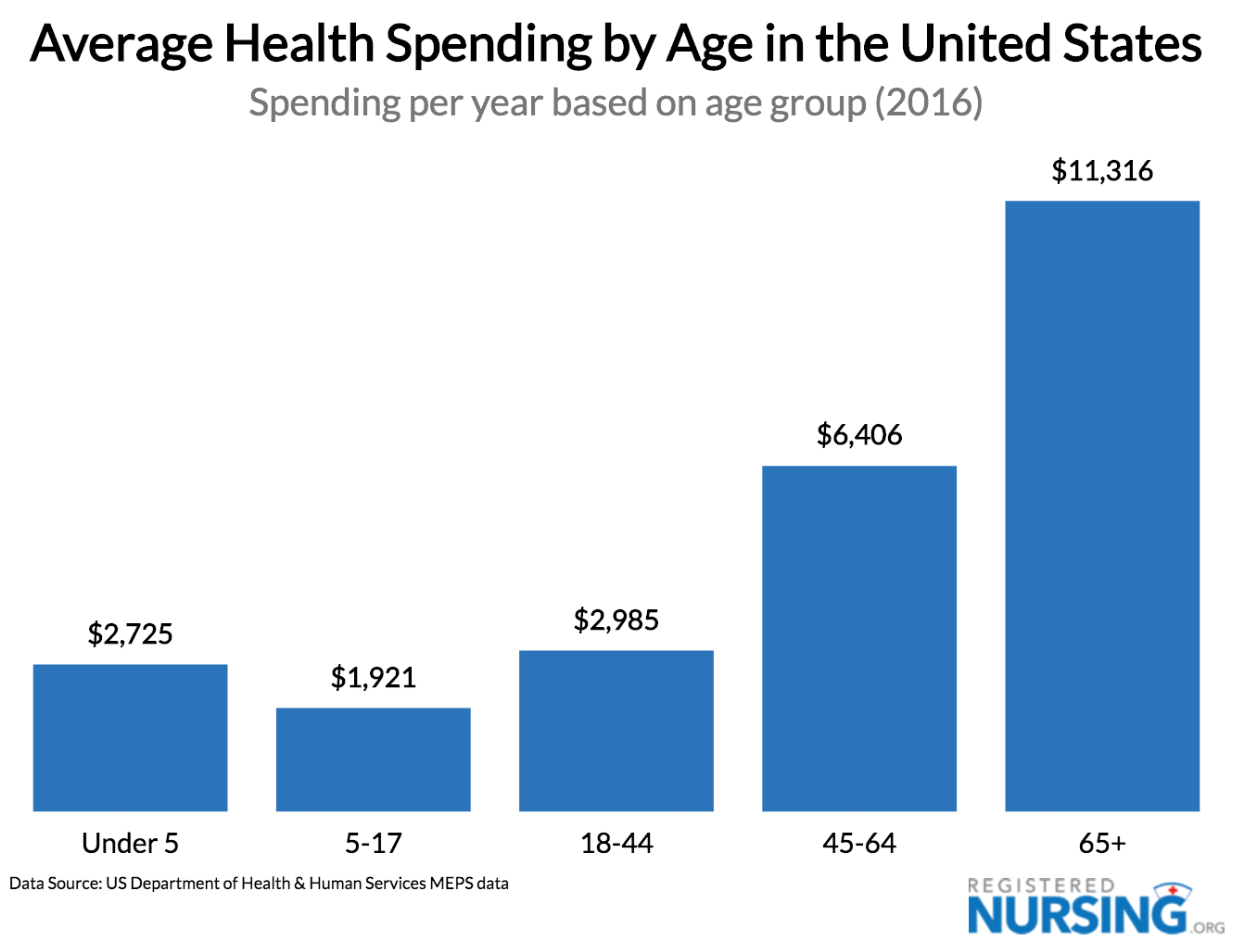

First there's the age piece:

Then, there's the healthcare trajectory:

We had a client with surprise (he was healthy) open heart surgery.

That bill was $5 million; $250K for each hour his heart was offline.

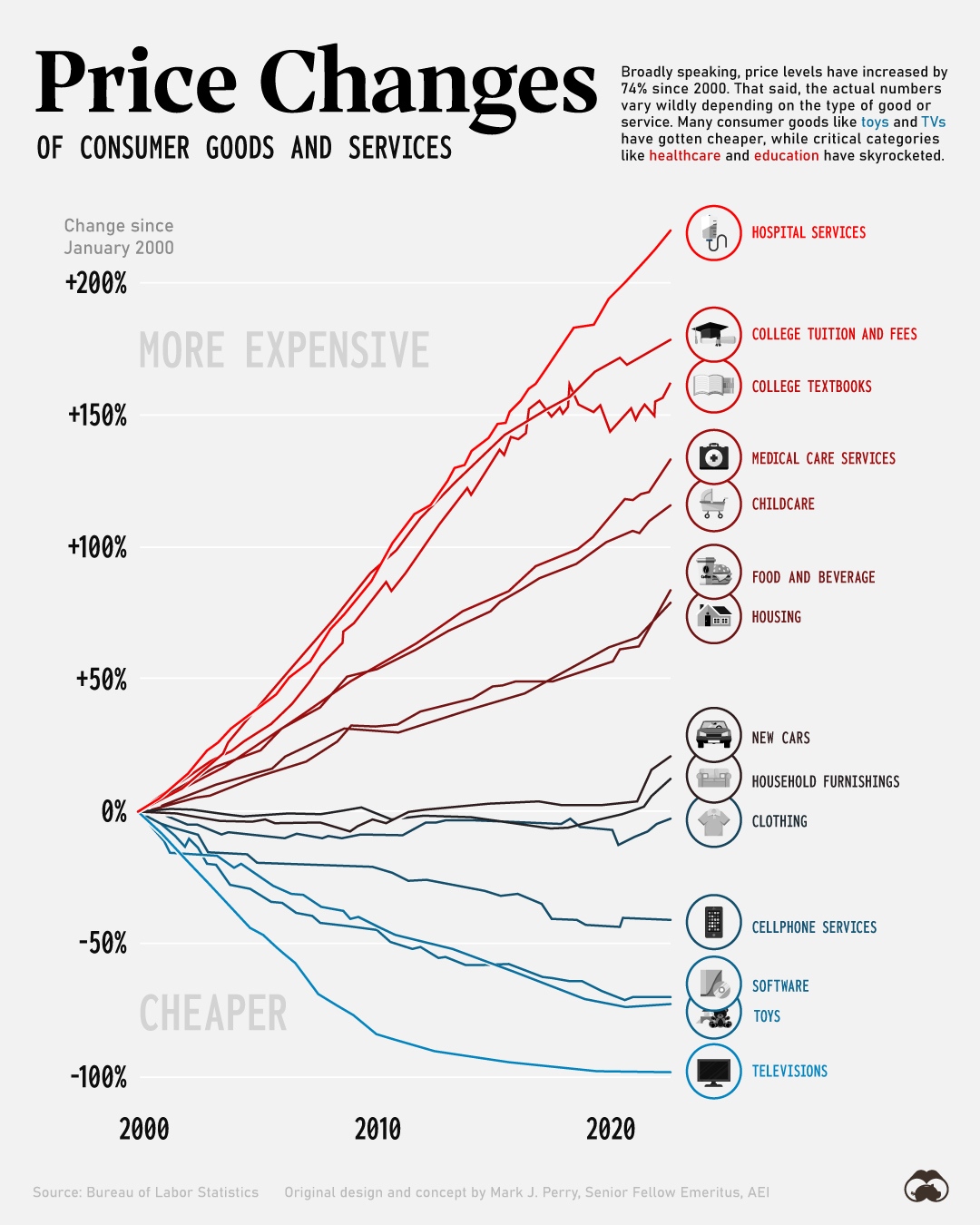

People just don't understand how quickly the bills can go up these days...especially in a hospital.

So...we want the 20% capped at some level. We'll look at the two ways

to do that (some have zero premium!!)

First, what's the timing of all this?

How and when to enroll - a planned attack

We'll assume you're new to Medicare.

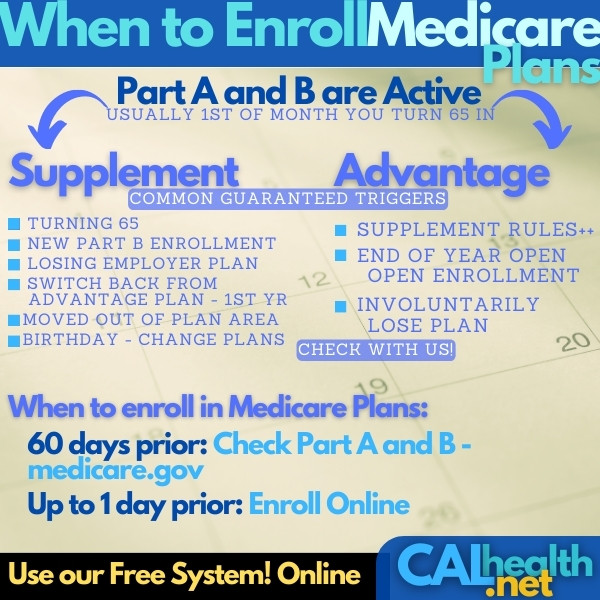

This generally means you're just getting your Part B setup after turning age 65 or being older and losing employer health coverage.

Let's say you're on Covered Ca and turning 65 on May 29th (the best birthday EVER!).

You'll be eligible for Part A and B on May 1st. It's always the 1st of the month that you turn 65 in.

Ideally, you would do the following:

- Set up your Part A and B (the latter requires you to "opt-in") around 2-3

months prior here

- Get your MIB# (ID# tied to your Medicare account)

- Apply for plan to "wrap" medicare with Advantage or

Medigap (remember..the uncapped 20% above) around

1 month before May 1st.

- Apply for Part D (most Advantage plans already include Part D) around the same time.

Here's the net net...

You need your Part A and B active in order to apply for the other coverages! We need a Part A & B effective date and this determines when the other plans can start.

Let's say you're reading this mid to late April for the above situation!

No worries...we can help you get it all dialed in before May 1st. The Part A and B through Medicare is really the slowest part.

Everything else can be done in a day and we just need to apply before the 1st of the month (May 1st in our example).

Now, if you're losing employer coverage, it's similar.

Let's say you're losing employer coverage April 30th. Get your Part A and B active right away. Apply for Advantage or Medigap/Part D coverage before May 1st.

The big takeaway is that we need our Medicare Part A and B active before doing anything else!

Okay...Medicare's all set and we have our Part A and B effective dates and MIB#. So then what?

Advantage plans versus Medicare supplements (or medigap)

This is really the big decision. We've written about it extensively at:

-

Medicare supplements versus Advantage plans

- How to pick the best

Medicare plan

- What's the tradeoff between Advantage plans and Supplements

Lots of deeper dives there but let's boil it down for people similar

to our countless conversations with new Medicare enrollees.

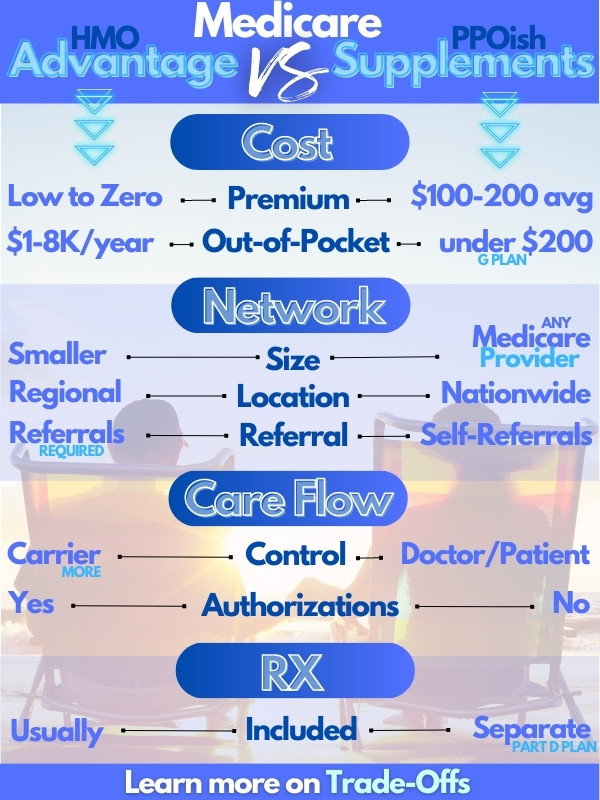

- Advantage plans (also called Part C) work like HMOs

- Medicare supplements (also called medigap) work like PPOs

What's the practical effect of this?

Quite a bit!

Let's give a summary level review on these opposing aspects:

- Cost comparison

- Access to care

First, cost.

- Advantage plans generally have zero monthly premium BUT you share more of the cost when sick or hurt with an "out of pocket max"

- Medigap plans generally have a higher monthly premium BUT you may have very little out of pocket when sick or hurt.

There are lots of brokers and carriers showcasing (pushing??) the Advantage plan zero premium but you have to understand the backend.

Remember the medical cost trajectory above??

Now in certain areas (greater Los Angeles), Advantage plans can have max's (your exposure for big bills) around $800/year which isn't bad.

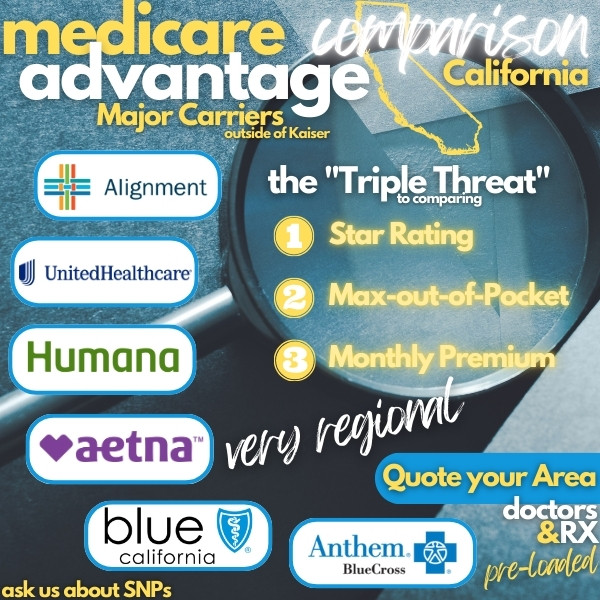

This fits in with our Triple Threat calcualation:

In most other areas, the max's may be a few thousand per year!

Not so great versus supplements. We looked at how to

compare the total

potential cost between both options.

We can help you compare the cost structure for your situation. Just need date of birth and zip code at help@calhealth.net

There's zero cost for our assistance and you saw our reviews above.

So...it's a trade-off of pay now a defined amount (Medigap) versus pay as services are needed (Advantage).

They both will cap the 20% coinsurance with Traditional Medicare and that's really what we're after.

Now, the 2nd piece - access to care.

This is where people really usually have their mind made up with HMO versus PPO (or Advantage versus Medigap).

With Medigap, you can see any Medicare provider anywhere in the US. You refer yourself out and most decision are made between you and your doctor (Medicare still has to approve).

With an Advantage plan, you have a defined list of providers and generally need a primary care doctor or medical group that manages care.

Decisions on course of care and who you can see are directed by the carrier! That's just a function of HMO and Advantage plans are HMO (most of them).

People usually are fine with HMO's or they can't stand them. The Medicare flavor of this is no different.

So...it's cost versus control over care. We're happy to walk through how this actually shows itself day-to-day or run the quotes for you here:

We've looked at switching plans here:

We haven't mentioned medication yet. One final "Part".

Part D for medication

First, most Advantage plans include Part D for medication and we don't recommend the few plans that are missing this benefit unless you're able to get RX coverage somewhere else (VA, etc)

If you go with a Medigap or supplement plan, you will likely need a Part D as well.

This is a separate plan that you choose and pay a monthly premium for.

We recommend getting at least a "placeholder" plan when eligible since there's a 1%/month increasing penalty for not enrolling when available.

These plans can be under $10/month and they provide some level of catastrophic medication coverage.

You can run your Part D quote here.

Again, this will likely be included in your Advantage plan (look for MAPD in the title) and the quotes are available here for both.

Learn more about our Top Tips to Save on Part D for medication here.

One note...the carrier for your Part D can and probably will be different than your medigap carrier.

That's pretty typical.

So...how do we size up all the rates?

How to quote your Medicare options

First, you can run your personalize quote (free service by the way) here:

You'll receive a separate quoting link for Advantage and Part D

shortly after.

Make sure to select the Eff date your Part A and B are active since the rates can be much higher for people younger than age 65.

For Advantage plans, focus on:

- Monthly premium

- Out of pocket max

- Star Rating

We can help do all this legwork for you since we work with some of

the biggest carriers.

Check out how to compare Advantage plans for more detail. Of course, reach out to us at help@calhealth.net

UnitedHealthcare® has been a leader in this space with the broadest network (remember...that's one of the big trade-offs with HMOs).

For Medigap plans, focus on the G or N plan:

- G plan - most popular and comprehensive plan on the medigap market

currently

- N plan - adds in copays for office visits/urgent care; 2nd most popular plan

There's the A plan or high deductible G plan for more catastrophic options to keep your pricing down.

They all use the same network and medigap plans are standardized by law - same benefits and network between carriers.

We looked at how to compare medigap plans and what medigap plans cover.

Anthem, Blue Shield Shield, and UnitedHealthcare® have been dominant for medigap pricing for years now.

Again, we can quote all of this for you and even compare the options at help@calhealth.net . We're happy with any of the big carriers.

So...you found options you like. Then what?

How to enroll in a plan to work around Medicare

So...this is actually not too bad and we can hand-hold all along the way with no cost to you.

Run your quote or email us for application options at help@calhealth.net

Many carriers have online application options now and we'll get you the right link for the carrier/plan of choice. Advantage and Part D enrollment is all online here!

Of course, we still have paper apps which we can get to you and secured emails or faxes are just a click away.

Remember, we want our Part A and B active with an MIB# before enrolling.

Ideally, we apply prior to the 1st of the month you want the policy active.

There can be special enrollment periods during which we can qualify regardless of health especially after you start your new Part B with Medicare.

Loss of employer coverage is another big trigger but not the only one.

We can technically apply for medigap plans any time of the year but outside the special enrollment windows, it may be subject to health. We can use the Birthday rule to avoid this if already enrolled in medigap.

Advantage plans and Part D have an annual open enrollment at the end of each year where we can apply, disenroll, or switch plans regardless of health.

Again, reach out to us with your situation, what you want to accomplish, your zip code and date of birth.

We'll get to work!

This is 90% of the details...a cheat sheet if you will.

We're here for the other 10% questions that arise! No cost for our assistance and look at our Google reviews:

Have questions? Schedule a quick chat with a licensed professional (Reviews above!!)

We work with some of the biggest carriers and plans available.