California Medicare Options - What's wrong with traditional Medicare alone

What's Wrong with Medicare by Itself?

We get the question all the time...

Is there a downside to just getting traditional Medicare and nothing else?

Medicare is generally new to most people. With it comes new rules, benefits, and...pitfalls.

First, let's establish that we're big fans of insuring the big bill only. You'll see lots of content to that effect for our pre-65 crowd with bronze plans and even high deductible HSAs.

I've personally had an HSA since they were called MSAs so being cost effective is definitely part of our bent.

And if you're wondering if we're just pushing some Medicare plan, here are our credentials:

As long as we cap our exposure for the big bill!

After all, that's the whole reason for health insurance anyway (and not the $10 copay).

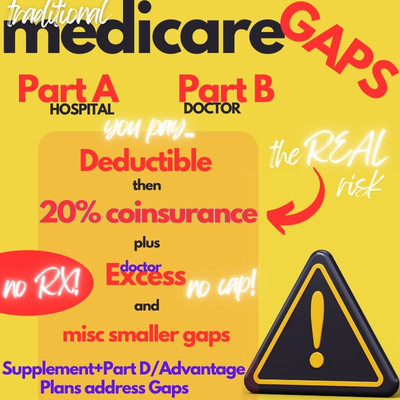

The problem with just having Medicare is that we're exposed to some pretty big risks at the worst possible time.

It's like canceling your home insurance when there's a hurricane approaching.

We'll explain why below and we'll also look at some cost effect ways to manage this deep exposure both on the Advantage side and the medigap side.

Of course, Part D for medication is a whole other question and we'll explain the pros and cons of just keeping with tranditional Medicare.

Here are the topics we'll cover:

- What is just having traditional Medicare alone

- The big risk with only

Medicare and a question of timing

- Medicare Advantage versus traditional

Medicare only

- Medicare supplements versus traditional Medicare only

- Part D versus traditional Medicare only

- How to compare options versus traditinoal Medicare

Let's get started!

What is just having traditional Medicare alone

First, a lay of the land.

There are two core parts to traditional Medicare:

- Part A - for hospital and facility costs primarily

- Part B - for doctor and office visit costs

Various little benefits revolve around these two but really, this is where the cost healthcare lies.

For medication, you have to buy a separate Part D plan (or an Advantage plan that has it included).

Traditional medicare works likes an 80/20 plan after deductibles are met (one for for Part A and one for Part B).

So...for a hospital visit, you'll pay the Part A deductible (goes up a little each year) and then start paying 20%.

Let's flip this and then look at what we're on the hook for...the "gaps" in traditional Medicare.

Now..you may be asking...

"Okay....I pay the 20% but till when??"

Exactly. There's no cap to this 20%.

Let's now make this practical for the "I never get sick crowd" and see why there very inexpensive ways to address this risk.

The big risk with only Medicare and a question of timing

So..we have no cap to the 20% we're paying.

A $1000 MRI, that's $200 you might pay after the deductible.

A $30K ACL repair, that's $6000 you might pay.

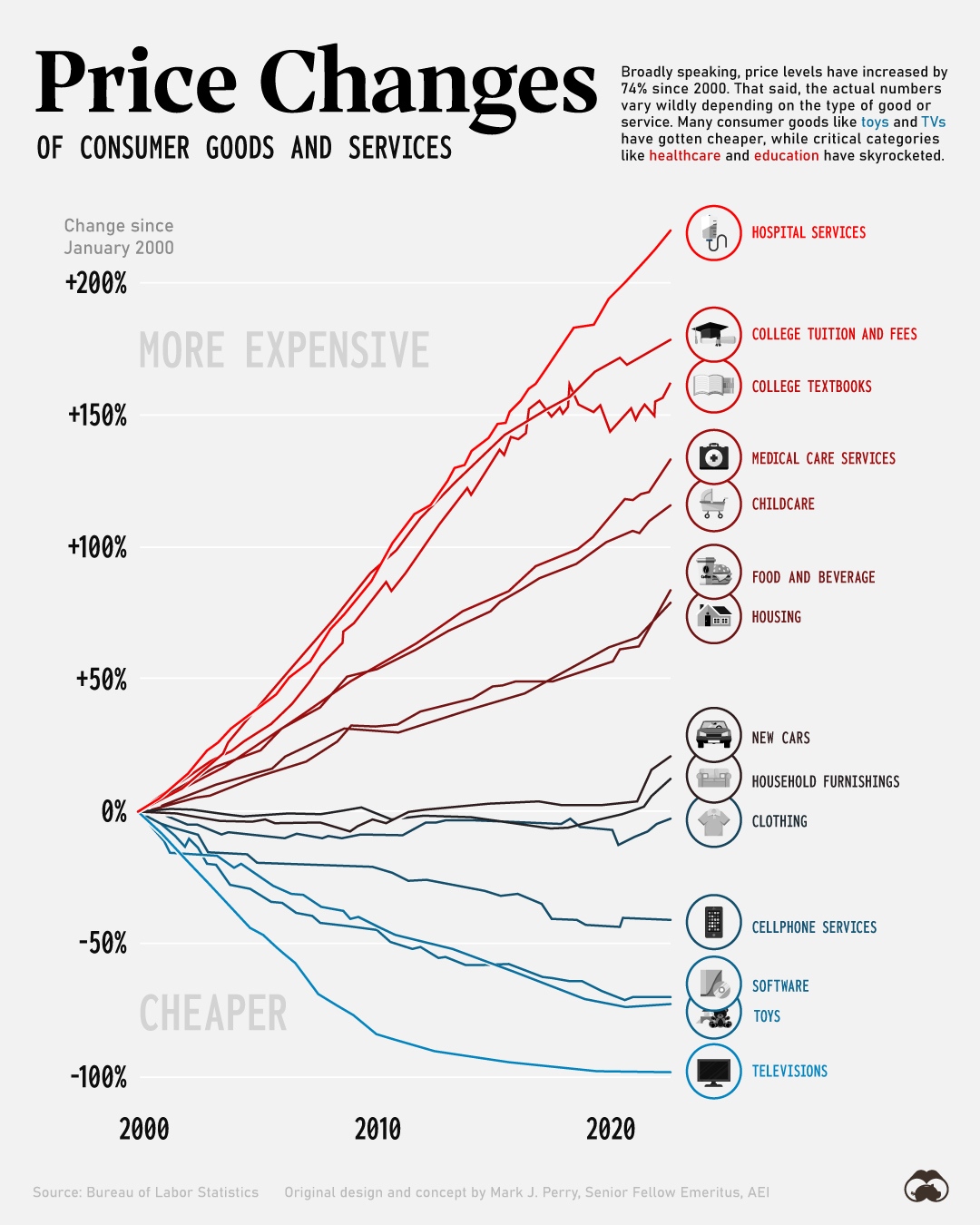

Here's the problem...the cost of healthcare..especially in a facility setting, is through the roof!

In fact, healthcare is outpacing every other expense in medical inflation except for...higher education.

Most people are completely disconnected from this cost structure unless they've had run-ins lately with hospital care.

After covid, that's more likely but $100k, $500K, and even $1M in costs are not unheard of!

- Knee or hip replacment (if they go well). $100K+

- Cancer treatment?

$250K+

- Accidents? $500K+

We had a client who had open heart surgery (totally unexpected) and it was...wait for it...

$5 Million.

$250K for each hour that machines kept him alive while his heart was offline.

We get the calls all the time from people who are both insured with us (whew!!!) or who are desparately seeking insurance (really difficult conversations).

We're not trying to "scare you straight" (old addiction lingo) but just let you know what the current state of healthcare cost is.

Ask a local hospital or just google cost for a given surgery.

That's one aspect but the other is about probability and timing.

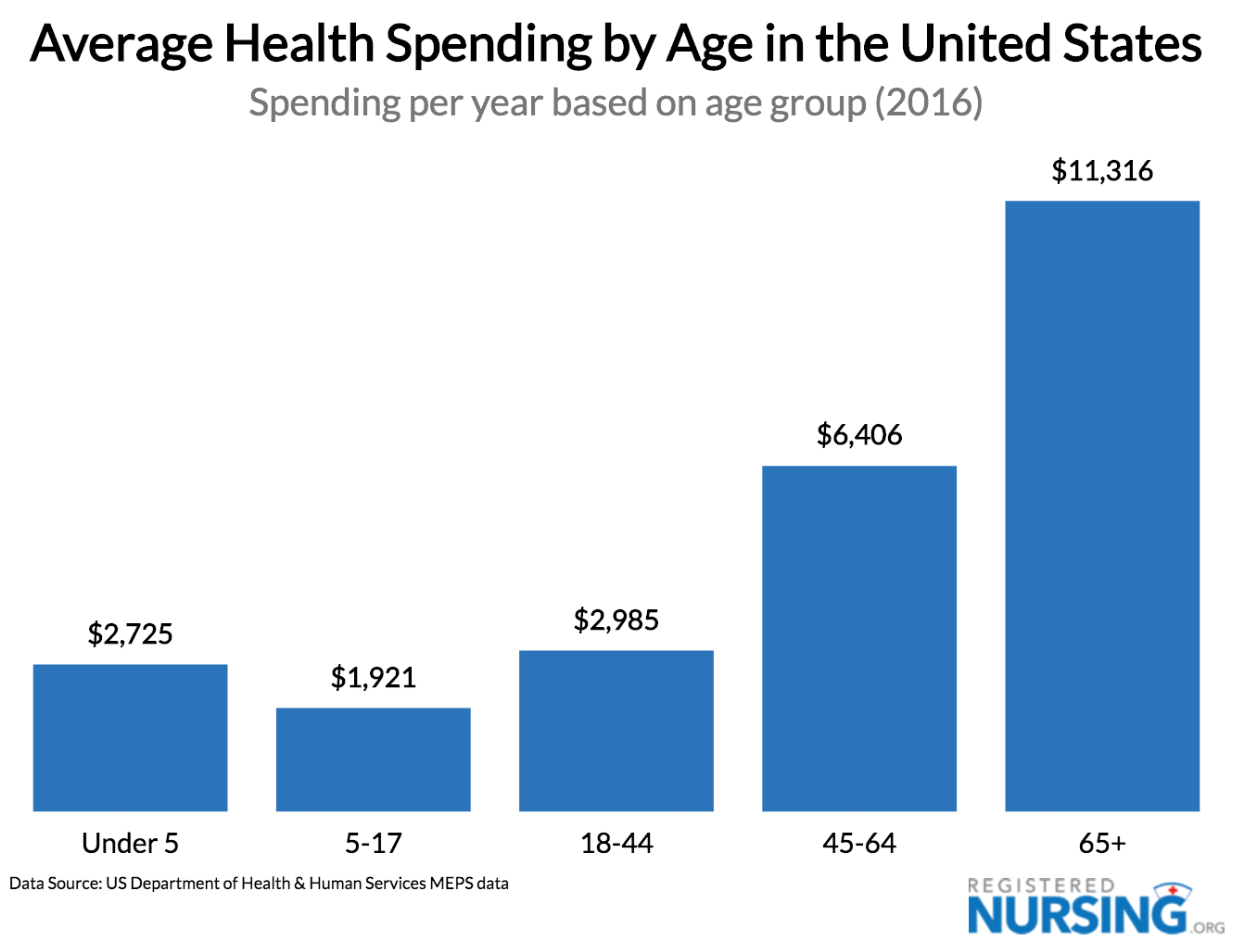

- With every decade of your life, health care costs double on average.

- Age 65+ is by far the most expensive time to insure

- 90% of healthcare costs are in the last 1 year of life

Medicare time is a horrible time to take the "I'm never going to need it" bet.

It's like Black Jack where you have to hit on 16 every time.

The main reason to go with Medicare alone is to save money but the sheer odds of even pretty simple health care costs (let's say $1000 annually - an MRI or ER visit) is completely stacked against you.

So...if the goal is to save money and cap that backend risk (the 20%), what are our options?

We have a few.

Medicare Advantage versus traditional Medicare only

Medicare Advantage plans are essentially HMO options (most of them) with these key features towards our goal:

- Must at least cover what core Medicare covers

- Must cap the out of pocket

exposure (called Max out-of-pocket)

- Has a network of providers that must

be used

- May include Part D for medication (we strongly recommend these

options)

- Can have zero or low monthly premiums

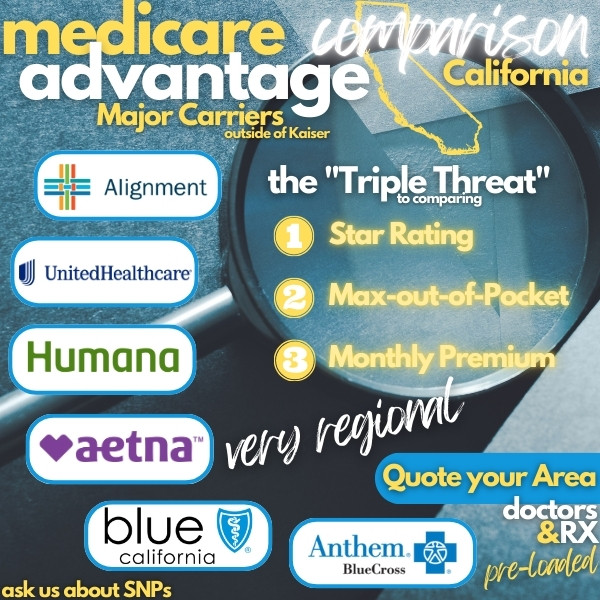

In more populous areas, it's pretty common to find plans with our triple threat:

- Zero cost premium

- Max out of pocket under $1000

- Star ratings of 4 or more (out of 5)

Learn more at our Advantage Plan insider's guide or how to compare Advantage plans.

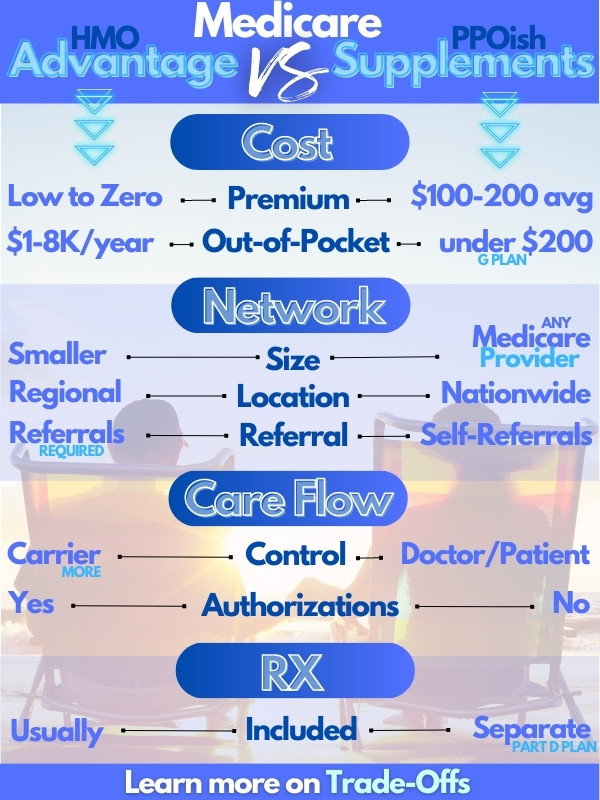

The trade-off (we believe in showing both sides) is that you have a network to stay within and healthcare costs will be more managed (the HMO piece).

If you absolutely want zero or low monthly premium, this at least caps the 20% and we would take addressing that risk versus some control on health care costs.

You can always go back to traditional medicare at the end of each year during open enrollment anyway (worst case).

Run your Advantage quote below with your doctor/RX info taken into account! You can also see Supplements and Part D:

Now...if you don't want any restrictions on networks and how health care decisions are managed, there are medigap plans.

Let's look at the lower cost options there.

Medicare supplements versus traditional Medicare only

Medicare supplments are closer to PPO options in that:

- You can see any provider that accepts Medicare

- Medical decisions are

made between you and providers (although Medicare still has to approve)

- Medicare dictates what's allowed and supplment carrier pays according to

your plan choice

- Will not include Part D for medication

- Costs range from under $100 to a few $100/month as we get older

The most popular plan is the G plan because it fills in all the major holes of Medicare except for the part B deductible (over $200/annually ).

For a 65 year old, a G plan may run around $130-150 with the best priced carriers. Run your quote here.

There are lower priced plans though that still cap our 20% exposure!

We recommend looking at:

- High deductible G plans - like a G plan with a separate dedutible built

in for "gaps" in Medicare

- K and L Plan - adds in a cap for 20% exposure

- A plan - Just the part A 20%

Of the three, we're probably biggest fans of the high deductible G plan if available since the true exposure is much lower for large bills and that's our goal.

To learn how Medicare supplements compare to Advantage plans or how to pick the best medicare supplement.

And the comparison??

One last stop. RX.

Part D versus traditional Medicare only

We remember when the allergy medications just exploded the cost of health insurance.

Claritin, Allegra, and Zyrtec.

They were roughly $80/month but this was unhead of back then and millions upon millions of people suddenly were getting prescriptions for them.

Then came the rhuematoid arthritis meds at $45K/year.

Now we're looking at potential gene editing drugs at $1M and there's no alternative!

So...you have to address this potential risk as well.

Part D is a separate plan that covers RX and it has a very specific set of benefit rules but the one we're interested in is the Out of pocket max!

When you get hit with large bills (or death by a thousand cuts) for medication costs.

Here's the deal...

If we don't get a part D plan when we're eligible (Part A and/or Part B effective), there can be a 1% penalty for EACH month we wait. Ouch.

For this reason, it's best to at least get a placeholder plan (low cost) and avoid the penalty while providing some out-of-pocket max exposure protection.

These plans can be under $10/month and most Advantage plans (even with no monthly premium) will include Part D.

We recommend avoiding Advantage plans that do not cover Part D as you will likely not be able to get a separate stand-alone medication plan.

Alright, 3 different alternatives to only Medicare. How to compare.

How to compare options versus traditinoal Medicare only

So a quick recap:

- Traditonal medicare only - uncapped 20% exposure on big bills

- Advantage plans - low/no cost; less control, caps exposure

- Supplements -

higher cost, more control; caps exposure

- Part D - varying costs; caps medication exposure

The big decision is around Advantage or Supplements.

We have deep dives on that question here:

How to pick the best plan

Trade-off between Advantage and Supplements

Insiders Guides to Advantage Plans

Insiders Guide to Medicare Supplements

Of course, reach out to us with any question! There's no cost for our assistance and we'll send over a quote (after your "opt in" required by law) with major plans in your area.

We focus on the biggest California carriers since they tend to have the strongest networks (more a concern for Advantage plans)

Really, it's a question of cost (monthly and on the back end) versus control (who you can see and how care is managed).

People generally know where their preference is from earlier experience with HMOs and PPOs (equivalent to Advantage and Supplements).

The medication exposure from Medicare alone is real and requires either a separate Part D plan (usually with a supplement) or one included in an Advantage plan.

Be wary of agents pushing Advatnage plans with super rich benefits for the small stuff. Low copays. Add-on vision/dental. Even money back to pay for Part B premium (which you pay to Social Security).

It's usally at the expense of the backend with a higher (sometimes much higher) max out of pocket!

This goes against everything we just discussed and it doesn't make sense to take on a $4K or $8K exposure in order to get a gym membership.

Don't fall for it. They're pushing so hard because it goods for the carriers who make it good for the agents!

We go the other way...help people really understand their options and they'll want to work with us.

Refreshing, right?

Sorry...no steak knives.

Quote Medicare Advantage Plans and Supplements with your Doctor and Medications Reflected!