California Medicare Options - pick YOUR medicare plan

California Medicare Options - pick YOUR medicare plan

a simple guide to picking a medicare plan...for you!

You can get an instant quote almost anywhere. Then what?

We need to have a relative (and not the weird uncle) in the business who will cut through all the nonsense!

To really know what's important when comparing options.

A tried and true process to cut through the dozens of options for the better values because there's a lot of "pushing" going on out there from carriers and brokers.

Look...I'm just not interested in a free set of steak knives!

That's what we'll do here and if you look at our Google reviews, you'll see that we really do try to help people.

Here are the main considerations when choosing a plan:

- Decision #1 - Advantage versus Medicare Supplement

- Decision #2 - Doctors and Medications

- Decision #3 - Price versus Benefit

- Decision #4 - Customer Reviews

Let's get started! We have some deciding to do!

Decision #1 - Advantage versus Medicare Supplement

We have a big guide comparing Advantage and Supplements.

This really is the first fork in the road for anyone looking to fill in the gaps of Medicare.

We also looked at why going with Medicare alone leaves you open to exposure for bigger bills (the 20% coinsurance of Medicare's allowed amount with no ceiling).

So...what's the trade-off with Advantage plans and Supplements.

Really, it's a trade-off between network and care control versus price.

Great...what's the actual effect of this in the real world?

Some people are familiar with the trade-off from having plans with networks pre-Medicare.

First, the nuts and bolts.

With Advantage plans, Medicare transfers the responsibility of paying

for health care to private carriers. These carriers attempt to bend

the cost curve of delivering care with networks and other rules around care

management.

As a result, there's a cost-constraint on care. That's both good and bad.

Bad because there may be situations where a certain course of treatment will be tried (or even denied) first (cheaper) before other options.

Also, there's a fixed network of doctors/hospitals that you have to remain in for benefits and it's usually based on your local area (around 45 miles generally).

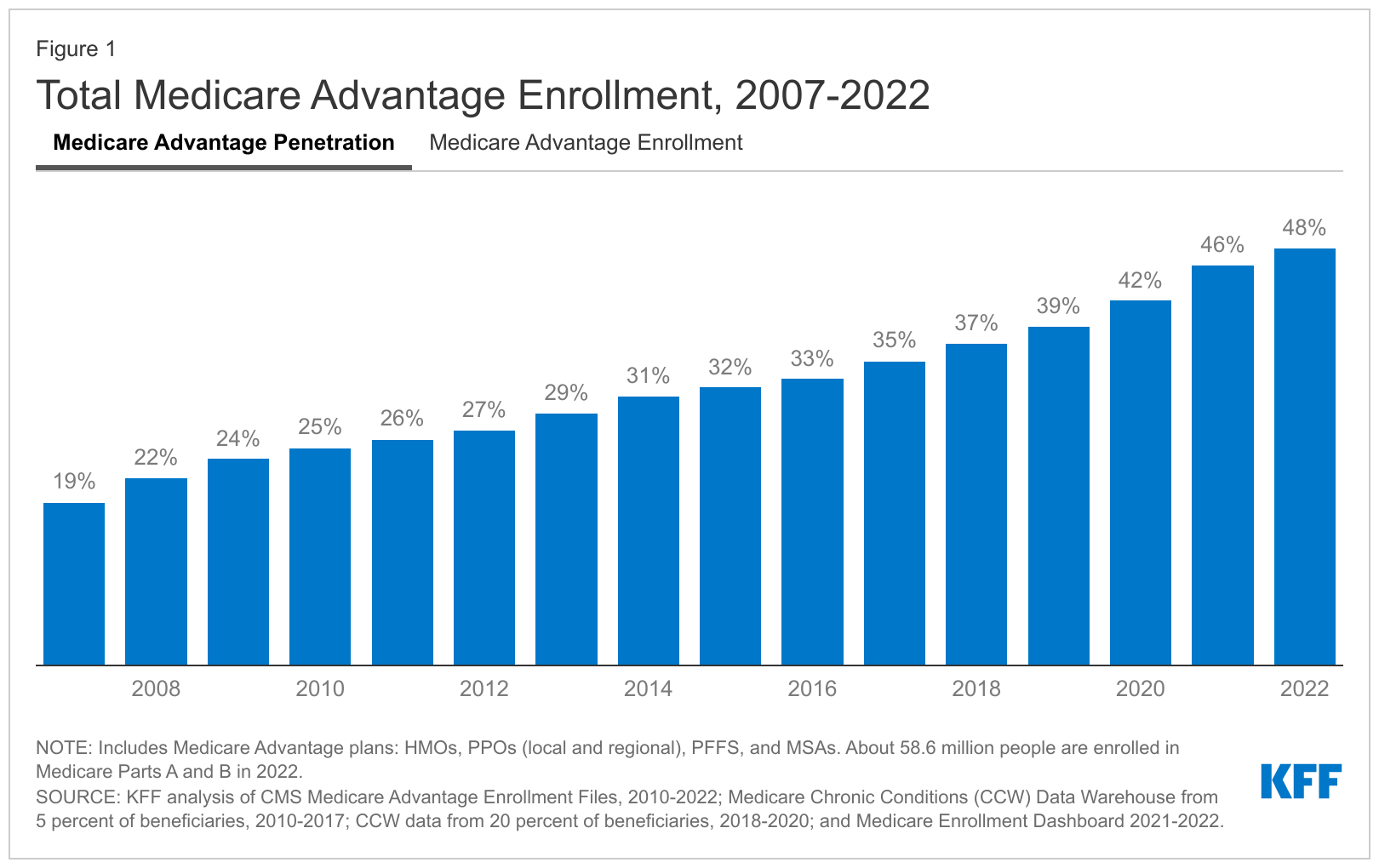

Good in that....the result is reflected in the monthly price! In fact, with the crazy medical inflation these days, we won't be surprised if the Advantage market just keeps growing.

It jumped from roughly 40% to 50% in just 2 years from 2019-2021 in California!

So...read the review for more detail but let's cut to the chase.

Can you afford a few hundred per month (G supplement plan; Part B Premium with Medicare, Part D for med) at age 65 and up from there (increases as you get older)?

For many people, this is not a decision. Advantage Plans can be low or no cost (learn more about the trade-off and how to work that in your favor).

So...

- I can't afford hundreds per month - Advantage plans by default

- I can afford a few hundred per month and really want control over doctors and care - Supplements (G plan generally)

We're happy to walk through your situation and there's no cost for our assistance.

Quote Medicare Supplements, Advantage plans, and Part D from major carriers with your doctor and medication info included:

By submitting the information

above, you are agreeing to be contacted by a Licensed Sales Agent by

email

or phone call to discuss information about

Medicare Insurance Plans. This is a solicitation for insurance.

Again, we really drill down in the whole Advantage plan versus Supplement Trade-off.

Let's turn to the network question next.

Decision #2 - Doctors and Medications

If you choose a supplement, any doctor that takes Medicare will be included so that's less of an issue.

If you choose the Advantage route, this becomes a big deal depending on how important your doctors are to you.

Before technology, this was such a nightmare! Different carriers. Different networks. Different medical groups.

Now...it's simple!

With our Quoting System, you can enter your doctors/medications and the system will automatically show you the options by cost that include those doctors!

You don't understand how cool this is and it will be available to you every open enrollment to make sure you're getting the best deal.

At no cost to you! Request your personalized quote above.

What about medications? That's the other key piece that can really differ from person to person.

If you choose the supplement route, you would get a separate Part D plan (can be different carrier and generally is).

You can also run that Part D quote above instantly.

There's a 1%/month penalty that keeps increasing if we don't enroll in a Part D when eligible.

For that reason, at least get a "placeholder" plan right away and you can change plans at the end of each year!

Now, if you go the Advantage route, Part D (medication) will likely be built into the plan.

Just like doctors, you can enter your medication info and the system will automatically show which plans include your doctors AND your medications.

As insurance folk, we have to geek out on this. You're talking about an hour of work in the olden days!

It's all instant and free to you here!

Techmology.

Once we have the "Suite" of plans available to us...then what?

Decision #3 - Price versus Benefit

Let's break this into two different directions.

First Medicare Supplements

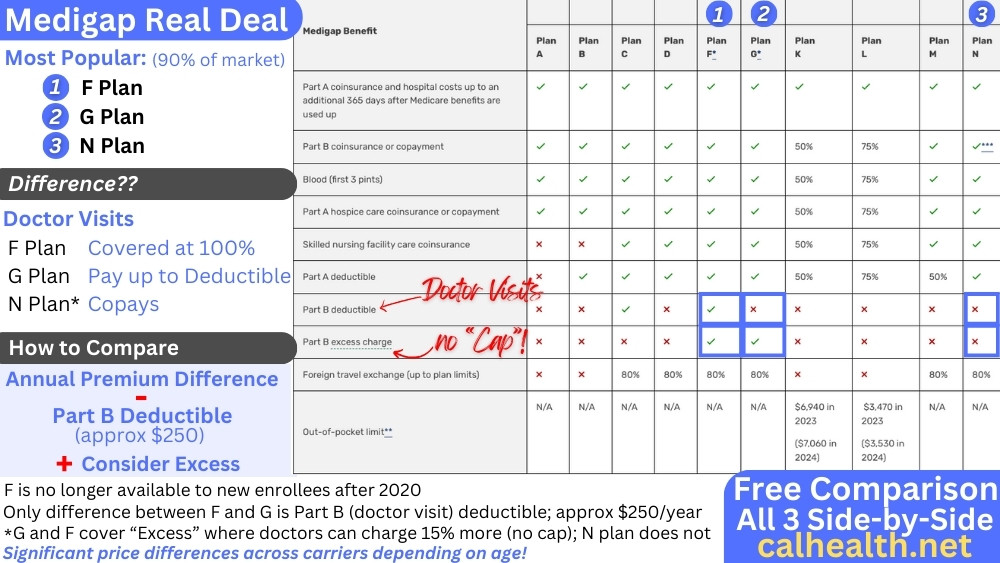

That's pretty easy..the G plan is the go-to option and for good reason.

It covers all the major holes of Medicare except for the Part B (doctor) deductible which is roughly $257/year (increases a bit each year).

The G plan is now the richest medicare supplement option since the F plan is no longer available to NEW enrollees.

More importantly, the G plan covers Medicare excess which is the 15% more that doctors are allowed to charge ABOVE what Medicare allows.

There's no cap on this 15%! If a surgery is $20K, you could be on the hook for $3000 extra. It's really important to cover this as there's pressure on reimbursement to doctors and more and more will charge the additional 15%

So then...it's easy! Just run the quote above and price out the G plan across the carriers. A high deductible version of the G will bring costs down but still keep cap on back-end.

The benefits are standardized so a G plan will have the same benefits AND networks from carrier to carrier.

Some carriers have little bells and whistle versions of the G plan (Extra, etc) but quote/compare the standard G.

Okay...that's the easy part. What about Advantage plans?

Goodness...there can be 50 plans in a given area and it's nearly impossible to tell what's different.

There may be a dozen plans with zero cost! What gives?

First, we've hopefully narrowed the options to those that include our medications and doctors (request that quote here).

This should narrow it down a bit!

Then what to do?

Next up, focus on the Triple Threat!

The Out-of-pocket max is a huge deal.

It's easy to get dazzled by gym memberships, etc but keep track of the core benefits.

The max-out-of-pocket is the main attraction!

It's basically lays out your worst-case exposure for out-of-pocket in a bad year.

This will generally run from Hundreds to Thousands of $'s per year depending on your area!

That's quite a range and we want to make sure to know our exposure if we have really big bills in a calendar year.

Really aim to lower this Out of Pocket Max exposure as part of your decision making.

Why?

You're entering a period of time in your life where healthcare costs just explode.

The advantage plan is now more expensive than a supplement if we have bigger bills!!

We really want you to understand what's best in YOUR interest!

Age 65+ is not the best time to take that bet so keep max out of pockets at a manageable level in case of bigger bills.

That should cut down a lot of the chaff and leave a few solid plans with low/no cost and low max out of pockets.

Generally, the copays and other benefits will fall in line since in today's medical world, the real cost is around facility (hospital) care and that's the max-out-of-pocket.

The other big driver of cost is medication but we've already taken that into account with our quoting system above.

So...now what?

Decision #4 - Customer Reviews

For supplements, cost is the big driver although there are some carriers that have long track records with Medicare.

There are a dominant Big 3 in California but we need to see who is best priced for your situation (area and age).

Between price and carrier stability, we usually have an exact plan to choose and enrollment is now easy and online through our system.

As for the Part D benefit (added to a supplement), the Star Ratings are a huge resource since there are so many options and they're so similar.

Our meds are already entered and total out-of-pocket pricing is given so it then comes down to how easy it is to work with the carrier.

That will be included in the personalized Part D quote. Along those lines...

Advantage plans are where we lean on Star Ratings more heavily.

If we have 4-5 plans with no cost and low max out of pockets with pretty similar copays and RX, how do we decide?

Again, this assumes they all work with our doctors/hospitals.

Hello Star Ratings!

Remember, it's not JUST doctor network and medication constraints with an Advantage plan.

The carriers has more "say-so" on what treatment is allowed or offered.

The Star Ratings captures (as best we can) how happy prior members are with balance here.

Some carriers might be involved in this regard and that will generally show itself in the customer reviews along with the usual paperwork requirements that goes along with any insurance policy these days.

The Star Ratings will be available through our personalized Advantage proposal here. Aim for 4+ stars!

There are two additional considerations out there in the Advantage world:

Part B Giveback plans: they can pay towards your Part B premium! Super popular these days (go figure)

SNP Plans: specially designed if you're eligible for medi-cal OR have certain chronic illnesses

Now....let's say you've read all this and just don't want to mess with it.

There's no cost for our assistance and all we do is help people figure out the best fit for them.

Request your proposal and we'll get to work. In a world of high-pressure sales, we try to go the other way.

Check out our other resources:

-

Comparing Medicare Advantage and Supplement Plans

-

The Trade-off

Between Advantage and Supplements

-

How and when to enroll in Medicare

plans

- Your Insider's Guide to Medicare Advantage Plans

-

Your Insider's Guide to Medicare Supplement Plans

We purposely kept this review at just high-level plan selection strategy. If you're really confused by the whole Medicare assault, reach out to us with ANY questions.

As a recap on how to pick the best Medicare plan:

- You really have to decide on Advantage versus Supplements. They're two separate worlds really. Control/Access versus Cost. Can you afford higher monthly premiums with a supplement? Be honest with this question as it will keep coming up year after year!

- Enter your doctors and medications into our personalize quote tool so you see the plans that work best with you

- Quote the different plans within your "style" (Advantage versus Supplement); focus on G plan for supplement and focus on lower Out-of-pocket Max (OOP) for Advantage.

- Wrap it all up with confirmation from Star Ratings!..especially for Part D and Advantage plans where there are so many offerings

- Reach out to us with any questions! As a licensed California health agent, there's ZERO cost for our assistance and it's time to go with people who have your best interest at heart (hopefully, the above summary shows this but check out Google Reviews just in case)

There is no cost for our assistance and no question is too small.

Call 800-320-6269 or email us at help@calhealth.net

Be well!

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact www.medicare.gov or 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 day a week to get information on all of your options.