California Medicare Options - Guide to UnitedHealthcare® Medicare Advantage Plans

Unlocking the Benefits: A Comprehensive Guide to UnitedHealthcare® Advantage Plans in California

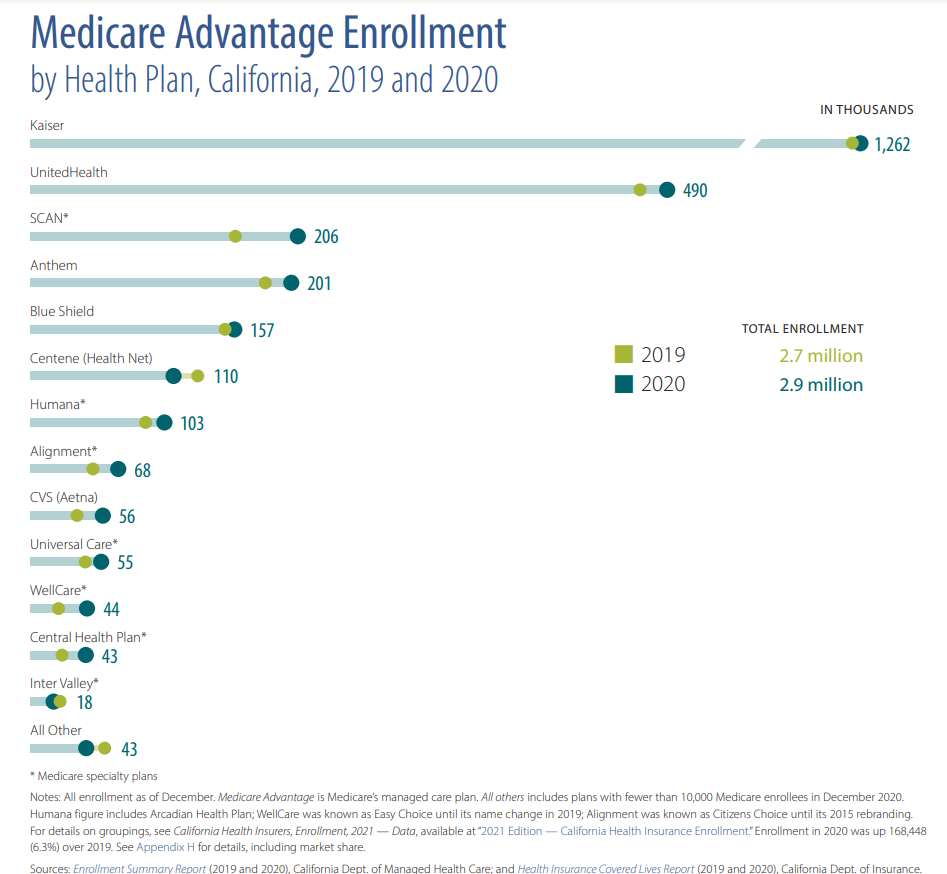

Behind Kaiser, UnitedHealthcare®is definitely the biggest player in the

California Medicare Advantage market. By a long shot!

For good reason.

They have a powerful ally in AAPR as the marketing arm for their advantage plans.

Talk about bringing a gun to a knife fight! UnitedHealthcare® is a good company to have in the battle for California's senior market.

Membership is not required, but nonetheless, many seniors will hear about advantage plans from UnitedHealthcare®, and more importantly, there's a degree of trust there.

The real story though is about their provider networks. UCLA and Cedars? That's ridiculously impressive for an HMO!

So...how do we compare and review United's Advantage plan offerings?

First, our credentials with 25+ years of experience in California's senior market.

Now that's out of the way, let's zero in on these topics:

- A quick intro to UnitedHealthcare®medicare advantage plans

- Are people

happy with UnitedHealthcare®Advantage plans

- Why is UnitedHealthcare®so popular

in California

- The different types of UnitedHealthcare®plans

- How to quote

UnitedHealthcare®Advantage plans

- How to enroll in UnitedHealthcare®Advantage plans

Let's get started!

A quick intro to UnitedHealthcare®medicare advantage plans

UnitedHealthcare® is one of the big 3 nationwide health insurance carriers so they're no spring chicken even in California health markets.

Their strategy has been different both in California and how they approached the Advantage market.

First, they're a dominant employer health plan carrier. They have pulled away from the California Covered Ca market for individual families but focused more on the Medicare market.

It's a pretty good marriage since UnitedHealthcare® has the required nationwide expertise and network prowess (only BCBS or Aetna can rival this).

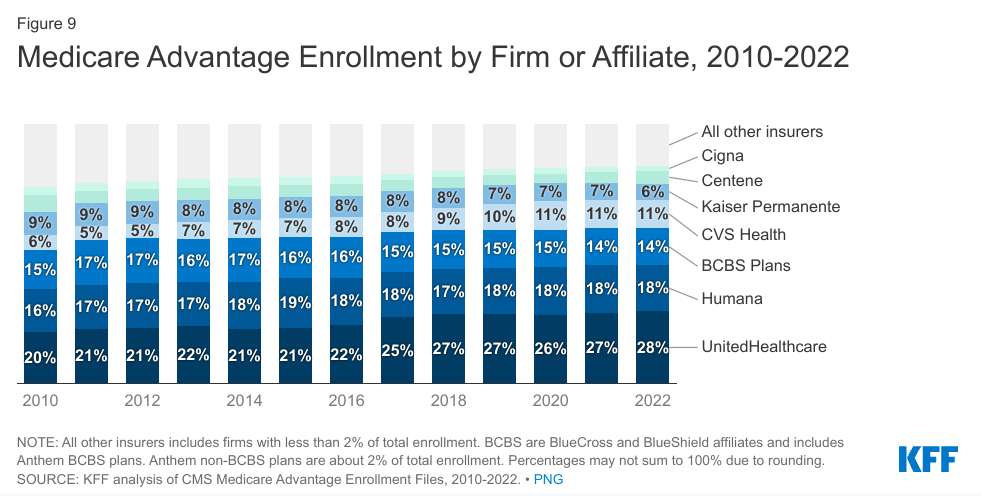

UnitedHealthcare® has 7.9 million ADVANTAGE subscribers in 2022 nationwide. Only a few carriers could pull that off well.

In California, it was just under 500,000 end of 2020.

Outside of Kaiser, this is by far the biggest carrier for Advantage plans.

So...what do all those members think about their coverage?

Are people happy with UnitedHealthcare®Advantage plans

Luckily, having friends in high places doesn't protect a carrier in the Advantage market.

Medicare has a built-in review system called the Star Ranking. Sorta like a Yelp review for Advantage plans and Part D (medication plans).

It's adjusted each year, and we can use it to compare not only carriers (UnitedHealthcare® versus SCAN as an example) but also different plans offered by the same carrier!

It's a 1-5 Star system with 5 star being the best (and very coveted for many reasons).

So...how does UnitedHealthcare® are in California?

UnitedHealthcare® had an average 4.2 rating in 2023 for California

This is pretty solid with 5 being at the top and 4 being the average nationwide.

Just a head's up...what matters is ranking in YOUR area since it can really be different from county to county.

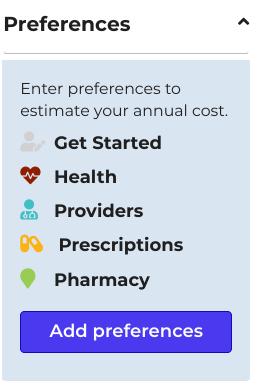

Run your quote here:

Make sure to add medication and doctor info so only the best-suited plans show in the quote for your situation.

Then...you can filter UnitedHealth on the left to see just their plans or compare them against the other plans in your area.

Let's do a quick scan.

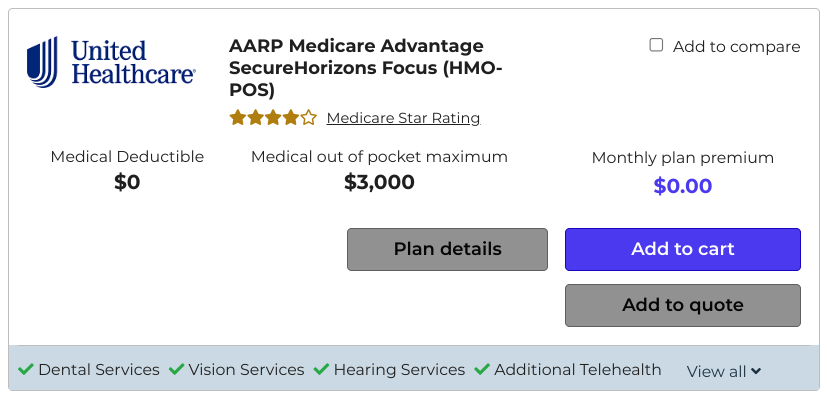

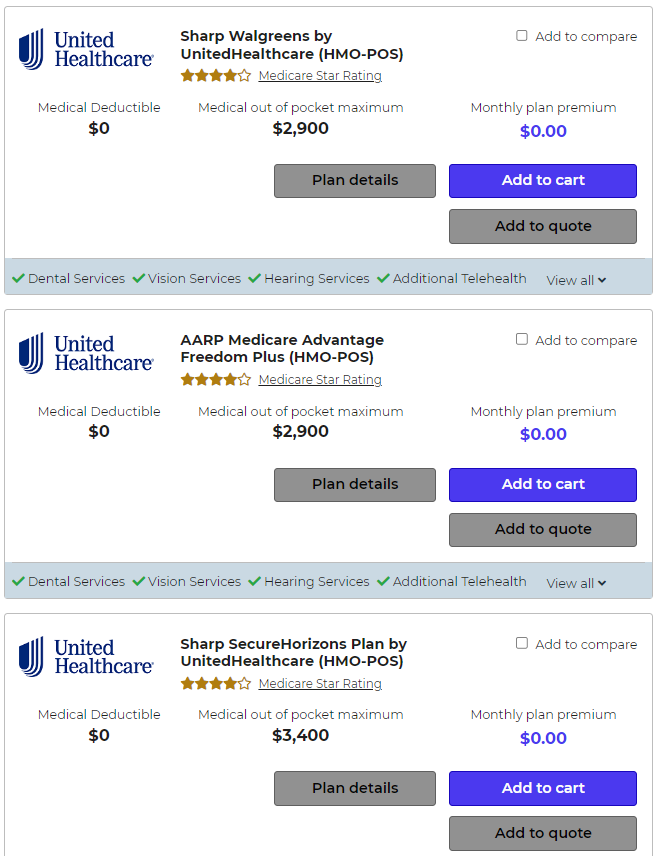

LA county and UnitedHealthcare® Advantage plans:

- UnitedHealthcare® rounds out the top 10 in terms of value

- Top HMO plans have 4.0 stars or higher rating; PPOs only have 2.5 (down the list)

We'll dig deeper into the plans below.

What about Bay Area (our other test market; San Jose specifically

since options change by area)?

- UnitedHealthcare® top plan comes in at #6:

Pretty heavy competition with SCAN (see SCAN review) and Alignment in this area. Very different from Los Angeles!

Again, 4.0 Star Rating by Medicare's internal system.

The real competition there is SCAN at 4.5.

Finally, San Diego:

- #10 on the list with Sharp, SCAN, and Alignment strong up above outside of Kaiser.

A pretty solid offering in terms of max out-of-pocket and premium. It's just really competitive there with Sharp and SCAN.

So... a solid offering in the major markets. There's one thing we're not seeing by just looking a the Star Ratings which can be the decision-maker for Advantage plans.

Networks!

Why is UnitedHealthcare®so popular in California

UnitedHealthcare® has an ace up its sleeve with Advantage plans.

First, we need to explain the two pieces we're not seeing that really make Advantage plans different from Medicare supplements.

Doctor networks and drug formularies.

With Advantage HMO plans, you have a defined network of doctors you have to use (outside of true emergency...be conservative on that).

This is just a function of the HMO model and a way to contain costs by working more tightly with a defined group of doctors.

Same for hospitals that contracts with those doctors and your advantage carrier.

Two of the biggest complaints (by far) with all Advantage plan members:

- I can't see my doctors

- My meds are not on the list

Again, this is the trade-off between Advantage plans and Medicare supplements (where you can see any Medicare provider).

If access to doctors and/or better providers is a key concern for you, UnitedHealthcare® becomes a real challenger.

They have the biggest Advantage plan networks, and that really matters when health takes a turn.

This really is United's lead-in with the whole market and sets them apart.

You can enter your doctor/medication info upfront when you run your quote here to make sure this question is addressed.

UnitedHealthcare® is more likely to be on that short list, and this could drive the decision!

We're happy to help you compare options, and there's no cost for our assistance:

So...let's talk about United's different Advantage plans. There are a few of them!

The different types of UnitedHealthcare®Advantage plans in California

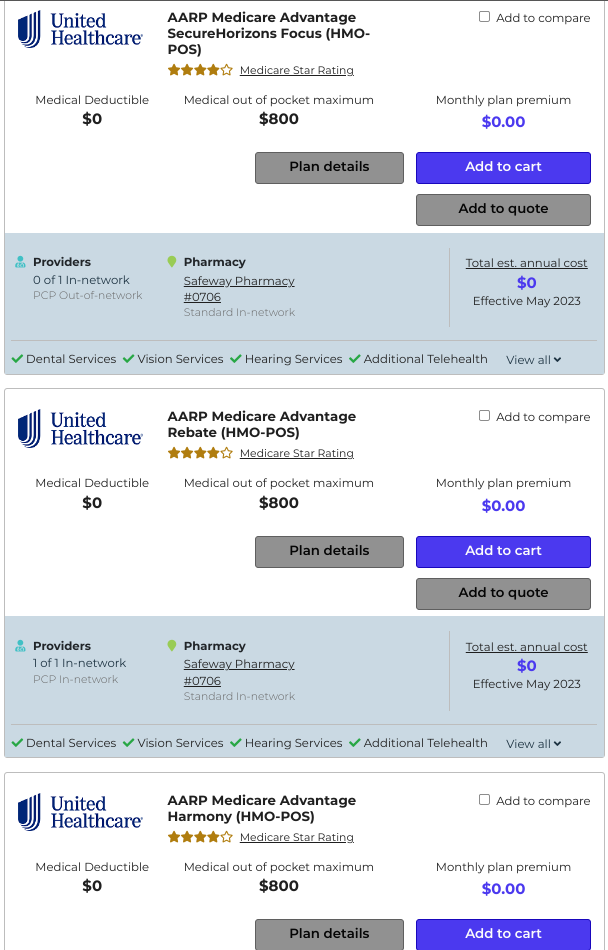

Just looking at Los Angeles County (the biggest Advantage market by far), we see a range of options:

- UnitedHealthcare® Choice Plans (1 and 2)

- UnitedHealthcare® Secured Horizons Focus plan

- UnitedHealthcare®

Secured Horizons Premier plan

- UnitedHealthcare® Medicare Advantage Rebate plan

- UnitedHealthcare® Harmony Plans

- UnitedHealthcare® Freedom Plus plans

- UnitedHealthcare® Patriot plans

Goodness, how do we compare all these? First, we're happy to help at help@calhealth.net!

A quick breakdown.

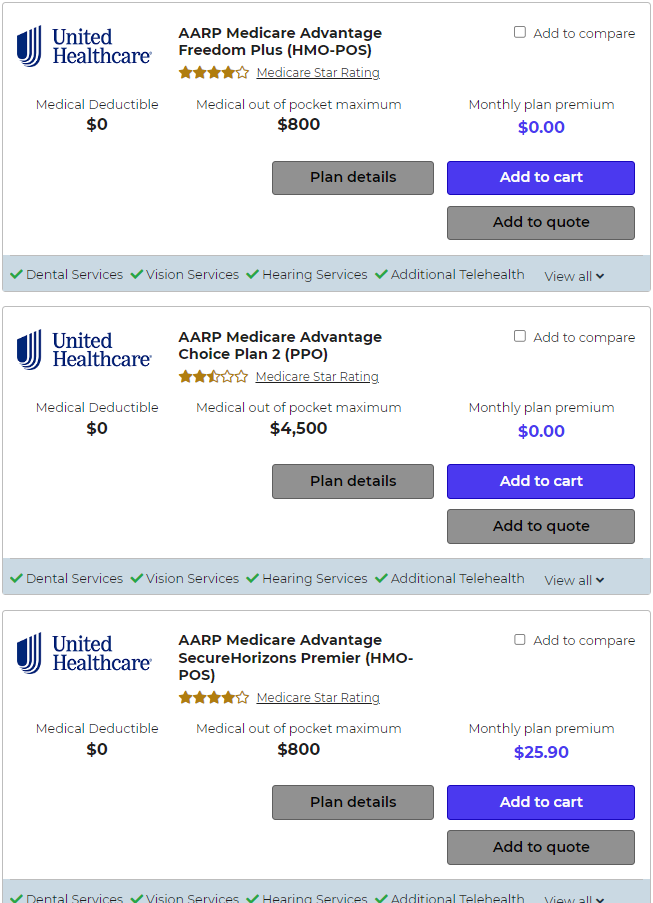

The Choice plans are PPO so you'll have a network in which you'll get the best benefits. Out-of-network always requires more out-of-pocket.

The Rebate plan kicks back Part B premium money to you. We're not big fans of this unless you're really struggling to make the Part B payments, and in that case, you really need to check into getting extra help (local county or Medicare). United's option here is one of the best since they kept their max lower.

What gives with the Secured Horizons plans? Secured Horizons was a huge senior player from Pacificare which UnitedHealthcare®bought.

Many of these members just stayed with SecuredHorizons (they were the original OG in this space for California when Advantage came out).

We can actually learn a lot from the quote you run in your areas since we'll have the "Triple Threat" data regardless:

- Lowest Max out of pocket (ideally under $1000 - we explain why in our

Insider's Guide to Advantage plans

- Low or no premium

- Star Rating 4.0 or higher

Okay. So...what shows for our Los Angeles quote?

The top 3 quotes (according to how Medicare shows them) from UnitedHealthcare® are:

- Secured Horizons Focus

- Rebate

- Harmony

Notice how the top 3 choices match our comparison requirement:

- Zero premium

- Max out-of-pocket of $800 (under $1000)

- 4 Star rating

We've given you the keys to the kingdom in our How to Pick the Best Advantage plan!

Down the list is their PPO option (Choice Plan) but the Star rating is not great at 2.5. This reflects people's attempt to get the pros of Advantage plans (cost) with more network flexibility.

So...somewhere between HMO Advantage and Medicare supplements.

You still have constraints on medications and how you access care. Just more network breadth and flexibility.

It's hard for us to justify a $4,500 max out of pocket when we can get the G plan at roughly $150 (varies by area and age) and a Part D for $20 (so $2000/annually) and have almost everything covered in terms of Medicare gaps (just not the Part B deductible).

Now, the front-runners make more sense since they're hitting our triple threat trigger!

The other "bells and whistles" seem like window-dressing for us (gyms, dental, etc.) since the max out-of-pocket is the real show. Learn more at our how to pick the best Medicare plan.

Don't get starstruck by free vision when there's a $5K backend if you get big bills!

65+ is a bad time to take that gamble.

In the end, United's real strength is its network, and this somewhat gets reflected in our Star Rating (remember...biggest complaint is that member can't see their doctors).

If network access is your primary driver, UnitedHealthcare® is the prime challenger.

This is great and all for 66 year old in Los Angeles County. What about your situation?

How to quote UnitedHealthcare®advantage plans

First, run your free quote here:

The doctor/RX info is really important because our free quoting system will show you the plans that work with your current setup!

That's complaint #1 and 2 that we can scratch off from the get-go!

You'll then get a full quote in your area.

If you might be eligible for Special Needs Plans (Medi-cal eligibility or chronic health), click on "See All Special Needs Plans" as we as "All non-licensed plans".

Reach out to us with questions but focus on the Triple Threat:

- Low or no monthly cost

- Lowest max out of pocket

- Star Rating of 4.0 or higher

UnitedHealthcare® generally has contenders that meet these requirements although some areas are tougher (Bay Area and Rural) for all carriers.

Again, the feather in their cap is the network size! For some people (roughly 30% of the market), this is the deal breaker!

So...what about when you find a plan you like and it works with your doctors and medications?

How to enroll in UnitedHealthcare®Advantage plans

When you run a quote through our system above, there will be an option for online enrollment with UnitedHealthcare® plans!

It will keep all your info, and here's the best part.

With each open enrollment, you can quickly update meds, doctors, etc, and you will save 90% of the time and hassle of comparing or changing plans!

There's no cost to use this secured system and zero cost for our assistance! Learn how to make sure an Advantage plan broker is good here.

Reach out with any questions. UnitedHealthcare®is our go-to for people who want the broadest doctor and hospital networks. We don't see that changing anytime soon.