Medicare Supplement versus Medicare Advantage Plans

Okay. Roll up your sleeves!

This is the big question we get from everyone eligible for Medicare.

With good reason!

First, Medicare leads in with its own language from the start.

Part A. Part B. G plan. Part D. You name it.

We're running out of letters to use.

Medicare's complicated enough for someone coming off of employer coverage or their own individual plan.

Now add to the mix two completely different ways of addressing the holes of Medicare.

Supplemental insurance (or "medigap plans") and Advantage plans.

Let's really understand how these two types of plans are different.

Most importantly, how does it affect you, the member?

First, our Credentials:

A Supplement versus Advantage plan comparison to end them all (finally).

You can always quote both options here:

or phone call to discuss information about Medicare Insurance Plans. This is a solicitation for insurance.

Links above refer to a 3rd party site for quoting.

If you want to jump to a specific section, feel free to click here:

- Traditional Medicare basics

- Medicare Supplements and Part D (the RX coverage piece)

- Medicare Advantage

- Supplement versus Advantage Comparison and Review

Before we get started, let's look at what core Medicare covers (and doesn't cover).

Traditional Medicare Coverage (no supplement or advantage plan attached)

Medicare is incredibly popular.

It is generally available to people who are 65 and older or who are permanently disabled under age 65.

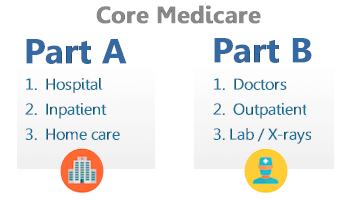

There are two main sections:

Part A

Part A is the part you generally pay into all your life through payroll taxes. You can also "buy in" to Part A if you did not make enough contributions.

You generally do not have to pay anything for Part A.

Part A covers Hospital and Facility costs.

Part B

Part B covers Doctors and non-"Part A" services (think doctor visits, labs, out-patient, etc).

Part B requires a monthly premium to be paid for most people.

The amount you pay will depend on how much money you made 2 years ago. It can go up from the base amount.

You have to "opt in" to Part B. You generally will not be automatically signed up.

So far so good.

What about the benefits under these two parts?

Core Medicare Benefits

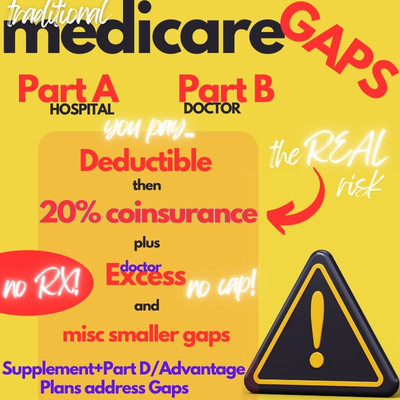

Medicare works like an 80/20 plan with a bigger deductible for Hospital and a separate one for Doctors.

- The Part A deductible is an amount you will pay first before the plan starts helping for hospital or facility services.

This amount goes up each year.

- The Part B deductible is an amount you will pay first before the plan starts helping for doctor, labs, and out-patient services.

This amount also increases slightly each year.

The 80/20 Hole to Fill in Medicare

The real "hole" of Medicare by itself is the 20% in our opinion.

Once you meet one of the deductibles mentioned above, you are responsible for 20% of the remaining charges (calendar year).

There is no cap to this 20% in a year (Jan-Dec)

For example, if you have a $100K bill, you'll be responsible for $20,000 if you only have traditional Medicare Part A and B.

That's really the main issue we want to address first.

Let's cap or get rid of this 20% share of costs.

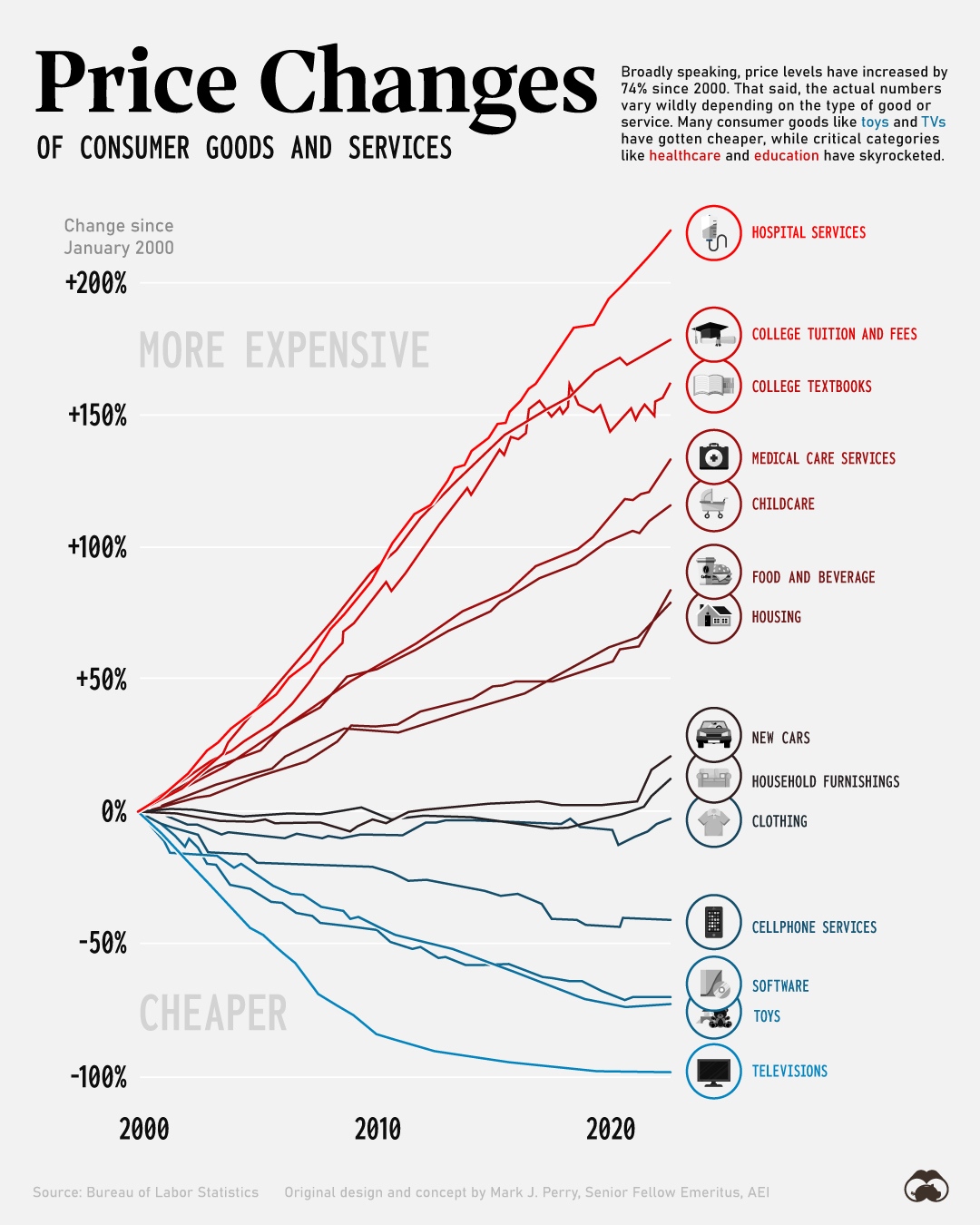

Keep in mind that in today's world, a simple out-patient surgery can run $25K.

That means you're potentially looking at $5K if you only have Medicare.

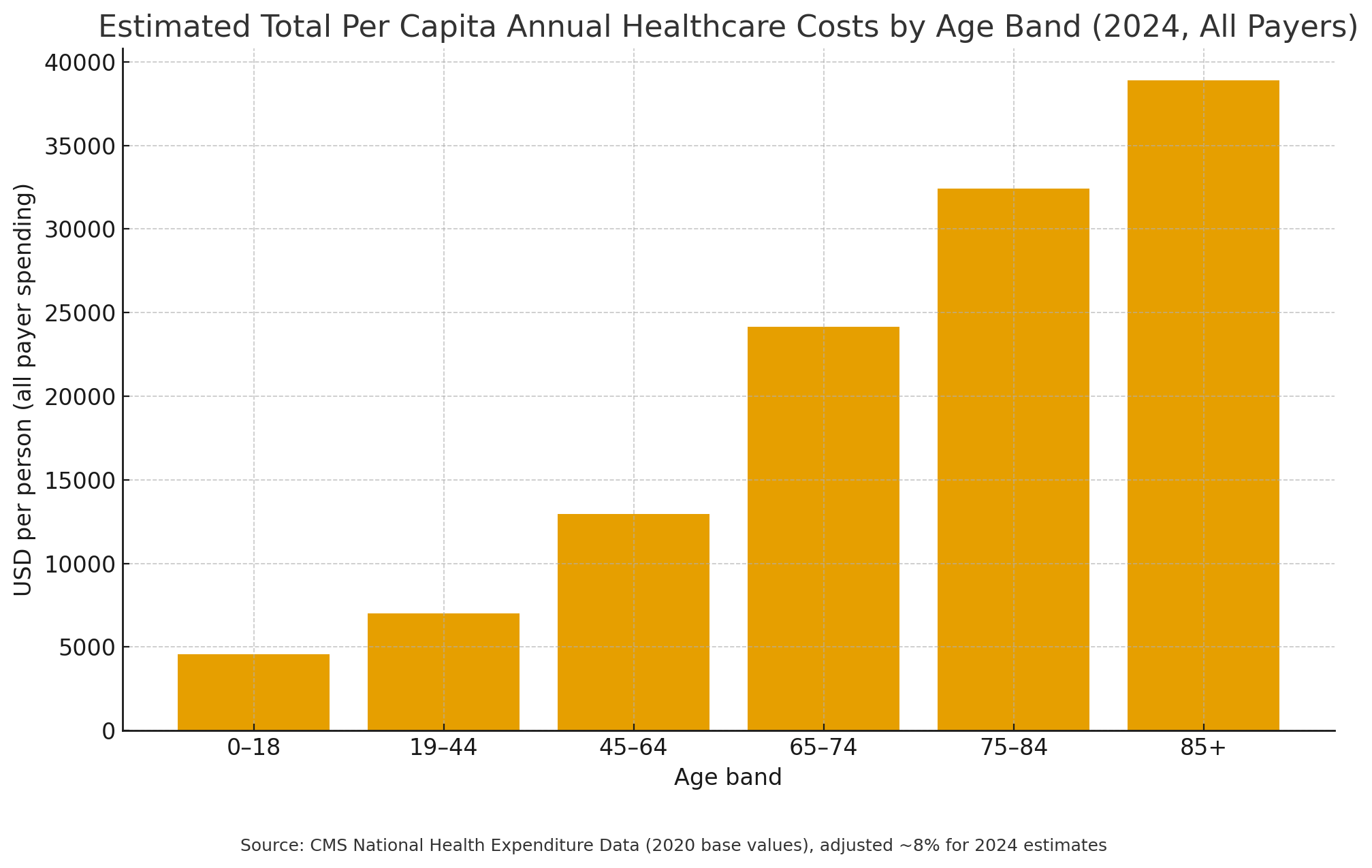

Health care costs are on quite a trajectory lately:

Traditional Medicare and Prescriptions.

When Medicare was first created, medications were not such a big deal.

Oh how things have changed!

Core Medicare does not cover RX other than what might be administered in a hospital setting (say during surgery).

Part D was created to address this gaping need and we'll discuss this later.

What do to about the deductibles and 20% coinsurance

So we have these big holes in traditional Medicare.

What can we do about it?

Enter Medicare Supplements and a little later on, Medicare Advantage Plans

We'll describe these separately but then we'll roll up the sleeves and compare the two.

That's what everyone is here for.

You can jump right to the Supplement and Advantage comparison here.

Medicare Supplement Basics (Medigap plans)

Let's first look at Supplemental insurance or "Medigap" plans.

This was the first type of plan to enter the market specifically to fill in holes of traditional Medicare.

For our use, let's look at the "Gaps" in Medicare we want to Cover:

- Part A (Hospital) deductible

- Part B (Doctor) deductible

- 20% co-insurance (Medicare picks up 80% after deductible)

- Excess charges (We'll discuss this below... important)

- Hospice Care - Part A benefit for end of life coverage

- Blood (first 3 pints)

- Nursing care (Extends existing Medicare benefit)

- Foreign Travel

Let's discuss which of these benefits are extremely important (for the novices out there).

Medicare Coinsurance

This is the real reason you get a Supplement in our opinion.

- It's basically protection from the big bill.

- Or a series of big bills.

- An onslaught of smaller bills.

Let's say we have $100K or even $250K of bills in a calendar year.

Think heart bypass. Think Cancer. We like to NOT think about these things but they're there and we want to make sure they're covered!

If you only have traditional Medicare, once the deductible is met (or both of them - hospital and doctor), you'll then start paying 20% of the remaining charges.

Your 20% exposure never ends!

- For that $100K bill, that's an exposure of $20,000 to you.

- For the $250K bill, you're responsible for $50,000.

As we get older, it doesn't make sense to take on this exposure...

You're more likely to have higher medical bills in the age band that Medicare covers.

Much higher.

We really should get a Supplement or Advantage plan to cover this 20% AT LEAST!

Medicare Deductibles

The deductible are not as extreme (depending on your finances) but it still makes sense to cover them since we're more likely to hit them during this age band.

Part A Deductible

The Part A deductible is for hospital and facility based services.

In 2025, it's just around $1736/year and goes up a bit each year.

At least this is capped but one hospital visit pays for an entire year of the G plan at age 65 in most cases. Read that back over...one slightly bigger bill pays for the richest medicare supplement.

Part B deductible

The Part B deductible for physician charges, services out of doctor's office, labs, etc.

It's just around $283 for the calendar year.

You can see how some pretty basic health care needs quickly pay for a Supplement or Advantage plan.

The Risk Most People Don't Know About - Excess

Excess. It's a term new to most people entering Medicare.

It can be important.

Basically, excess allows Medicare providers to charge up to 15% more than the allowed Medicare charge for a service and still be considered a Medicare provider.

It's hard to get good stats on how many doctors do this but they're out there.

As finances continue to pressure the Medicare system (simple number of working Americans supporting number of Medicare eligible Americans), there will continue to be reimbursement pressure.

Under this pressure, more doctors will likely to start charging the excess amount.

We want this covered ideally.

Not because of where we are now but because of where we'll be 5-10 years out.

Keep in mind that you may be selecting a plan to cover decades if health changes!

We need to plan accordingly.

The Big Four Gaps

The other gaps in Medicare are potentially less of an issue.

- The first three pints of blood (Medicare covers afterwards).

- A limited Travel insurance benefit (travel insurance works better).

Hospice and Nursing care are critical but the big four are the two deductibles, the co-insurance, and the excess coverage.

We also need to talk about the biggest gap in Medicare.

Prescriptions!

Part D brings Rx to Medicare

We've talked about Part A and Part B.

Let's skip C and go right to D!

Part D came to the party late but was very well received!

Part D is a private plan that you purchase which covers medications.

- This is separate from Medicare and separate from Supplements.

- Part D benefits are generally embedded in Advantage plans.

That's a big difference and we'll discuss this when we compare them.

Just know we need medication coverage for now.

That's basic Medicare. Just the broad strokes of what's missing.

Let's fill in those missing pieces.

We'll start with Medicare Supplements

The Medicare Supplement Approach

Medicare Supplements are private health plans you purchase to fill in the holes of Medicare we discussed above.

Let's look at the key factors that make them so popular.

Networks for Medicare Supplements

The big draw of Supplements is that they work like PPO's (or how people think PPOs work!).

- You can see any doctor or facility that participates with Medicare which is most of them.

- You're not locked into an area and can even see providers in other States.

- Decisions on healthcare are made between you and your doctor as long as Medicare covers the service.

Supplements are about flexibility and control.

Let's look at the actual Plan benefits.

Medicare Supplement Plan Comparison

Keep in mind that supplement benefits are standardized by the Federal government.

This means that a G plan with one carrier will be identical to a G plan from another carrier.

It then comes down to price, pricing stability (important), and customer service.

We'll help compare the carriers in the comparison section.

Plan A through Plan N

A cause of confusion is that the supplement plans have letter names from Plan A to Plan N with a few letters missing in-between.

Each one has slightly different items that they cover. Here's the lay of the land from the Medicare Handbook:

Medigap "Real Deal": Compare F, G & N

Doctor Visits

How to Compare

Availability

| Medigap Benefit | Plan F | Plan G | Plan N |

|---|---|---|---|

| Part A coinsurance & hospital costs (extra 365 days) | 100% | 100% | 100% |

| Part B coinsurance / copay | 100% | 100% after Part B deductible | Copays apply [1] |

| Blood (first 3 pints) | 100% | 100% | 100% |

| Part A hospice coinsurance / copay | 100% | 100% | 100% |

| Skilled nursing facility coinsurance | 100% | 100% | 100% |

| Part A deductible | 100% | 100% | 100% |

| Part B deductible | Covered | Not covered | Not covered |

| Part B Excess charges [2] | Covered | Covered | Not covered |

| Foreign travel emergency (to plan limits) | 80% | 80% | 80% |

| Out-of-pocket limit | N/A | N/A | N/A |

[2] "Excess charges" are up to 15% above the Medicare-approved rate when a non-participating provider bills more; Plans F & G cover these, Plan N does not.

Only difference between F and G is the Part B deductible (2025: $283/yr). Significant price differences can occur by carrier and age.

Important note!

In 2020, the C and F plan went away for new enrollees.

Existing members can continue to stay on those plans and we discuss in another article how to use that information.

The G plan is the heir to the throne that the F plan held before.

The F plan had been the most popular supplement plan by far since it fills in all the major holes of Medicare including Excess (important as we mentioned in Medicare overview).

Interestingly, many people (millions) are probably over-paying on the old F plan.

How to Compare

You can quickly run your personalized quote here:

Here's the net net for Supplements.

It's really hard to argue against the G plan if you want the flexibility and control that supplements offer.

It covers excess and all the core gaps in Medicare aside from the Part B (around $283 annually in 2025) deductible.

The pricing is great...especially against the phased out F plan.

To make it short...I would enroll my parents on the G plan.

If you have a supplement, you also need a Part D for medication (2 separate plans).

You can also run your Part D quote via this link:

As licensed health insurance agents with decades experience in the Medicare supplement market, we're happy to help you.

We contract with all the major carriers so we really just want to find the best value for your situation.

Quote above or pick a time to chat. Email is always welcomed as well.

That's a top level look at Supplements.

What about Medicare Advantage plans?

The Medicare Advantage Plan Way

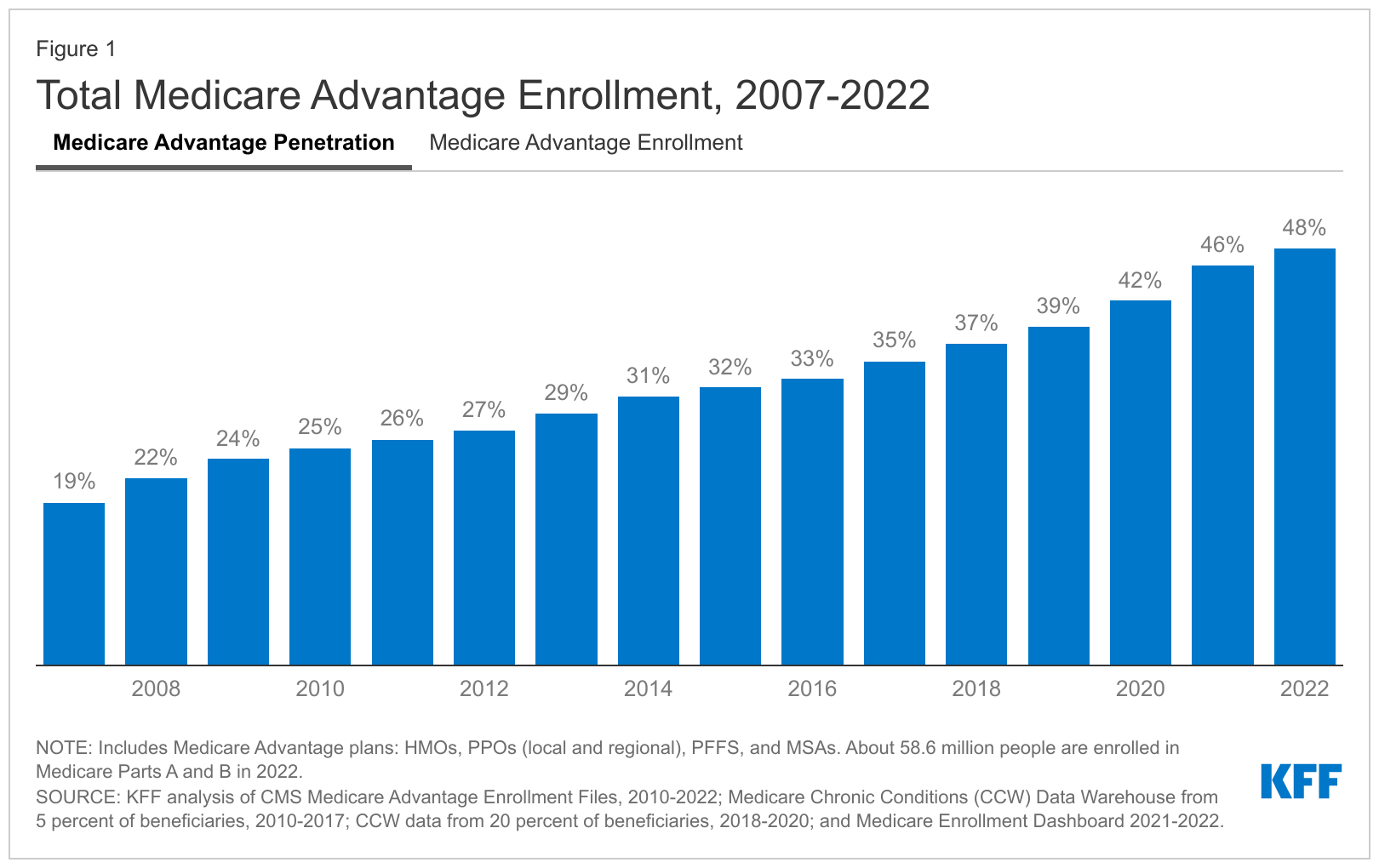

Think of Advantage plans as the HMO of the Medicare world. Sure...there are PPO Advantage plans but the vast majority that are popular are HMO by design.

We had Medicare HMO's before but advantage plans are a new take on the whole model.

And they've taken off (over half of the medicare market now). And growing!

The trade off is monthly premium versus control and network access.

For some people, this is a question of affordability and we totally get that! Especially coming off of the richer silver plans from Covered Ca!

Advantage plan Basics

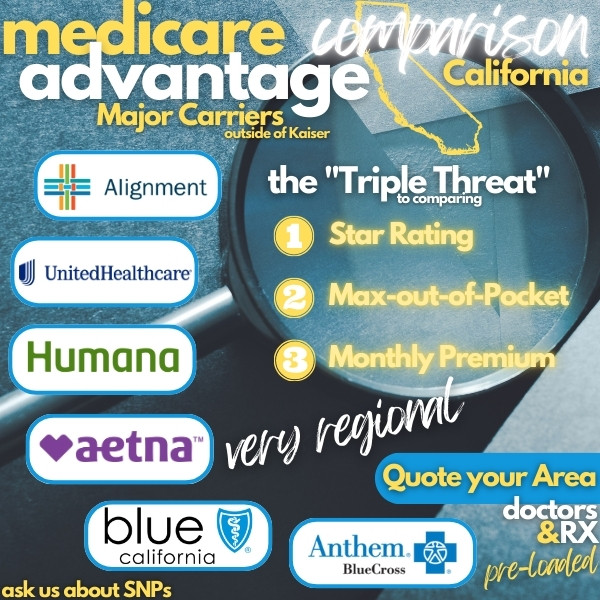

You can quickly run your quote here for Advantage plans:

- This is important since each carrier has subtle differences in the plan design.

- They cover the basic benefits of Medicare (except excess since you generally have to stay in network).

The plans usually breakdown into a few key components that are very comparable to how pre-65 health insurance plans work.

Office Copays

There is generally a copay for office visits. Primary may have a different copay from Specialist.

Deductible

For larger services beyond the office copay, there may be a deductible you have to meet first.

Coinsurance

Once the deductible is met, you may then pay a percentage of the remaining bills until you hit the max out of pocket.

Max out of pocket

This is the amount you can expect to pay in a calendar year for covered benefits. It's really your protection from the big bill.

Very important.

In fact, we go through how the OOP (out of pocket max) may be THE key in comparing Advantage plans.

Now this is only scratching the surface with Advantage plans!

Carriers are given a lot of creativity to add different benefits and options while meeting the core insurance requirements.

For example (not an exhaustive list):

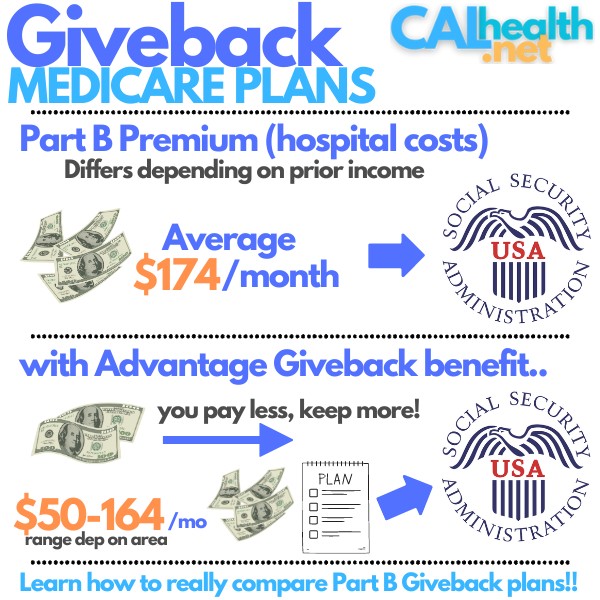

- Part B Giveback benefts - can pay towards your monthly part B premium!

- Medi Medi plans - richer benefits for people with both Medicare and Medi-cal

- C-SNPs - plans designed around specific chronic illnesses

- Flex Cards - money that can be used for OTC, groceries, gas, vitamins, etc

- Dental, vision, hearing aids, gym memberships, etc

The Part B Giveback plans are wildly popular now since they can mean $100's/year in real money in your pocket.

For now, we'll focus on just the core Advantage plan layout. One more note...

Medication and Advantage Plans

Medication coverage (Part D) is generally included as a covered benefit in Advantage plans.

This is usually handled with copays that vary for generic and brand drugs.

The Advantage Network Difference

With Medicare Advantage plans (most of them), you have to stay within a network of providers.

This is true of all HMO's.

This network is usually based on your home address. Roughly 45 miles out but we'll send you a link to submit your doctors and then run the quotes according to the plans that work with YOUR doctors!

Decisions on healthcare will be more "managed".

This means there is a cost consideration taken into account on what course of treatment to pursue.

Again, that's how HMOs work...not always a bad thing in todays world.

Out of your area, you will generally only have coverage for true emergencies.

That's top level look at Advantage plans.

Now...the big show.

Let's compare Supplements and Advantage Plans in a way you can actually use.

Medicare Supplement versus Medicare Advantage Plan Comparison

Taking a look at the quote, you can pretty quickly size up what the trade off is.

It's PRICE!

Let's break down each comparison:

- Monthly premium

- Out of Pocket

- Doctors

- Control

- RX

We'll start with the one on everyone's mind at retirement...Pricing.

Pricing

Put simply, Advantage plans are generally low or no cost plans depending on the area.

This is the monthly premium you're paying to have the plan.

It's separate from Part B premium direct to Medicare or Social Security!

The popular plan (G plan soon) will be coming in between $150/month - $200/month depending on the area at age 65. For some people, that's not workable.

Some carriers have discounts of $25/month for the first year if you're new to Medicare (new Part B) for the G plan.

Let us know if this your situation so we can quote you correctly!

In that case, the Advantage plan may be the only option that's financially feasible.

You can quote both Supplements and Advantage Plans here:

Monthly pricing is THE primary benefit of Advantage plans with Medicare.

BUT...it's not the only calculation that affects money!

Out of Pocket Comparison - Supplements and Advantage Plans

If you get sick or hurt, how much will be out of your pocket?

Starting with age 65, we shouldn't expect healthcare needs to decrease!

In fact, healthcare expenditure roughly doubles with each decade of a person's life (outside of the maternity blip).

This only accelerates as we get older!

Expect more healthcare expenditure.

That's a big deal with the Supplement and Advantage plan comparison.

With a G Supplement plan, you'll have very little out of pocket (just the doctor deductible of $283/year in 2025).

With an Advantage plan, you could have a few $100 out of pocket depending on your plan choice. In some areas, the max can go up to $3-4K annually!

How do we compare these?

We need to really compare the annual premium difference against our annual worst case exposure!

When we discuss the tradeoff between Advantage and Medigap Plans, we walk through this calculation with examples to make it clearer.

Now the Part B Giveback plans can sweeten the Advantage pot by $100's/year which explains why they're so popular now if you're in good health.

We can help with this process but the decision between Supplement and Advantage plan usually comes down to PPO versus HMO in the way most people think of these plans. Happy to help compare!

That's brings us to doctors!

Doctor Comparison between Supplement and Advantage plans

We touched base on the pricing difference.

What about doctors?

Very different.

With Supplements, we can use any Medicare provider. Anywhere in the US.

If there's a specialist in Arizona for a given illness, you can see them (assuming Medicare provider).

You can take the policy with you if you move. In or out of the State.

With a Medicare Advantage plan, you generally pick a primary care doctor or medical group which coordinates your care.

You must stay within this network for care unless you have a true emergency.

The list of doctors and hospitals will also be smaller in a given area.

If there are hospitals and/or doctors you absolutely want access to, it's best to check on their participation first.

This used to be a brutal process every open enrollment! Now, run your quote here and you can securely enter your doctors and meds. Sort by "Total Estimated Cost" and our free system will then quote the plans that fit your situation!

Game changer...especially every open enrollment (just update your meds/doctors and you're off to the races!). Saves so much time! The online directories are fool proof so reach out to us to chase down doctors/hospitals.

Just a recap since most advantage plans are HMOs and supplements work like PPOs.

The list of doctors is different.

What about how we interact with them?

Yes. Different...

Control over Health Care between Supplements and Advantage plans

This is more a function of how HMO's work.

The polite way to say it is that the care will be more "managed".

With a supplement, you and your doctor make more decisions on what course of treatment to pursue. It still has to be approved by Medicare but generally, more flexible!

With an Advantage plan, the care must be approved by the

insurance carrier.

- It may take longer to get to a certain type of treatment.

- Try 3 weeks of PT before getting an MRI. etc.

This is just the way HMO's work and most Advantage plans ARE HMO's.

If you want more control over health care decisions, Supplements will work better for you. People usually have a pretty good idea of their preference for HMO or PPO as a guide.

The way to "offset" this is to pick an Advantage plan with good reviews!

The Star Rating is probably our favorite litmus test for Advantage plans. We want 4 Stars or higher.

This will directly reflect just how "managed" an approach a given carrier takes! Our secret sauce!

Don't worry, that will be in our personalized quote as well.

Let's talk about the final piece...Prescriptions!

Prescriptions with Supplements and Advantage plans

The distinction with RX falls in line with other differences between the two.

First of all, RX is NOT covered by Medicare Supplements OR Medicare itself (Part A and B).

You have to get an additional Part D plan to cover medications:

- The Part D plans is offered by private carriers.

- The Part D plan then pays according to the benefits and you have different levels of coverage you can pick.

- Part D requires its own conversation.

It's a whole different world!

What about RX with Advantage plans?

Advantage plans generally include medication coverage. You'll see MAPD in the title with "PD" being for Part D or Prescription Drug.

Also, due to the HMO nature of most Advantage plan, decisions on what medications to prescribe will be more controlled by the insurance carrier.

The benefits may be comparable depending on the plan you pick but the list of drugs may be more narrow although we're seeing a slow merging between Advantage medication and stand-alone Part D you get alongside supplements.

Medicare Supplement versus Advantage Plans Wrap Up

Hopefully, we have given you a good overview at how the two plans differ and compare.

Net net...

It's best to think in terms of PPO (Supplement) versus HMO (Advantage). That's the big decision with Medicare!

For specific questions, we're happy to help.

We have dedicated California agents here to help. Zero cost for our Assistance and no obligation!

- Our goal is not one or the other

- Our goal is to find a great fit for you

- We don't push or "sell"

- Check out the Google Reviews

Again, how can we help??

Call 800-320-6269 for any questions on which option is best for your situation. Our services are free to you!