California Medicare Options - Why is the G medigap plan so popular?

Why the G Plan is the most Popular Medicare Supplement

Even back when we had the F plan, it accounted for 80% of the Medigap market.

The new G plan has taken the rein since the F plan left the market for new enrollees and for similar reasons.

We'll talk about the obvious reasons but also touch on the less-known superpower of this plan (Excess Charges!)

As for our credentials...

Just like it's predecessor, the G plan makes up the majority of the medigap market.

Let's look at why along these lines:

- What does the G plan cover

- How does the G plan compare with other

supplements

- The G plan and Excess Charges

- How to quote and compare G

plans in California

- Who has the best pricing for G plans now

- What's

the G extra or inspire?

- How to enroll in the G plan

Let's get started.

What does the G plan cover

First, it's important to understand that the G plan is a Medicare supplement. Medicare supplements are the senior equivalent of PPO plans in that you can see any provider (nationwide) that accepts Medicare.

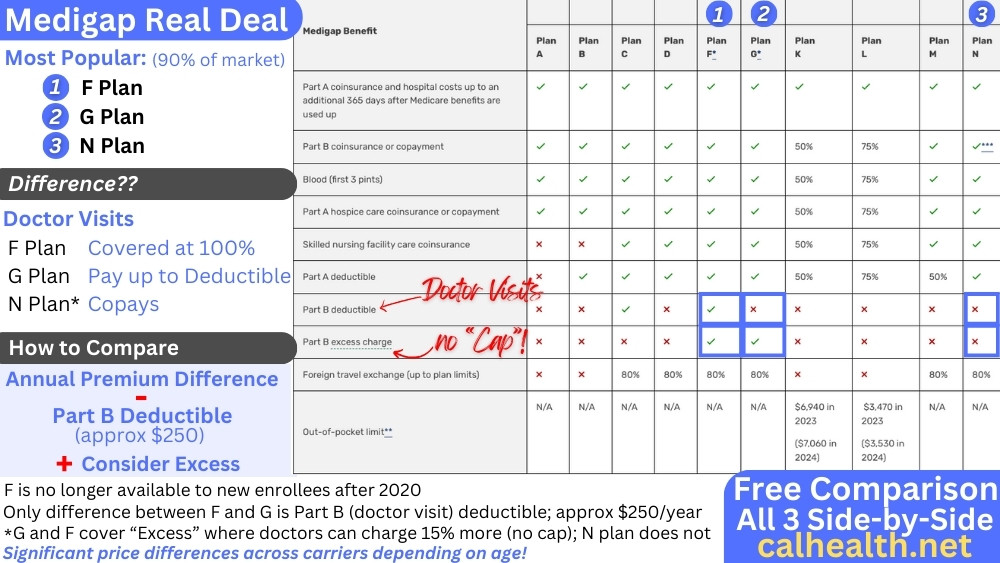

Medicare supplements fill in the gaps of what Medicare doesn't cover with different plan options from A - L.

G happens to be the most comprehensive of the medigap plans.

It fills in all the major holes of traditional Medicare except for the part B (doctor) deductible which is a bit over $240 (goes up each year).

Here's the quick take:

We've already looked at why the 20% is the real reason not to go with just Medicare alone.

There's no cap on this 20% which means you could pay this amount...indefinitely!

A $100K bill can add up to $20K for you. It's the wrong time of life to take this gamble with the state of healthcare costs.

The only difference between the G plan and the old F plan is coverage of the Part B deductible so roughly $240+/year.

Interestingly, the premium difference between the two can be $100's of dollars each year which is why many people with the old F plan are moving to the G plan.

This will only continue since the F plan "book" is shrinking (no new people coming on) and as a result, there's a rate spiral that occurs over time.

So...let's go practical with this...how do you compare the G plan with the other supplements.

How does the G plan compare with other supplements?

They all have the same networks, so it really boils down to benefits and price.

Let's first look at what they have in common:

- All plans cover the Part A 20% coinsurance (the most important piece) at

100%

- All plans cover Part B (doctor) with 20% coinsurance but with

different cost-sharing

- All plans but A cover the Part A deductible (but with different cost-sharing)

You'll notice some of the plans build in a percentage that you have to pay up to a max out of pocket.

This means that your total exposure will be higher if you get sick or hurt...up to those levels.

Now let's talk about the glaring difference:

Only the F and G plan cover Excess charges!

This is really the only reason to go with the G plan rather than say..the C plan.

For this reason, almost every carrier has a G plan offering but not all have the C and other supplement plans.

We're happy to help you compare the different supplements and there's no cost for our assistance!

Let's touch base on the Excess charge since many people new to Medicare are unfamiliar this term.

The G plan and Excess Charges

In California, a doctor can choose to charge more than 15% over what Medicare allows and still be considered a Medicare provider (in-network).

The problem with this charge is that there's no "cap" to it. As you know with the 20% coinsurance, we want caps!

A $10K charge may result in $1500 out-of-pocket due to these excess charges and that defeats the whole point of maybe saving a few $100/year in premium by going with a lesser plan.

It's always the big un-capped bill that we want to address with supplements and for new enrollees, the G plan is the only Medigap option that covers Excess charges.

More about this hidden charge here: Medicare Excess charges.

The bigger issue is trajectory.

Medicare's budget is under quite a bit of stress these days. Pure demographics (more people on Medicare versus younger workers to support) will drive increasing pressure for the next few decades.

This means that Medicare will need to find ways to squeeze costs and unfortunately, we can look to the ACA law and how it really leaned hard on the doctors (as opposed to hospitals and RX) to find savings.

As they keep putting pressure on doctors, we expect to see more and more choose to charge the extra 15%.

It's just the way things are going long term and it's important to make sure that 15% is capped.

If you really understand the supplements or insurance generally, THIS is the real reason to get the G plan versus the other options.

Otherwise, we would drop to a C or less since the other difference generally have a fixed cap and we can easily analyze the "cost" of not covering those in a bad year (lots of medical expenses).

There's no way to calculate excess since it's uncapped!

That's why...the old F plan and now the G plan are the leaders (and for good reason).

So...how do we find the best value for the G plan.

How to quote and compare G plans in California

This is easy.

You can run your quote here across the major carriers in California which all offer a G plan option.

Blue Shield and Anthem have been the best priced over the last 5-10 years really.

United Health is the carrier tied to AARP (they'll be in the quote as well). We have a comparison of Shield versus Anthem versus United medigap.

The big reason for this popularity is that they all have a $25/month new to Medicare discount!

It can differ depending on the area and age.

Maybe more importantly, these carriers have the longest track record

with the supplement side of things (as opposed to Medicare Advantage plans -

see comparison of Advantage and Medigap).

RRun your quote below and check our Google Reviews...we really try to help people find the best options for them at no cost for our assistance!

Who's the market leader right now for the Gplan?

Who has the best pricing for G plans now/h2>

Over the last 5-7 years, Blue Shield has had the best pricing for Medicare supplements. That's not taking into account their $25/month for the first year discount for people new to Medicare.

Anthem Blue Cross is generally 2nd and occasionally priced better depending on the area.

It's been roughly 90/10 over the last few years.

This makes sense since both carriers really have the Medigap market and process nailed down after decades in the business.

AAround 10 years back, AARP (United Health) was pretty hard to beat for medicare supplements but that's more rare these days. It can change so run the quote!

Shield is non-profit but ultimately, you need to go with the best pricing since the benefits and networks are identical.

Big comparison of California medigap carriers.

Or almost identical. What about the enhanced G plans?/p>

What's the G extra or inspire?

The Medigap market is competitive in that some carriers have rolled out "enhanced" versions of the G plan.

You'll see G plan Extra or G plan Inspire as examples.

Shield really went into this space aggressively.

The quick take??

The Extra plan adds in additional benefits with the big ones being vision and hearing aids.

TThe Inspire adds in a AAA membership (basic level) if available in your area to the G extra option.

Look at the pricing.

Does the premium difference between the G standard and the G Extra/Inspire justify the addition of:/strong>

- Vision

- Hearing Aids

- AAA basic membership (Inspire only)

If so, that's not a bad way to go.

One note...there's a benefit tucked into a vision where they take a picture of the back of your eye (retinal scan).

Painless and fast...this is the coolest benefit ever. They can basically take a snapshot of the state of your internal cardiovascular system and see way in advance (years eve), signs of:

- Metabolic dysfunction including diabetes

- Cardiovascular issues

- Blood pressure issues

We won't be surprised if dementia, Parkinson's, etc also have subtle signs soon (if not already) in this snapshot.

Very cool and do it annually! Vision covers that.

We can also get Delta Dental and/or VSP vision separately for seniors.

There can also be high deductible versions of the G plan which reduce the premium but add in a high deductible!

So...we find the rate for a G plan. Then what?

How to enroll in G plan

This is the best news. When you run your quote, we'll send you a link to enter your doctor and RX info.

We work with a system from Integrity

tthat makes this all seamless and

there's zero cost to you!

Remember, the G plan does not cover Part D (for medication) but

you can run that quote right away here:

You'll also see the G plan options and even be able to span class="auto-style1">apply online for both the G plan AND the Part D.

OOnce your information is loaded in, this makes it very easy to shop/switch at the end of each year for the Part D.

There are different rules for changing supplements like the G plan so reach out to us with your situation!

In good health, we can switch supplements any time of the year. With health issues, there may be options around your birthday (the so-called Birthday Rule).

Online applications for Medicare supplements is pretty revolutionary and

we're happy to offer it!/p>

Of course, we're happy to help you with any questions. Just check out our Google reviews!

Related Articles:

-

How to pick the best Medicare supplement plan

- What is Excess charge

- Guide to Part D for medication

- How to Enroll in Medicare plans