California Medicare Options - Compare and Review the major California Medicare Advantage plans

California Medicare Options - Compare and Review the major California Medicare Advantage plans

California Dreamin': Comparing the Best Medicare Advantage Plans

We noticed a concerning trend online.

Looking at some big Advantage plans comparison, there was a decided slant for one carrier or just a few.

Clearly, there's some kind of arrangement between the carrier and the owner of the site.

We want an impartial comparison of California Advantage plans to end all comparisons!

Hello there!

First, our reviews:

So...a few caveats before beginning.

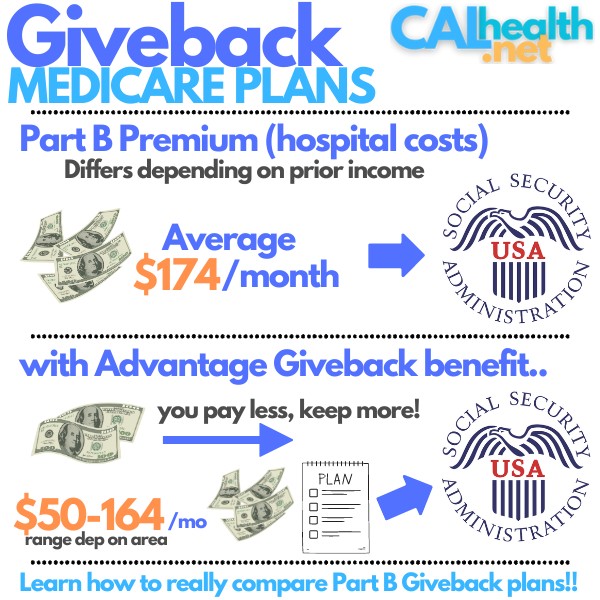

We'll cover the new popular kid on the block, Part B Giveback plans!

Advantage plans are definitely regional! We'll use three big areas

as our basis so we understand how to compare them in your area:

- LA county

- Bay Area

- San Diego

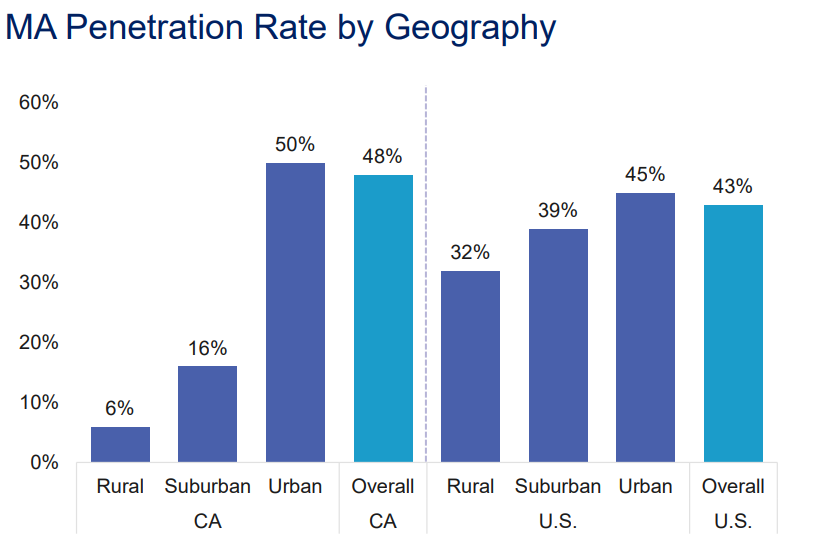

Advantage plans work best in more populous areas so we'll be able to get a lot of information from these three areas. Rural areas are a totally different ballgame but we'll discuss how to address them below.

We're going to lean heavily on the Medicare Star Rating and for good reason! This is the Yelp Review of Medicare Advantage plans and it's internal to Medicare so no funny business like the comparisons above.

We'll focus on the biggest carriers generally (except for the regional smaller players) for a specific reason.

They make up the majority of the market and most Advantage plans are HMO. The HMO model itself favors size!

The bigger the enrollee base, the more leverage a carrier has and generally, the bigger/better the doctor or hospital network.

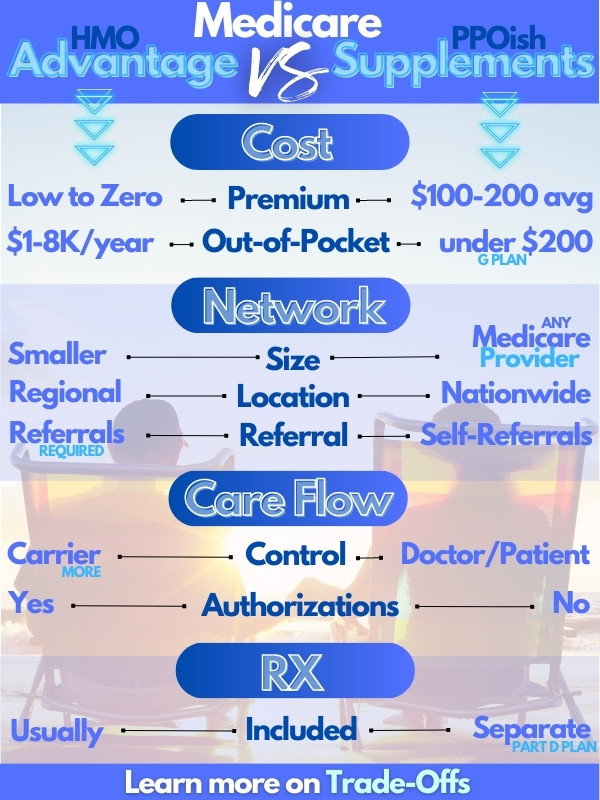

One of the two main trade-offs with Advantage plans versus medicare supplements is the network so we want to stack this in our favor.

That's just the way HMOs work and Advantage plans are no exception. There's a distinct advantage (sorry) to being bigger....so we'll focus on these players.

One note...we're not covering Kaiser which is THE biggest.

People know if they want to go with Kaiser so that's a done deal usually. They have very high rated plans but people generally want to remain in Kaiser networks or they want access to their doctors/hospitals (outside Kaiser).

You know who you are!

As for us, we're independent agents who work with all the big carriers. Our quoting system will even show you major carriers and plans in your area.

Here are the topics we'll cover for our comparison:

- What are the top California Advantage carriers

- How do the main California Advantage carriers compare

- What about smaller regional Advantage plans

- What's with the popular Part B Giveback plans?

- How to quote and compare Advantage plans in my area

- Top tips to avoid bad Advantage plans

- I don't like my Advantage plan...what can I do?

- The secret (not so secret) 5-Star Move option

Let's get started. You'll notice we added some escape action details (if you don't like your Advantage plan) on the end there!

What are the top California Advantage carriers

Why focus on the biggest carriers for Advantage plans?

It's all about HMO.

Essentially, the HMO model is a mini-single payer ran by a private (sometimes non-profit) company.

This means there's a fixed bucket of money per enrollee that comes from Medicare.

This also means there's a fixed bucket of money that goes to the providers (primary care, medical group, etc) to manage care.

It's much better to

have 1000 enrollees in this situation than 100!

If one person has really big bills (say...a $1M surgery...not unheard of these days), you want to spread that among as many people as possible. 1000 is better than 100!

Over our 25 years in the industry, we've seen how small or closed plans get blown out as a result of too small of a pool of people.

It's also why Advantage plans are generally not in rural areas. Just not enough bodies to spread the risk of big bills over.

https://www.dhcs.ca.gov/services/Documents/OMII-Medicare-Databook-February-18-2022.pdf

Of course, almost every plan and their mother is in LA county!

So...we focus on the biggest carriers with any HMO model. Why?

Look at the from the doctor's point of view. They are also getting a fixed bucket of money for each enrollee.

They have the same cost constraint....300 members is better than 30 in case one has really big bills. Remember...it's one fixed bucket. If you exhaust it, you lose money!

By definition, this is how HMO's work and thrive. They put a cost constraint into the equation and before you rail against this meddling, understand that they're winning!

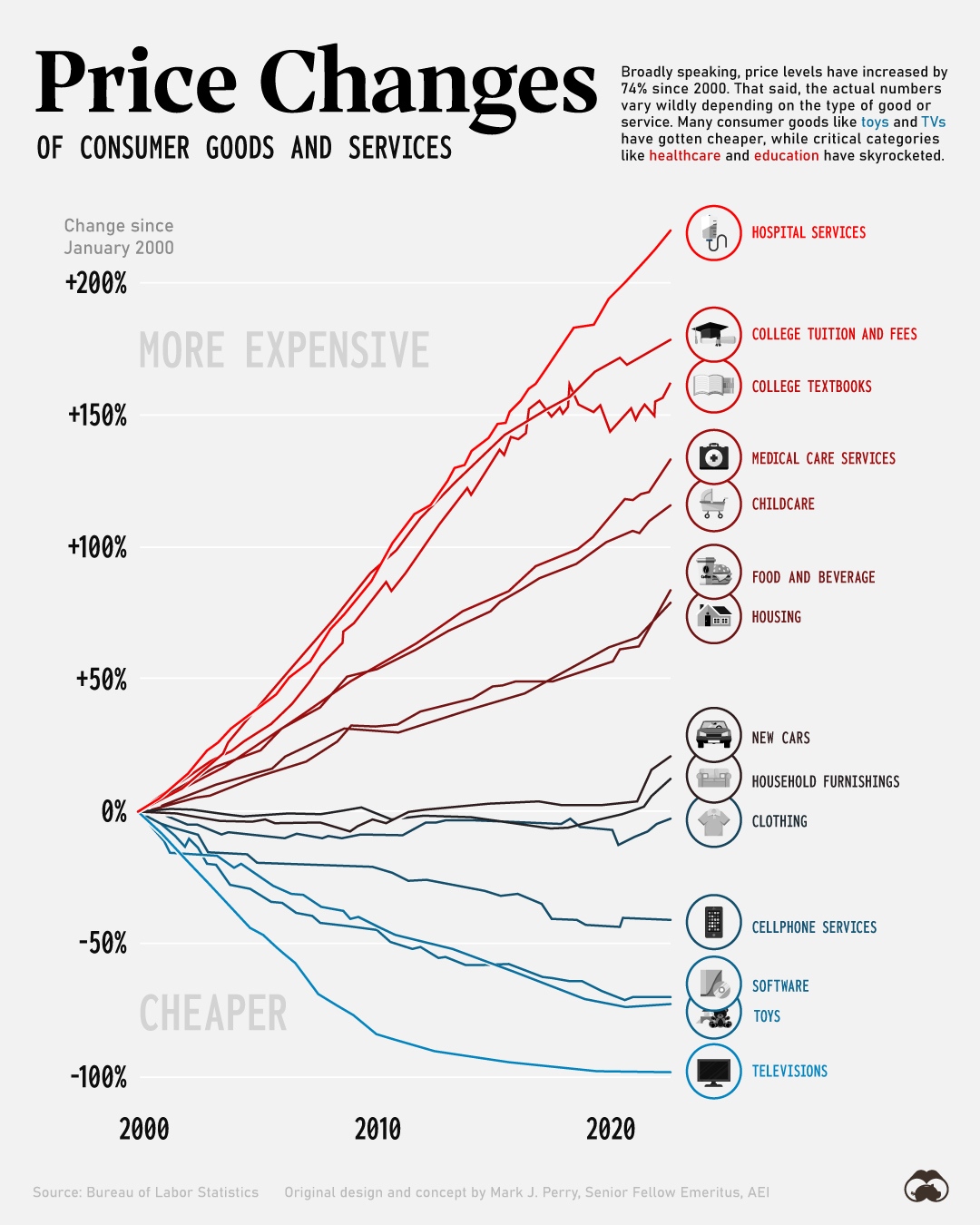

In fact, we've seen the Covered Ca market go from PPO to EPO to HMO over a very short period in the face of this same spiraling health care cost inflation.

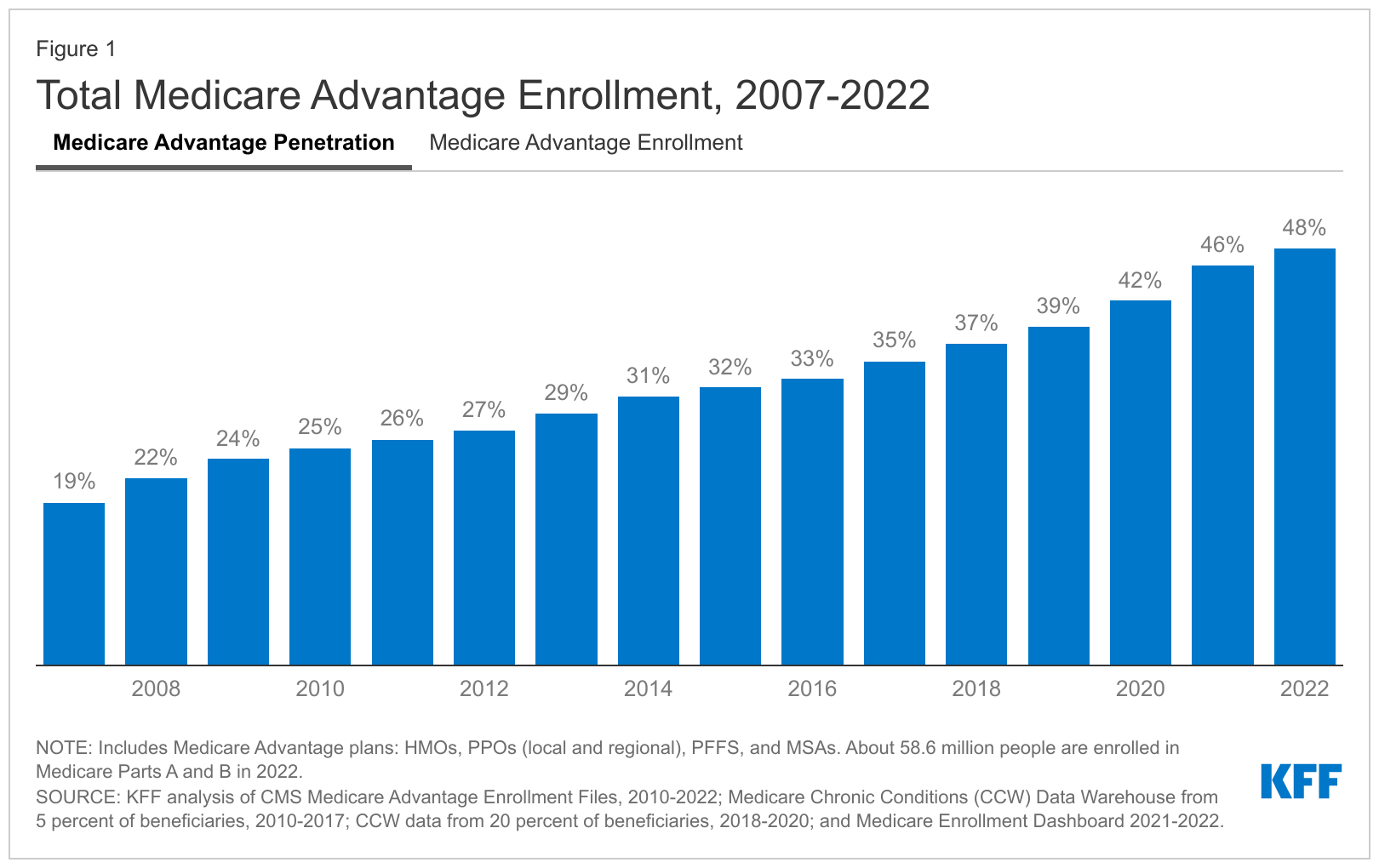

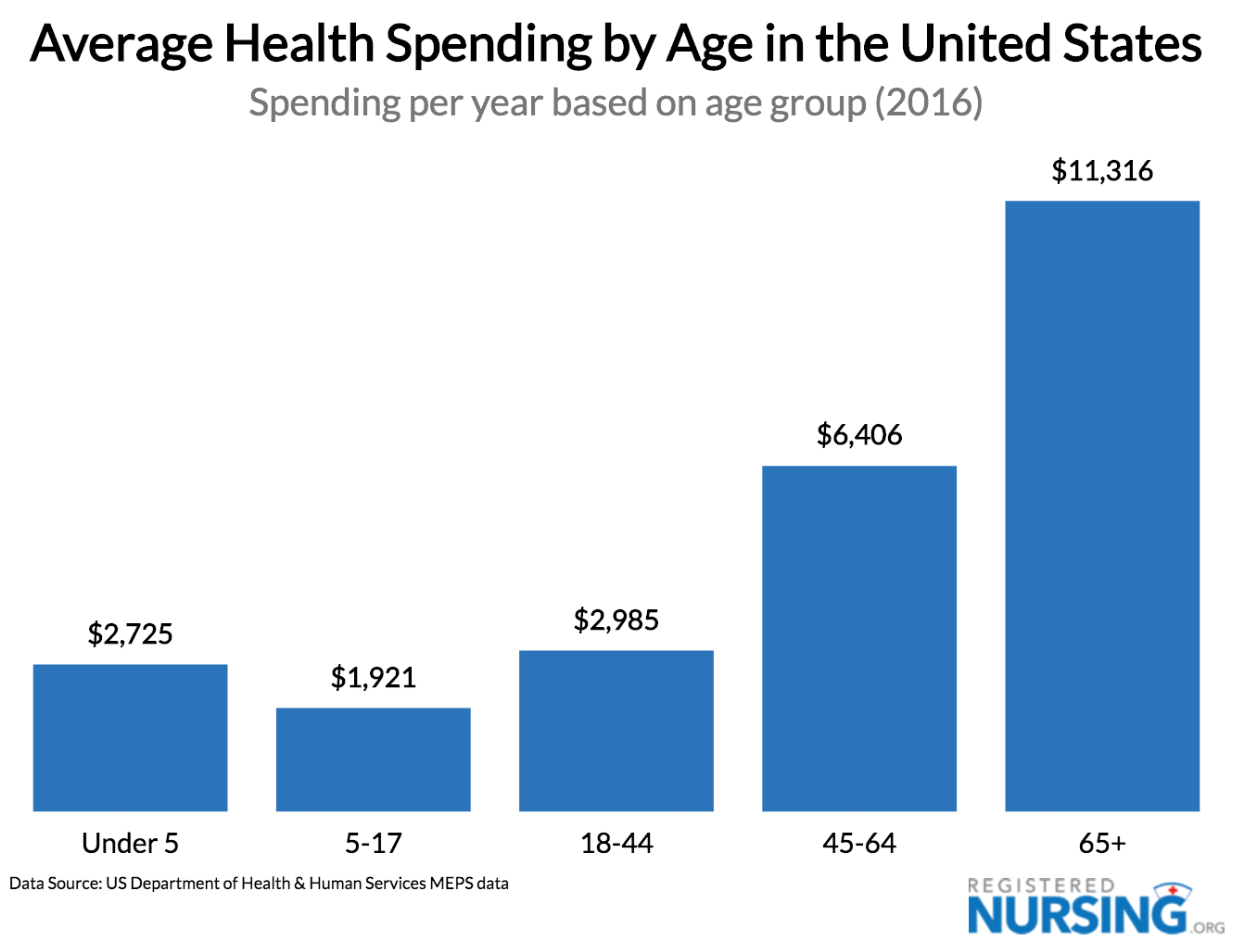

Advantage plans went from 40% to roughly 50% in 2 years (2019-2021) and we estimate 70% by 2030. It's winning.

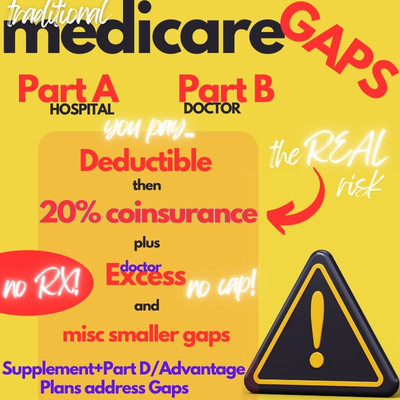

Just look at what's coming...

Now before this scares you off, also know that there are plans that have 5 star ratings (out of 5 more on this below) and satisfaction levels over 90%

It can be done well and we'll note what we see on this side and how to take advantage of that information.

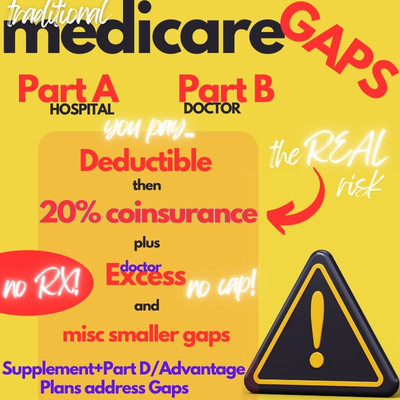

More info about Advantage plans versus supplements or Advantage plans versus Medicare alone.

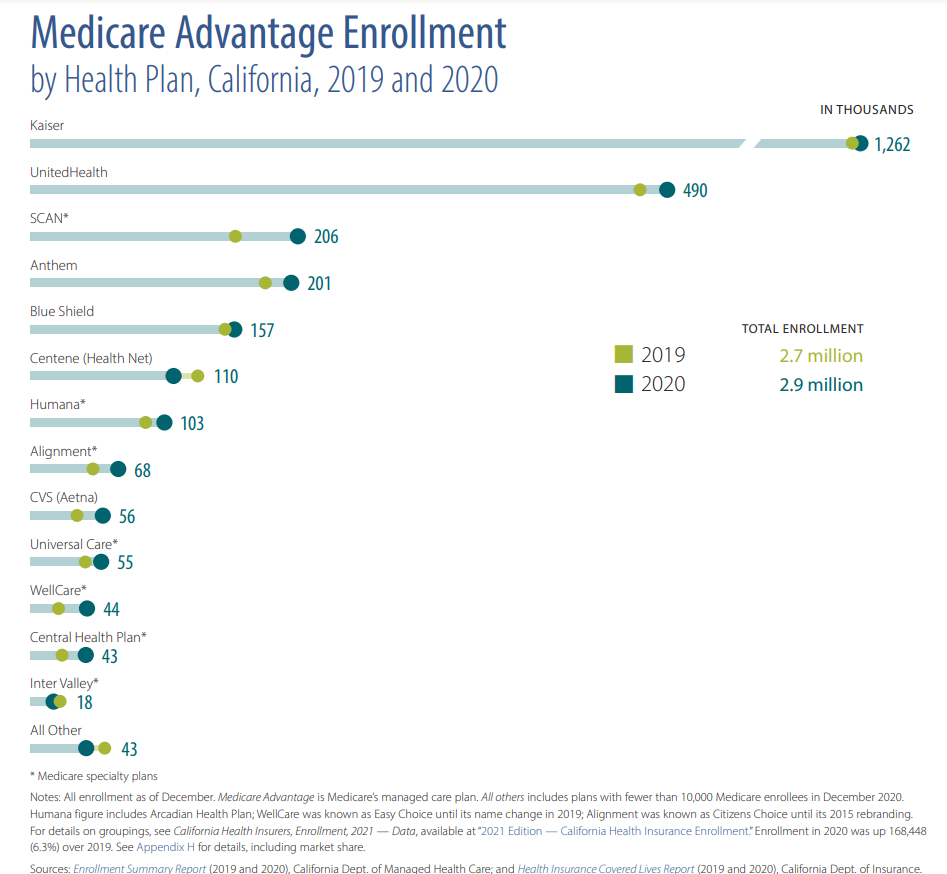

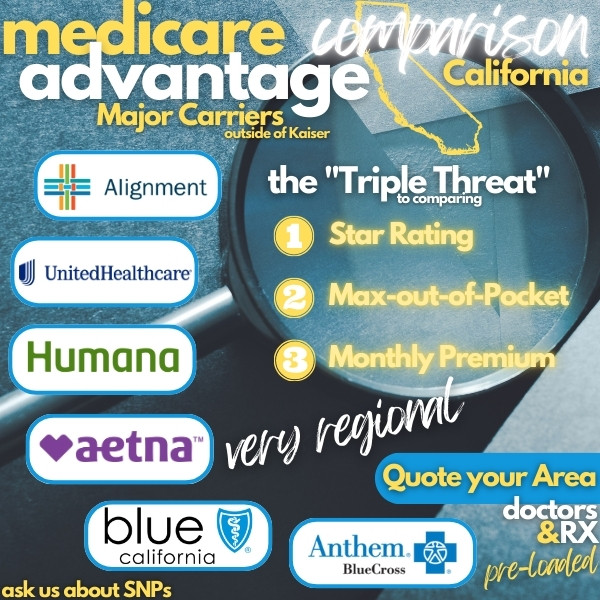

So...who are the biggest carriers in California?

We focus on the following:

- UnitedHealthcare®

- Alignment

- SCAN

- Anthem

- Blue Shield

- Wellcare (Health Net or Centene)

- Humana

- Aetna

Right off the back, you can see that UnitedHealthcare® is a monster player in this market.

Scan and Alignment are quickly growing and we see why with the way they're doing things (more on that below).

Then you have the traditional carriers that just dominate the State's health insurance market across all segments such as Anthem and Blue Shield (two separate carriers in the senior market for California).

Health Net was originally an HMO carrier spun off from Anthem many years ago so that model is well known to them. Goes by Wellcare in this market.

Finally, you have the big nationwide carriers, Humana and Aetna.

Humana is one of the biggest nationwide carriers but in California, they really went full bore on the Advantage market specifically.

Aetna is another nationwide player who focused on Advantage in California and partnered with CVS (a fascinating union).

Alignment is aggressively pushing into the market and looking at our Alignment plan review, this will only continue. Very impressed.

Again, each region will be different and some carriers will have better options/pricing in one area but not another.

It can even change from year to year as they jockey for market share only to underprice plans and have to adjust the following year during open enrollment.

We expect to see many small and aggressive carriers fly too close to the sun and see rates explode next year. You can't outrun health care cost inflation for too long!

So...we have our main California players.

What's the best way to compare them?

How do the main California Advantage carriers compare

Before we get into this, know that you can reach out to us do all the legwork if it's just too much. We believe in giving you all the tools free and upfront to run quotes but we're also here to help at no cost to you!

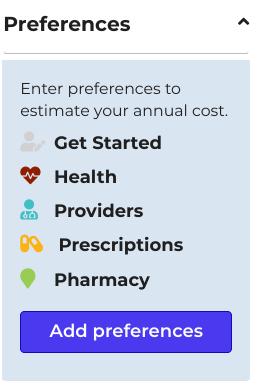

Since it's all a regional game (doctors and plan rates, etc), we first need to run our quote here:

Make sure to enter your doctor/RX info for Advantage or Part D quotes since the system will show plans according to your preference:

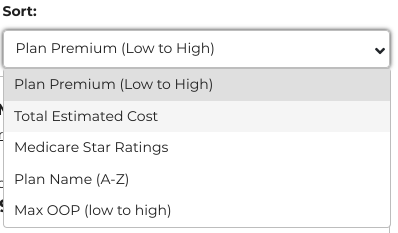

Sort by "Total Annual Cost" up top. This will take into account your medications!

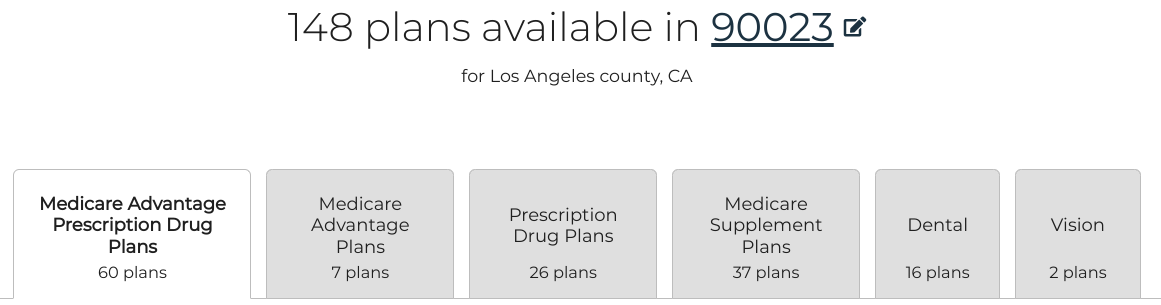

When you look at the quote, you can click on the Advantage tabs up top:

You'll notice you can also look at Supplements or just Part D (for medication). Most Advantage plans cover medications already. We don't recommend the 2nd Tab; "Medicare Advantage Plans" unless your meds are covered somewhere else (VA, Union, etc).

Okay...so 60 Advantage plans plans in Los Angeles.

We already explained above why we focus on the biggest carriers.

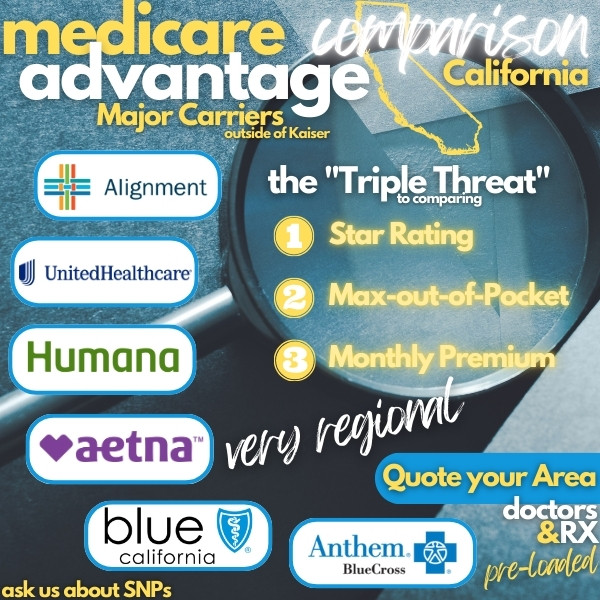

So...how do we compare them? Here's the secret sauce:

- Star Rating for each plan (lean heavy on this)

- Lowest premium and

lowest max out of pocket

- SNP plan offerings if eligible

Let's break these down.

The Medicare Star Rating is essentially our Yelp review of each plan and it's managed by Medicare so it can't be monkeyed with.

Just over 4 is the average. 5 is the best. 3.5 is the floor in our view but aim for higher than average.

Then we're trying to find the best combo of monthly premium and max out of pocket.

Here's where people get their heads turned by an aggressive agent (see how to find good Advantage agent).

Monthly premium is obvious and we assume the plan works with your doctor and meds since you entered that in our form before the quote. Very important.

Complaint #1 and 2 with Advantage members are around access to preferred doctors and medications!

The max out of pocket is the real deal. Don't get distracted by low copays or gym memberships.

The whole reason to have an Advantage plan (or health insurance for that matter) is to cap your exposure on big bills.

An add-on vision plan will do you a lot of good when that hospital visit causes you to hit the $4K max on the plan aggressively pushed to you!

Don't fall for it. We want a low max out of pocket and we explain why at our How to Compare Advantage plans review.

Again..this is WHY you get anything in addition to traditional Medicare to begin with and there are many plans and agents pushing plans that have great up-front benefits (small bills) but just clobber you on the back end if something bad happens.

At that point, you're better off get a medicare supplement when you compare the annual premium cost versus exposure!

65 and older is not the time to take that bet! You're doubling on 16 (Black Jack reference for those confused).

Okay...so let's look at our three areas to see how this works practically (you can apply same formula to your area)

Los Angeles County Advantage Comparison (zip 90023 - different zips will differ)

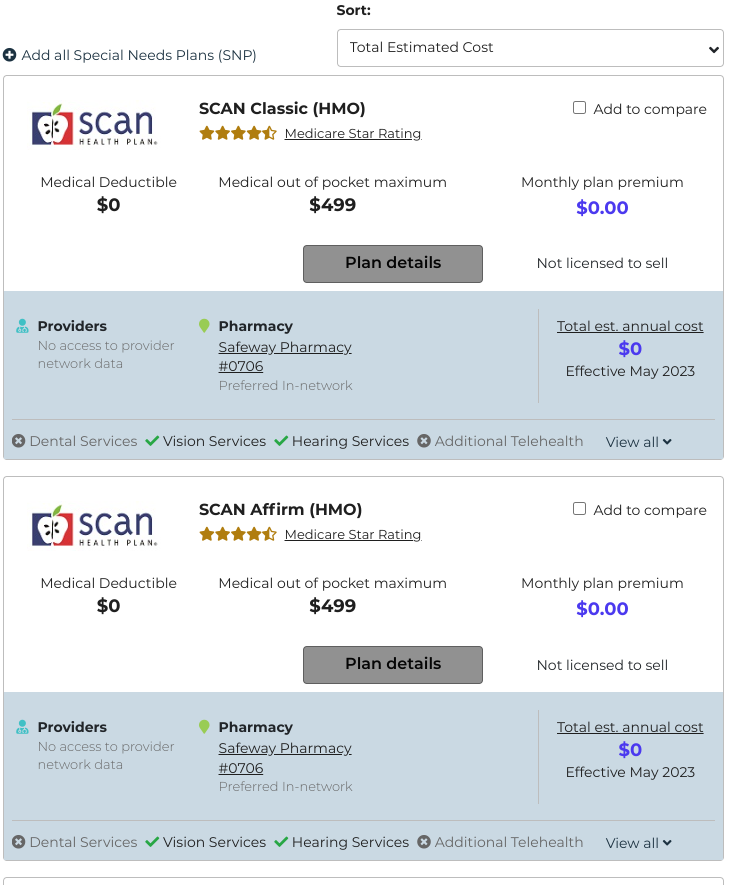

We find plans right in our "Triple Threat" zone for cost, max out of pocket, and Star Rating.

For our quoting engine (100% free to you), you can sort top-right by different preferences:

We like the Total Estimated Cost because it will take into account your medication costs if entered.

Default is Plan Premium which isn't bad either.

So...in the top 10 plans, we have...

Top 3 are SCAN plans outside of Kaiser:

- Humana

- Alignment

- UnitedHealthcare®

In that order. We would take Alignment over Scan IF you have doctors with them that you can't find with SCAN!

We'll look be low at how to take doctors into account when quoting. Big review on Scan Advantage plans or Alignment Advantage plans.

For example, the powerhouse medical group Optum down south or Sutter health up North might be a strong reason to consider Alignment.

Otherwise, if doctors are covered under both, the Star Rating for SCAN is pretty ridiculous (good)!!

Goodness.

- Max out of pocket under $500

- Zero monthly premium

- 4.5 Star Rating on the their top 3 plans

SCAN is a non-profit and we're really impressed by what their doing. Big of Review of SCAN Advantage plans here.

Being in the health insurance business for 25 years and seeing just a constant barrage of rate increases with very little done to actually make people healthier, they're knocking it out of the park.

It's hard to get excited about health insurance but they genuinely appear to want to bring down cost by improving health!

Sortapacks (medications come in morning/night packets), drive cards, and just one innovation after another.

In LA county, if they work with your doctor/hospital, it's hard to beat. They also had a 91% satisfaction rate in 2022. Hard to beat.

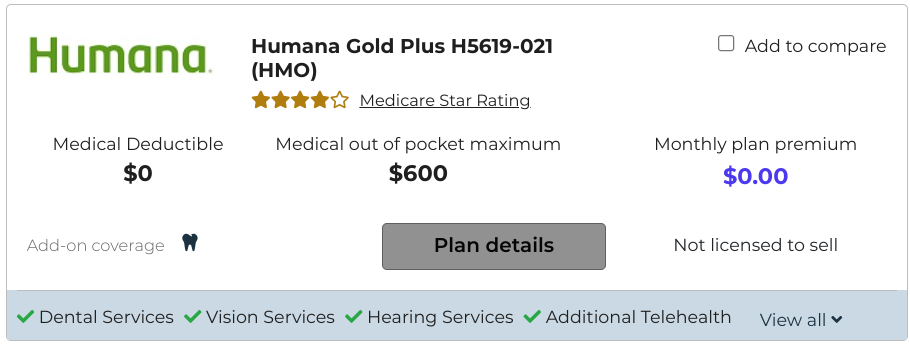

Next up is Humana:

Again, Max at $600. 4 Star Rating. Zero monthly premium.

Solid and the reason you would go with Humana over Scan might be providers if you enter in your doctors and medications and that affected their ranking (versus SCAN as an example).

Again, the #1,2 complaints for new Advantage plan enrollees are that their doctors are meds are not covered!

We take all the guesswork out of this by building it right into our quote

engine (partnered with Integrity

- zero cost to you for this option).

Make sure to enter that info so the quote is correct.

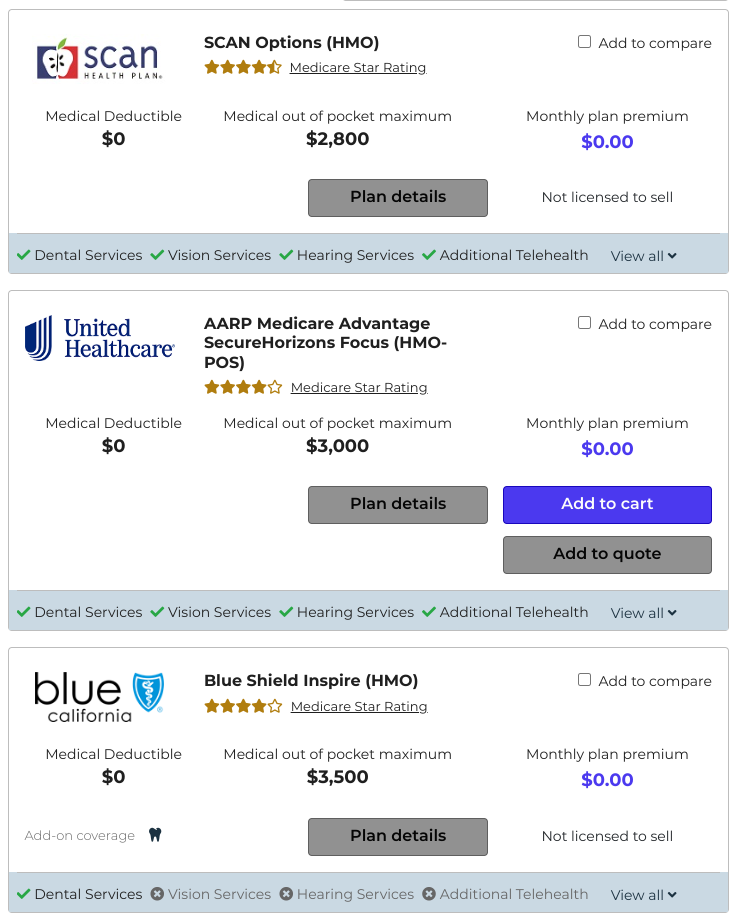

After Humana, there are two Alignment plans but SCAN has higher ratings and they're both slightly smaller carriers so we prefer SCAN in that situation.

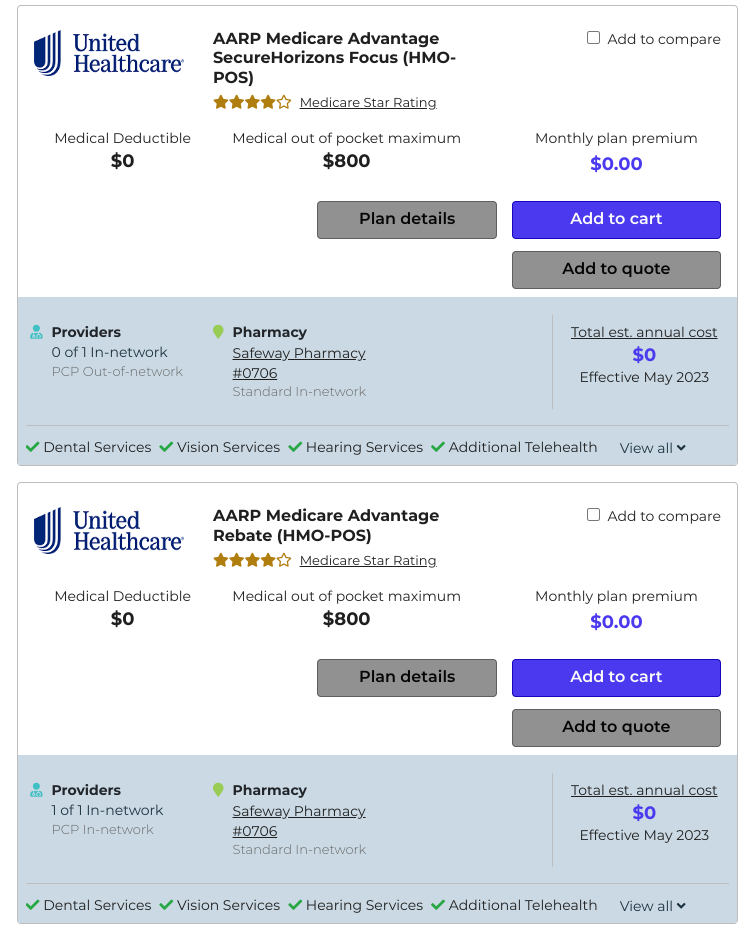

Then, UnitedHealthcare® rounds out the Top 10. Not surprising. Remember...they're the dominant California carrier after Kaiser (totally different network). Big guides on UnitedHealthcare® Advantage or UnitedHealthcare® versus SCAN.

Max has crept up to $800. Zero premium still. 4 Star Rating.

This just about fits the bottom of the top 10 positions.

We've doubled our max and lost a 1/2 a Star.

So...how do we compare these?

United's secret weapon is their network. It's probably the biggest in your area. For example, they have UCLA and Cedar Sinai which is a ridiculous coup! Two of the premium hospital groups in the State if not the country!

That's an example of their network prowess and it's probably going to sway many decisions.

In our SCAN versus UnitedHealthcare® Comparison, we note how UnitedHealthcare® has the biggest Advantage network so this may be the dealbreaker!

Blue Shield then round out the next 10 spots with Anthem further down. Again, LA county has many plans so this isn't necessarily a knock on them and there will be network differences.

Enter your doctor info. Enter your medication info. Then use the formula above for your area (Star rating, max out of pocket, monthly premium).

If you may qualify for special plans called SNPs (Special Needs Plans), click on "See Special Need Plans" towards to the top of the quote.

The two most common are:

- D-SNPs for people with both medi-cal and Medicare eligibility (about

22% of the enrolled population)

- C-SNPs for people with chronic diseases

There can be advantages to these people with certain plans.

For example, you'll notice there are three SCAN plans up top (rank 1-3).

The first one (Classic) is for people eligible for medi-cal. SCAN Balance is for people with chronic disease.

This is where a good agent really comes in handy! Check out our google reviews!

Alright...let's pivot to the Bay Area...we'll use a San Jose zip code to show it can really vary by region.

Bay Area Advantage Plan Comparison

Wow...look at the top 3 (outside of Kaiser)!

Very different (yet similar) to LA.

SCAN is top spot (again, Alignment was in top 5 but we prefer SCAN due to it's Star Rating!)

A few things to notice.

Star ratings still look good. Zero premium as well.

The max out of pockets have really jumped up! $2800 is now the lowest!

There is one carrier called Brand New Day with a $1500 max but it has a 3 star. WE hear from many people after enrolling in that plan not realizing that it the reviews are not great.

Remember, 4 is the average! 3 generally means a pretty bad experience and we expect to see some major changes in the the coming years.

This always happens when small, aggressive carriers try to gobble up marketshare. Just a word of caution after seeing many such situations over 25 years.

So...the Advantage model does not work AS WELL in the Bay Area reflecting that costs are higher. Providers are more "protected" and have more leverage to charge more.

Remember...size of population directly affects HMO success!

Here's a question of smaller, more effective (SCAN) versus larger players (UnitedHealthcare® and Blue Shield).

If they all work with your doctors, we can go based on the same formula but there may be differences in network!

What if you want Sutter health including PAMF? You have to consider Alignment's Sutter plan (it's literaly in the name!) in this case. Make sure to enter your doctors in the quote tool below!

We're getting the hang of comparing Advantage plans. One last stop. Due South!

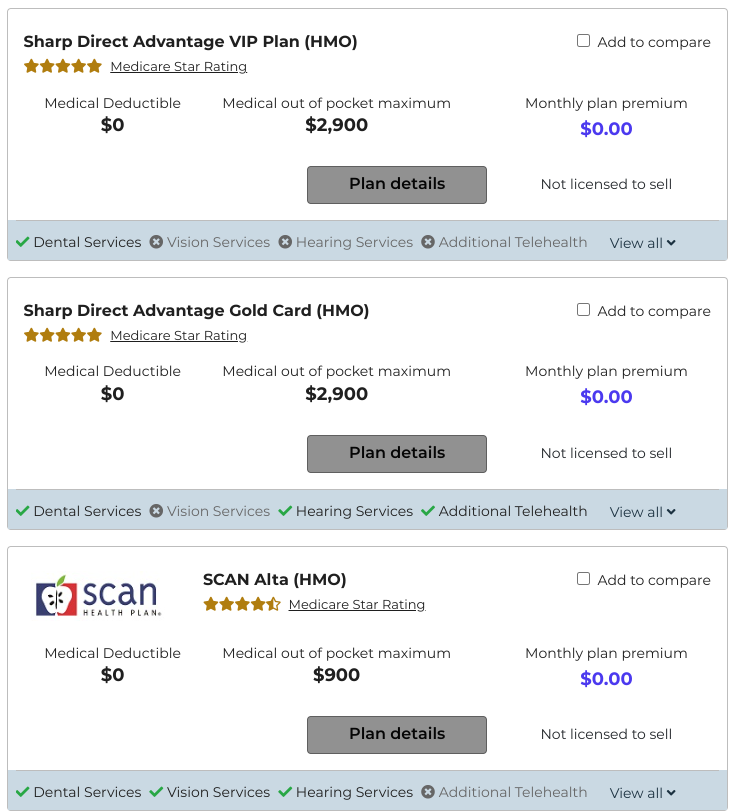

San Diego Advantage Plan Comparison (91911 zip)

Okay..we expanded the carrier list a bit to give an example of local prowess.

Sharp is powerhouse in San Diego!

We see that on the Covered Ca market as well. People just love Sharp and like SCAN, they're an example of what happens when health care is managed "well".

5 Star ratings! No monthly premium.

The only issue we have is the max out of pocket. $2900. Ouch!

Why does this matter?

Look, a G plan medicare supplement will run a 65 year old around $150ish. That's roughly $1800 annually. A Part D plan might be $10 at the low end. So $2K out the door (plus your Part B premium).

A G plan pretty much covers all the gap of Medicare except for the Part B deductible (just over $200).

So...if we have much go on healthwise, we can actually pay MORE with the advantage plan and we're losing the control/flexibilty of the medi-gap plan.

THAT's why we want a low max. We look at that in our Trade off between Advantage plans and Supplements.

With Max's under $1000, we're always coming out ahead which justifies the extra restrictions that come with HMOs (Advantage plans).

That still points us to SCAN (plan #3)! We're starting to see a pattern here (again, we're certified with all the big carriers outside of Kaiser so we have no incentive to go with one over the other).

It's just hard not to like what they're doing in healthcare delivery!

Down the list, you see Alignment looking strong. Humana (tied to UC San Diego but SCAN may have UCSD now).

UnitedHealthcare® rounds out the top 10 list. Their provider list is their strength!

Let's take a quick detour on the smaller regional Advantage plans first.

What about smaller regional Advantage plans

So, we looked at Sharp above in San Diego county. BrandNewDay is also sprouting up around the Bay Area.

How we compare these smaller, regional players in the California Advantage market?

Our same formula applies with a few wrinkles.

First, know that in some cases, there may be big changes from year to year as the health care costs catch up with aggressive smaller players.

Claims usually take a few years to catch up with aggressive enrollment. We've seen it all the time.

Now, we can change our Advantage plan every year during Open Enrollment so that may not be too much of an issue just understand you may be buying 1 year of benefits.

Some carriers are really well-established such as Sharp down south so that's less of an issue. It just means you need to stay in the Sharp network as opposed to SCAN or UnitedHealthcare® where you may have a wider breadth of providers.

Again...focus on the Star Rating with smaller ratings because all the benefit and cost advantages don't matter if you're unhappy with how they manage your healthcare.

Under 4 Stars is a real sign of issues and dissatisfaction with their members!

You can still see the regional players in our area through the quote tool...just select "non-licensed plans" up top.

What about this new-fangled Giveback plan?

The Part B Giveback Plans

The popoularity of Part B Giveback plans has exploded. From 2-3% to over 15% in a few years of the entire Advantage market and we expect that to get up to 25% shortly.

Why?

Inflation. The cost of everything is going up.

These plans will pay towards your Part B premium that seniors are required to pay every month up to $164/month (Alignment's popular plan).

That can be almost $2000/year in real money in your pocket.

Learn more about how Part B Giveback plans work or how to compare them.. Huge reviews on every facet of this because we definitely understand the need!

Look...it's still health insurance so that all needs to work as well and the Star Ratings have our back on that front.

So...what about your area and situation?/em>

How to quote and compare Advantage plans in my area

It's easy...and free to you!

RRun your quote here:

For Advantage or Part D, make sure to enter your doctor and RX info. span class="auto-style1"> That's complaint #1 and 2 with Advantage enrollees!

You'll then get a full quote with all the plans in your area.

The big carriers will show right away. You can also click on "show Special Needs Plans" to view them as well.

You can sort top-right but we recommend lowest premium or lowest total cost if you have lots of medications.

YYou can also select different filters on the left side including the Part B Giveback plans.

Focus on the "Triple Threat"br>

- Star Ratings

- Lowest Max out of Pocket

- Lowest Monthly Premium

IIn that order!

If you think you might qualify for special plans based on medi-cal eligibility or chronic disease, reach out to us at 800-320-6269, help@calhealth.net, or pick a time to chat here.

We can point out the plans that might offer you added benefits or reduce out-of-pocket costs.

We like to look at multiple plans/carriers to make sure you getting the best option! That's our role as good agents!

A few tips to avoid the stinkers!/p>

Top tips to avoid bad Advantage plans

- Make sure your doctor/med info is entered when you get the link.

Issues around this is complaint #1 and 2.

- WWatch out for plans with

big max out of pockets! This can mean $1000's out of pocket.

SNPs/a> may differ here!

- Beware

of anyone or company pushing just one plan! Red flag. It's probably

not in your interest

- BBeware of pushy salespeople who seem to want you

to enroll in a plan over anything else.

- Don't fall for the bells and whistles! The free set of steak knives will probably come back to bite you

Don't enroll in a plan unless you feel confident (get assistance!) and don't get pressured into applying for coverage.

This is the #1 complaint against Medicare Advantage agents! We don't push!

Check out Google Reviews./p>

In fact, we just gave away all our secrets! Most agents would think that's crazy but it's the right thing to do.

Learn more on how to avoid bad Advantage plans or bad agents.

Let's say you don't like the plan you're in. What can you do?

I don't like my Advantage plan...what can I do?

Most people are familiar with the Annual Open Enrollment period from Oct 15th-Dec 7th.

They may not know the other period that follows for do-overs.

This is call the Medicare Open Enrollment (as opposed to Annual) and it runs from Jan 1st to March 31st of each year.

During this time, you can change to another Advantage plan or back to traditional Medicare once.

You probably weren't told about this because agents don't want the extra work but it's an important protection to know.

There can other triggers during the year...the main ones being:

- Move out of area

- Medi-cal eligibility change

- Involuntarily loss of coverage

Let's look at one more ace in your pocket.

The secret (not so secret) 5-Star Move option

If a 5 star plan is available in your area, you're allowed to change Advantage plans to that one once per year!

This is one of the benefits offered to plans that keep their ratings very high with enrollees and it's designed to incentivize carriers to really up their game.

We're happy to help with any questions around these changes or how to compare Advantage plans generally.

You now have 90% of the equation down pat.

Questions around eligibility for SNPs (Special Need Plans) and comparing your area's specific options are the final 10%.

WWe're happy to help at no cost to you!!! Happy Hunting (and saving).

Related Articles:/strong>

-

How to pick the best Medicare supplement plan

- What is Excess charge

- Guide to Part D for medication

- How to Enroll in Medicare plans