California Medicare Options - compare Supplements and Advantage plans

Understanding the Trade-off Between Medicare Supplements and Advantage Plans

Let's put the firehose of sales pitches down just long enough to get our breath.

Everyone is promising the moon and we know that's not realistic...or real!

So...how do we really get to the bottom of whether the Advantage Plans or Medicare Supplements might be the best fit for you?

It really comes down to two very important considerations.

Everything else is just there to confuse you and push you in one direction or another.

We believe that IF we really help people make the BEST choice...they'll make it with us since our assistance 100% free.

So...to that aim, we'll cover these topics:

- Real quick comparison of Advantage plans and Medicare supplements

- Key #1 - Pay now or pay later; the Big bet

- Key #2 - networks and say-so

- How to compare options with each camp

Let's get started! This is the big game people. As license agents, there's zero cost for our assistance and we're happy to walk through questions specific to your situation.

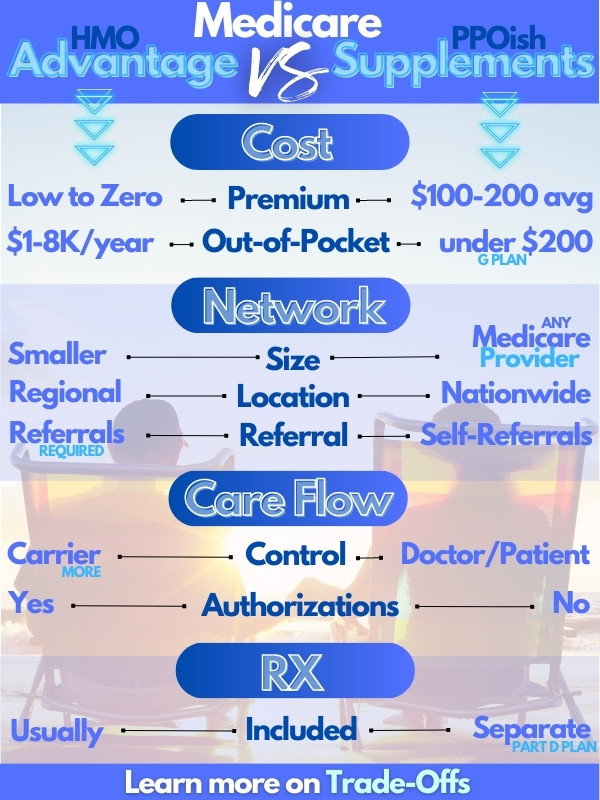

Real quick comparison of Advantage plans and Medicare supplements

We have deep dives on how these two models really work here:

It's really a question of PPO versus HMO!

A refresher course on the two...

- Essentially, with a PPO in the Medicare flavor of things, you'll be able

to use any Medicare provider, and care is largely driven between you and the

doctor (with Medicare's approval, of course).

- With an HMO (Advantage Plans), the networks will be smaller and based on where you live. Care will also be more "managed" which loosely translates into...cheaper to the carrier (and Medicare).

Of course, for this trade-off in control, there's a resulting difference in cost!

Advantage plans can be low or even no cost monthly! They may even include the Part D drug benefits as well.

Medicare supplements generally run $100+/monthly and Part D (medication benefit) will be a separate charge (generally $10+/monthly).

Okay...so doctor choice and care control versus cost. Easy....right?

Not so fast!

Key #1 - Pay now or pay later; the Big bet

If someone is pushing a no-cost Advantage plan with added bells and whistles but not explaining the "back-end", run don't walk.

For one thing, they're really not acting in your best interest!

We're not anti-Advantage plans (they're the ONLY choice for many people as we'll see below) but it's important that you see both sides.

So...a quick recap:

- Advantage Plans: Low or even zero cost per month; generally include part D

- Medicare Supplements: $100+/month; Part D for medication is additional (usually around $10+to start)

That's your monthly amount...the premium paid to keep the policy active.

It's only half of the equation really!

What about if we get sick or hurt? I bet they forgot to mention that part right?? Just zero monthly premium in skywriting!

- With a G plan (the most popular Medicare supplement), there's very little

out of pocket for medical expenses after the doctor deductible (around

$240/year; goes up yearly).

- With an Advantage Plan, you generally pay copays and/or coinsurance (a percentage of bigger expenses) until you hit the max-out-of-pocket.

These max numbers are critical to comparing your options!

In a bad year, how much are you expected to pay towards out-of-pocket expenses?

It generally runs around $1000 in areas like Los Angeles and goes up quite a bit from there depending on the plan you choose or area!

The basic Advantage rule of thumb...

The richer the smaller bills, the more you'll pay for big stuff

There's no way around this since Medicare is paying the carriers all the same amount of monthly money for each enrollee (that's how HMOs work by the way).

We have a huge Insider's Guide to Medicare Advantage

Okay...this isn't inherently bad but we need to include it in our calculation.

So...let's take an example:

- 65 year old in Los Angeles

- Lowest priced G plan (run quote here) is $130/month or roughly $1500/year

- Standard Advantage plan is zero monthly and $1000 max out of pocket

In a great year (no expenses), you're saving $1500/annually (Part D savings may increase that savings a bit) with an Advantage plan.

In a bad year, you save $500 ($1500-1000 spent towards max versus the supplement).

Okay...still not bad in this given situation. As long as you're okay with the doctor networks and the structured care.

Now...here's the issue.

That plan that the fancy salesperson or mailer is pushing with little bells and whistles may have a max that's much higher. $2000. $3000. $8000-10000???

Yes.

Alright...so you may be thinking... "I'm healthy...what does it matter?"

In fact, many pre-65 plans have max out of pockets around $8000 (bronze through gold plans).

So...ask yourself...are the health insurance carriers and their legion of salespeople sand blasting your mailbox and answering machine for the good of humanity?

No. Sorry...we're Medicare agents ourselves but it's important that you understand the playing field.

They love these plans because they know it's a terrible bet on your behalf.

Healthcare costs double with every decade of a person's life. You're entering the most expensive period of medical spending OF YOUR LIFE.

It's like betting on your favorite basketball team after their three big stars just tore ACLs (costs around $30K+ to fix if simple by the way).

So how can we use this information practically in our interests??

Here's the basic calculus:

- Can you afford a supplement; not only now but 5 years from now (probably $200-300/monthly then)

- What is the worse-case comparison between deductible and premium savings

For some people, they will never touch an HMO. For others, it's not a

question....Advantage plans work with their budget.

We have lots of people coming off of the silver 94 plan at Covered California with premiums of $10-20/month. Jumping to $300 ($130 G plan, $20 for part D, $150 for Part B with Medicare) for a supplement isn't really in the cards.

That makes the decision easier. It's an Advantage plan to fill in the basic holes of Medicare.

At least now, you know how to compare the many, many Advantage plans available from a cost perspective.

The Part B GiveBack plans have been very popular since they can reduce your monthly Part B premium!

Of course, we're happy to run the quote for you and find the best values to make the whole process easier. There's no cost for our assistance. Or run it for free here:

We'll focus on the max-out-of-pocket combined with your doctors/medications. It's a perfect strategy.

Speaking of doctors..

Key #2 - networks and say-so

That's the cost side of things.

Now the other big piece...who we can see and how care is "approved."

Advantage plans will generally have more narrow networks and we need to stay within a regional medical group or list.

This works pretty well in more populous areas with lots of people and lots of providers. Really, that's a function of the HMO model itself.

Keep in mind that you will likely not be able to see that wiz-kid doctor in another area for a particular issue.

You would need a Medicare Supplement for that (but it will cost you).

Again, in more populous areas, people generally have pretty good responses about their doctor networks in Advantage plans.

One other important note...once we get past certain eligibility triggers, you may not be able to go to a Medicare Supplement once on an Advantage plan for a period of time (generally 1 year).

If we're in relatively good health, we can always apply for a medicare supplement based on health outside guaranteed issue windows.

Every now and then we get a call from someone with a serious health issue that wants to move to a supplement to expand who they can see or what's being allowed.

This can be an issue unfortunately and it's part of the equation.

The other piece is management of care.

With an Advantage plan, the health insurance carrier has more control or say-so over a course of treatment.

For example, we'll see clients with back pain.

Rather than going forward with surgery, the carrier may require a series of steps first such as PT and other options.

This isn't necessarily a bad thing as some doctors are maybe a little too quick to cut (prostate is a big issue of contention on that front as are uterus removals).

- With Supplements, the decision is generally between the doctor and the patient.

- With Advantage plans, there's a cost incentive introduced into the discussion

Usually, Advantage plans will pay a fixed amount to a doctor for each HMO member they have.

It's a fixed budget ultimately and must be divvied up. Sorta like Single Payer (no judgment...just explaining pros and cons when you have a fixed budget).

Again, this isn't always bad as our healthcare system is so fast to blowtorch healthcare needs with lots of care. Our 2 cents.

So....we just need to understand that the two models might feel different.

We're happy to walk through your particular situation to find the right fit. No cost for our assistance!

How to compare options within each camp

First, top level...Advantage or Supplements??

A recap:

Advantage Plans are best for...

- Cost-conscious members who can be flexible with doctor choice and care flow

Medicare Supplements are best for:

- Require more control and flexibility of both doctor choice AND care flow

Medicare supplements are pretty easy. The G Plan is the dominant plan by far and fills in most of the holes of Medicare (just the doctor's annual deductible remains).

You can run a quote across major carriers to see who's priced best.

- Networks are the same (any provider that takes Medicare)

- Benefits are standardized (a G plan is a G plan across carriers)

Anthem, Blue Shield, and United are generally priced best.

Pricing stability is critical and this can vary by area. Just run your quote and know that some of the carriers can have first year discounts but we want to know the full rate since we're making a decision potentially for years! We have a massive guide to medicare supplements.

As for Advantage plans, we believe in giving you instant quotes across major carriers..for free!

This takes about 90% of the work out of the process (it's a free system

we offer PLUS no cost for our assistance throughout the year!)

Make sure to use our Triple Threat System for Advantage Plans:

Then, aim for low max out of pocket. Don't be blinded by the free stress squeeze balls and pretty lights (gym discounts, etc.).

The real game is that back-end protection versus the monthly premium once we've zeroed in on the doctors and medications!

The Star Rating should be 4 stars or Higher!!

Of course, lean on us. If you appreciate what we're trying to do here, show us some love, and let us get to work for you. There's zero cost for our assistance!

So you know who you're dealing with...

The goal is really to make this as painless as possible while providing your clearest explanation of how to pick well.

Choose well. How can we help?

There is no cost for our assistance and no question is too small.

Be well!

Call 800-320-6269 or email us at help@calhealth.net

Quote Medicare Advantage Plans and Supplements with your Doctor and Medications Reflected!