California Medicare Options - How to use the California medigap birthday rule

Using the California Medigap Birthday Rule to Your Advantage

Every day, we help people find better values for their Medicare coverage to the tune of $100/year.

Many times, we use the so-called Birthday Rule in California if someone can't simply change Medigap plans based on health or guaranteed issue rules.

We'll explain all below but beyond just the logistics of how it works, we'll look at strategies to get the most out of it!

That's where we go the extra mile and it shows in our reviews:

We'll cover these topics along the way:

- What is the California Medigap birthday rule

- What is lesser or equal

value with the birthday rule

- When should I apply in order to use the

birthday rule

- Switching from F to G plan with the birthday rule

- Switching carrier with the birthday rule

- Switching from the old J or I

plan with the birthday rule

- Switching from Advantage plans to Medigap

with the birthday rule

- What about Part D for medication

- How to quote

plans available with the birthday rule

- How to apply for plans with the birthday rule

Let's get started!

What is the California Medigap birthday rule?

Many people are familiar with enrolling in Medicare originally and how they could pick any Medigap plan regardless of health.

This is usually at age 65 or coming off of group coverage (with other triggers like moving, involuntarily losing coverage, etc. - Switching to Medigap).

There's a window of 6 months during which you can choose a plan, and they can't decline you based on health.

Once we get outside these "guaranteed issue" windows, we generally have to qualify based on health to enroll or change Medigap plans.

People can generally still qualify based on health, as the underwriting is pretty relaxed. We'll try this way and see what the chosen carrier comes back with.

But...worst case, in California, a person around their birthday can:

- Switch plans to equal or lesser benefits within a carrier or to a new carrier

The golden ticket!

This is available for people aged 65 and older in California.

So...what plans can we change to?

What is lesser or equal value with the birthday rule?

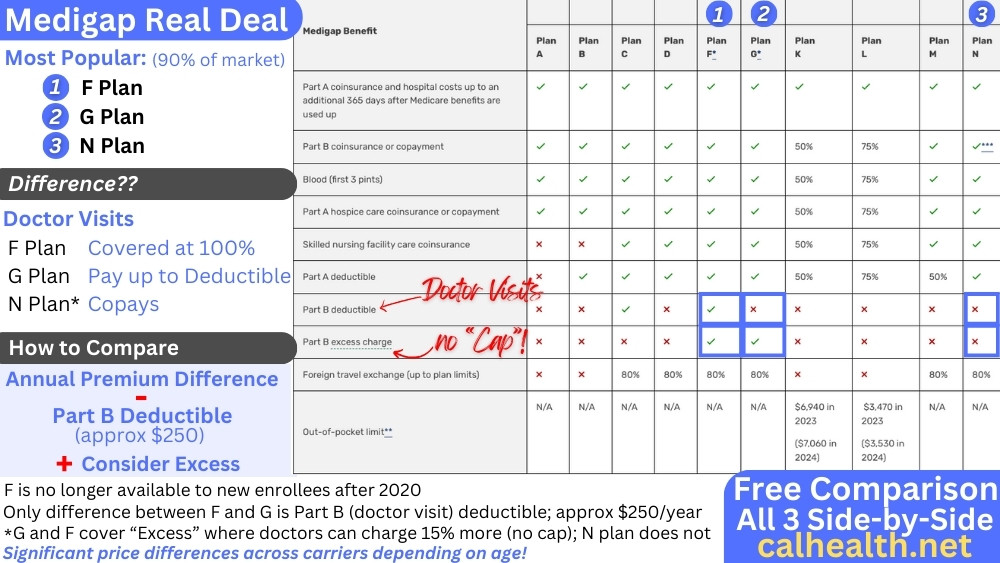

There's a range of currently available Medigap plans:

We'll rank the most popular plans in order of increasing value, although you should reach out to us with your situation at help@calhealth.net :

- J (no longer available to new enrollees)

- I (no longer available to new

enrollees)

- F (no longer available to new enrollees but maybe able to

switch)

- G is currently the most popular and richest plan for new

enrollees

- C is not very popular

- N adds in copays for office visits and

urgent care

- A the barebones medigap plan

Now...there are wrinkles to this now. Some carriers have brought out different versions of the F and G plan (extra, etc) that might affect rankings.

There are also high deductible versions of the G and F plans.

Check with us about your current plan and the one you're interested in and we'll double-check if the switch is subject to the birthday rule at help@calhealth.net

There's zero cost for our assistance and we try to knock it out of the park:

Let's really zero in on the timeframe since it's pretty important.

When should I apply in order to use the birthday rule?

Here's the official rule.

You need to apply for the Medigap plan:

- 60 days prior to the 1st of the month that your birthday fall in

60 days after your birthday

This is directly from Shield's Guaranteed Issue Guide (very handy). They are very flexible and other carriers may differ on timing so check with us.

So, let's really break this out to make it clear (that's what we do!!)

Let's say your birthday is May 15th.

You must submit your completed application as early as March 1st (60 days prior to May 1st) and no later than July 15th (60 days after the actual birthday...depending on the year, count the actual days with June having 30!!).

As for the effective date, it will be the 1st of the month following app submittal but no earlier than May 1st in our situation even if we submit March 1st.

We make the "completed" part easy by having online apps available for the major carriers:

We can also take paper apps and help with any questions so there's

nothing that will mess up the processing. More on quoting and enrolling

below.

Let's now look at the most common situations.

Enrolling anew in a Medigap plan with a birthday rule

Some people just have traditional Medicare by themselves and have decided that they don't like the 20% uncapped risk.

Good thinking because the costs we're seeing on this side are ridiculous and you don't want to be on the hook for 20%...of an open-ended number!

The birthday rule is a great time to enroll newly in a Medicare

supplement for people who

just have Medicare.

Keep in mind that we need both Part A and Part B to get a Medigap plan. You may only have Part A so you would need to enroll ("opt-in") to Part B through Medicare ( www.medicare.gov ) in order to get a Medigap.

One note...there can be a period you need to wait before Part B starts if you waited past the original Medicare window.

Check with Medicare or Social Security in advance in case you have to wait (we see 6-month periods pretty regularly). We have a "Bridge" plan we can use during this time.

If you're just becoming eligible for Medicare (losing group coverage, turning 65, etc), that won't be an issue.

We definitely need both Part A and B to enroll regardless of the birthday rule. It may be a two-step process (Part B and then birthday rule for Medigap). So plan ahead and reach out to us!

We have big reviews on how to pick the best Medigap plan or Compare the Medigap benefits.

Of course, we're happy to help!

So..let's see where we see switches that generally make sense.

Switching from F to G plan with the birthday rule

This is the big one. So many people are still on the F plan which was discontinued to new enrollees effective 2020.

We have a giant review comparing the F Medigap plan and the G plan.

It's generally a savings of around $700+ per year versus the Part B deductible (max around $240+; goes up a bit each year).

So, worst case...a net savings of around $500/year is pretty common.

Otherwise, the other benefits are identical!!

This is just found money and we're happy to help people find it.

The strange part to us...millions of people are STILL on the F plan.

That's 100's of millions going to the carriers that should remain with seniors. This is almost a badge of honor for us to help people make the change.

Again, we should try right away and see if we qualify. Otherwise, we have the birthday rule in our back pocket since the F to G is a true lesser benefit (just the doctor deductible of roughly $240+).

You can quote all the G plans here side by side from major carriers:

There's another angle though even if you want to keep the F plan (or G plan, etc).

Switching carrier with the birthday rule

Let's say you have the F plan and want to keep it.

Run the quote across the carriers!

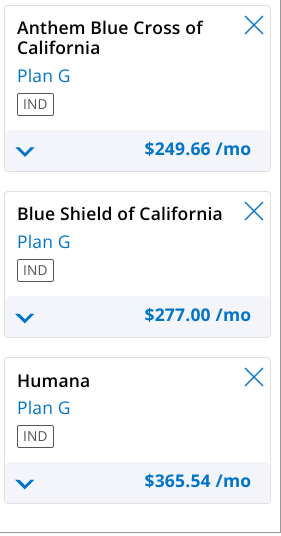

The spread for rates is just ridiculous considering that the risk to the carrier is the same (benefits are identical).

Look at an F plan spread in Los Angeles (it gets worst and changes for older ages):

Goodness. That's more than $100/month.

And there are lots of people on that Humana or Shield G plan.

Maybe 10's of thousands!

Year after year...paying $100/year for the exact same plan and network.

We want to literally build a crusade in helping people move to the lowest priced plan with quality carriers and our secret weapon??

The birthday rule.

Again, we try with a standard app and health questions but if there's an issue, we wait for the birthday and we pounce!

You can quote across the major carriers here:

Let's look at even more ridiculous situations.

Switching from the old J or I plan with the birthday rule

Like the "closed" F plan, some people are still on the old J and I plans.

More about the J plan (see a comparison of the J and G plan here).

The real reason to get the I or J back before 2010 was medication coverage. It was the only way to get it and it wasn't great (it had a cap of $3K on the J plan).

In 2010, Part D was created in Medicare which finally brought medication benefits to the senior market.

The I and J were closed for new enrollees but many people are still on the J plan. It makes up roughly 3% of the senior market still!

The pricing difference is even more extreme between the J and say the

G plan with a Part D.

It could be $1000's/year. Check out the review above but this is another big chance at savings.

Let us know what you're paying now for your J, I, or F plan plus your date of birth and zip code. We'll run the numbers and do a complete comparison for you at zero cost!

We mentioned how the I and J plan covered medications. How does Part D work with the birthday rule?

What about Part D for medication and the birthday rule

Learn all about Part D here but it is a whole separate beast from Medigap coverage.

The new Medigap plans do not cover mediation so we'll need a Part D plan. If you're on the F plan, you probably already have a Part D so this may not be an issue.

What if you don't have Part D or you still have the I or J plan (our condolences)?

This may be a two-step process then if we use the birthday rule.

The rules for when we can enroll in Part D are separate from the birthday rule or Medigap in general.

Worst case, we can enroll during open enrollment at the end of each year (Oct 15 - Dec 7th) for a Jan 1st eff date.

If we have to use the birthday rule to enroll in Medigap, it may go like this:

- Get a Medigap plan around the birthday

- Get Part D for medication starting Jan 1st (enrolling Oct 15 - Dec 7)

There could be a gap.

Again, if you're using the birthday rule to downgrade from a say an F to a G (very common), you probably already have a Part D and that can continue. It's separate from the Medigap choice.

If, however, you're newly enrolling in Medigap (only had traditional Medicare) or are downgrading from the J or I plan, you may have to wait till Jan 1st for Part D to kick in.

Reach out to us and we can help you!

Alright...that's the why. Let's look at the how!

How to quote plans available with the birthday rule

This is easy. And free to you!

You can quote the major carriers here:

A few notes.

Really check out our How to Compare Medigap plans or reach out to us to run the quote and find the best values.

The G plan is the most popular by far and we explain why here.

Since the benefits are standardized (A G plan is a G plan, regardless of carriers), we have a big comparison of the carriers here.

As for pricing, it's generally been:

- Blue Shield of California

- Anthem Blue Cross (diff carrier from Shield

in the Medigap market)

- UnitedHealthcare®

This can vary by area and age so it's really important to run your personalized quote here!

Reach out to us with any questions to compare.

Comparing the Medigap benefits guide is super super helpful.

Alright, we find a plan we like that will save us $100/year (very common...seriously).

Now what?

How to apply for plans with the birthday rule

This is our favorite part.

With our online system (totally free to you), you can submit online applications to the major carriers:

Even Part D quotes and enrollment are available.

When you run the quote, we'll send over access to the online apps which takes the old process of about 45 minutes and drops it down to roughly 15 minutes.

If you need help and want someone to walk you through it, no worries. Let us know a good time at help@calhealth.net and we're there to help.

People seem to like our assistance: