California Medicare Supplement Options - Insider's Guide to Medigap plans

Key Tips to Picking the Best Medicare Supplement Plan

Medicare is usually a brand new world after decades of private health

insurance.

New terms. News names. A whole new language (Part A, Part B, etc)!

You can run your quote anywhere and needless to say, you're getting so much mail on it that a few trees have suffered as a result.

The problem is that most of that "paid" mailing is pushing one plan or another...not necessarily what's best for YOU.

SO...let's boil down the key points to understand so you can make an

informed decision.

As independent California medicare supplement agents, there's no cost for our assistance and we work with all the major carriers!

More importantly, we seem to really help people...

Here are they points we'll cover and feel free to reach out with

any questions at 800-320-6269 or at

help@calhealth.net

- A quick lay of the Medicare plan landscape

- The supplement versus advantage plan decision

- The most popular plan on the market

- Don't forget Excess

- Part D for medications

- Pricing shenanigans and stability

Let's get started. This is meant to be a quick

summary...definitely contact us with a personalized walk through the options

above.

We covered the How and When to enroll questions as well as the very important Trade-off between Advantage Plans and Supplements.

A quick lay of the Medicare plan landscape

Medicare basically works like an 80/20 plan with deductibles.

They're paying 80% of the allowed charges and you're picking

up 20% after two different deductibles are met.

- Part A is for hospital or facility care and it has a larger deductible that goes up a bit each year

- Part B is for doctor costs and it has a smaller deductible which goes up each year.

That's the nuts and bolts of it!

So far, so good?

The Medicare supplement plans fill in these big holes (plus some smaller ones) with different benefits.

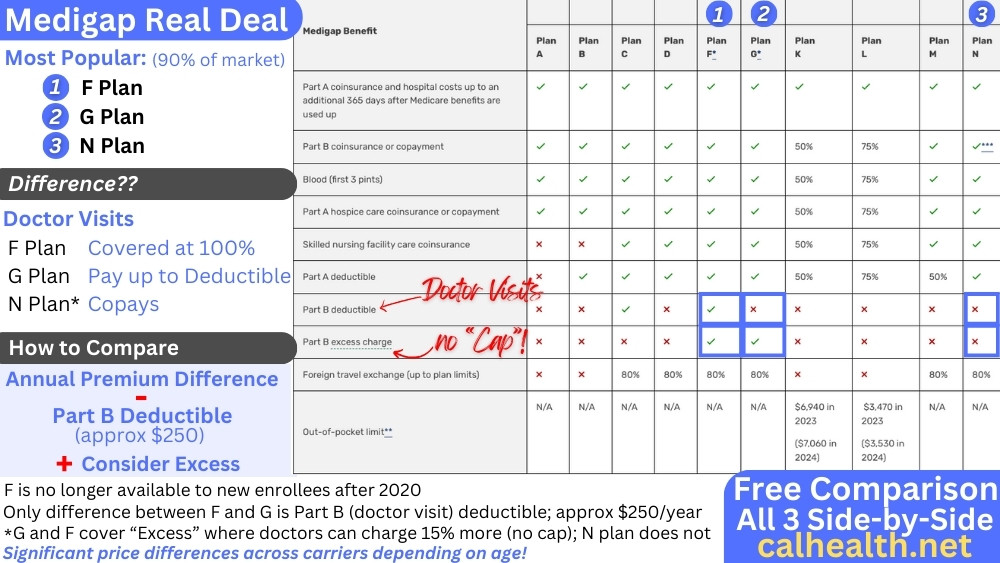

There's a range of plans from A to N with different levels for the deductibles and coinsurance:

The least expensive plan on the market is the A plan and the richest plan is the G plan.

There may be high deductible versions of the G plan which are even

cheaper.

We'll touch on Excess below since it's a very important consideration

among the plans.

Let's first dive into the big decision before looking at the plans.

The supplement versus Advantage plan decision

We have a whole section on Medicare supplements versus Advantage plans.

Advantage plans are essentially HMO style plans designed to wrap around Medicare.

There's a big sales push for these since they can have zero or very low premium.

You'll get lots of mailers for these plans!

Nothing's free so what gives?

First, they are HMO in design so you're limited to the doctors/hospitals you can use (smaller networks) and the carrier has more control over medical decisions.

That's just how HMO models work to keep costs down (their intended goal, after all)

The bigger issue that never seems to be in those mailers is the backend.

With medicare supplements..especially the G plan, you can expect very little out of pocket when you're sick or hurt.

With Advantage plans, there's generally a large out of pocket maximum.

This is an amount you have to pay before the plan goes 100% in a given calendar year.

It's usually a $1000 or even a few thousand dollars.

Essentially, you're saving in monthly premium now with additional risk if something happens healthwise.

Here's why the carriers love Advantage plans...

At age 65, it's not exactly the best

age to take that gamble!

On average, healthcare costs double with every decade of a person's life.

The carrier is more than happy to offer you a plan with shared backend in the thousands during a time you're more and more likely to have such events.

Let's say a G plan is $130/month at age 65. An

Advantage plan is zero dollars monthly with copays and $3K max.

If you have bigger bills and hit the $3K, that's the equivalent of

$250/month premium!

Double what the G plan is. See

why carriers love it?

Now, there's a way to make this work in your interest as we explain but you want to aim for Out-of-pocket max's around $1000/year. Learn more at our Insider's Guide to Advantage plans.

The issue is that once you get past the open enrollment period, you

may not be able to change from the Advantage plan to a supplement.

You're now making this same tradeoff at age 70? 75?

See why they love it?

Again, check out our big review of

Tradeoff between Advantage Plans

and Supplements

For some people, Supplements monthly premium just isn't in the budget and we totally respect that. We want those people to get the most out of that option though..

So...back to supplements: What is the most popular supplement plan...by far.

The most popular supplement plan on the market

The G plan is the most popular supplement on the market. We have a full review on the G medigap plan.

It replaced the old F plan, which used to be the most popular option.

Essentially, the G plan fills all the holes of Medicare at 100%

except for the Part B deductible which runs around $150/year.

This means you'll pay the doctor visits for the first few hundred

(goes up a bit each year).

Otherwise, the G plan is the richest option on the market and since

we're age 65 and up, that's the right bet as healthcare costs go up

accordingly.

You can quote all the G plans (even high deductible versions) side by side here:

Let's turn to one important piece that really makes the G plan pop.

Don't forget Excess

There's a term that you may not recognize if you're new to Medicare.

Excess.

Basically, doctors can choose to charge up to 15%

more than what

Medicare allows.

This is becoming more common as Medicare is forced to squeeze costs

with budgetary issues.

The problem is that the 15% is not

capped.

We definitely want excess addressed and only the G plan covers it.

Most people (and sales literature) totally skip over this because they

don't understand the ramifications.

Medicare is projected to be insolvent by 2026. They will make

changes and you can expect further tightening of reimbursement to providers.

More doctors will take the 15% which is

already the trend.

Let's say you have a surgeon that charges excess and his/her charge is $10K (not uncommon these days).

You're on the hook for $1500!

Again, there's no cap or limit to this 15% charge so we want it addressed.

That basically makes the G or G high deductible

mandatory.

What about medications?

Part D for medications

There's one more key piece...RX!

A whole separate plan addresses prescriptions (outpatient like what

you at a pharmacy) and it's called

Part D.

This is a plan purchased through a carrier and you quote through the

same system here.

Better yet, we can quote the plans according to your medication list and favorite pharmacies and there's ZERO cost for this assistance.

Just run your quote here and make sure to enter your doctor and medication info.

You'll see a quote of plans that cover your medications in your area based on best value - total out-of-pocket which is monthly premium + copays.

Check out our guide for Part D.

Again, Medicare nor supplements (including G plan) cover medications. So....essentially 3 pieces:

- Tradional Medicare - Your Part A and B with Medicare (Social Security)

- G plan supplement

- Part D for medication

Let's finally talk about pricing.

Pricing shenanigans and stability

This is actually very frustrating to us. People are already confused (hopefully less now!) in dealing with the newness of Medicare.

The plans are standardized so a G plan is a G plan in benefits and network regardless of the carrier.

What you're basically shopping then is pricing, pricing stability going forward, and ease of use.

Most of the carriers are pretty easy to work with since

they're all tied in with Medicare.

It really comes down to pricing!

Here's the rub...some of the carriers will offer discounts up front for

new enrolled (new Part B's...usually turning 65 or leaving employer health

plans).

This makes them look very cheap up front and then they charge more for the next few decades!

When you run a quote, you're just seeing this one carrier that's 20% cheaper not realizing that you'll more than pay for it over the life of the policy.

Very similar to the Advantage plan's high Out-of-pocket-max trick above.

In terms of pricing and stability, Anthem Blue Cross and Blue Shield of California (two separate carriers at the Medicare level in California) have been dominant for some time.

They may have small discounts for first year but their longterm trajectory is lower than other carriers.

The quote will show you full price (before discounts) so you can compare apples and apples but any applicable discounts will be available to you when you enroll.

Remember...it's not the first year that matters with Medicare since you'll have the coverage for years!

That being said, Shield and Anthem are usually cheapest as well which makes sense since they have the longest track record in the supplement market.

You can run your quote above to see how it stacks out for you.

Enrollment is super easy with our online system!

- Run your quote above

- Enter your doctor/medication in the quote (for Part D and Supplements or Advantage plans)

- Reach out with any and ALL questions

- Complete online app right through system and it's easy to make changes at the end of each year without having to re-enter everything!

Of course, there's no cost for our assistance and we're happy to help with any questions!

Related Guides:

- Compare Medicare Supplements and Advantage Plans

- How and when to sign up for Medicare

- The Medicare Supplement Guide

- The Trade-off Between Supplements and Advantage Plans

Call 800-320-6269 or email us at help@calhealth.net

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact www.medicare.gov or 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 day a week to get information on all of your options.