California Medicare Options - Difference between traditional Medicare and Advantage Plans

What's the Difference Between Traditional Medicare and Advantage Plans

This is a great question and many answers give you only half the story.

It's really important to understand both what we get...and what we're giving up!

There's a lot of "sales push" that says it's all roses with added benefits through Advantage plans but at 65+, we now know there's no free ride in the universe.

We're not anti-Advantage plans...in fact, we help people find the right one every day.

We're just pro-information! Don't take our word for it:

Let get to it along these categories:

- What does traditional Medicare cover

- What do Advantage plans add to

traditional Medicare

- What are we losing with Advantage Plans

- How to really compare Advantage Plans

Let's get started!

What does traditional Medicare cover

First, we need to introduce the default option. Traditional Medicare.

We'll assume you have both Part A AND B.

- Part A is the hospital piece that's usually no cost (paid into it your

whole life).

- Part B is for doctor expenses and requires a monthly premium

That's generally what is thought of as "Traditional Medicare".

Here's the rough sketch of what's "missing":

Let's break these down a little bit because it gets to the heart of why get anything beyond traditional medicare anyway.

There's are one big glaring reason!

First, with Part A or Part B, you'll have a separate deductible. An amount that you have to pay up front.

It goes up each year and is over $1500 for hospital and over $220 for doctor.

This can be a big number but it's capped. What comes next isn't!

After the deductible is met, you then pay 20% of the charges...indefinitely.

Forever.

So...a $100K bill may leave you with a tab of $20K!

Yea, but I'm not going to have big bills like that..."I'm in good health."

We just got off the phone with someone who had a $5 million bill for open heart surgery. It was $250K for every hour he was kept alive by machines while his heart was offline.

A simple knee surgery is quickly $25K if it goes well.

This 20% is the real risk with just having Medicare. There's no cap to it! Bad time to take that risk...

Another potential gap that no one talks about is "excess". We have a full review on Excess charges.

Doctors are allowed to charge up to 15% more than what Medicare allows. This is becoming more and more common with time as Medicare looks to contain costs unfortunately.

The issue with Excess charges is that there is no cap just like the 20% coinsurance above.

We don't like blank checks.

There are other smaller gaps in traditional medicare but the big three above are the critical pieces.

Medicare supplements were designed to fill in these gaps to varying degrees depending on the plan choice.

The new kid on the block, Advantage plans, also addresses many of these. Let's look at how they work.

What do Advantage plans add to traditional Medicare

With traditional Medicare, Medicare itself essentially manages your insurance.

An Advantage plans transfer this responsibility to a private carrier. Essentially, Medicare gives the allotted money over to the carrier and they then manage care.

Why do this at all from Medicare or the carrier's point of view...what's to gain?

The carriers are able to take advantage of well-established models such as PPOs and HMOs to contain healthcare costs and potentially offer richer benefits to the member.

Most of the big ones are HMOs since this model is the most aggressive and successful at reducing costs.

You're seeing the whole pre-65 Covered Ca market slowly move to HMO since the ACA law came into effect as a result.

Like it or not...it's winning the cost battle and that will continue...right into the Medicare market.

First...the basic lay of the land with Advantage Plans:

- Advantage plans must at least cover what traditional Medicare covers

- Advantage plans may offer additional benefits

- Advantage plans generally

have smaller networks that traditional Medicare and you have to work within

that network (outside of very limited situations like true emergency)

- Advantage plan benefits are more "managed" - required referrals,

pre-authorizations, step-therapy, etc are all used to keep costs down

- Advantage plans are based on your local geographical region

- Advantage

plans can be low or no cost

- Advantage plans must have a max out of pocket (total annual exposure) under a certain level

Okay...so how do we really make sense of this?

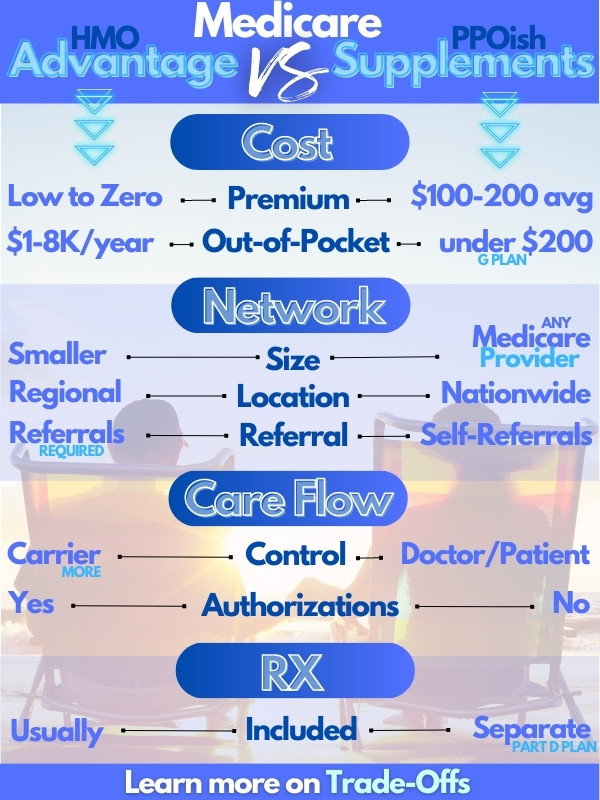

Essentially, you're likely to get richer benefits (less out of pocket) and a "cap" on your exposure with Advantage plans BUT you will have more restriction on who you can see and how care is managed.

It's an HMO afterall!

Where supplements fill in the gaps of traditional Medicare but you pay more monthly, Advantage plans try to "richen" the benefits by containing costs.

They primarily do this through selective networks and managed care.

Most salespeople will just pitch great copays or add-on dental/vision but we feel it's important to see the whole picture.

No matter what, we want to address the 20% coinsurance since there's no cap and it can be a total budget crusher.

You're entering the most expensive time to insure and sharing 20% of a $500K bill is not in the cards.

For this reason, Advantage plans are likely the sweet spot between just Medicare and medicare supplements:

- Traditional Medicare - big 20% risk; lowest cost

- Advantage Plans - low/no cost but

caps risk with more restrictions

- Medicare Supplements plans - more expensive monthly but addresses 20% risk without restrictions

You can learn more about Medicare Supplements versus Advantage plans.

So...we can run our Advantage quote and see all the benefits but let's address what we're losing first.

What are we losing with Advantage Plans

HMOs by definition are fixed buckets of money per enrollee.

This is true for Medicare or even pre-65 plans.

The carriers then provide doctors or medical groups a fixed bucket as well and the doctors manage care...ideally within that allotted budget.

It's not that different than NHS or national health care!

So...how does this translate out to you in real terms?

Essentially, there's a cost consideration in care.

There may be a "step-treatment" approach where lower-cost options are tried first.

For example with back pain, a course of anti-inflammatories and then physical therapy might be recommended before jumping to surgery.

In practical terms, this isn't a bad thing actually in today's medical world where providers are "quick to cut". Many issues can resolve and surgery is rarely an all-positive affair (my ACL can attest to this).

You really see this on the medication front (most Advantage plans include a Part D medication plan).

A simple substitution of a generic for a brand can reduce the cost by 10 fold (which you're paying for in your premium!!) for the same basic ingredient and efficacy.

With traditional Medicare, there's no real incentive for a doctor to prescribe generic especially with the Pharma reps coming by toting the newest brand which is slightly changed from older meds.

That's just the game. The HMO aspect of the Advantage plan brings a "check" on this write-anything situation with traditional Medicare (and even supplements).

Keep in mind that most of our healthcare costs are actually with medication and facility costs (hospitals).

So...to address the gaps of traditional Medicare via an Advantage plan, we can expect:

- Smaller networks which we need to work within

- More managed care

through a primary care doctor hub

- Step-treatment where lesser priced

options are tried first (and often work!!)

- Required referrals for specialists (generally pretty common-sensical in outcome)

People generally have a sense of how they work with HMOs from prior coverage. Advantage plans are just a post-Medicare version of this same process!

You can learn about the Trade-offs between Advantage plans and Supplements but in terms of just having Traditional Medicare, that's a risky bet.

You're choosing the most expensive time in your life to not cover 20% of the potential bill!

If the Medicare supplement is too expensive, the Advantage plans at least caps your exposure while adding in some cost constraint!

It might be the sweet spot for many people in Medicare.

Just a note...just like the pre-65 Covered Ca market, HMOs will probably swallow up the Medicare market as well simply because health care costs are exploding higher.

As Supplements keep ticking up at a faster clip, it just puts more pressure on people to jump to Advantage plans.

This is the future...like it or not!

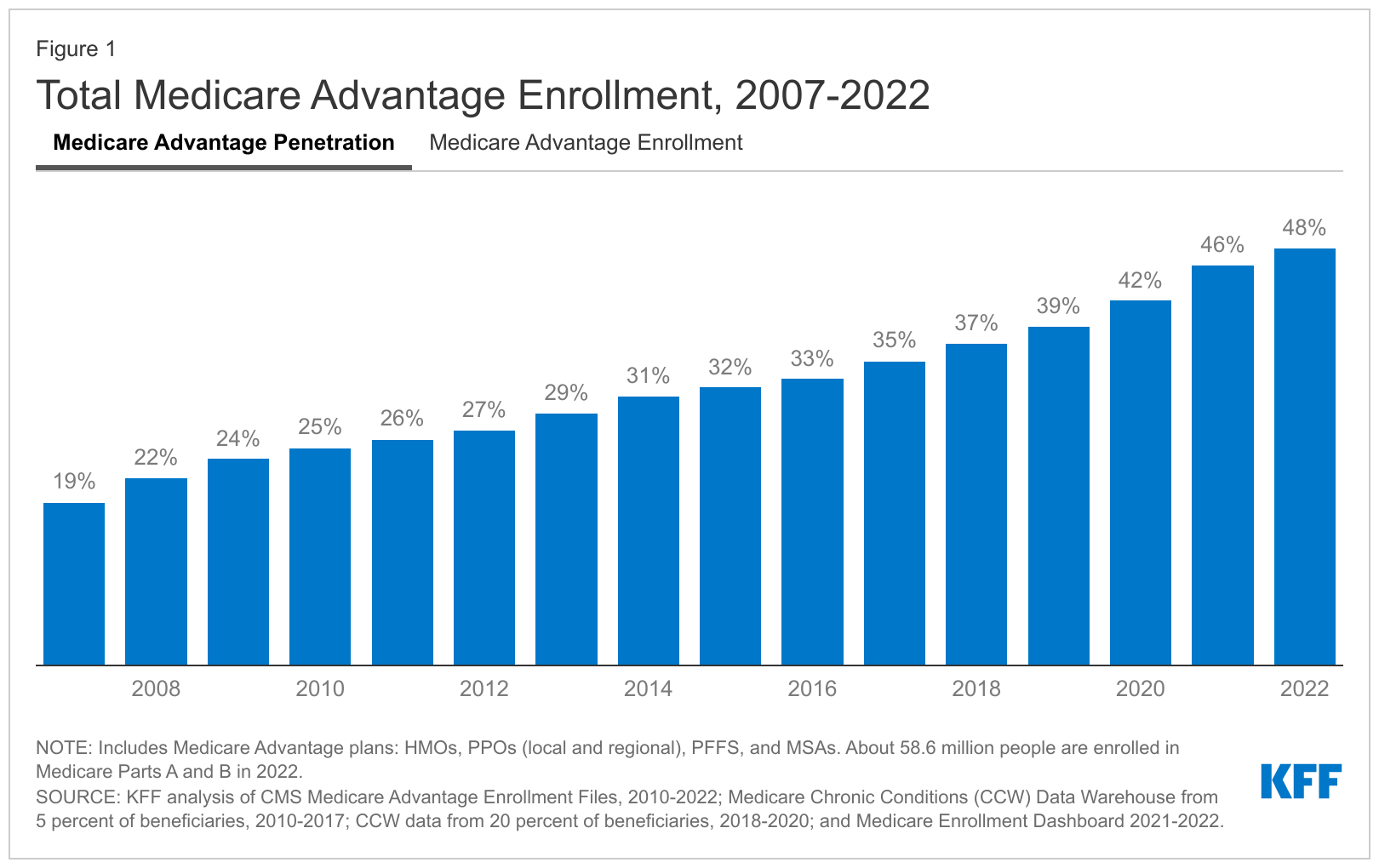

In fact, the share of the Medicare market jumped from 40% to 50% in roughly 2 years beginning in 2019.

Expect that to continue and we're estimating 70% by end of the decade.

There are PPO style Advantage plans which are a hybrid option between HMO Advantage and Traditional Medicare for people who really have issues with HMO (again, we all know where we fall on that question).

Of course, you can quote ALL the options in your area with your RX and doctors included through our FREE system:

Speaking of which, how on Earth do we compare all the Advantage plans available?

How to really compare Advantage Plans

You're going to get wholloped by a slew (that's a mouthful) of marketing slicks for this-and-that Advantage plan.

Seriously...it's a bit sickening and none of them are really discussing the pros...AND cons like above.

Try to avoid the shiny lights and offers...focus on the Sweet Spot of Advantage plans.

- Zero or low cost (otherwise get a supplement)

- OOP (max out of pocket) under $1K

- Star Rating 4 or higher

We explain why this is the goal at our How to Compare Advantage Plans.

Combine this with your doctors/RX for the plans and this process becomes so much easier!

Our system automatically does all this for you and there's no cost to use it.

Run your quote below:

Check out our Google Reviews to see how we work. Again, no cost for our assistance and we actually provide quotes for major plans in your area...even if we're not contracted.

Learn more about Advantage plans in our Insider's Guide to Advantage plans and make sure to check out our Part D for Medication Guide.

Most Medicare Advantage plans cover Part D and we strongly recommend choosing one that includes medications since you may not be able to get a stand-alone Part D if your Advantage plan doesn't cover it!

There is no cost for our assistance and no question is too small.

Be well!

Call 800-320-6269 or email us at help@calhealth.net

Quote Medicare Advantage Plans and Supplements with your Doctor and Medications Reflected!