California Medicare Options - What's wrong with Medicare Advantage Plans

What's Wrong With Medicare Advantage Plans?

We get this question quite a bit.

First, our credentials:

Usually, people are getting sold on how they're the best thing since sliced bread or the worst thing since burnt toast.

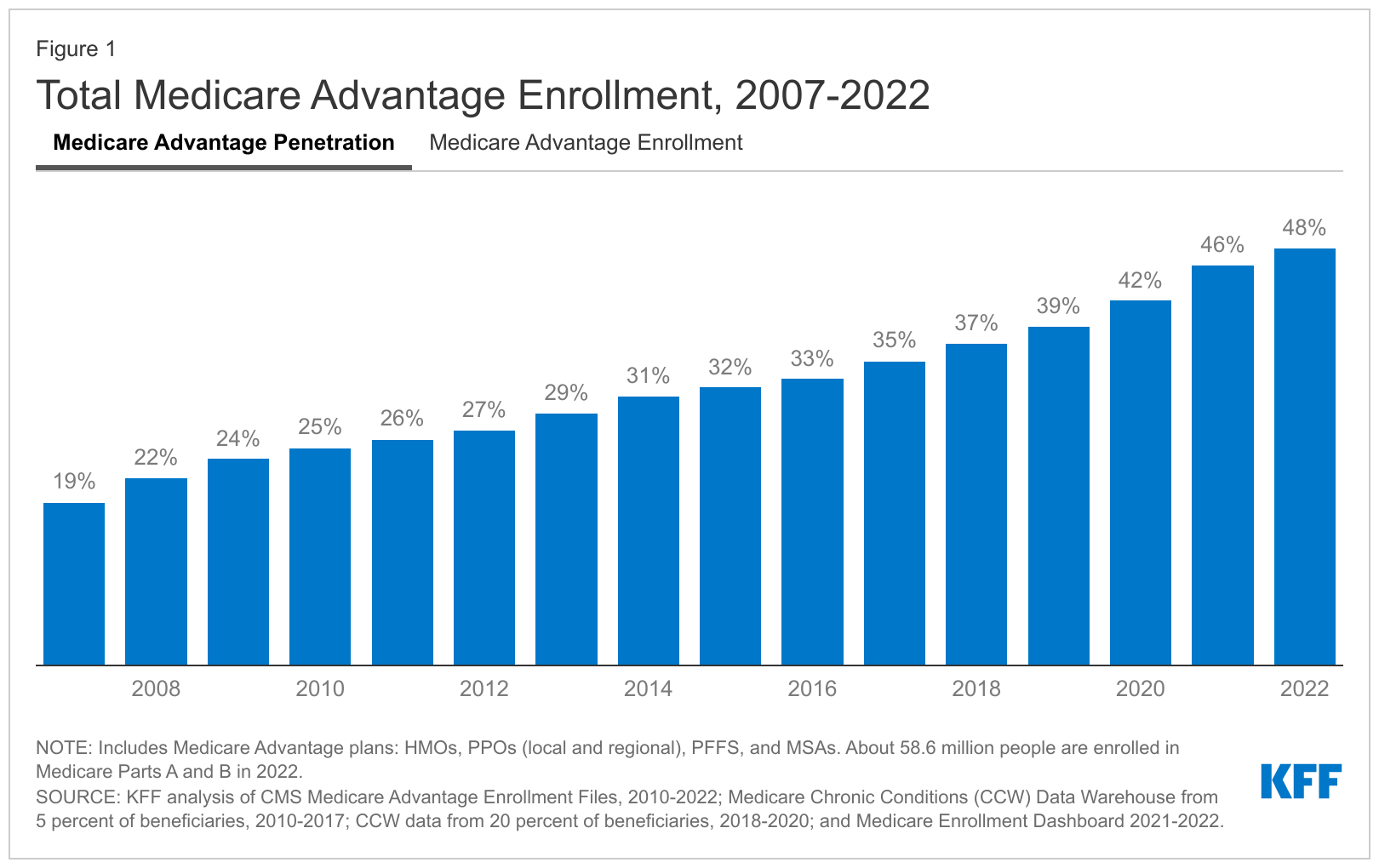

The truth of course, is somewhere in the middle and the percentage of Medicare members who have embraced Advantage plans jumped from 40% to 50% from 2019 to 2021 so something's there.

Let's cut through the marketing and doom hype to really understand why the question comes up.

There's a very clear segment of the population for which Advantage plans will probably be the best fit so it's more a question WHO is wrong for Medicare Advantage plans?

We noticed that many of our CoveredCa members who had Silver 94 or 87 benefits were going to Advantage plans after they turned 65...especially if they were on HMO's.

Two huge hints.

Here are the topics we'll cover:

- What's wrong (or different) about Advantage plans

- Who is wrong for

Advantage plans

- How to avoid bad fits with Advantage plans

- The "sweet

spot" for Advantage plans

- What's wrong with just traditional Medicare?

Let's get started. Quick...before the next flyer shows up in the mail.

What's wrong (or different) about Advantage plans

Here are the biggest complaints we hear with Advantage plans:

- I can only see certain doctors

- They're not really free

- You have to

pay a lot if something big happens

- I have to jump through hoops for care

or medications

- I need referrals to see certain doctors

Those are the big ones. Interestingly, choice of plan can address quite a bit of this but let's focus on the access to care issues (certain doctors, jump through hoops, referrals, etc).

This isn't really down to Advantage plans but to HMO models directly!

Most Advantage plans are HMO in design. It's important to understand what an HMO is in practical terms.

If you already know that HMO isn't a good fit for you then Medicare supplements are likely the better option and you can learn how to pick the best one here.

So..HMOs.

Essentially, HMOs are mini-Single Payer setups run by private companies!

Seriously...they both revolve around a fixed dollar pot of money that's divvied up among a group of enrollees for health care delivery.

With Advantage plans, Medicare allots a bucket of money per enrollee to the carriers who in turn, allot a bucket to providers (doctors, hospitals, medications, etc).

The goal then all the way down the line is to deliver the best healthcare within that budgeted amount (again...it's a fixed budget).

This is true for ALL HMOs by the way. Advantage is just the latest addition to the party for Medicare.

So..what's the net effect of this?

Cost becomes a consideration.

With Medicare or even Supplements which are just extensions of the Traditional Medicare system (fills in gaps but Medicare dictates what's covered), there's no fixed budget.

Whatever costs occurs that are deemed necessary...get covered.

So...what does this "cost constraint" actually mean for you?

Well...on one hand, it's the source of all that's "wrong" with Advantage plans:

- There's a fixed network you have to work within

- Referrals are needed

for specialists

- There may be "utilization management" such as step-programs, pre-authorizations, RX substitution (such as brand for generic, etc) and more

The last one is really where some people get upset.

For example, with a back injury, the doctor and carrier (remember, they're somewhat aligned now with a cost consideration involved) may recommend (strongly!!) a course of anti-inflammatories first followed by physical therapy and other options before surgery.

Now...this may actually align health care delivery with your best interests! Without a cost constraint, many doctors might opt for surgery quicker than what is best for you.

You see this with prostates, hysterectories, and much more. Quick to cut.

I had a terrible situation where my cornea was scratched (off) and the new one wouldn't adhere to the eye. It's called corneal erosion (just nightmarish...would tear in the middle of the night without warning).

Three times, the so-call "best" eye doctor in the area scheduled me for surgery where they scrape the cornea off completely in the hopes it grows back correctly. Yes, it's as bad as you can imagine.

Turns out, he was a partner in the brand new eye surgery center where this proceduce occured for a few $1000 each time.

It also turns out that a simple course of doxycycline (common antibiotic) can disrupt this entire erosion process.

I even asked him about it and he warned "sure...but it can cause stomach irritation".

Seriously...you're about to scrape off my cornea with a scalpel???

Took the doxy and avoided the surgery. Never an issue again.

I digress but you see how maybe, the cost constraint (Doxy is a few dollars versus $1000's in his new eye surgery center) might add a bit of "protection" to health care delivery.

More importantly, the pre-65 market is showing us where everything is going.

In 2014, most carriers had PPO options in most areas with Covered Ca.

- Then some PPOs turned into EPOs (like PPO but no benefits

out-of-network...like HMO)

- Then HMOs started popping up in areas where we

never had HMOs (like our county, Monterey)

- Now, there are only two PPOs

(Shield and Health Net)

- Shield is aggressively pushing their HMO option

We expect that PPO's will likely be a thing of the past within a few years since the rates are now roughly double for the same benefits between PPO and HMO.

We're seeing clients who were adamant about PPO switching to HMO because the cost difference is so pronounced!

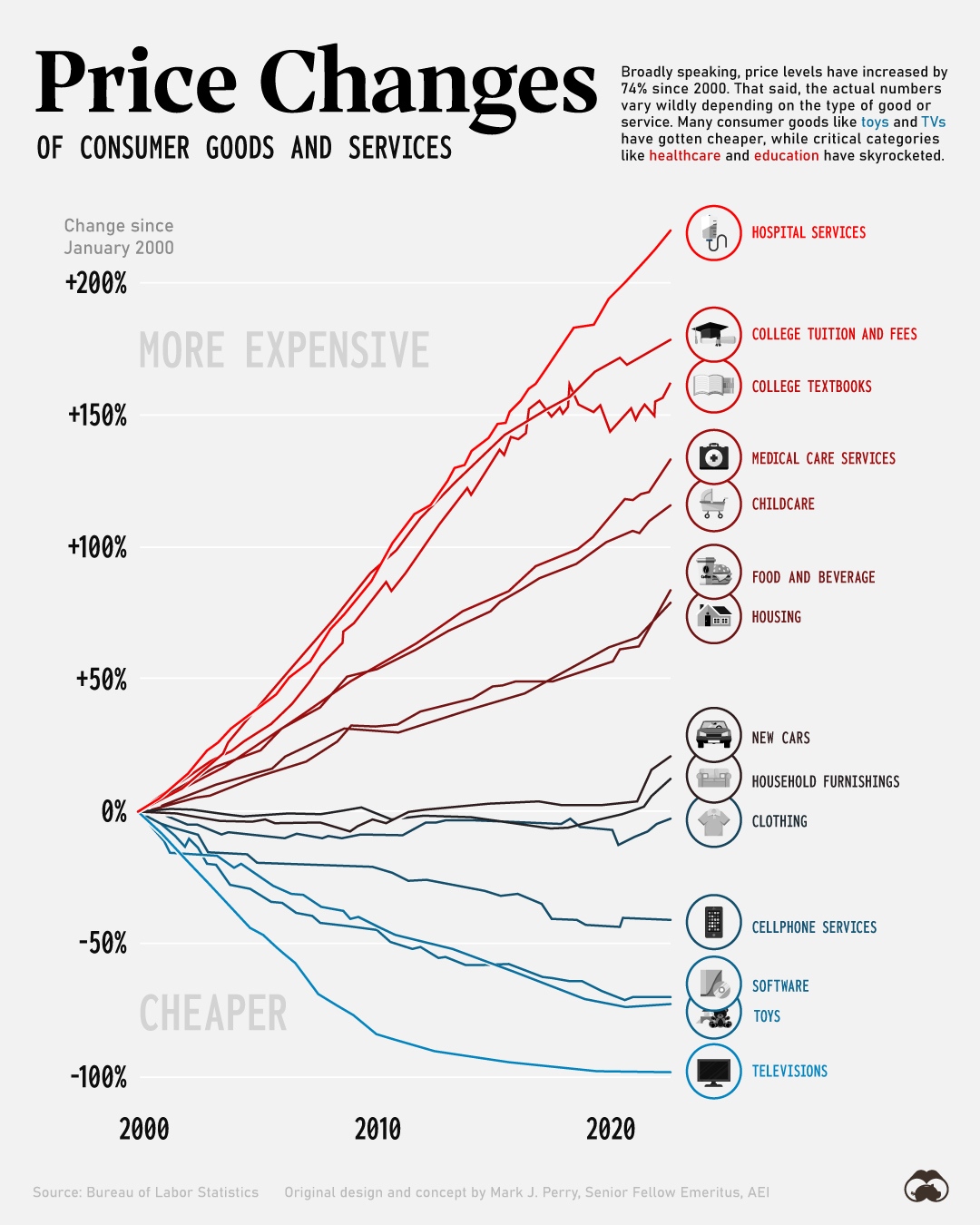

All the things that are "wrong" with Advantage plans do one thing very well...they keep cost down and we're heading for a world with skyrocketing medical costs (along with education in case you're going back to college :).

We won't be surprised to see the Advantage share of the market approach 70%ish by end of the decade if not sooner.

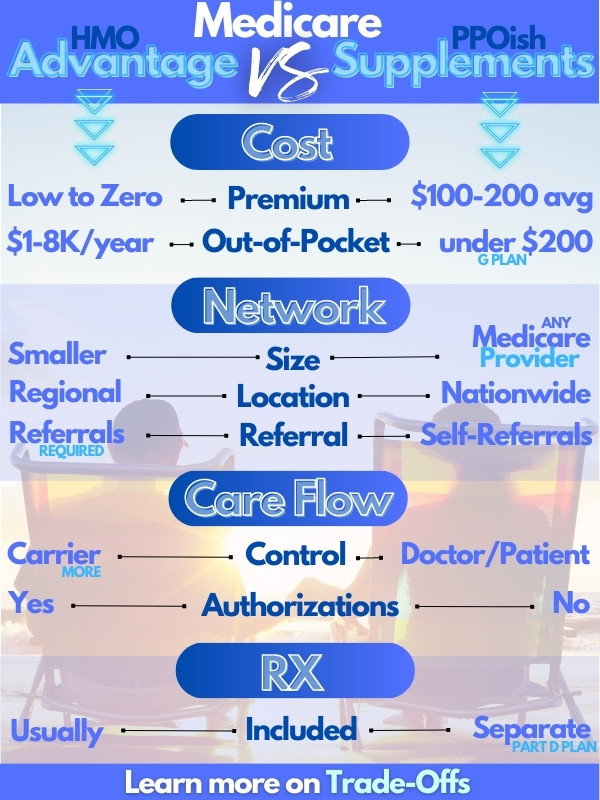

To learn about the difference between Advantage plans and medicare supplements (PPOish).

There are some Advantage plans that are more like PPO (PPO or PFFS plans) but they still have cost constraints. Medicare supplements are the most flexible option to fill in the gaps of Medicare so it's important to learn how to compare them.

So..Advantage plans are not necessarily wrong but maybe wrong for certain people.

Let's go there!

Who is wrong for Advantage plans

This is right back to the question of HMO versus PPO.

Which one are you?? People generally have a good sense of which one they prefer and can AFFORD!

Advantage plans may be wrong if:

- You do not want to be held to a network

- You want to see doctors in

other areas and even other States

- Want reduced "management" of care in

terms of authorizations, etc

- Want to self-refer to specialists

- Can afford to pay for medicare supplements (around $2K annually depending on age/area)

Keep in mind, you'll need to get a separate Part D for medication with a supplement or traditional Medicare while most Advantage plans include a built-in Part D.

Really...this is about cost.

- If money is not an object, Medicare Supplements are usually the approach

people take.

- If $300/monthly (maybe $150 for G plan supplement, $150 for Part B, and $30 for Part D as a hypothetical example) is an issue, Advantage plans may be the better option. We looked at total Medicare cost estimate

In the end, here's the calculus that matters to people...

With advantage plans (Part D RX coverage bundled in) at low/no cost, is that worth it to give up some control on who I can see and how health care is "managed"?

If not, Advantage plans may be wrong for you!

There are even new Part B Giveback advantage plans that can mean up to $2k back to you!

We're happy to walk through this comparison and our quoting system will allow you to see major Advantage plans and Supplements in your area.

Let's turn to the bigger issue...the WRONG ADVANTAGE plan!

How to avoid bad fits with Advantage plans

There are so many pushy salespeople trying to roll people into the "wrong" fit Advantage plan because it benefits them.

You know the ones...salespeople that cold-call you or break other rules (yes, that's not allowed!)

In a given area, there can be many carriers and plans within the Advantage plan flavor. Check out Los Angeles' comparison which is very competitive.

Unlike Medicare supplements which have standardized benefits (a G plan is a G plan regardless of the carrier), Advantage plans can be really different.

There are some really bad ones out there in the following respects:

- Super high Max out-of-pockets (your exposure in bad years); Head's

up...the SNP plans are an exception since medi-cal will help with the

back-end if eligible

- Really poor

Star ratings - a sign of bad customer service and too many hoops

- Poor provider networks - small with holes in specialties and poor coordination

So...maybe it's more that people are being enrolled in the wrong Advantage plans!!

How do we avoid this?

First, run your quote below. Make sure to enter your doctor/RX info so the personalized quote reflects your needs.

Then, you'll be able to see major Advantage and Part D plans in your area.

We focus on the biggest carriers (explain more why here) but by clicking on "see non-licensed plans", you can see all in your area just like from the Medicare site!

In the end, we contract with the biggest carriers have the best ability to avoid what's wrong with Advantage plans.

Size = better networks generally and the dominant players have systems in place to coordinate care well.

Now you can see all the Advantage plans. How do we pick the right one for your needs?

The "sweet spot" for Advantage plans

We have a whole review on how to compare Advantage plans but there's the basic blueprint to avoid bad Advantage plans.

- Monthly premium at zero (or as low as available in your area)

- Out-of-pocket below $1000

- Star ratings of 4 or higher

Get as close to these three goalposts as possible to find the "sweet spot" of Advantage plans.

In some areas like Los Angeles, this is easy. In other areas, you may have to give ground (premium might be higher or OOP might be higher, etc).

Remember, Advantage plans work best with LOTS of people...very populous areas. Hence, Los Angeles makes these requirements easy.

There can even be specialized plans for people with medi-cal/medicare, with chronic health issues, or in institutions. Reach out to us if any of these might apply.

Of course, if it's all overwhelming, we're happy to look at area and zero in on options for Advantage and/or Medicare supplements.

There's zero cost for our assistance and we actually try to help people (and not sell them):

One more question comes up. Why get an Advantage plan at all if they're

so wrong? Why not stay with just Medicare by itself.

Sure...if you have $20K laying around.

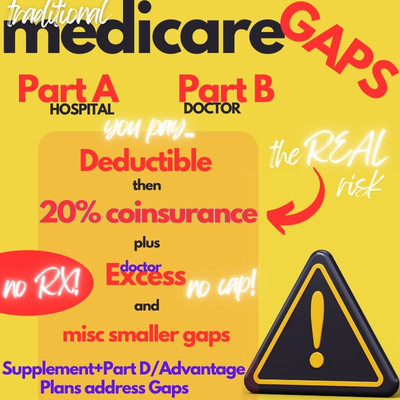

What's wrong with just traditional Medicare?

Most agents or carriers will try to sell you on add-on vision benefits or $10 office visit copays but that is not the issue with traditional Medicare by itself.

By a long shot.

It's not even the deductibles for Part A (hospital) and Part B (doctors). Sure, we don't want to have to pay short of $2K but still not the big risk.

It's the 20% coinsurance.

Beyond the deductibles, there's no cap on the 20% you have to pick up.

We just got off a phone with a person who had open heart surgery. Even for our jaded ears, the total cost shocked us.

$5 Million.

$250K for each hour his heart was "off-line".

So, if you have traditional Medicare, you're on the hook for 20% of $5 Million (or whatever the discounted rate might be) in that situation.

Even if that comes down to $1M, that's $200K!

Next, you're thinking "Well, I'm healthy. That's not going to happen to me!"

Again, it hit him out of the blue but accidents don't care if you're avoiding seed oils and practicing mindful meditation.

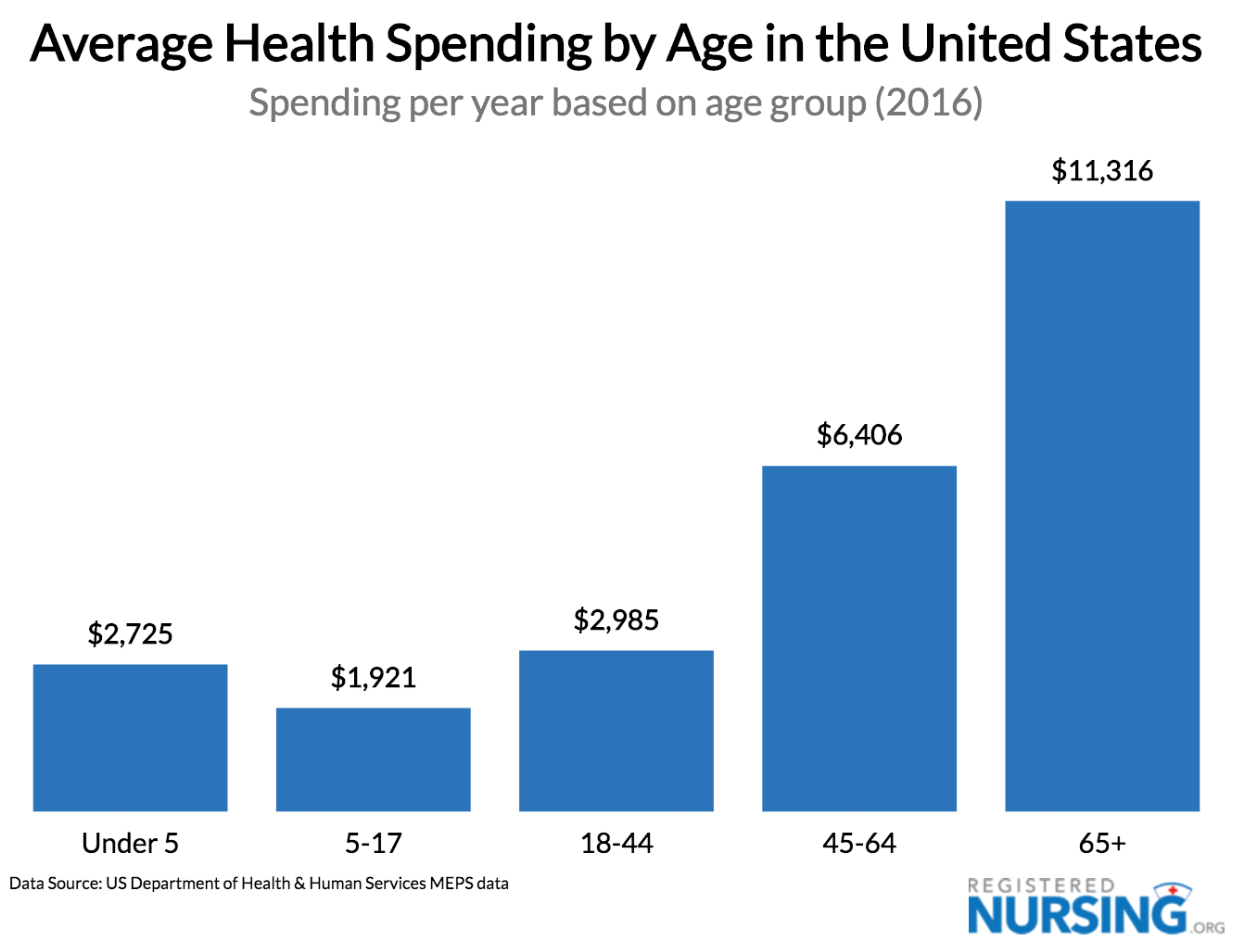

More importantly, 65+ is the most expensive time for healthcare costs. By far!

It's a terrible bet to make.

So...the question then is how do we "cap" this 20% exposure.

The more expensive (albeit flexible) way is with Medicare supplements. Somewhere between that option and just Traditional Medicare are...Advantage plans!

By law, Advantage plans have to have a MOOP or max out-of-pocket per year. A "cap" including the 20% co-insurance.

Use our criteria for avoiding the wrong plans and even consider PPO or PFFS plans for more flexibility (but higher cost).

It's a middle ground between Supplements and total exposure (the 20% pitfall).

We're happy to walk through any questions. No pushing and zero cost for our assistance!

Hopefully, you now have a balanced look at the pros and cons of Advantage plans. What's what we aim to do...empower people to make the best decision for themselves.

There is no cost for our assistance and no question is too small.

Be well!

Call 800-320-6269 or email us at help@calhealth.net