California Medicare Options - How doe Social Security Giveback Plans Work?

Social Security Giveback Plan Explained

We get the question daily...

Is there a plan that will give back money to Social Security?

They're generally vague on specifics but have heard from friends of such a plan.

Let's explain the whole package and even look at how to compare the different Social Security giveback plans.

It can be up to $2000/year in actual money in your pocket as we'll see below!

First, our credentials:

We'll cover these topics:

- What is the Social Security giveback plan

- Who is eligible for Social Security giveback plans

- How to compare Social Security giveback plans

- How to quote and enroll Social Security giveback plans

Let's get started!

What is the Social Security giveback plan

This refers to a type of Medicare Advantage plan.

You can get a full explanation of Advantage plans for Medicare but the giveback speaks to an add-on benefit that some Advantage plans offer.

A little background.

There are two parts of Medicare:

- Part A - Hospital: Usually no cost since if you paid payroll tax during life

- Part B - Doctor: usually requires a monthly premium

It's this Part B premium where the giveback benefit comes into play.

The giveback plans will pay a certain amount towards your Part B premium each month. We'll look at the range below.

Technically, the Part B premium is paid to...Social Security!

Either a monthly auto-deduction or quarterly billing is the standard payment process.

So...we get requests for info on Medicare giveback plans or Social Security giveback plans.

Now you know that it's a type of Medicare Advantage plan that will pay towards your Part B premium bill with Social Security.

This can mean real money though in your pocket and we'll see below how much.

One note...Part B is not required but without it, you're exposed to an UNCAPPED 20% of doctor costs.

A surgeon's bill of $10K means you're paying $2K without Part B.

This is the wrong time to take that bet!

Who is eligible for Social Security giveback plans

Here's the good news!

If a Social Security giveback plan is available in your area and you have Part A and B with Medicare, that's all it takes.

We'll see how to tell if you have this option available to you below. More on who is eligible for Giveback plans.

There may even be medi-medi options available such as Wellcare's giveback plan.

Remember...these are health insurance plans for people with Medicare by default so we need to make sure they function well in that respect first.

The Social Security giveback is just a give a bonus!

Let's go there now with a sample comparison.

How to compare social security giveback plans

We have a big review on how to compare giveback Advantage plans but let's run a sample.

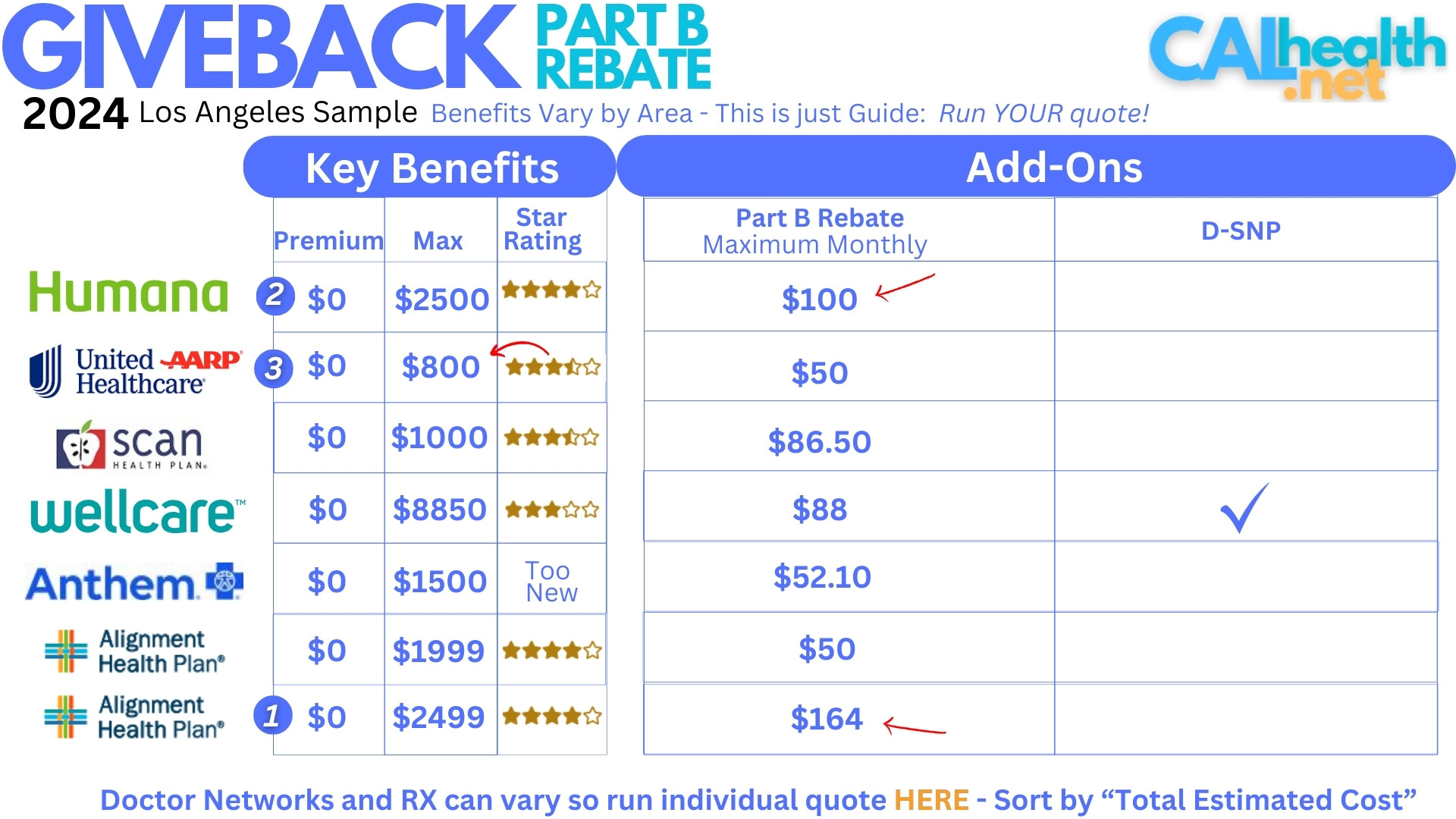

We'll look at the current quote in Los Angeles (your area and situation may differ):

Focus on these highlights when you run your quote below:

- Amount of giveback benefit

- Star Rating

- Out-of-pocket max

- Doctor networks

- Medication coverage

Let's touch on those briefly since we have the giveback plan comparison for more detail.

First, the amount of giveback benefit varies quite a bit from $50 to $164.

The standard Part B premium to Social Security is around $174 now and it goes up each year.

Why such a spread?

First, understand that people have different amounts they pay to Social Security based on their prior income.

It can go up or down from the standard amount of $174.

Keep in mind that you can't get more back than what you pay Social Security.

If your bill is $80 and you pick a plan with $100 giveback benefit, you'll only get the $80 paid to Social Security.

Now, the other aspects of what makes an Advantage plan good or not.

Star Rating is critical as it tells us how actual members really feel about their plan. It's the Yelp of Advantage plans.

We want 4 Stars or higher ideally. 3 Star is pretty average and each ½ makes a big difference.

Next is out-of-pocket maximum. This speaks to your exposure if you have really big healthcare bills in a year.

Really, let's look at NET out-of-pocket max. Meaning, the max minus the giveback benefit.

Based on this, we like the following:

- Alignment: big giveback benefit cancels out the higher max with great Star Rating

- UnitedHealth: lower giveback but also lower max; so so Star Rating

- Humana: blend between the two

One note: the Wellcare plan has a really high max but it's a medi-medi giveback plan so Medi-Cal should help absorb this exposure.

Again, check out our Giveback plan review or how to compare giveback plan guides.

If this is all too confusing, reach out to us at help@calhealth.net or pick a time to chat here.

Let's look at Social Security giveback options in your area.

How to quote and enroll Social Security giveback plans by zip code

We believe in giving you the ability to compare giveback plans pressure-free - we let you take the lead on your terms.

Quoting is free, secure, and instant here:

A few notes.

- Filter for "Part B Giveback" for plan type. This will show plans that give back to Social Security.

- Under preferences:

- Enter your doctors/hospitals - super important

- Enter your medications/dosages

- Enter your preferred pharmacy

- Sort by "Total Estimated Cost"

Now, use our guide above or at the Comparison guide with the amount, Star Rating, and max as goal posts.

Of course, there's zero cost for our assistance and we're happy to analyze the options for you. Look at the Star Ratings...we really do try to help.

Then...think if there's anything you can spend the Part B premium on. Yea, we thought so with today's costs going through the roof.