California Medicare Options - Alignment Advantage Plan Comparison and Review

Alignment Advantage Plans Review and Comparison

It's hard to get excited by a health insurance company or plan. Let's face it...too many years of being under-delivered.

Now, we're not ready to sing the praises of Alignment health advantage plans but the introduction sure has gone swimmingly!

Our background is here just so everything's on the table and we work with the biggest Advantage plans in California.

So...what gives?

First, understand that we have to deal with all the Advantage plans as brokers from the annual accreditation to the day to day membership and enrollment interaction.

You can tell a lot about how a company is run just with this segment of interfacing.

Some carriers are unbelievably difficult to navigate...and even some of the biggest ones!

Tech issues. Cumbersome processes. That's all going to translate into a member's interaction with the carrier and should eventually show up in the Star Rating.

The Star Rating is part of our Triple Threat decision making process for picking a solid Advantage plan.

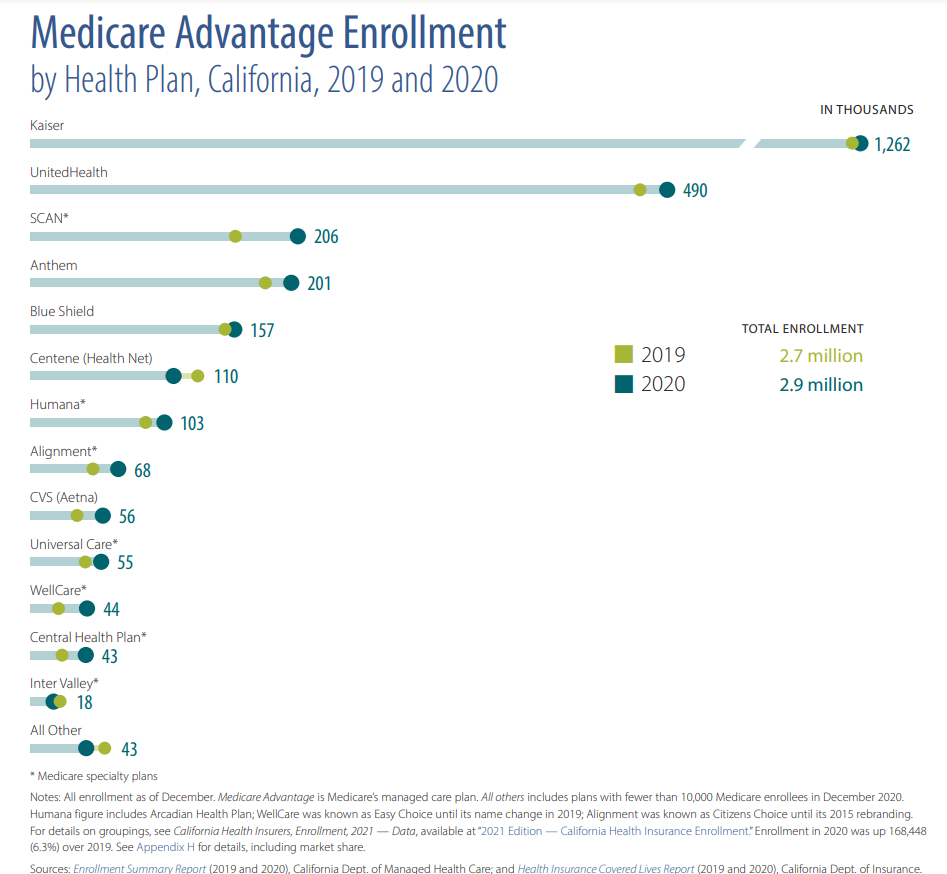

It's starting to show in the enrollment numbers among some really big competitors:

Okay...so what about Alignment?

Let's get into it with the following sections:

- Our introduction to Alignment

- Alignment's popular Advantage

Plans

- Alignment's Money Back plan

- Alignment's networks and

regions

- A quick look at Alignment's Advantage plans

- How to quote and enroll in Alignment Advantage plans

Let's get started! It's always Open Enrollment somewhere!

Our introduction to Alignment

As agents, we actually added Alignment after some of the biggest plans for our appointment.

Customers were requesting them directly which is the only reason we did so.

Expecting the usual frustration in the appointment process (it's never fun), we begrudgingly started the process.

Wow. So streamlined and straight forward. Everything just...worked. Systems worked. People respond back quickly and address any issues right away. Multiple times.

Look...agents don't get the full fire-power of an Advantage plan carrier's customer service prowess.

That's saved for the actual members since they "vote" each year with the coveted Star Rating.

So...seeing a well-run company respond this way to agents was...refreshing.

They pretty much nailed our interaction. Does this translate to the members? Are we seeing it in the Star Rating?

Yes!

Alignment today announced that its California Medicare Advantage (MA) HMO – which represents roughly 89% of its MA membership – has maintained an overall 4- out of 5-star rating from the Centers for Medicare & Medicaid Services (CMS) for 2024, marking its seventh consecutive year as a 4-star or greater plan

Goodness. 4 out of 5 is fantastic and beats most other plans in their respective areas. More importantly, look at the track-record.

Last 7 years.

There are smaller carriers that will pop up in the Advantage market aggressively and then just get blown out.

See it every 2-3 years.

7 years is a fantastic run for an Advantage carrier in one of the most competitive markets (California).

We're not surprised as every interaction we've had has been fast, effective, and friendly.

Just well run.

The Star Rating is really really importantly. It speaks to how satisfied members are with a carrier and its plans.

It's not the only factor though. We also need the other pieces to fall into line:

- Monthly cost

- Potential out of pocket

- Networks

Let's go there now. What do their plans look like?

Alignment's popular Advantage Plans

First, Alignment offers Advantage plans from Orange County and up across California!

Let's start in Los Angeles...the King Kong Advantage market.

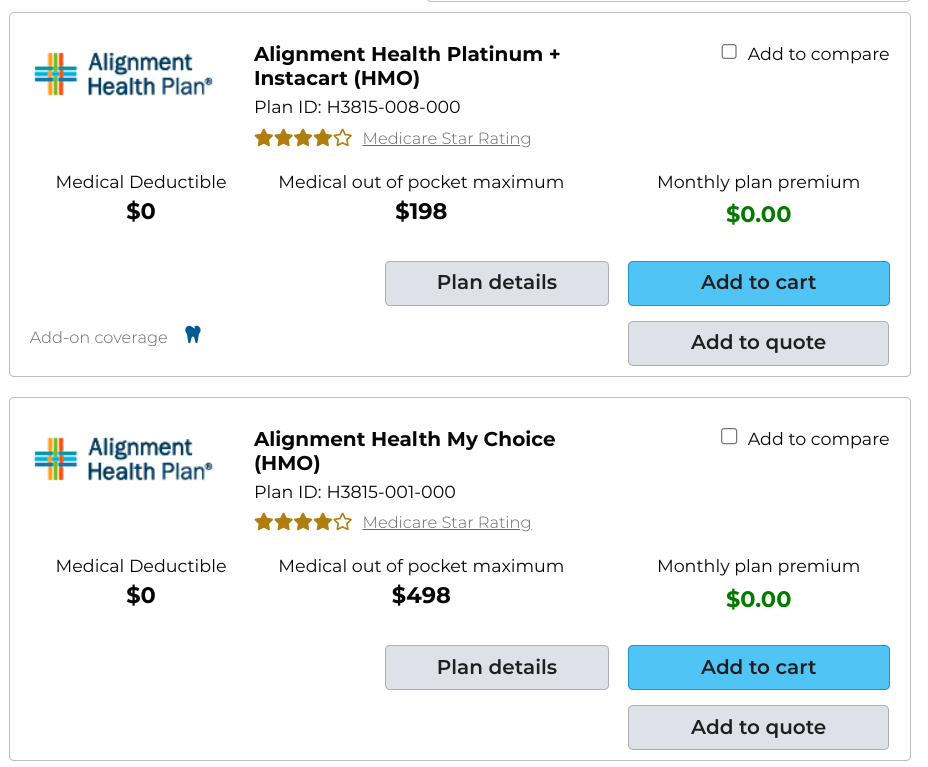

Goodness. They're plan #1 and 2 when you run your quote here.

It's very common to find a zero deductible or premium plan in

Los Angeles...most have these.

It's the max out of pocket that's the deal breaker.

At $198 and $498 for the year, this compares very well against the standard $800 with other carriers.

That's huge deal..you can think of the difference like a $50 or 30 a month premium being added to competing plans if you have bigger health care needs.

You notice the "Instacart" in the first plan's title. What gives?

They give!

Here's the quick explanation:

- Members with a qualifying chronic condition who enroll in one of

these plans will have access to:

- $50 to $100 quarterly grocery

allowances through Instacart

- A complimentary Instacart+ membership

with free delivery on all orders over $35

- A live customer support

line to assist members while setting up an Instacart account and

placing orders

- A curated Alignment Health Virtual Storefront on Instacart where members can easily shop Alignment Healthcare’s recommended items

https://www.alignmenthealth.com/Newsroom/Press-Releases/Alignment-Healthcare-and-Instacart-Launch-Co-brand

Basically, this is a grocery allowance for people who are

chronically ill for food DELIVERY.

Some people are in food "deserts" and find it difficult to get quality food. This is part of Instacart's new push to help seniors.

That's $200-$400/year in direct help!

No wonder it's so popular. You can quickly quote and enroll in this plan here. Make sure to put in your medications and doctors while setting filter to "Total Estimated Cost" or we can run the quote for you! Zero cost for our assistance.

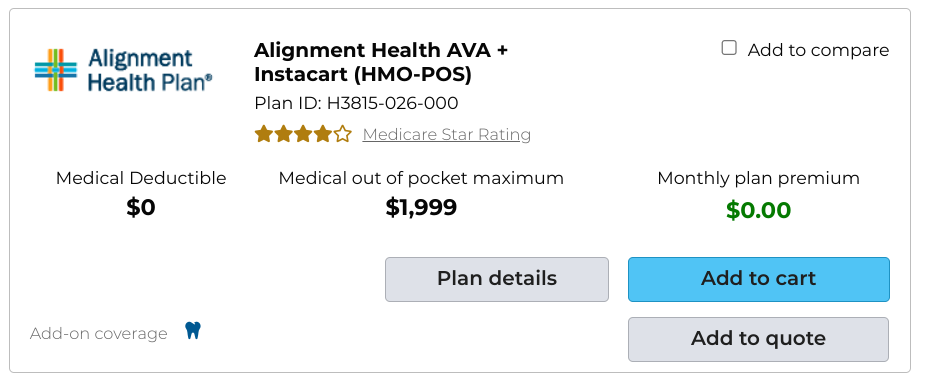

Another popular plan is their Part B Cash Back plan.

In fact, this combines Part B cash back AND the instacart benefit.

Still zero premium and deductible in Los Angeles but our max out of pocket is higher now.

In fact, there's a whole blend of different benefits including PPO, HMO, and other add-ons.

Probably, the best bet is to email us at help@calhealth.net and let us know your needs including the following:

- Eligible for medi-cal

- Chronic illness

- Doctor needs/choice

- Veteran status

- Interest in financial support for groceries, over-the-counter-meds, transportation, and/or caregiver support

This with your medications/dosages and we can provide an accurate quote that best meets your needs!

Zero cost for our assistance and you saw our review up above. We can even compare Alignment versus UnitedHealth (AARP) or SCAN among others. You can quote here:

What about networks?

Alignment's networks and regions

So the county list is pretty extensive and you see it run from Orange and Riverside county up north:

- Alameda

- Fresno

- Los Angeles

- Madera

- Marin

- Merced

- Orange

- Placer

- Riverside

- Sacramento

- San Bernardino

- San

Diego

- San Francisco

- San Joaquin

- San Luis Obispo

- San Mateo

- Santa Clara

- Santa Cruz

- Sonoma

- Stanislaus

- Ventura

- Yolo

What about networks? That's a huge deal with Advantage plans. When we run quotes for customers, their doctors and hospital routinely come up. Let's hit some highlights but make sure to enter your doctors when quoting here:

Let's start in Los Angeles.

We'll hit some of the big ones and start with hospitals:

- USC Keck

- Huntington

- Glendale

- Cedars-Sinai (wow!!!)

- Los Angeles General

There are many more. Basically, if you want Cedars or Huntingtons, Alignment is hard to beat. If you want UCLA, it's probably UnitedHealth (AARP) - see United Health Advantage plans.

We can find good plans (Star Rating, etc) with either so our network really drives this decision.

Let us know your doctors/hospitals and we'll run the quote across the board to find the better options.

What about some of the biggest medical groups as a test run?

Alignment works with:

- Optum (huge deal in LA)

- PIH

- Keck

- Cedars

- High Desert

And dozens more. Again, check with us on your medical group and we'll do the ground work.

This is LA county but see the same good coverage from Sacramento to the Bay Area. Alignment is a real player in the California Advantage market (which is dictated by networks with very powerful healthcare providers).

Run your quote here and put your doctors in the preference box.

So...how do we compare the Alignment Advantage plans? Lots of moving pieces.

A quick look at Alignment's Advantage plans

Here's are tried and true approach.

You can run your quote below and even filter for just Alignment Advantage plans.

Make sure to enter in your doctors, medications, and dosages.

From there, a few key questions.

- Are you eligible for Medi-cal?

If so, select DSNP plans.

- Do you have a chronic illness? If so, select CSNP plans.

Qualified individuals can get richer benefits and pay less out of pocket with these specialized plans.

Beyond that, a few key criteria. Do you want more flexibility in choice of providers and how care is managed?

PPO fits that bill but you'll give up something in terms of how much you pay.

Most members choose HMO's, the traditional "cut" of Advantage plans.

Stay away from plans with lower Star Ratings. Their members aren't terribly happy.

Then, it's finding a sweet spot between core benefits:

- Monthly premium

- Deductible

- Out of pocket max

Against add-on's:

- Part B rebate

- Instacart money

For our Los Angeles example (every county will have different options), we see the following:

- AVA (PPO) 007

- AVA + Instacart (HMO-POS) 026

- CalPlus Heroes

(HMO) 036

- ESRD Balance (HMO C-SNP) 033

- Heart & Diabetes (HMO

C-SNP) 010

- Heart & Diabetes CalPlus (HMO C-SNP) 039

- My Choice

(HMO) 001

- My Choice CalPlus (HMO) 007

- Platinum + Instacart (HMO)

008

- smartHMO (HMO) 013

- the ONE + Rite Aid (HMO) 034

Okay.

- AVA is their PPO with the Platinum plan with a POS (potential

out of network benefits) on the AVA+ Instacart

- C-SNP is for chronic illness (heart, diabetes,

ESRD)

- MyChoice is their straight forward Advantage offer (no bells

whistles but better cost structure)

- CalPlus Heroes is their

Veterans plan (richer if you qualify)

- SmartHMO is the Part B cash

back

- MyChoice adds in some additional cash back benefits for OTC

Alright...this is all 40,000 foot view stuff. Let's get to specifics. Your specifics!

How to quote and enroll in Alignment Advantage plans

You can run your Advantage plan quote including Alignment options here:

A few notes to get the best value.

- Make sure to enter your doctors, medications/dosages (exactly) in

the preference box

- Filter quote by "Total Estimated Cost" - this

takes into account copays and monthly premium

- Select DSNP if you

eligible for medi-cal and/or CSNP if you have a chronic illness

- Select "Alignment" on left if you only want to see their plans

There you go!

Now focus on:

- Star Rating

- Monthly premium

- Deductible

- Max out of pocket (don't neglect this...lots of shiny plans that leave you with a big bill if your health takes a turn)

From there, you compare the bells and whistles and see if it's really worth the cost to you.

Part B giveback (SmartHMO)

MyChoice reimbursements

Instacart

Of course, there's the PPO versus HMO decision to make first.

This is all complicated so feel free to reach out to us with this information and let us chase down the options for you.

It's what we do. All. Day. Long. Zero cost for our assistance.

Till then, hopefully we've given you a good review and comparison of Alignment. We'll put them head to head against some of the biggest player such as UnitedHealth (AARP), SCAN, and more.

Till then. Be well.