California Medicare Options - Guide to Los Angeles Medicare Advantage Plans

Mastering the LA Medicare Maze: A Comprehensive Comparison of Los Angeles Medicare Advantage Plans

This is by far the biggest market for Advantage plans California.

All the big carriers are competing in this area and with competition, some are taking very different routes.

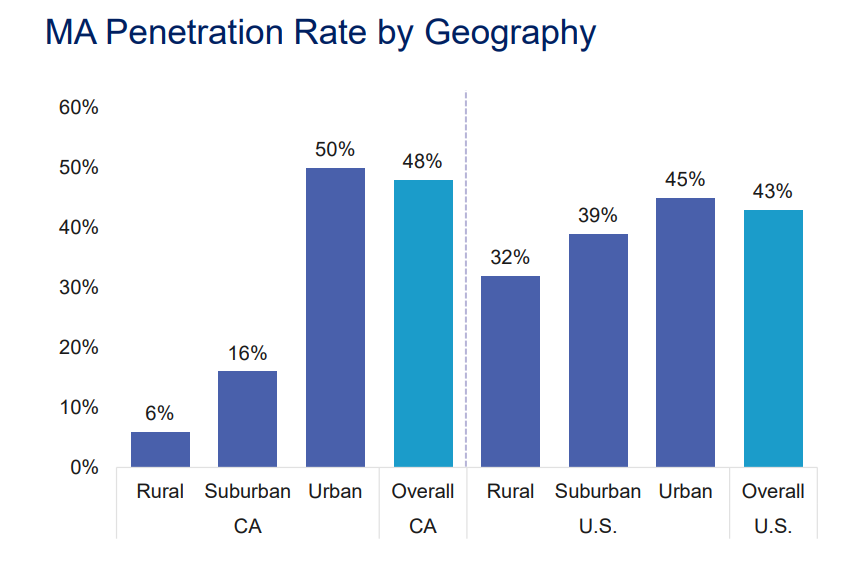

LA is so prominent that it partially drives Advantage plan enrollment trends for all of California.

This matches the general "fit" of Advantage plans with more populous areas like LA:

We'll go into why this occurs in our section below on why Advantage plans are so popular in Los Angeles.

Along the way, we'll compare the major carriers in Los Angeles below while also

focusing the leaders and why they're leading!

First, our credentials please:

Here are the areas we'll cover:

- Why are Advantage plans so popular in Los Angeles

- What Medicare Advantage plans are in the Los Angeles market

- Comparing Medicare Advantage plans and rates in LA county

- The SNPs or Special Need Plans in LA county

- What's the best Medicare Advantage in Los Angeles

- Are there Advantage plans that work with UCLA or Cedars

- How to quote Los Angeles Advantage Plans

- How to apply for Advantage plans in LA

Let's get started!

Why are Advantage plans so popular in Los Angeles

First, LA leads the State in Advantage plan enrollment and adoption as a percentage.

Why?

Most Advantage plans are HMOs and by definition, HMO's work best when you have lots of providers and lots of enrollees. See our Insider's Guide to Advantage plans.

It's important to understand why as it will affect our choice.

HMOs are like mini single-player plans. There's a fixed bucket of money that Medicare pays each carrier per enrollee. The carrier then in turn, pays providers a fixed amount per enrollee.

What if a person has really big health care expenses?

Managing this "risk" is much easier when you have 1000 of members versus 100. That's why you don't find Advantage options (or very few/rare) in more rural areas.

The opposite of rural?? Hello Los Angeles!

There's nothing "country road" about the 405 after 2pm.

There's a hidden benefit to this great fit with the HMO model.

LA county has some of the best Advantage plan offerings across the State.

In fact, there are dozens of plans that hit our "Triple Threat" of plan

selection:

- Low or no premium

- Max-out-of-pocket under $1000

- Star Ratings of 4+ stars (out of 5)

If you go up to the Bay Area or even down to San Diego, you can find max-out-of-pockets over $2-3K!

We explain in our Comparing Supplements versus Advantage plans why this really makes Advantage plans less attractive.

No need to worry though in Los Angeles.

It's quite easy to hit our 3 requirements and then some.

Okay..let's look at the actual players in the county. We'll look at carriers outside of Kaiser since people generally know if they want to stay in the Kaiser network or not.

So...drumroll please.

What Medicare Advantage plans are in the Los Angeles market

Almost all the carriers are in LA but we'll focus on the strongest ones:

So...let's run a sample quote for a 67 year old in 90023.

Here's the top 10 (this is just sample...run your quote below):

- #1 and 2 - Kaiser

- #3-5 - SCAN

- #6 - Humana

- #7-8 Alignment

- #9-12 United

Shield then has a strong showing after that and then Aetna and Anthem Blue Cross start to kick in.

So...how do we analyze this?

Some context helps before we really compare them.

Complaint #1 and 2 for Advantage plan enrollees are that they can't see their doctors and their meds are not covered by the plan respectively.

We address this by allowing you to enter your preferred doctor and medications in our free quoting system (more on that below).

There will definitely be differences between the plans in terms of networks!

We already mentioned the big one...Kaiser. With Kaiser, you have to stay in their network (outside of rare situations).

So then there's SCAN, Humana, and United.

Alignment is a smaller carrier and that's going head to head with UnitedHealthcare® in Los Angeles (see Alignment versus UnitedHealth) and we'll explain why below.

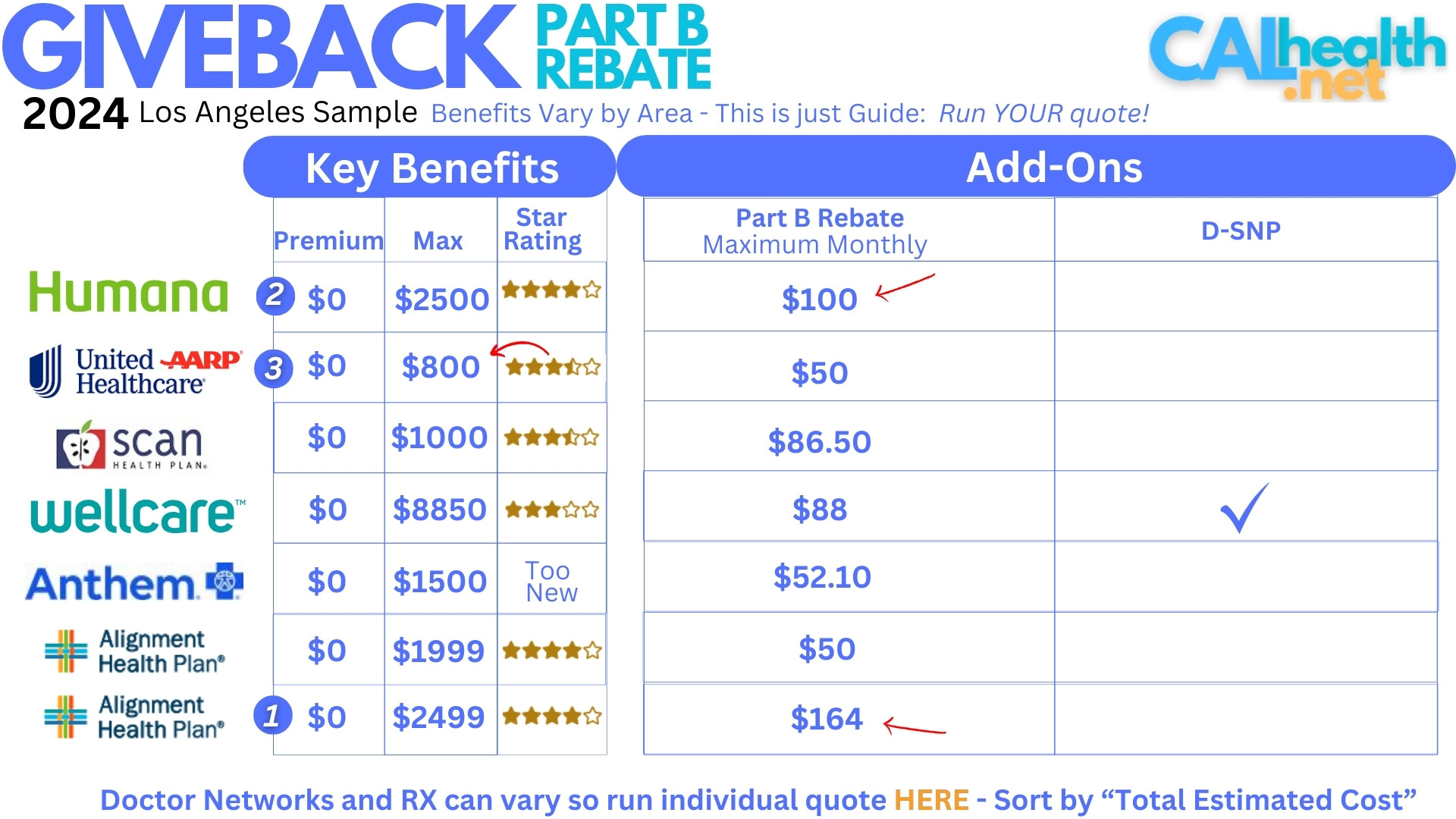

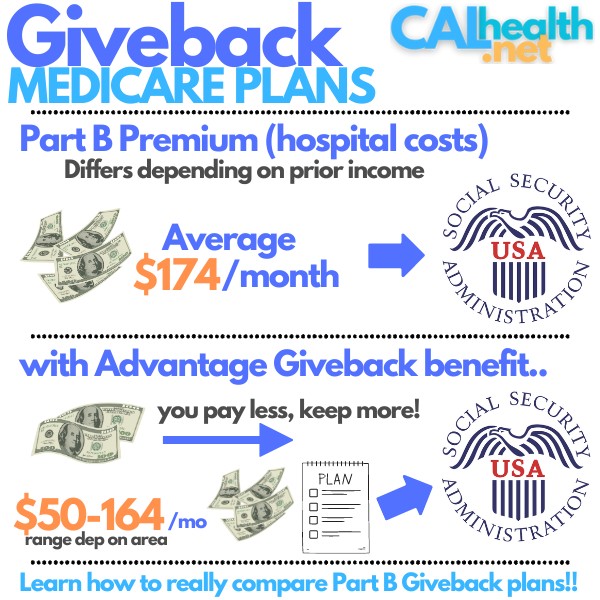

A big part of this is their $164/month Giveback plan with a 4 Star rating.

We also have to focus on Triple Threat:

- Star Rating - measure of how it actually feels to be on the plan from other

members

- Premium (although they're all pretty low in LA county)

- Out of pocket max - this is a big deal that almost no one focuses on!

We explain why a max over $1K(unless it's a medi medi plan like Wellcare's) quickly starts to lose favor versus the G medicare supplement plan.

Check out the Tradeoff between Advantage and Supplements.

With all that said (networks and our triple threat), let's get to it.

Comparing Medicare Advantage plans and rates in LA county

First, the power showing by carrier you may not have heard of. SCAN! Big Guide on SCAN Advantage plans.

Goodness.

Two plans with $499 maxes, zero premium, and the Star Rating! 4.5!

4 is the average and 5 is the top (excellent). SCAN is crushing it in LA county and the results show in terms of enrollment. They're 2nd behind United!

Check out SCAN Advantage plan guide which compares their different plans. We're fans of #1 or 2 because of the max.

Next up, you have Humana's top showing:

Again, solid. 4 Star. Zero premium. Max of $600 ($100 higher than SCAN's).

Check out the Humana Advantage plan guide for more info.

Alignment follows Humana with 2 plans and they're quickly gaining market share with a 4 Star Rating! Their Giveback plan is also a strong contender.

Then, you have biggest Advantage carrier outside of Kaiser in California:

At the time of this quote,

4 Star ratings. Zero Premium. $800 max.

Check out our UnitedHealthcare® Advantage Guide to learn more how the plans differ.

Secured Horizons was the original OG in Advantage plans back in the day before UnitedHealthcare® bought Pacificare.

Their second plan is a Part B Rebate option where the plan pays part of your Part B premium.

These have been popular and UnitedHealthcare® has the lower out-of-pocket max in this category although the giveback benefit is not as rich as Alignment or Humana.

Let's turn our attention to a huge part of the Advantage market in Los Angeles.

The SNPs or Special Need Plans in LA county

SNPs are a big player in LA...more so than most other counties.

There are three main types of

Special Need Plans:

- D-SNPs - dual eligible for Medicare and Medi-cal

- C-SNPs - people with chronic disease

- I-SNPs - people in an institutional setting

The D and C options are more prevalent.

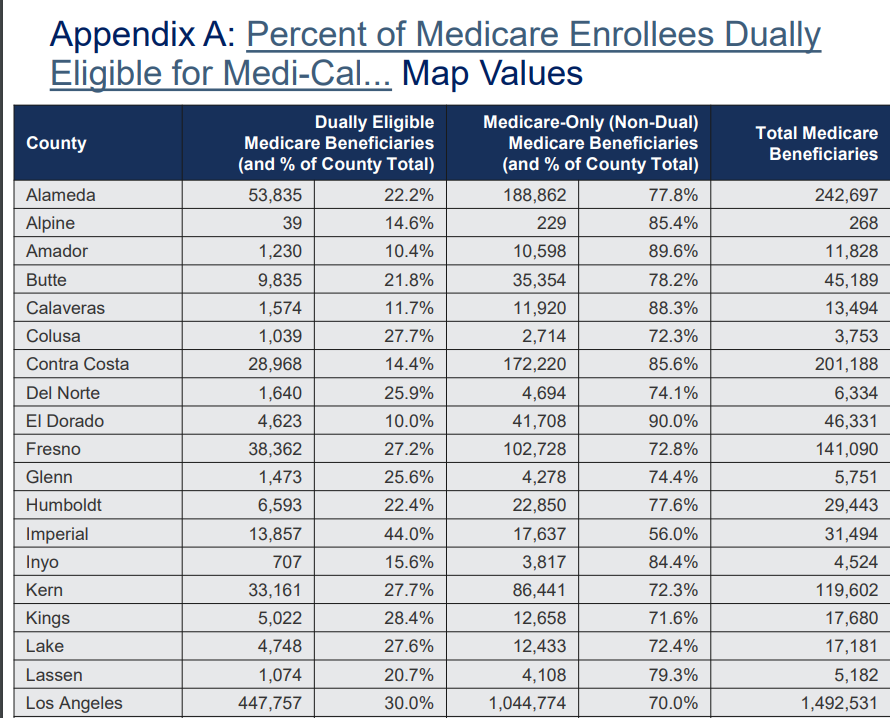

Look at D-SNP eligibility alone in LA:

https://www.dhcs.ca.gov/services/Documents/OMII-Medicare-Databook-February-18-2022.pdf

Wow...30%!! Almost 500K people.

That's just D-SNP. C-SNP are a whole other (with some cross-over) category.

To see these plans, you just click "show special needs plans" in our free quoting tool below.

Check with the county or Medicare but if you're eligible, it can mean richer benefits and less out of pocket.

This changes the line-up completely!

Now UnitedHealthcare® comes up first:

This is their SNP for people with chronic diseases.

And we can see Anthem's strategy in this crowded LA market with the next 3 plans:

And Health Net by Wellcare makes its appearance:

Wellcare's big contender has been a D-SNP (medi medi) plan WITH Giveback Part B benefit! More on Wellcare's Giveback medi-medi plan.

C-SNPs and D-SNPs.

One note on the D-SNPs. Even though the max is much higher, if you're truly dual eligible (Medi-cal and Medicare), there can very little out of pocket so check with the county.

If you are eligible for SNP plans, it's important to consider these options and make sure to put your doctor/RX in the quoting system so the plans are ranked according to that info.

So...those are broad strokes. What's the net net?

What's the best Medicare Advantage in Los Angeles

We're hesitant to use words like "best" for Advantage plans since every person's situation is different.

- Do you qualify for SNPs and can you work within their care management

- What plans work with your doctors

- What plans cover your medications

What we can say is that SCAN, Humana, and UnitedHealthcare® are strong options for LA County for standard HMO-type Advantage plans.

For SNPs, United, Anthem Blue Cross, and Wellcare by Health Net are leaders

LA is so competitive that there are other strong plan offerings further down the list from Blue Shield and other carriers.

We just don't have to be too choosy!

Remember...options can differ by zip code and age so it's important to run your own quote below but you now have a sense on how to compare them.

We need to talk about a very important consideration that doesn't show directly in the comparison above.

Doctor and hospital networks!

Provider Networks: Are there Advantage plans that work with UCLA or Cedars

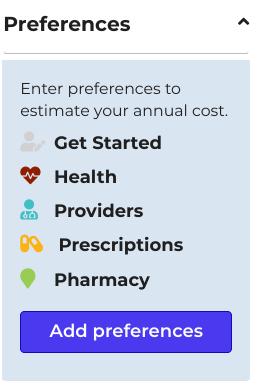

In the quote system below, you can actually enter your doctors and the system will show if plans work with them (and your meds!)

With Advantage HMO plans, we have to stay in networks so it's really important to enter this info up front.

Remember...complaints #1 and 2! Doctors and meds not covered!

This is where certain carriers really stand out. It may be the "killer app" for UnitedHealthcare® when comparing.

They have the largest network and that's really their selling point.

Let's take two examples that are near and dear to people in Los Angeles. It's telling because we lost most carriers for them with Covered Ca.

First UCLA (this can change from year to year so check with us for current status).

UCLA lists one plan from Blue Shield and a few from UnitedHealthcare® on the HMO side.

Cedars lists multiple Blue Shield and UnitedHealthcare® plans for standard options.

For the SNP side, they list multiple Anthem plans.

So...just looking at two of the premium hospitals in our State (if not the country) that happen to be in LA county, we can see some cross over between Shield and UnitedHealthcare® with Anthem's SNP plans well received by Cedars.

Again, if you have specific doctors, medical groups, and/or hospitals that you want, reach out to us at help@calhealth.net and let us chase it down! There's no cost for our assistance!

This is all great but what about your rates in LA?

How to quote Los Angeles Advantage Plans

First, using our system is 100% free to you. It's free. Secure. Fast!

Run your quote here:

Make sure to add your doctor/RX info for Advantage plans:

Sort by "Total Estimated Cost".

You can also click "show special need plans" above the quote as well if you're eligible for these.

The plans will display by lowest cost with Star Ratings and max's figuring in as well.

Of course we're happy to help you walk through your options. There's no cost for our assistance and check out our Google ratings. help@calhealth.net or pick a time to chat.

The great part is that at Annual Open Enrollment, your info is all still in the quoting system. Just update any info, doctors, meds, and you can all the new plans and rates.

What if you find the right plan?

How to apply for Advantage plans in LA

This is equally easy for most of the carriers.

The same quoting system above (free to you) allows you to enroll right online!

Switching plans at Annual open enrollment becomes a 10-15 minute deal versus starting all over. Your info's already there!

Again, no cost for this option and if a carrier doesn't work with the online enrollment, we can send you other options to enroll.

Please reach out to us with any questions!

Important Disclaimers:

- We do not offer every plan available in your area. The number of organizations and plans available will be specified for your specific quote here. Please contact Medicare. gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

- Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations, exclusions, copays, deductibles, and coinsurance may apply.

- Part B Premium give-back is not available with all plans. Availability varies by carrier and location. Actual Part B premium reduction varies.

- Every year, Medicare evaluates plans based on a 5-star rating system.

- Not affiliated with or endorsed by the government or Federal Medicare Program. Goodacre Insurance Services is an insurance agency not affiliated with the government.