California Medicare Options - Wellcare Medi-Medi Giveback Plan in Los Angeles

Review Wellcare Medi-Medi Giveback Plan in Los Angeles

We have a big review of Medicare Giveback plans generally and even an explanation of how to compare Giveback plans but one is really gaining attention.

Wellcare's Medi-Medi giveback plan.

At the time of writing this, Wellcare has the one Medi-Medi plan that can give back money towards Part B in major areas.

So it's a hit!

We'll look at how this works and why it's so popular but first our credentials:

Let's cover these topics:

- Quick intro to giveback plans

- Wellcare's Medi-Medi giveback plan

- How to compare Wellcare's giveback plan against other options

- How to quote and apply for Wellcare Medi-Medi giveback plan

Let's get started!

Quick intro to giveback plans

Learn how Giveback plans really work but a quick intro is needed.

First, they are a type of Medicare Advantage plan. You can understand medi-medi Advantage plans in more detail.

In order to have an Advantage plan, you have to have both your Part A and Part B with Medicare in effect.

Part A usually doesn't have a cost since you paid in all your life but Part B has a premium that you deduct monthly from Social Security or get a quarterly bill.

This amount has a base level of $174 but it can go up or down from there depending on income.

Most people who have Medi-Medi (both Medicare and Medi-Cal) qualify based on income so the Part B premium can be a difficult cost especially in today's world where everything seems to be going through the roof.

That's one part of the equation (the giveback piece) but then there's the Medi-Medi side of things.

Some plans are designed for people with this status of having both Medicare and Medi-Cal.

They're called D-SNPs (Special Need Plans) or Medi-Medi.

The design of these plans has been specifically tailored for these people. Benefits can be more coordinated and work directly with Medi-Cal for a seamless approach with richer benefits.

This plan design however doesn't address the Part B premium which can be hard to come up with though for people on Medi-Cal.

If only we had a plan that offered both a Giveback benefit AND Medi-Medi design.

Hello Wellcare!

Wellcare's Medi-Medi giveback plan

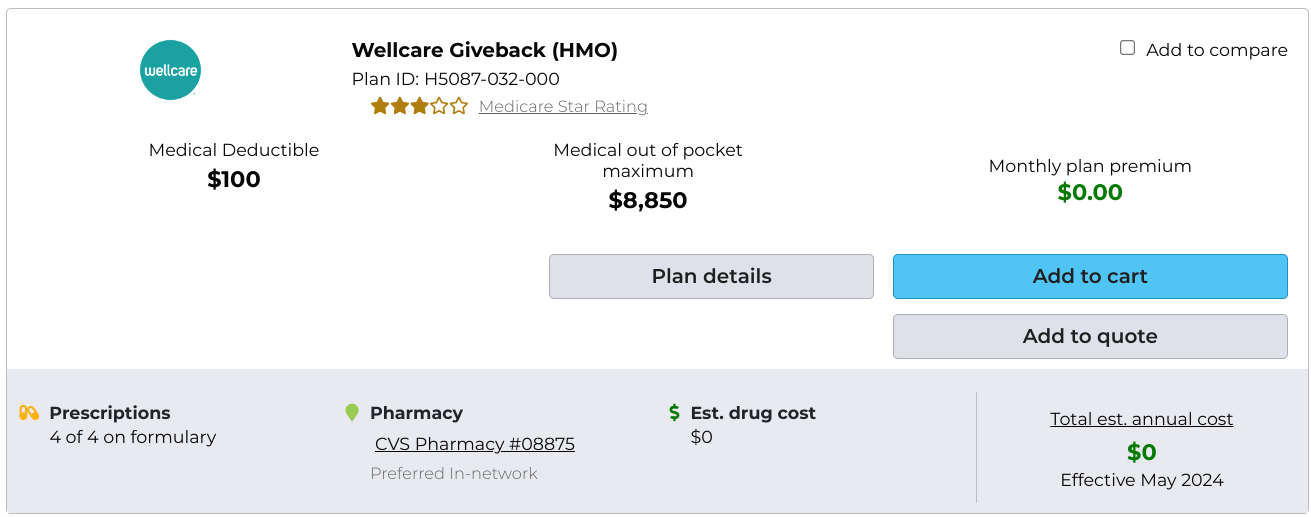

Here's a sample quote from Los Angeles but we'll show you how to quote your options below.

Let's go through the basics.

- It's 3 Stars in terms of rating which is average (check

current status for your area)

- The premium is zero

- The deductible is $100

- The out-of-pocket max is $8850

A few words on the deductible and max. The max seems really high especially compared to the other Giveback plans in the area (we'll see in next section) but that's not the full story.

If you have Medi-Cal and Medi-Medi or D-SNP status, Medi-Cal will absorb this exposure as Medi-Cal coordinates with Wellcare.

That's the whole point of Medi-Medi plans. More coordination and more cost-sharing so you have less out of pocket.

What about the giveback benefit?

The Wellcare Medi-Medi current giveback benefit is up to $88/month (can change from year to year).

That's just about perfect. Why if the average is $174/month?

Most people on Medi-Cal are not paying the average Part B premium due to income.

The vast majority of Medi-Cal members qualify based on income so $88 is actually a better fit than going higher like Alignment's giveback plan at $164.

Speaking of which, let's compare the Wellcare Medi-Medi giveback plan against the other giveback plans in our sample Los Angeles quote.

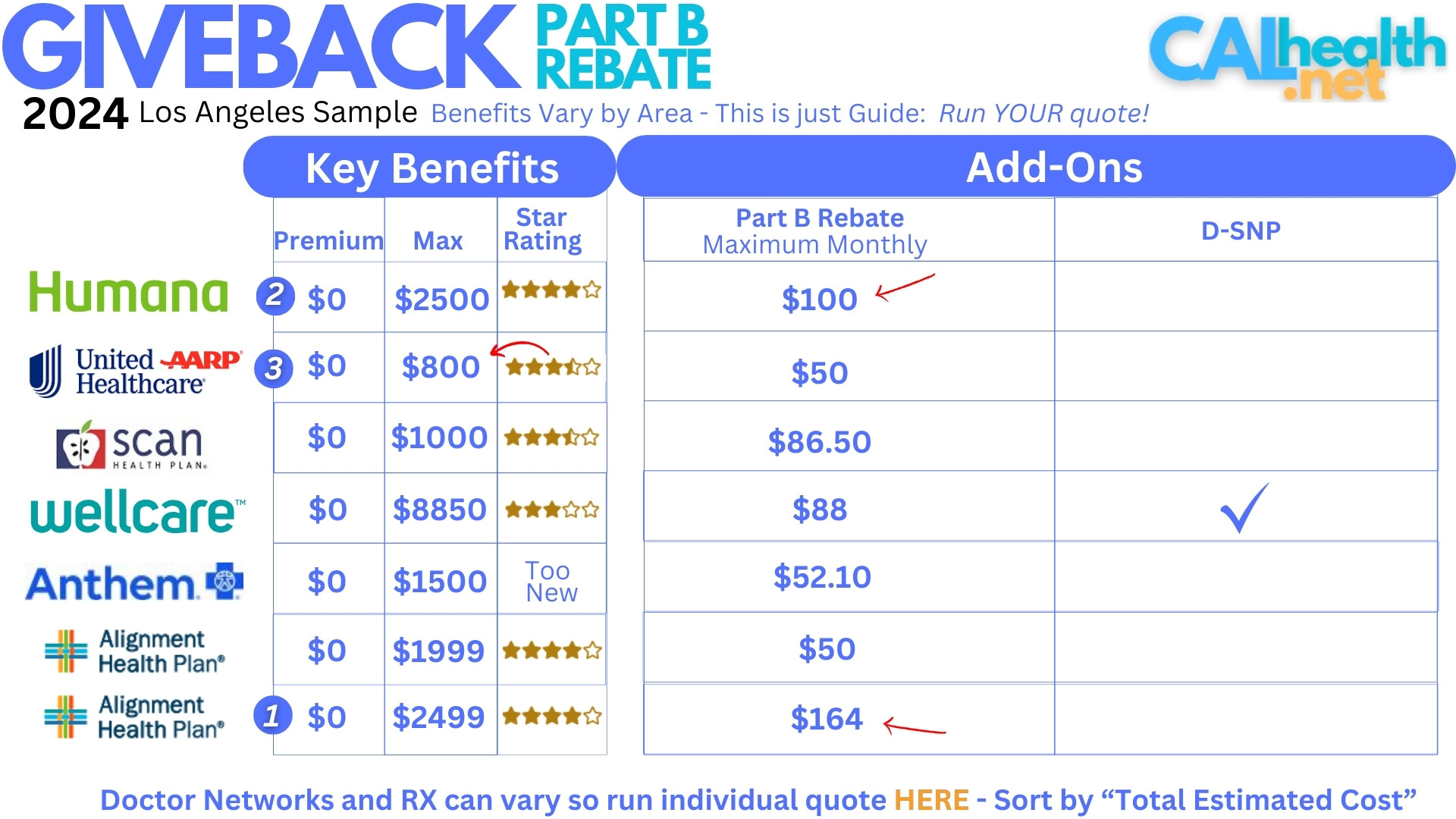

How to compare Wellcare's giveback plan against other options

Here's a sample Los Angeles giveback plan comparison:

First, we have to note that Wellcare's plan is the only Medi-Medi giveback plan on the list.

The other plans are standard Advantage plans that have a giveback benefit.

Medi-Medi plans were specifically designed to benefit people with dual eligibility. So-called "Full Dual".

Richer benefits. Less out-of-pocket. More coordination between the Advantage plan and Medi-Cal.

It's hard to turn away from this if you do have the status!

Let's compare just the Giveback aspect and other parts of how we compare Advantage plans.

We'll focus on our Triple Threat criteria:

There are plans with richer Star Ratings. Alignment's popularity is largely around its 4 Star rating.

Humana also does well here (which is why it's one of our Top 3).

As for the giveback benefit, the range is from $50 to $164 (Alignment again) but remember, we can't get more back than what we pay to Part B premium.

For example, if we have a Part B premium of $80, and choose a plan with a giveback plan benefit of $100, you'll only get $80.

That's why Wellcare chose $88 for their Medi-Medi giveback benefit since it's assumed that the enrollees will be Medi-Cal eligible based on income.

The Out-of-Pocket max is quite different between Wellcare's giveback plan and the rest of the options but remember that if you have full dual status, Medi-Cal will help there!

If you have dual-status (Medi-Medi) AND want (or better yet, need) a giveback benefit to help with the Part B premium.

Wellcare for now is the dominant option when available.

So...is it available to you?

How to quote and apply for Wellcare Medi-Medi giveback plan

We make this fast, secure, and free:

We put this all in your control but follow these steps to get the best quote:

- Filter by "Part B Giveback" for plan type if you want to see these

- Under "Preferences", enter your doctors and hospital

- Enter your medications and dosage

- Enter your preferred pharmacy

- Sort by "Total Estimated Cost" to take into account medications

If this all sounds too confusing, reach out to us for free assistance at help@calhealth.net or pick a time to chat.

We fully expect more Giveback plans to come to market over the next few years for Medi-Medi members due to their popularity.

They've grown from 2% to over 13% in a few short years and the Medi-Cal market can make up over 1/3rd of areas like Los Angeles.

This will only expand and Wellcare was smart to address the need first!