California Medicare Options - Why do people pick medigap over advantage plans

Why Do People Choose Medigap over Advantage Plans

Let's really boil this down without "pushing" one way or the other.

We'll break it down to really practical, day-to-day considerations from 25+ years of experience in the senior market.

Are there definitely clear "preferences" of people that lead them to either Advantage or Medigap plans?

We'll see if this fits you!

Here are our credentials so you know we're trying to do right by the reader.

Okay...let's get started, and we'll rank the reasons people go with Medigap from

most to least important:

- A quick intro to Medigap versus Advantage

- #1 reason people go with Medigap - "choice of doctors"

- #2 reason people go with Medigap - "control over medical decisions"

- #3 reason people go with Medigap - "ability to use through the US and when

traveling"

- #4 reason people go with Medigap - "cost certainty"

- Quoting and comparing Advantage versus Medigap plans

Let's get started!

A quick intro to Medigap Versus Advantage

Let's set the stage for what drives all the actors below.

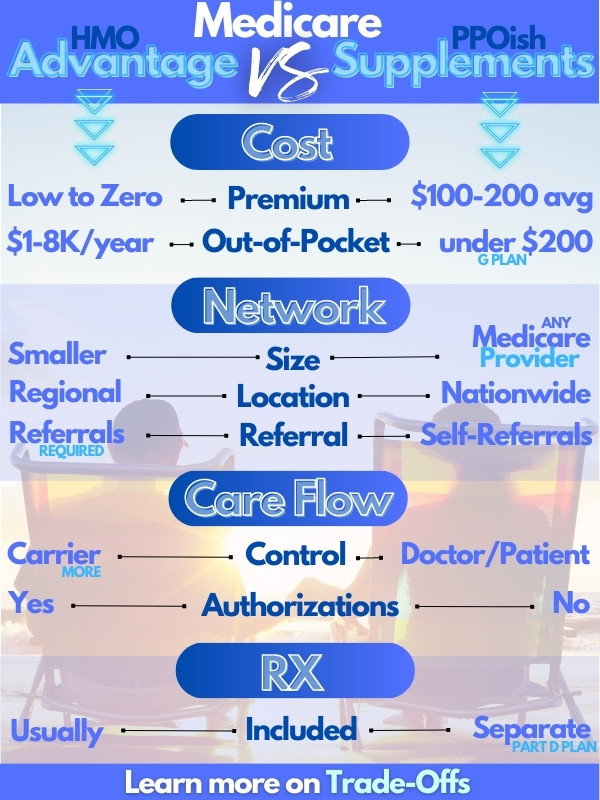

This is really a question of HMO (advantage) versus PPO (medigap).

We have big reviews on comparing Advantage versus Medigap or the Trade-off with Advantage plans but here is a quick synopsis.

To really understand everything below, you have to get a glimpse behind the curtain of two very different models.

Medigap is simpler.

It works like a PPO in that you have a massive list of providers (doctors and facilities) that contract with Medicare.

You can use these providers, and the medigap plan will fill in the holes of traditional Medicare according to your plan choice (see what medigap plans cover).

That's it!

Advantage plans are much more regimented. They're mainly HMOs after all!

Think of HMOs as a mini-single payer plan.

There's a fixed bucket of money to pay for healthcare costs per person.

Medicare pays the carrier a fixed amount per enrollee who then pays the providers a fixed amount (minus their overhead).

So...the provider and carrier must be much more involved in what care is offered and from whom.

Otherwise, they lose money!

There's a built-in incentive to "manage" costs along with healthcare.

This basic mechanism drives everything below as we'll see!

Let's get into it.

#1 reason people go with medigap - "choice of doctors"

This is probably the biggest reason people choose medigap over Advantage plans.

Most medigap plans are HMO which means there is a defined list of providers that you must stay with outside of a true emergency.

There are no benefits outside this list for non-emergency.

The list is much smaller than the full Medicare provider lists with medigap, and since there is a cost constraint, you may not find the best doctors on that list.

That's just part of the trade-off regardless of what plans say. Generally, HMO networks are about 2/3rds the size of the full Medicare list in California from our experience.

You also have a point person or medical group.

Most of your care will be from this primary provider or coordinated through them.

This includes referrals to specialists!

The advantage network is also based on a certain distance from your home address. You generally will need to stay with providers about 30-40 miles from your location.

This is fine for most services but what if a specialist for a type of cancer is at UCSF and you live in Monterey?

Too bad, generally. You'll need to see providers in your medical group.

You can run your Advantage plan quote and enter your doctors to see if they work for you here:

The choice of doctor is the biggest reason we hear from people that pick medigap

over advantage but the 2nd reason is as important and generally intertwined.

#2 reason people go with medigap - "control over medical decisions"

Remember the whole cost containment bent for advantage plans?

Right in line with this is how healthcare is managed.

With a Medicare supplement or medigap plan, most decisions are made between you and your doctor.

As long as the given service is covered by Medicare, if you're doctor recommends it, you're good to go and medigap will pay accordingly (after Medicare pays).

With an Advantage plan, there is much more control from the health plan over what health care is delivered and how.

What does really mean practically?

There are many different approaches to this and you can expect versions of all of them.

First, your primary doctor has to refer you. You can't just go to a specialist for a back injury.

Less expensive medical care may be tried first before something that's more expensive.

For example, pain meds may be recommended before physical therapy before surgery with said hurt back.

There can be limits in place (say for days of physical therapy).

Generally, you need more pre-authorizations and simply put, the Advantage plan can say "No".

You see all these quite a bit on the RX side with the built-in RX plan with Advantage.

More cost-effective medications can be subbed out mid-year for a condition. Not uncommon.

If you don't like the hoops associated with getting a health plan to approve care, Advantage plans are probably not the right fit.

Net net...more control and "management" of health care by the carrier versus medigap.

Let's look at the flexibility to move around between the two.

#3 reason people go with medigap - "ability to use through the US and when traveling"

Remember above how we have to choose doctors and/or medical groups within our area for Advantage plans?

Healthcare really is locked into your general region.

Sure, you'll be okay for true emergencies while in other parts of the US but otherwise, you have to remain local.

There are 3 places where this is felt between Advantage and Medigap:

- Specialists in other areas

- Traveling around the US or splitting time

- Traveling out of the US

Let's look at each.

What if a cancer or back specialist is in another city or even another State?

It happens all the time...usually with something more serious or exotic.

Cancer's a big one. Surgery is another. The heart also comes to mind.

With an Advantage plan, you will likely not be able to see providers in other areas even if they really are superstars in what you're dealing with.

That's one-way Advantage plans contain costs.

Next, there's out of State.

Medicare is a federal program which means it has a nationwide network of providers (doctors and hospitals).

If you have a medigap plan, you can see Medicare providers across the US!

We see this with people that:

- Split time between two different States (so many Texas license plates in

Monterey!)

- Travel quite a bit across the US (visiting kids, etc.)

- Want to see the best doctors for a given situation which happen to be in other States

If you need this flexibility across the US, medigap is going to be a better fit

for you.

Finally, there's travel out of the US.

Medigap plans can include foreign travel benefits. Here's the general benefit chart:

There is stand-alone travel insurance (out of the country) which you can get here but medigap plans (especially the most popular ones like the G plan) include foreign travel as a benefit.

Advantage plans do not.

Finally, let's look at the cost piece. You maybe surprised!

#4 reason people go with medigap - "cost certainty."

Interestingly, most people pick Advantage plans to save money.

The monthly premium can be zero!

That's only half the equation though.

What about out-of-pocket expenses when you get sick or hurt??

We look at this in detail in our How to Pick the Best Medicare Plan.

Here's the rough sketch.

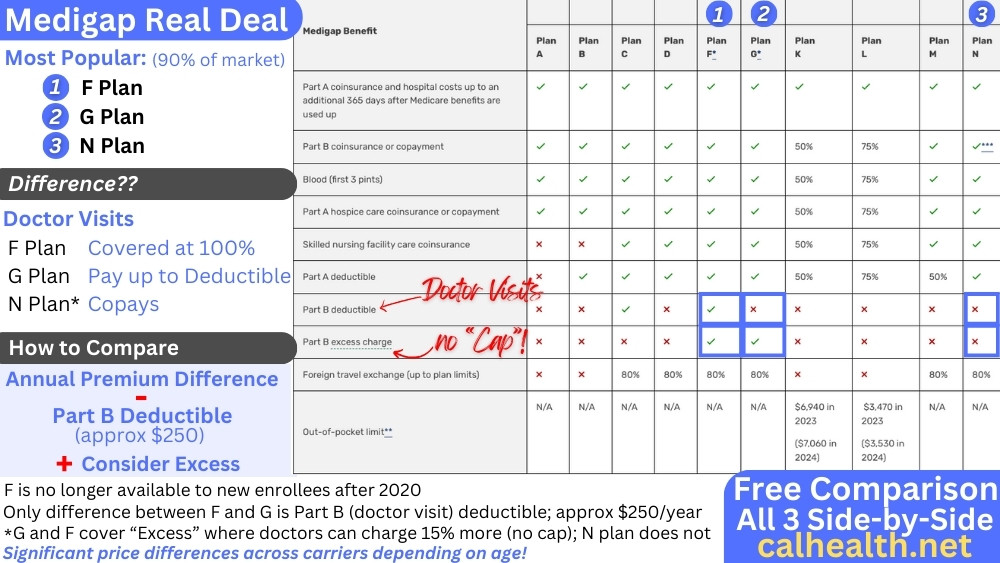

With a G medigap plan (the most popular), you'll generally have very little out of pocket aside from the Part B deduction (around $240/year...goes up a bit each year).

We looked at the total cost expected for Medicare plans with the G plan being around $300/month (includes G plan, Part B, and Part for Medication - the standard combo at age 65).

Many Advantage plans have zero premium but they have shifted it to the back end in terms of a Max-out-of-pocket".

You're going to share the costs in terms of copays and coinsurance (% you pay) till you hit the max.

The lowest max's on the market are generally around $800 and can be found in more populous areas (greater Los Angeles - see Los Angeles Advantage plan comparison).

In other areas (Bay Area, San Diego, more rural areas), the max maybe $3-4K!!

If you have bigger health care costs, this can be the equivalent of $250-300/month premium.

A wash!

Okay okay...you're healthy. You never go to the doctor but the odds are not in your favor age 65 and older:

So...what was a decision made to save money may not pan out. We go through this

in our Picking the Best Advantage plan and our "Triple Threat."

It comes down to the area and expected healthcare costs.

We're happy to walk through your situation with 25+ years of experience and there's no cost for our assistance!

Finally, the rubber hits the road.

Quoting and comparing Advantage versus Medigap plans

Everyone's situation is different. Remember that area and age really drive this decision.

Run your quote for both medigap AND Advantage plans here:

Compare the G plan versus an Advantage plan with one of the top carriers

(UnitedHealthcare® is a good bet in most areas) with the highest star rating.

Take into account the following:

- Monthly cost (total - see our total Medicare cost calculator)

- Exposure to big bills (advantage plan max out of pocket versus $240ish for G plan)

Look at it over an annual period and now factor in:

- How important is doctor choice, and are your doctors in the Advantage network

(UnitedHealthcare® has the biggest network)

- How important is control over healthcare decisions

- How likely will you need coverage in other areas, States, or even internationally

Again, this can get complicated. Send us your zip code and date of birth, and

we'll run the comparison for you!

help@calhealth.net

We can go through any questions you have we really do try to help people with impartial and easy-to-understand advice.

See what others say: