California Medicare Options - What is the most popular medigap plan in California

What is the Most Popular Medicare Supplement in California

For people who want more control over provider networks and how medical health care is handled, supplements are the way to go.

That much is pretty easy for most people but then there's the question of which medicare supplement?

There are clear "winners" in terms of popularity both in terms of plan and

carrier which we'll cover below.

We work with all the major supplement carriers so this is solely a reflection of the market is choosing.

Our credentials are here.

Let's just into the different areas along these lines:

- What do medicare supplements cover

- What's the most popular supplement in California

- What are the most popular carriers in California

- How to quote the main supplements in your area

- How to enroll in the main supplements in your area

Let's get started!

What do medicare supplements cover

First, why even look at medicare supplements at all? Versus either just having medicare by itself or an Advantage plan?

For the medicare alone question, it's important to understand that that there are's a big, uncapped hole in medicare around the 20% coinsurance piece.

65+ is the absolute wrong time to take this risk:

At a minimum, we want to address the 20% coinsurance.

We see medical bills of a few 100 hundred thousands all the time from clients these days. Anything in a hospital setting can quickly explode in cost and we don't want to be on the hook for 20% of that charge.

So, there are then two ways to cap this 20% exposure:

- Medicare supplements (like PPO)

- Medicare advantage plans (like HMO generally)

This really comes down to how much control you want over who you're able to see (providers) and how that care is managed (HMO versus PPO).

People generally have a pretty good sense for their preference from prior experience (through employer or Covered Ca).

We looked at how you really have to be careful with Advantage plans in certain areas as the max-out-of-pocket creeps up quite a bit and makes supplements much more attractive.

Check out our Tradeoff between Advantage plans and supplements or How to compare Advantage plans and supplements.

This tends to occur based on region with greater Los Angeles being the place of strongest showing for Advantage plans.

Assuming we want more flexibility and control, that brings us to the supplement side of things.

So...what's the big winner there?

What's the most popular supplement in California

By far, the most popular supplement in California is the G plan.

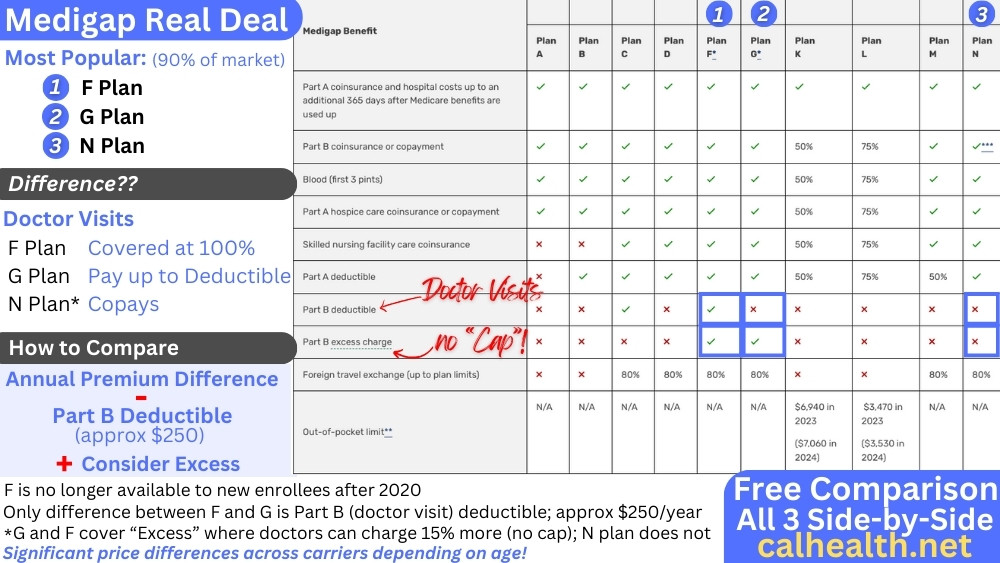

Here's the broad strokes of the different plans available:

- The F plan is no longer available to new enrollees and it was the market leader

for decades until 2020.

- The G plan takes its place with almost identical benefits except for the the

Part B deductible which just over $200 (indexed to go up each year).

- The G plan is currently the most comprehensive medicare supplement on the market for new enrollees (some old enrollees still have the F plan).

It fills in the major holes of Medicare with one particular focus on Medicare excess.

Most people are unfamiliar with "Medicare Excess" but it's incredibly important.

As you may know from our site, we don't like uncapped risks.

Medicare excess allows Medicare providers to charge up to 15% higher than what Medicare allows and still be a "in-network".

G is the only current plan (F also did it) that covers this uncapped risk of 15%.

We don't want 15% of a $10,000 bill (or higher). Defeats the purpose of having coverage!

They just wrapped up the latest debt ceiling increase ($4 trillion) and total debt is expected to jump to to $50T by 2030.

There's going to be constant pressure to curb costs and you can expect some of this to fall on Medicare and by default, the doctors!

Look for more and more doctors to charge this 15% excess and make sure to have it covered with the G plan.

The C plan is the step down which doesn't cover Medicare excess but you'll notice the premium difference isn't that great to justify the uncapped risk.

That's why most carriers offer a G plan!

It's by far the most popular.

There can even be G plan high deductible plans if you want more of a high deductible option which still keeps the Excess cap in effect (albeit, at the higher deductible number now).

We're happy to walk through all the options with you!

Okay...so that's the plan piece. What about the most popular carriers in California?

What are the most popular carriers in California

For Medicare supplements, there are three main carriers in California:

- Blue Shield of California

- Anthem Blue Cross of California

- UnitedHealthcare®

You can quote of all of them side by side for the G plan or other medicare supplements.

Over the past 5-7 years, Shield has generally been priced well depending on the area. Occasionally, Anthem might be cheaper in a given area.

UnitedHealthcare® used to be cheapest everywhere with their initial discount but that hasn't been the case in a while.

Keep in mind that the benefits and networks are standardized so there's no real difference in coverage between Shield or Anthem or UnitedHealthcare®.

Medicare determines what is allowed as well and the carrier just pays accordingly.

So...how do we see the pricing for California's most popular medicare supplement for your age and area?

How to quote the main supplements in your area

This is easy (and free).

Just click here to quote all the major medicare supplement plans:

You'll see options from the most popular medicare supplement carriers in California:

You can filter by carrier or even by the G plan itself.

We're happy to walk through any questions comparing the options with you directly. There's zero cost for our assistance and people seem to enjoy the assistance!:

How to enroll in the main supplements in your area

This may be our favorite piece. Before, enrolling in a Medicare supplement was a complicated and long process.

Now, we can enroll online for most of the major carriers including Shield, Anthem, and UnitedHealthcare® mentioned above!

You can access the online app right through the application here:

There's even access to quotes for Part D (medication) plans which also have an

online application capability (see the tabs up top):

Reach out with any questions on the whole process and check out our How and When to apply for Medicare Supplements.

We're here to help!