California Medicare Options - Medicare advantage out-of-pocket max

Understanding the Max Out of Pocket for Advantage Plans

It's 1/3rd.

1/3rd of our Triple Threat selection for Advantage plans.

Most people are "sold" on the zero premium and maybe low or no copays and not much attention is paid to the backend.

What happens if you get really BIG bills in a calendar year.

You can't dismiss that now after the last few years. We've seen our fair share of $250K+ bills with clients lately.

We'll look at how to take the max into account, how to compare it with supplements, and also how it figures into the Giveback plans.

Lots to look at.

Our credentials are here:

Here's what we'll cover:

- Do Advantage plans have a max out of pocket

- How to compare Advantage plan out of pocket max's

- Advantage plan out-of-pocket max versus supplements

- Cash Back savings versus out-of-pocket-max

- Medi medi plans and the max out of pocket

- Quote plans to compare benefits versus out-of-pocket maxes

Let's get started!

Do Advantage plans have a max out of pocket

What exactly is a max-out-of-pocket and do Advantage plans have one? Yes!

The out of pocket max protects you on the backend from really large bills.

The standard max is usually from $800 - $8000.

That's quite a range but we'll understand why below.

Advantage plans generally have pretty rich benefits:

- Low copays of office visits

- Fixed amounts for hospital days

Some costs can be very low or even zero!

So why does a max matter?

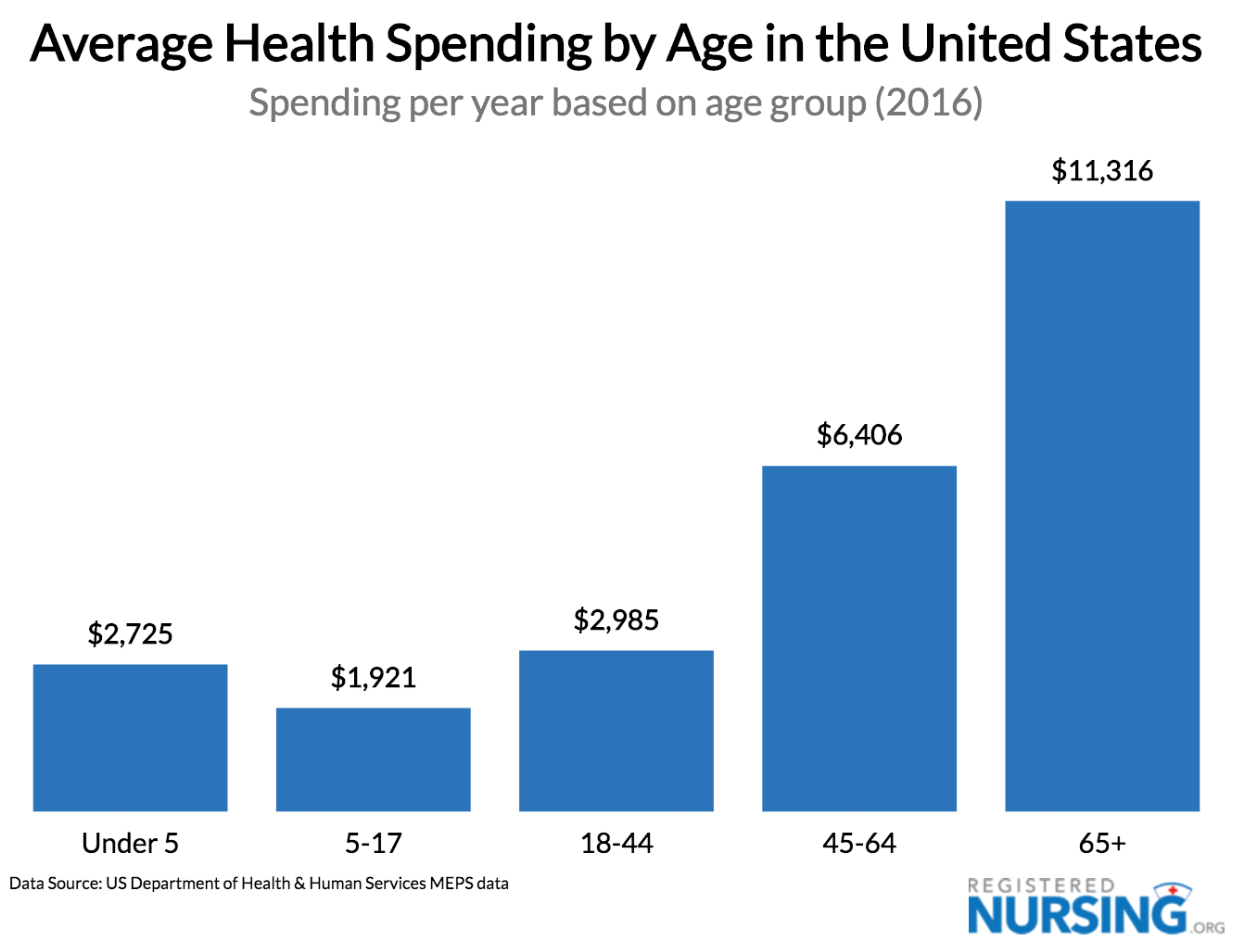

It's really if we get into a bad bad year with lots of healthcare costs or very very expensive ones.

Think of a heart attack situation. We've recently seen a few that were $350K!

Half a million or even a million isn't unheard of these days for anything facility based. If a person has extended time in a facility setting (hospitals), the nickels and dimes can quickly explode higher.

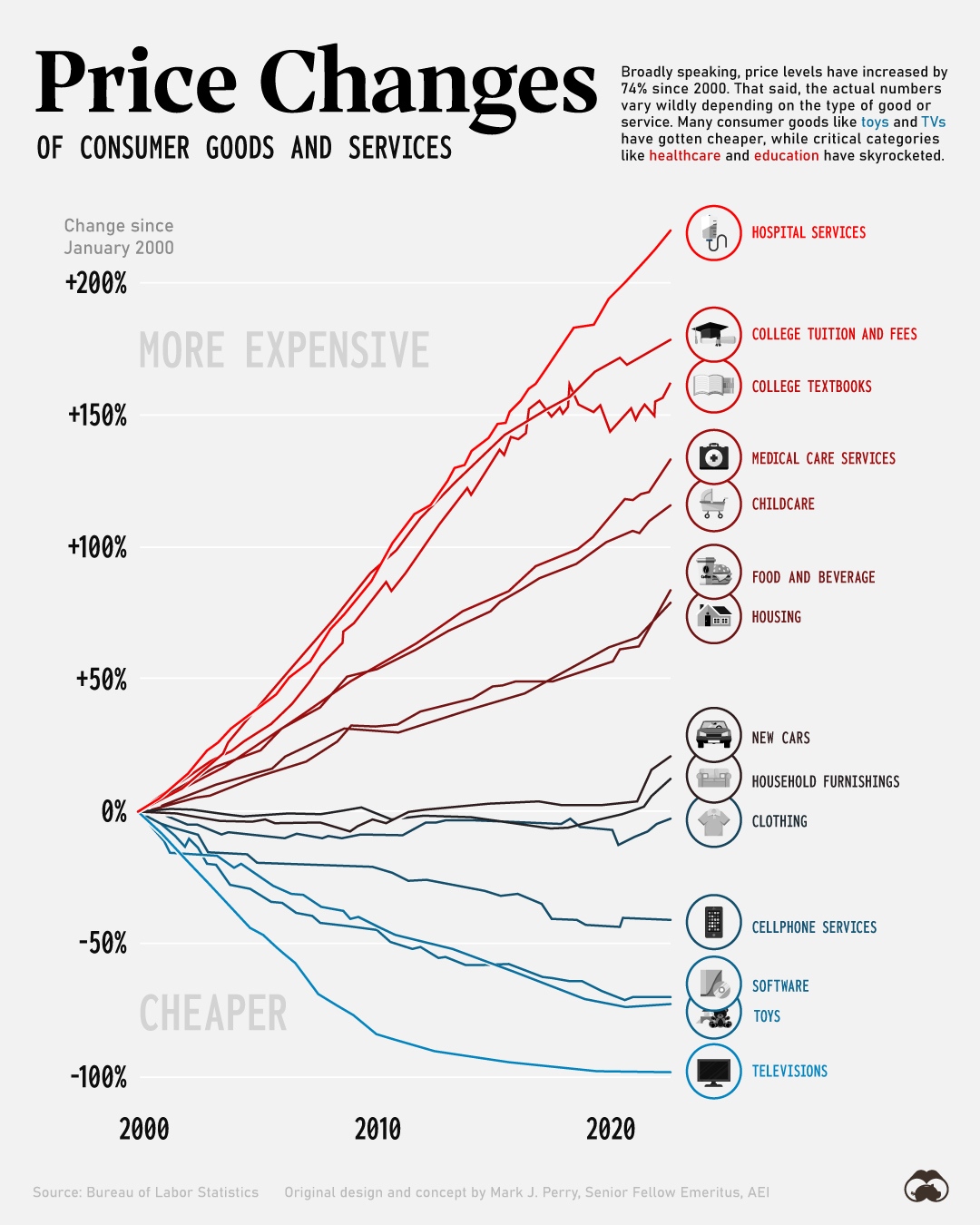

Do you really want to fight against this trend?

or this one...

The max protects this running cost train from wiping you out. It caps your exposure in a calendar year for a certain amount.

The nickel and dining will stop at some point!

Everyone's so bedazzled by the no premium, and grocery delivery that they completely disregard the out-of-pocket-max when comparing Advantage plans.

Most people think..."I'm not going to get sick!"

It's there for a reason! Many people are hitting that max every single day in California.

You can tell a bad advocate if they only tell you the office copays and flashy spending cards but forget to mention the max.

So...how do we compare the different Advantage plans in California?

Thought you would never ask!

How to compare Advantage plan out of pocket max's

When you run your quote below, you'll see a range of different out-of-pocket-maxes.

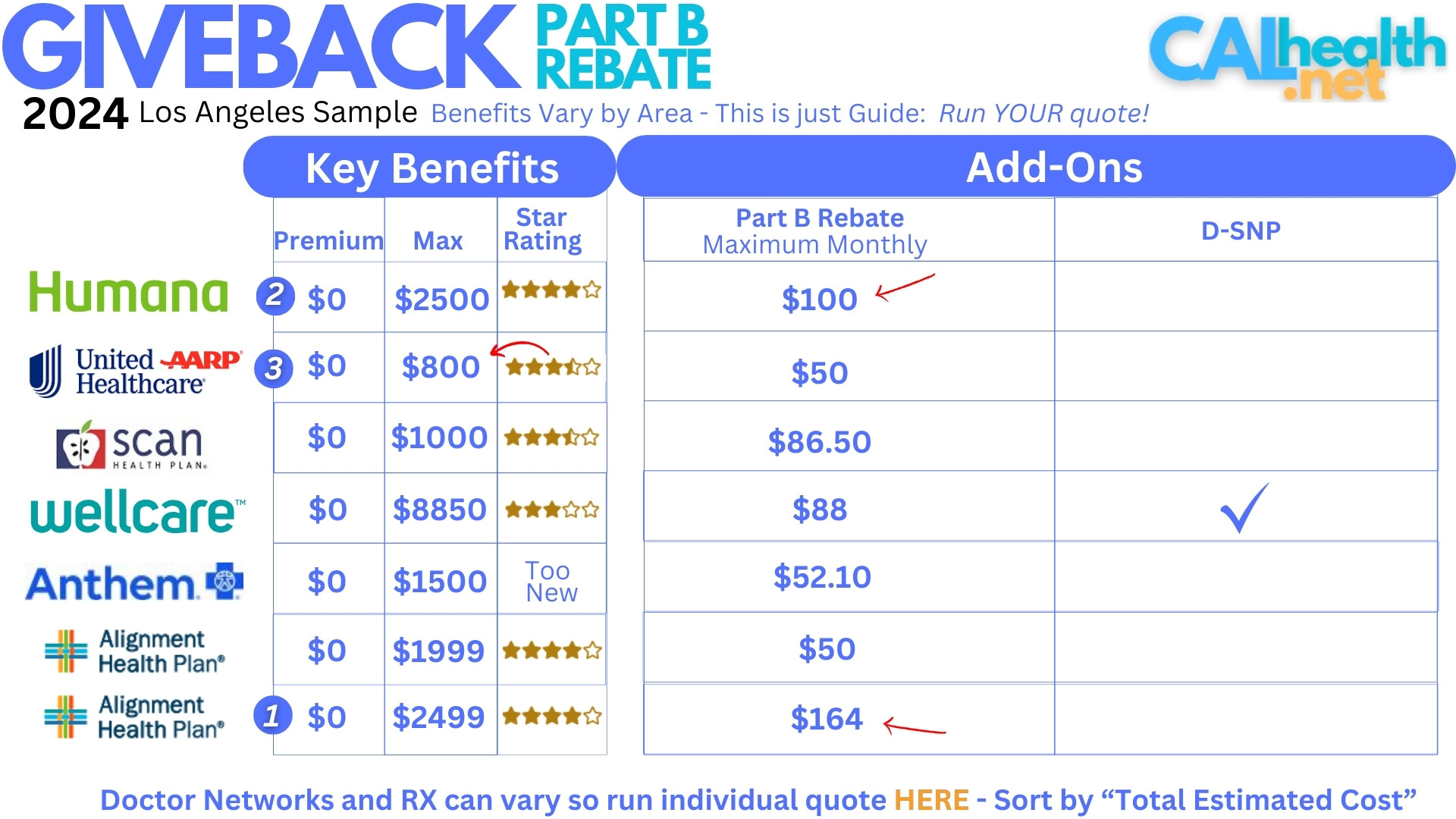

Let's take Los Angeles for example.

The maxes run from $199 (Alignment plan) to over $8000!

What gives? Is this the equivalent of bronze and platinum plans in Covered Ca?

Not really.

Usually, carriers will have a lead plan with their lowest max. This is their "strongest hand".

Other plans then add in additional benefits which are very popular so generally, a higher max reflects a trade-off.

For example, you may see higher maxes with:

- Part B Giveback

- Flex Cards

- Richer Benefits

- Richer Networks

- PPO options

Of course, we need to take into account monthly premium, deductible, and most importantly...Star Rating!

That reflects how happy the actual enrollees are with the plan.

For example, in Los Angeles, the Alignment Platinum+Instacart has a $199 max which is ridiculously good. And a 4 Star rating.

It's one of the most popular plans for this reason.

The max then goes up to $499 and up from there. You'll start to see max's in of a few thousand over time.

Then, you see max's over $8K, especially if you select "Show Special Needs Plans".

What gives? These plans are generally eligible for D-SNP or C-SNP, special need plans based on medi-cal, LIS, or chronic illness.

If you qualify, that max may not be as big a deal and we'll look at that below in more detail.

How does this max affect the whole supplement versus Advantage plan decision?

Advantage plan out-of-pocket max versus supplements

We have lots of deep dives on how to compare Advantage and Supplements.

Let's break down the max calculation.

A G plan will have just the Part B deductible for exposure. So let's say $200/year.

You also pay around $150/month for a new 65-year-old. So that's another $1800/year.

So...$2K per year plus Part D for medication. Let's keep it at $2K to make it easy since some Part D plans can be pretty inexpensive (Wellcare's plans for example).

We'll contrast Alignment's Platinum+ plan. The max is $199/year and zero premium.

Sure, it's an HMO so care will be more structured but we're just looking at cost.

Now you see why Alignment plans are so popular and growing:

On a purely cost basis, it's $200/year with Advantage plans versus $2000/year with G plan supplement.

This Alignment plan is a new addition with that lower max amount. The low max in Los Angeles used to be around $800/year.

There, it's $800/year versus $2K with supplements. Still a good deal if you're okay with HMO style of doing things (see Trade off with Advantage plans).

Where it gets trickier is when our max starts getting higher...$3-4K/year!

Hmmm...if we get really big bills, we might be on the hook for $3,000. If we're healthy, it's okay but otherwise, hard to justify against the supplement.

This was Los Angeles but most other areas in California (Bay Area or San Diego, etc) actually have max's that start around $3k!

We have to evaluate how that works for our situation. We're happy to help you with this at no cost at help@calhealth.net or pick a time to chat.

You can always run your quote here:

Let's look at the Give Back option.

Cash Back savings versus out-of-pocket-max

Big guide on Cash Back Advantage plans but this is a very popular option these days and no wonder.

Everything's getting more expensive!

The Part B Rebate or Give Back plans will pay towards the monthly Part B premium at different levels.

At max, this benefit can run around $2K/year. But the max out of pocket might go up.

Looking at Los Angeles: (we'll show you how to quote your area below):

Looking at Alignment's SmartHMO as their Cash Back plan, the max is $2499 versus the Platinum+ at $198.

But...you're getting almost $2K towards Part B (goes directly to Social Security). So really...that max is like $499!

See how that works? That's not a bad way to get cash now (Part B savings) and if you have a bad year, it's a wash!

Learn more about the SmartHMO Advantage plan option.

What about those really high out-of-pocket maxes.

Medi medi plans and the max out of pocket

You'll see some plans have their max's right up to the top of the limit set by Medicare. Over $8K.

So what does that mean and why would anyone choose those after reading our out-of-pocket max review!

There are plans that have special designations. Essentially, they're for people who are eligible for medi-cal and Medicare...so-called "medi-medi". These are called D-SNP plans.

These plans assume that medi-cal will help out with the out-of-pocket so the max is not as important if you are eligible for medi-cal...so-called Dual Coverage.

Make sure you have this eligibility but if so, these plans can offer more coordination than the other Advantage plans.

We can help you to see if you're eligible but the above situation was for Los Angeles. How do you run your quote?

Quote plans to compare benefits versus out-of-pocket maxes

We make this easy, fast, and free.

A few notes to get the best quote.

Under the "Preference" box, make sure to add:

- Your doctors

- Your medications and dosages

- Your preferred pharmacy

Sort by "Total Estimated Cost" up top.

The max will show in each plan detail but we're happy to help compare and contrast the different options but you now have a good understanding of the out-of-pocket-max.

Happy to check out the options for you at help@calhealth.net or with a quick chat: https://calendly.com/dennis-jnw