California Medicare Options - How to quote California medicare plans

Quote California Medicare plans

Quick Guide to Quoting Medicare Plans

You're either new to Medicare or just looking for a better value.

How do you go through all the options and come out ahead? It's probably not by following the countless flyers and even phone calls you keep getting.

In our Picking the Best Plan guide, we go through how about 90% of that is probably in the carrier's interest and not yours

So...let's take 25+ years of experience in the California medicare market and get to brass tacks

If you need our referrals, check out Google reviews:

Now that's out of the way, here are the topics we'll cover. Step by

Step!:

- Quick lay of the Medicare land

- Running your Medicare Quote

- The doctor and medication QuickForm

- Comparing the Advantage and Part D plans

- Enrolling online (like a boss)

Let's get started! Of course we're happy to help with any questions and there's ZERO cost for our assistance as licensed Medicare agents in California.

Quick lay of the Medicare land

We've covered this in detail at our Medicare versus Advantage plan guide but we'll hit the highlights.

Key Points:

- You're usually eligible for Medicare the 1st of the month you turn 65 in or after losing employer coverage (many smaller triggers but check with us)

- Medicare has two big holes: deductibles and 20% coinsurance (amount you pay)

- Medication is not covered by traditional medicare so we need to address that separately

- Two ways to fill in holes: Medicare Supplements (PPOs) or Advantage plans (HMOs)

So far, so good! This is just the high-level stuff...learn more at our Comparing page.

The big question is Medicare Supplement or Advantage plan.

It's a trade-off between control of doctor choice and medical care VERSUS cost. Read all about it at our Advantage versus Supplement Trade-off Guide.

Up above, you can get the Medicare Supplement, Advantage, and Part D rates right away!

Zero obligation and Zero cost.

Let's first look at the supplement quote above.

Running your Medicare Quote

We quote the major carriers across California but in the last 5-7 days, it's really been Blue Shield or Anthem in terms of cost.

The plans are standardized so a G plan will be identical from carrier to carrier both in terms of benefits AND doctor network (any provider that takes Medicare essentially).

It then becomes a question of cost and future cost! Meaning...which carrier is stable longer term.

That's been Shield and to a lesser extent, Anthem for years now. Even AARP (United) hasn't kept up but don't take our word for i

Run the quote! (above)

So...how do we read the quote?

Focus on the G plan to establish which carrier is priced best in your area for your age.

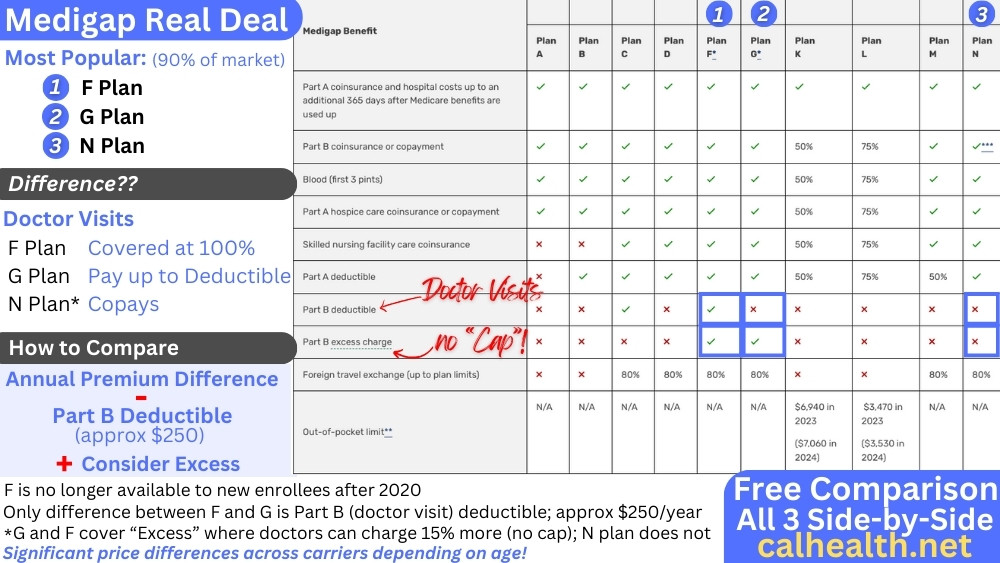

It's the go-to medicare supplement these days with about 80% of the market (if not more). We go into why the future cost is also important in the Insider's Guide.

We explain why in our Insider's Guide to Medicare Supplements with Excess (doctors charging more than what Medicare allows) being the big reason.

Generally, this is 80% of the work done now since the plans are standardized and have the same networks.

Just the Part D for medication left. Let's go there and also for the second part of the equation...Advantage plan quoting.

Advantage and Part D Quoting

Unlike many brokers, we believe in making the quotes instantly available to you and under your own control. We don't hound you!

Those rates available above! Free. Instant. Secure.

With that info, we can then run a very personalized quote based on your doctors and medications!

If you need to shop at open enrollment, just update the meds/doctors (if needed) and everything else is still there! No need to start from scratch every year!

It really is a game-changer and there's no cost to you!

Doctor networks and medications will be different from Advantage plan to Advantage plan so we can't really run this quote well without that info!

The system is entirely secure and HIPAA compliant (strictest level of requirement). There's NO obligation (other than to receive a personalized, free quote).

Of course we're happy to help!

Comparing the Advantage and Part D plans

Check out or Insider's Guide to Advantage plans to really understand how to compare these.

We'll give away a big secret (we're such gossips)...

Focus on the Out-of-Pocket Max (OOP) and the monthly premium.

This is how the carriers really look at it! Don't get blinded by free vision, vitamin discounts, or pet grooming add-ons.

That's NOT the calculus or true exposure with a Medicare Advantage plan and the carriers/sales people know it.

The OOP Max basically states how much you have to pay in a bad year (Jan-Dec; covered benefits, in-network).

Aim for an OOP max around $1000 or lower. We explain why this will pencil out best against the costs of Medicare Supplements above in our How to Pick Best Medicare Plan Guide.

The new Part B rebate plans are pretty popular and we understand why with up to $164/month coming back to enrollees!

With all our doctor and medication info entered (Advantage plans generally cover medication too), we can now accurately price the plans with max's around $1000.

This is the sweet spot for Advantage plans and we'll the focus on the carriers with the best customer reviews for similar options.

Of course, we can help with any questions!

Part D for medication is very similar to this same process for people getting Medicare Supplements.

Same form from above and we'll generate a quote based on the lowest total-out-of-pocket (both monthly premium and copays based on your meds).

Every open enrollment, we'll send an update link where you can add/subtract/change and voila...the options for the new year are all there.

Okay...so we found the plan we want...time to fill in long forms in triplicate (remember those days??). Not!!

Enrolling online (like a boss)

This is our favorite part.

When you receive the personalized quote, access to online applications is available for all the plans!

Your info will already be entered so you just update any changes and no need to completely re-fill everything anytime you want to make a change (such as open enrollment).

This takes the old process of probably 30 minutes and condenses it down to...around 10! At most.

We're here to help with any question on the supplement, Advantage, or Part D enrollment.

As insurance agents who remember the bad-old days of forms and copies and faxes, we can't tell you how much we geek out over just how fast and easy this process is now!

It's one less reason not to quickly shop the market to get the best value.

Hopefully, you can see from above that we want what's in your best interest but just in case:

Of course, there's no cost for our assistance and we're happy to help with any questions!

800-320-6269 or help@calhealth.net