California Medicare Options - Guide and Review of California Aetna CVS Medicare Advantage Plans

Aetna Medicare Advantage Plans in California: Comparing Options, Benefits, and Network Sizes

We have one of our three giant nationwide carriers that also has aggressively pushed into the California Medicare advantage market.

The space is very competitive so Aetna did something that was pretty smart (and ahead of its time).

It partnered directly and explicitly with the leading pharmacy CVS!

We'll discuss below what this means for you as a member and why it's probably a trend that will explode across the Advantage market.

Aetna just got there first!

First, our credentials with 25+ years of experience in the California senior insurance market:

We'll cover these areas in our review:

- A quick intro to Aetna's Advantage Plans in California

- Are people happy with Aetna Advantage plans

- Comparing the different Aetna Advantage plans

- How to quote Aetna Advantage plans

- How to enroll in Aetna Advantage plans

Let's get to it!

A quick intro to Aetna's Advantage Plans in California

Most people know Aetna from their employer coverage. They haven't been in the individual/family market (think Covered California) in years now but just came back.

They're also a big player in the senior market with Medigap plans and more recently, Advantage plans.

They are truly one of the big 3 nationwide insurers:

https://www.statista.com/statistics/828436/largest-health-insurance-companies-in-us-by-membership/

Now this is nationwide for all markets but even in Advantage plans specifically, they're a big player:

https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2022-enrollment-update-and-key-trends/

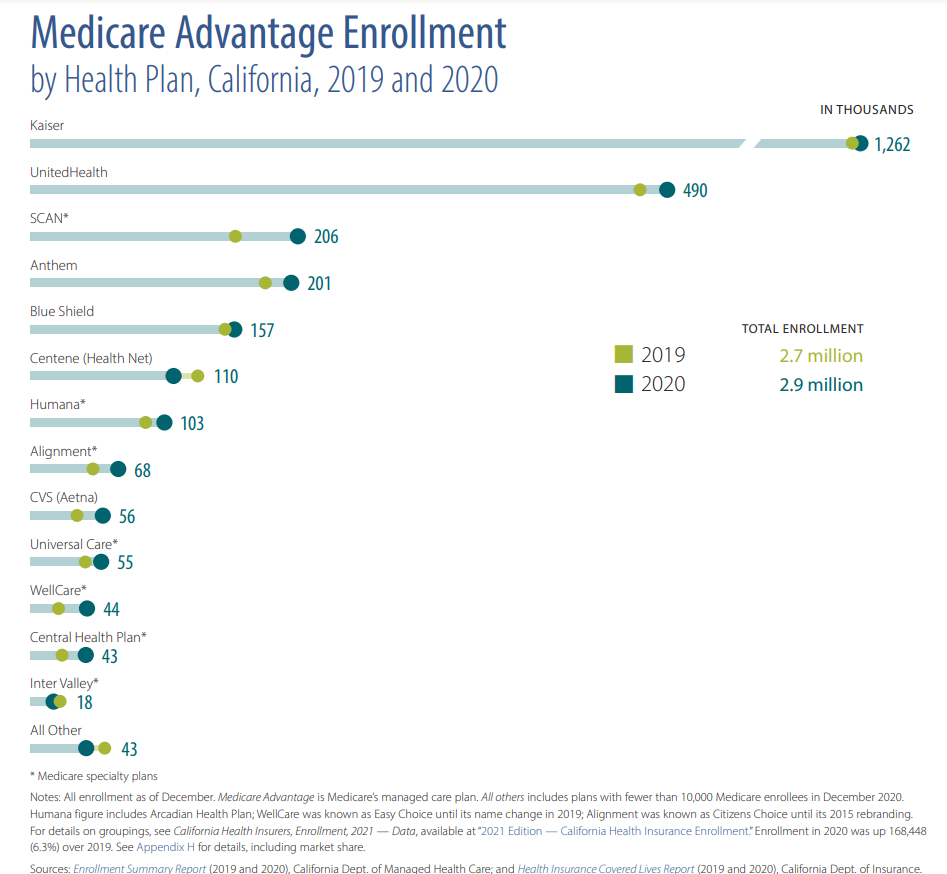

For California Advantage, they're right in the middle:

Here's the big news.

CVS, the largest pharmacy bought Aetna in 2018! Not the other way around.

This speaks volumes about where the money flows in health care.

Since then, their Advantage enrollment has exploded. From 2021-2022, they added 282K members nationwide.

Why the move with CVS and how does that affect you?

Medications are a huge driver of healthcare costs (along with hospitals) and the big promise of Advantage plans is to bend the cost curve for healthcare costs.

When Aetna members use CVS pharmacies, they'll get the best benefits even though they can use other pharmacies in-network.

For this reason, Aetna Advantage plan drug copays can be pretty impressive when in this special network!

If medications are a big cost factor for you, that puts Aetna in consideration depending on how they compare in your area.

CVS is not just medication though and they're expanding their HealthHubs (think clinics) across their network.

Essentially, they're looking to address the more common healthcare needs all in-house!

Look for this to expand to where urgent care, preventative, etc can all be done there.

The move in 2018 was really a game-changer to the whole market.

This reflects in their stand-alone Part D plans (called SilverScripts) which is consistently priced well when we run quotes for people.

With time, this effect should also show in their Advantage plans since the medication is generally included and can make or break a plan being affordable.

So...how is it being seen by Aetna members (or should we say CVS members??)

Are people happy with Aetna Advantage plans?

We always lean on the Medicare Star Ranking since it's internal to Medicare from actual members and hard to fake.

Aetna's plans in California generally come in at 3.5 stars (out of 5) for Advantage plans and 4 stars for Part D.

The average is just over 4 so that puts them right in the middle for California. This differs from nationwide where they are at 4.

Again, Star Rankings can differ by area and even plan so it's important to run your actual quote here:

Make sure to enter doctor and medication info (to avoid complaints #1 and 2 with Advantage plans).

To really see California data...we need to run these quotes! Let's go there now!

Comparing the different Aetna Advantage plans

We're going to run sample quotes for 3 areas:

- Los Angeles

- Bay Area (San Jose)

- San Diego

We can use this to see how Aetna fares but also to compare their plans.

Let's get started with the biggest market for Advantage plans...LA!

Aetna Advantage in Los Angeles

One note...Aetna is not in the top 2 pages when we run this quote which speaks to how competitive LA is.

That being said, there can be small differences between plan #5 and plan #15 due to this intense competition.

Okay...when we filter for Aetna alone on the left, we first see their 3 HMO Advantage plans:

The first 2 plans have a 3.5 Star Rating but the max out of pocket is higher than we would like according to our Triple Threat selection system:

We explain why this matters against Medicare supplements (which Aetna also offers) at our How to Pick the Best Medicare Plan.

The third plan hits the monthly premium and out of pocket max under $1000 but the star rating drops to 3 stars.

If that comes up next year, we would expect Aetna to jump in the rankings within this very competitive LA market.

So what's the difference between the Plus and the other two besides the max out of pocket?

This is super important when comparing Advantage plans and you'll see it across carriers.

- The Plus has a smaller network but richer benefits to offset this.

- The Select and Prime have bigger networks but more exposure on the back-end (max out of pocket)

Enter your doctor and medication info when we send over the form (secured) so it takes the guessing out of this.

If you want a broader network, expect to share more costs!

Again, we see this across many carriers. Different options that mix and match network size (doctor options) versus benefits (copays, maxes, etc).

We can help you analyze this for your situation. Just email us at help@calhealth.net and we can run the quote for you. Zero cost for our assistance!

You'll notice there's one other plan there. A PPO!

The PPO Advantage plans are somewhere between the HMO Advantage plans and Medicare supplements.

Straddling both worlds.

We're not huge fans of PPO Advantage plans from any of the carriers. Why?

Look...a G plan will cost you around $150/month for a 65 year old in LA. The only gap there is the Part B deductible which is just over $240/year.

Your premium above is around $100/month with the PPO. And...you're taking on the risk of $5500 for the max out of pocket if you have bigger expenses. That's a bad gamble versus the $2K for the G plan (bad year healthwise).

Defeats the purpose of the whole Advantage plan model (HMO) and speaks to why we want max-out-of-pockets under $1000.

Again, check out How to Pick the Best Advantage Plan to learn more about how this calculation works.

Let's go to San Jose. Completely different situation!

Aetna Advantage in Bay Area

Aetna has now moved up quite a bit when we run the quote. The out-of-pocket maxes have also jumped across the board (and carriers)!

Here are the top Aetna plans in this area when we run a quote for San Jose:

Okay...we see some common faces.

The Select and Plus plan both pop up but there's a new entry in this area. The Elite plan.

The Select and Plus have 3.5 and 3 star respectively so nothing new there from LA.

The Elite is a PPO plan and now the've added a $750 deductible.

Again, how does this work against a G plan with only a $200+ Part B deductible, $2000K in premium, and no back-end (outside of the Part B deductible).

The Prime max is $5,500!

People...65+ is the worst time to assume you won't have big healthcare costs!

https://www.registerednursing.org/articles/healthcare-costs-by-age/

Again, we would rather have the definite monthly premium with a supplement versus the risk on the backend. It's the wrong time to take this gamble!

The Bay Area is interesting in that most of the max-out-of-pockets are much higher which generally means that the Advantage model is not able to contain health care costs as well as in Los Angeles.

What about San Diego??

Okay...so Aetna has some top 10 contenders (Select and Plus plans):

Basically, their HMO options (Choice is PPO).

3.5 Stars and 3 Stars respectively.

Like in the Bay Area, the max-out-of-pockets have come up in San Diego with $2000 being the lower of the two.

Again, we're not big fans of max-out-of-pockets over $1000 as we explain in our comparing Advantage and Medigap plans.

One note... in San Diego, when we flip on "Show all Special Needs Plans", Aetna has a D-SNP come up.

D-SNPs are designed for people with both medicare and medi-cal. Even though it shows a very high max out of pocket, being eligible for both (medicare and medi-cal) can result in very small amounts out of pocket!

There are also C-SNPs for people with chronic illnesses.

Check with your county to see if you're eligible and then reach out to us at help@calhealth.net

Alright...what about your situation?

How to quote Aetna Advantage plans

First, run your quote here.

A few notes.

- Make sure to enter your doctor and medication info! This addresses complaints #1 and 2

- You can also click on "Show all Special Needs Plans" if you think you might qualify for medi-cal, "extra help" based on income, or due to chronic illnesses.

- You can filter by a range of different plan selections but the system will show you the plans in terms of lowest cost first and Star ranking next.

- Sort by "total estimated cost" up top

This hits 2 out of our 3 requirements for the Triple Threat:

Of course, this is complicated. Reach out to us with any questions and there's zero cost for our assistance. Again, our Google Reviews:

What about enrollment with Aetna plans?

How to enroll in Aetna Advantage plans

This is all good news!

For enrollment in Medicare Advantage, supplements, and/or Part D plans, we have fully integrated online enrollment!

Right through the same quote tool you just used so the information is already there!

It works just like a shopping cart but here's the cool part.

At Annual Open Enrollment each year, you can quickly quote and change plans after updating doctor, RX, and basic info.

This cuts out 90% of the work and time! Of course, we're there to help then too at no cost to you!

Email us at help@calhealth.net or call us with any questions: 800-320-6269.

Check out Google Reviews to see how we work!

Related Articles:

- Compare Medicare Supplements and Advantage Plans

- How and when to sign up for Medicare

- The Medicare Supplement Guide

- The Trade-off Between Supplements and Advantage Plans

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact www.medicare.gov or 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 day a week to get information on all of your options.