insurance till Medicare - Approaching Medicare Options

Health insurance bridge to medicare

This is a very common question for people in the their 60's.

It's usually driven by a desire or let's face it, need to save money.

Occasionally, it's because a person doesn't have other option till Medicare starts.

Again, the cost is the typical driver.

There are really two meanings people have when they want gap or bridge health insurance until Medicare starts:

- Enrolled late and have to wait till Medicare begins age 65 and older

- Waiting for Medicare to start (usually at 65th birthday) and looking to save on monthly cost till then.

We'll cover the options for each of these as they're quite different.

We'll also walk through some very important considerations when looking at bridge health insurance to get you out to Medicare.

Let's get started.

You can jump to any section here:

- Medicare bridge plan if over 65

- Options available under age 65 for bridging health insurance until Medicare starts

- Catastrophic health insurance till Medicare starts

- Obamacare until Medicare starts

- Short term health to bridge until Medicare starts

- health sharing plans until Medicare starts

Let's understand if this might make sense in your 60's till Medicare kicks in (age 65 for most people).

We have wonderful tools for people entering Medicare...just a few so you enter the space minus the deer in the headlights feeling:

- How to pick the best Medicare plan

- The trade-off between Advantage plans and Supplements

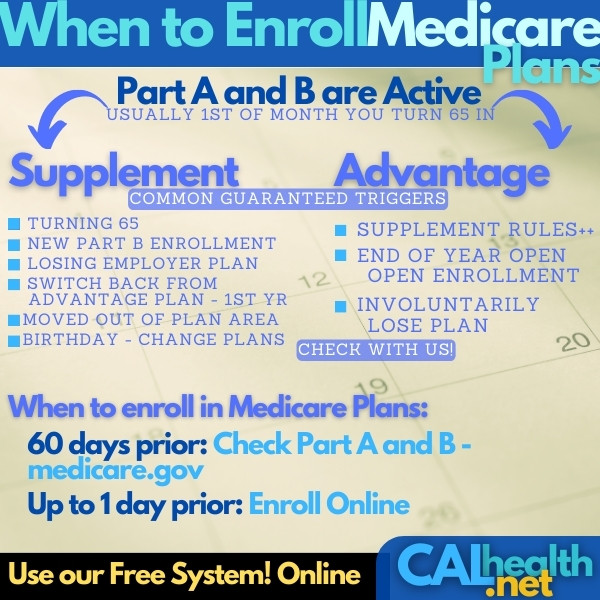

- How and When to Enroll in Medicare

Don't take our word for it...

Finally, you can quote major plans in your area (Advantage, Supplements, and Part D) based on your doctors/RX here:

First, let's look at the option for people already in their Medicare eligibility period but unable to enroll.

Medicare bridge plan if over 65

Let's spell this out a bit.

Some people will become eligible for Medicare Part A and B but will not enroll right away.

They'll miss certain deadlines for enrollment.

They may decide to enroll but find out that they have to wait till a certain date for their Medicare to kick in.

It could be 1 month or months!

Most people are automatically eligible for Part A which keeps them out of the Covered Ca market.

The only way to address this since they're already age 65 and older is a Medicare bridge plan.

There's one carrier which is solid for this and we can send you all the information.

Just email us a request for the Medicare bridge plan and we'll send over details, rates, and application.

This plan is also used for parents who visit from other Countries and do not have Medicare established yet although they may be eligible for Covered Ca IF not eligible for Medicare Part A and B.

It works well for people age 65 and over since we can't get individual plans for them.

This is a specific need for people who are already age 65 and older.

Let's look at the other common need till Medicare kicks in.

Options available under age 65 for bridging health insurance until Medicare starts

Let's say that you're age 64 and maybe you have 11 months till Medicare will start.

By the way, for most people, this start date is 1st of the month that you turn age 65 in. Learn all about how and when to enroll in Medicare.

If you have group health coverage, this probably isn't an issue since the company should be paying for part of your cost.

Where people are looking for a plan until Medicare starts is when they have expensive coverage.

This is usually either:

- Cobra coverage which is continuation of company insurance that you pay for

- Individual family insurance including Obamacare or ACA plans

If you don't have a tax credit, these plans can be ridiculously expensive in your 60's.

We're seeing rates close to $1000/month per person on just the bronze plan.

This is hitting at just the wrong time when people are retiring and seeing their income go the other way.

For many people this, isn't doable.

So the questions comes up...

What can I get for catastrophic coverage until Medicare starts up?

There are 3 options (the first, we may have already addressed):

- Covered California (if we can get a tax credit or have health issues)

- Health sharing plans

- Short term health plans or health sharing plans (bad news on this front)

Let's check out each one separately.

Covered California until Medicare starts

We bring this up only because many people might qualify for a tax credit but don't realize it.

This happens for a few reasons:

- They're using the wrong period of income

- They're using the wrong income calculation

- They don't include the full household members correctly

- They don't realize they're in the right income range

Here's the deal...if you can get a tax credit in your 60's, the subsidy is huge...even if you're near the top of the income bracket.

There's no cap any longer...it's tied to just under 10% of the AGI on the 1040 tax form (for this year, next year's filing)

The number goes up a bit each year.

If you think you might qualify for a tax credit, check with us first. Run your quote here.

If you can't qualify for a tax credit or can't enroll at this time (missed open enrollment and don't have a special enrollment period), then what?

Short term health to bridge until Medicare starts

If you're getting Medicare within 11 months, short term used to work.

In many States, we still have traditional short term health options which can you quote here.

One note, in some States like California, they banned short term health plans.

There is still one option called health sharing plans. These are NOT insurance plans. They work like memberships and we use them when someone either can't or doesn't want a Covered Ca plan (although Covered Ca is still our first choice for true health insurance).

You can quote, compare, and enroll in health sharing plans here:

Here are the quick points:

- Can start midnight following online enrollment

- Can continue or cancel month to month from 1 to 11 months

- More catastrophic in nature - does not cover pre-existing conditions

- Uses a large, nationwide PPO network

- Generally costs less than unsubsidized Bronze plans if you don't qualify for a tax credit

You can learn all about Health Sharing options here.

Of course, we're happy to help with any questions on these options.

The other aspect for people in their 60's is the limited period of time.

Medicare's coming!

Supplements and Advantage plans will be guaranteed issue if you enroll in time!

As licensed California agents, there's zero cost for our assistance with Medicare supplements, advantage plans, and Part D. Learn all about them here:

Best Medicare Supplement value - Why the G plan is hard to beat

The Trade-off Between Advantage Plans and Medigap

How to pick the best Medicare Plan

Insider's Guide to Advantage Plans

We're just trying to get to the finish line!

Maybe it's a few years.

Maybe it's a few months.

That quite literally is the decision people are forced to make now with the state of health insurance rates.

This is new to many people so please let us know how we can help.

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!

.jpg)