California Medicare Plans - What is the best value in medicare supplements

Best Medigap Value in California

Medicare supplement plans in California have gone through many changes over the past few years.

We've lost some plans...gained some plans but one plan has remained strong and true through all the tumult.

The G Plan.

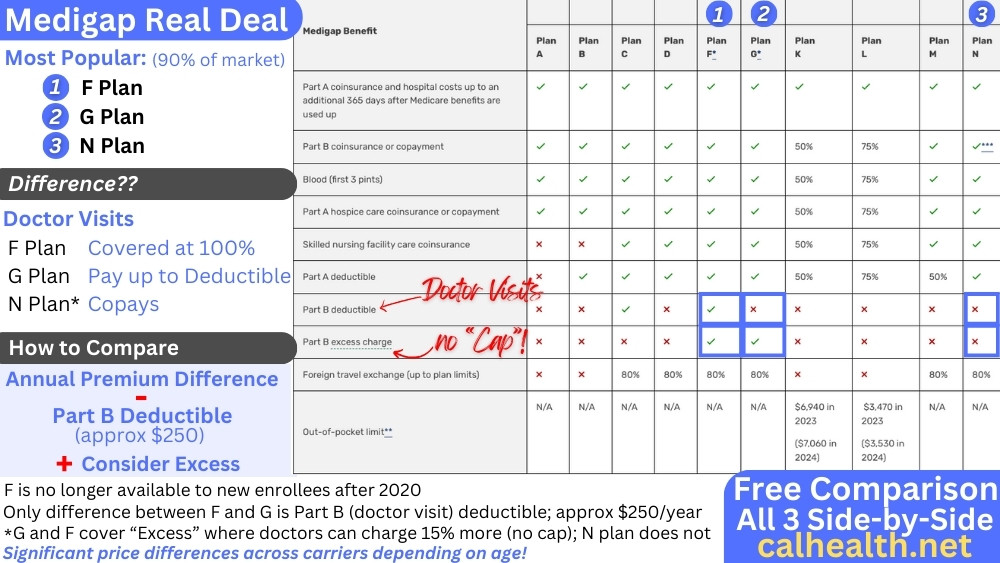

This standardized plan has been the most popular Medigap plan since the F Plan was discontinued for new enrollees and will continue to be.

Let's take a look at the basic benefits and why it stacks up so well.

You can always run your quote here:

First, a walk through the core benefits of G Medigap plan

This is really the big pro for the G Plan.

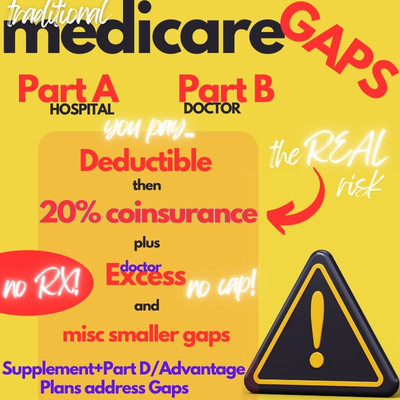

The plan covers all the main "gaps" in coverage that having only traditional Medicare poses EXCEPT for the doctor annual deductible (around $150/year).

The G Plan covers the Part A deductible, 20% coinsurance for both Part A and B plus additional supplementary benefits.

It also covers Excess which is very important and will become even more so in the future when Medicare inevitably squeezes the doctors further.

You can see the full benefit summary when you run your California Medigap quote.

It's the most comprehensive plan in the Medicare supplement flavor on the market which is the big attraction. You can learn about Supplements versus Advantage Plans here.

Benefits are only one concern when choosing a Medicare supplement plan - Cost is equally important.

There are versions of the G plan with high deductibles which can offer lower cost options and still keep a cap on the back-end.

You can learn all about those at our G medigap plan

Comparing G Plan with Employer Provided Plans

On the pre-65 market, having such rich plans would translates into a very high premium relative to the other plans.

Medicare supplements are a little different.

With the pre-65 plans, the insurer is covering 100% of the risk.

With a supplement plan, Medicare is covering 80% of the expenses.

The supplement plan is covering 20% of the potential risk.

Because of this fact, the difference between an G Plan and say a C plan is not as great.

With this fact, it usually makes sense to move up the benefit scale and take a richer plan. That's the G Plan.

On the benefit side, the Excess benefit is really critical.

You can access the online application here for major carriers here:

G Plan and Medicare Excess

A Medicare provider can charge up to 15% higher than what Medicare allows. There's no cap to this 15%.

For a $20K bill, you might pay $3000.

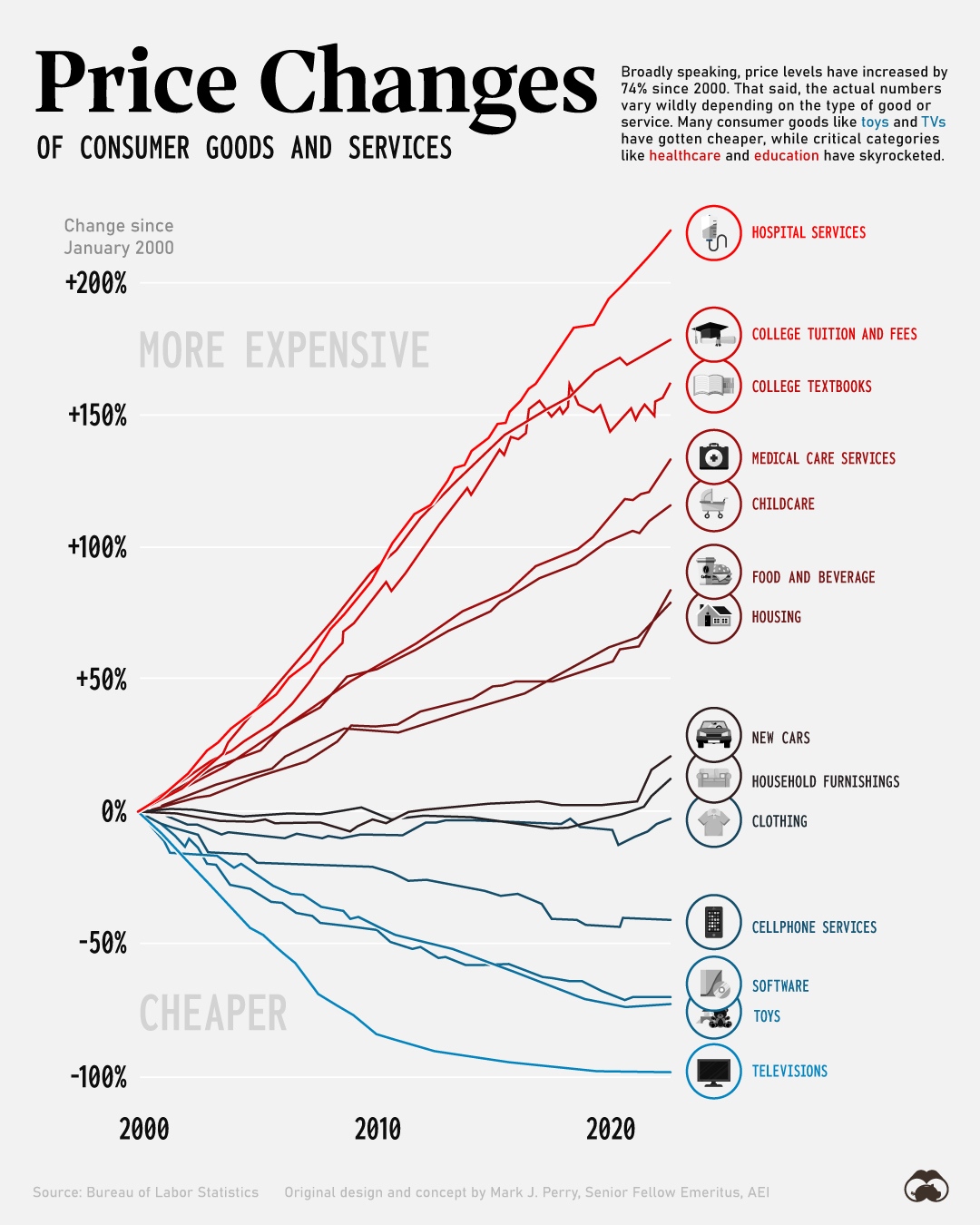

This can only go up from there. The future of healthcare costs is only going higher and excess is going to be a bigger deal:

It's very important that we cover this un-capped risk and the G Plan is the only supplement (outside of closed F plan) which does that.

Run your Medigap quote below and compare the benefits and cost against the other plans on the market. Use the G Plan as the benchmark against which you compare the other plans.

Blue Shield and Anthem (two separate carriers) have been priced best for years now depending on the area.

Since the G Plan is standardized by Medicare (the benefits are identical from carrier to carrier), find the lowest priced G Plan and use that. Medication will be handled with a separate Part D plan.

Related Pages:

- Comparing Medicare Advantage and Supplement Plans

- The Trade-off Between Advantage and Supplements

- How and when to enroll in Medicare plans

- Your Insider's Guide to Medicare Advantage Plans

- Your Insider's Guide to Medicare Supplement Plans

Call 800-320-6269 or email us at help@calhealth.net

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact www.medicare.gov or 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 day a week to get information on all of your options.