What are health sharing ministries and plans

OneShare is the most flexible option and you can quote it here.

What are health care sharing plans and ministries?

If you received double digit rate increases during the recent open renewal for ACA health plans...

And you don't get a tax credit based on income...

You probably went on line frantically looking for options.

Something that didn't cost the same amount as rent or a mortgage.

You also don't want to pay the 2.5% of income penalty.

There's really only one option that address both of these concerns.

Health sharing plans.

Which begs the question....

- What is health sharing?

- What are health sharing ministries?

It's a new term to many people so let's really dive into and discuss the good and bad so you can make an informed decision.

You can jump to any of the main topics here:

- When did health sharing plans start

- How the ACA law brought health sharing laws to popularity

- What are health sharing plans

- What are health sharing ministries

- What are the main health sharing ministries

- Which is the best health sharing company

- What are the pros and cons of health sharing

- Important considerations for health sharing

- When can you enroll in health sharing plans

- Is there a tax penalty with health sharing plans

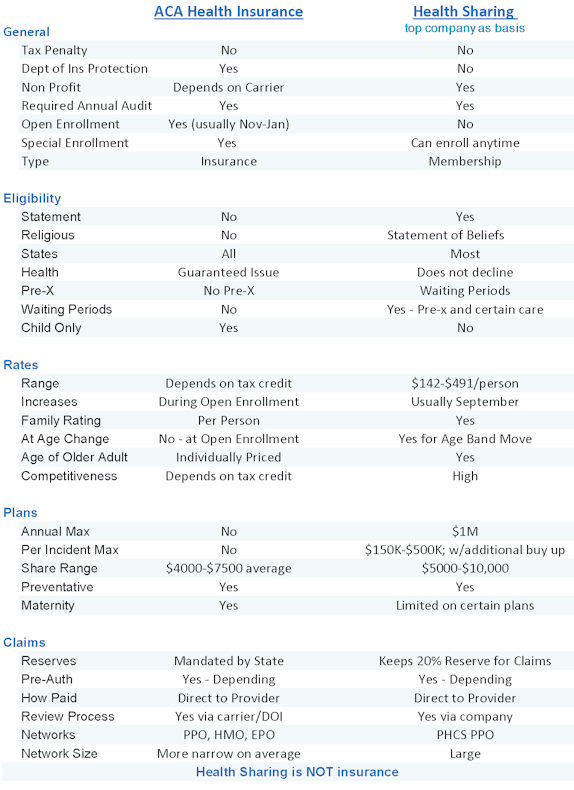

- Health sharing versus ACA health insurance

Lots to cover.

You can always jump to the online quote here:

Let's get started!

Like the detectives always say, "From the beginning, Mam"

Where did health sharing plans come from?

Health sharing plans have been around for a long long time.

Just under the radar and with a pretty small footprint.

OneShare Healthshare is a licensed 501(3)c

Originally, they were just a way for similarly minded individuals to share health care costs.

This was in lieu of health insurance.

This usually revolved around a shared religious belief but we now have options that are pretty relaxed.

We'll get to that part in a minute.

So we have companies that coordinate the sharing of health care costs among members.

A pretty small phenomenon for decades.

Enter the ACA (Affordable Care Act) law.

ACA (Obamacare) affect on health sharing plans and ministries

The ACA law is literally 1000's of pages.

It's the ultimate example of Congress' ability to make legislative sausage.

Especially with such a contested law where every vote was needed to pass.

For this reason, there are lots of carve-outs, add-ons, and footnotes.

One of them specifically dealt with health sharing ministries and plans.

Let's first talk about the "bat" that the ACA law uses.

Basically, you have to have a certain level of qualified health insurance or pay a penalty.

The penalty is usually just under $700/person or 2.5% of income...whichever is higher.

That's a pretty big bat especially for people who earn too much to get a tax credit.

Back to the Congressional sausage maker.

Some of the legislators wanted to offer people an exemption for having to get ACA coverage along religious lines.

A religious exemption.

These were more conservative politicians of course.

The health sharing ministries were the logical choice to fit this role since they already existed and were loosely based on religious affiliation.

Voila!

We have our exemption for the ACA penalty.

That's only half the story.

Way back in 2012, we wrote an article on how the ACA law was going to explode the cost of coverage if you didn't qualify for a tax credit.

It was all right there in the design of the plan.

Needless to say, costs have roughly doubled or tripled since 2014.

If you don't get a tax credit, you've been hit very hard.

A collective "duhhh" is probably emanating from this statement.

"Why do you think we're reading THIS??"

So back to health sharing...

And back to millions of people looking for an alternative to ACA health plans.

Health sharing plans ARE the only alternative that allows you to avoid the penalty and actually cover health care costs.

So...what are health sharing plans?

What are health sharing plans?

First, understand that health sharing plans are not health insurance.

Essentially, health sharing plans are memberships.

You pay a monthly amount to have the health sharing ministry (so called due to the religious exemption mentioned above).

In return, the company will coordinate payment of health care costs among its members.

Which begs the question...isn't that what health insurance does?

Yes...but there are some important differences we'll discuss below in the health sharing versus health insurance section.

Here are some important points on sharing plans:

- Generally does not cover pre-existing conditions

- Can enroll anytime of the year - no Open Enrollment

- More catastrophic in nature

- Different levels of religiosity and requirements

- Some health share ministries do not decline based on health

- Exemption from tax penalty with health sharing plans

- Different terminology for plans (MSRA versus Deductible, etc)

- Priced much lower than non-subsidized bronze plan

- Does not have oversight or requirements of Department of Insurance

These are some of the big ones.

You can research more on health share versus health insurance or our health share plan comparison.

It's very important to really understand the differences.

What are The Main Health Share Ministries?

The word "ministry" usually throws people that are just desperately trying to afford health coverage and avoid the penalty.

Essentially, health share plans were adopted as a way to get out of the ACA requirement.

They were couched in a religious exemption because the Congress couldn't just say you can avoid the penalty "because you feel like it".

For this reason, they are health share ministries.

That being said, OneShare is the most secular plan offered by a health share ministry.

For this reason (and many others), they are definitely our favorite of the 6.

Which brings up a good point.

There were 6 health share ministries that were officially given an exemption under the ACA law.

They are (in order or popularity and strength):

- OneShare

- Liberty

- Medi-share

- Samaritan

- Altrua

- Christian Health Ministries

We have a comprehensive comparison of the the major health share companies here.

The clear winner across many fronts is OneShare which why we focus on them.

More information on them here.

The key point is that we avoid the penalty while getting coverage for health care costs so this is the list to start with.

Let's talk about which one might be best and why.

The best health share ministry

In our view, after researching and dealing with these companies, AlieraCare (Trinity Healthshare is Ministry, AlieraCare is administrator) is the clear winner.

We get into more detail at our best health share company page, but here are the highlights.

Reasons OneShare is the best health share ministry plan

- Keeps 20% of monthly dues for reserves (super important)

- Does not decline based on health

- Has a reasonable waiting period for pre-existing that starts at enrollment (instead of at treatment or symptom like others)

- Is priced similarly to pre 2014 plans which matches where they should be priced.

- The most flexible and least restrictive of the ministries in terms of belief statement

- They do not have lifestyle requirements

- Uses a broad, nationwide PPO network. You have a card to show the doctor/hospital!

- $1M lifetime max benefit (similar to pre 2014)

- Combines 1st dollar coverage (preventative, copays) with catastrophic coverage

- Choice of Member Responsibility amounts (similar to deductibles) and per incident max benefits.

They're just doing everything right in this market segment and we fully expect them to run away with it.

This is important!

They are growing significantly now which gives them more strength.

Health sharing ministries do not have Department of Insurance protections so it's real important that we pick the strongest of the pack.

Again, we have an entire comparison of the health share ministries and another article on how to pick the best health share plan.

What about health sharing pro's and con's?

What are the pros and cons of health sharing plans

This is really the key question.

Of course, we're comparing health sharing plans like OneShare to Obamacare or ACA health insurance plans.

Health sharing is NOT health insurance as we detailed above.

First, one main difference may make the decision pretty easy.

Open Enrollment and Health Sharing plans

If you are outside open enrollment and do not have a Special Enrollment trigger (usually loss of group coverage, marriage, birth, or move that affects options), we may not be able to enroll in traditional ACA health insurance.

Health sharing plans do not have an open enrollment period.

We can apply anytime of the year.

The only constraint deals with effective dates.

So...what if we can get either health insurance or health sharing?

That's where we really need to compare the options.

For more detail, you can check out the health insurance versus health sharing but here are key points.

For this exercise, let's bullet point the pro's and con's.

Health sharing pros

- Waiver for the tax penalty for not having coverage

- Can enroll anytime during the year

- Monthly cost is much lower versus unsubsidized (no tax credit) bronze ACA plans

- OneShare does not decline due to health

- Large, nationwide PPO network

- Combination of catastrophic with some first dollar coverage depending on plans

- reserves kept for plans (very important for health sharing...maybe most important)

The decision really comes down to cost.

If you get a tax credit, you're probably not looking at health sharing plans.

But...if you can't qualify for a tax credit, the cost of ACA health plans have exploded since 2014.

We're seeing monthly costs of $1000/person for people in their 60's and that's on a Bronze plan!

It's just not possible for many couples to pay $25-30K per year in health premium.

It's crazy really.

So health sharing plans are running about 1/3rd to 1/2 the rate of the unsubsidized ACA plans.

That's the motivation.

That and of course not getting hit with the 2.5% penalty for not having coverage.

So...what are the downsides?

Cons of health sharing

- Waiting period for pre-existing conditions and certain treatments

- Does not have protection of Department of Insurance

- Does not have mandated benefits of the ACA (Affordable Care Act)

- Plans are not required to pay (this is why 20% reserve above is so important and why AlieraCare is our ONLY choice)

The conversations usually boil down to this....

Will they pay if something happens?

That question is the one reason we only deal with OneShare's plans.

They pass the smell test on monthly costs.

They are roughly cost of what we had before 2014 (ACA law went into effect).

This makes sense.

They also resemble what we had before (waiting periods, $1M life max, etc).

OneShare sends out a monthly tally of medical expenses processed and paid.

Roughly 30% of the renewal open enrollment renewals without tax credits went with health sharing plans across major health brokers.

That's a big deal.

A growing member's base is critical to paying future medical expenses.

That's true for health sharing as well as health insurance.

Check out our health insurance versus health sharing for more detail on how to compare the two.

Important considerations for health sharing

Health sharing plans work well for many people.

But they're not for everyone.

If you have ongoing or serious health issues now, health sharing probably doesn't make sense.

This is because of the waiting period for pre-existing conditions.

AlieraCare plans has a 2 year waiting period for pre-x from the time of enrollment.

This means they won't pay out for expenses related to a pre-x condition for 2 years.

Take this into account when considering health sharing.

There are also waiting periods (shorter) for new situations from time of enrollment (pregnancy, cancer, etc).

Mental health is not a covered benefit with health sharing plans. That's a big difference.

If pregnancy is planned, it probably makes more sense to go with health insurance.

At least for the mother!

You can mix and match plans.

For example, if one spouse has prexisting conditions, get ACA health plan for him/her and get OneShare for the other spouse with no issues.

We see this approach all the time.

Otherwise, health sharing becomes a question of comparing annual costs versus the limitations of coverage described in the member's guide.

When can you enroll in health sharing plans?

Anytime!

There's no Open Enrollment with OneShare health sharing plans.

The only impact is on the effective date.

Effective date rules for health sharing plans:

- If you enroll between the 1st of the month and the 15th, you can get the following 1st of the month as the earliest date.

- If you enroll between the 15th of the month and the end of that month, you can get the 15th of the following month as the earliest date.

One note...we may be able to get midnight following online enrollment here.

That's it!

For many people outside Open Enrollment, health sharing plans like OneShare will be the only option (other than short term which has duration limits and the tax penalty).

We can enroll anytime during the year with OneShare and pro-rate the tax penalty on a monthly basis.

That brings up a good point...

Is there a tax penalty with health sharing plans?

NO!

Health sharing plans allow you to avoid the tax penalty which is usually 2.5% for people who do not qualify for a tax credit.

That's a huge deal.

If you make $50K as an individual, you could pay us $1200 in tax credit.

That pays for a big portion of the health sharing plans.

Worst case, get OneShare's catastrophic plan to avoid the tax penalty.

Many people enquire about the lowest price way to avoid the tax penalty.

You can quote and enroll in that here (click on Catastrophic link on left):

With any of the qualified health sharing plans, you have an exemption from ACA tax penalties.

Health Sharing versus Health Insurance

This is more involved.

So much so that we created a separate, comprehensive comparison of health insurance and health sharing.

Health sharing is not insurance.

Below is a nice introduction to their differences but we really recommend reading further at the article above.

Of course, we're happy to help with any questions.

Wrap Up For Explaining What Health Sharing Plans and Ministries Are

We've covered a lot.

There's definitely more since health sharing is new to most people but growing very quickly.

We always recommend reading the Member's Guide below that gets sent out AFTER a person enrolls.

This really gets into the nuts and bolts of how health sharing plans work.

If you need additional information or have questions, please feel free to contact us at 800-320-6269 or by email.

Our services are free to you as licensed agents!

You can run your health sharing quote here to view rates and plans

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!