California Medicare Options - Should I switch from J plan to the G plan?

Switching from the J Medigap Plan to the G plan?

It's actually surprising to us after all this time.

People are still on the J plan!! The wild part is that many of them have been recommended to stay there by their brokers.

We'll look below at why this is so surprising when comparing the J plan with the current G plan on the market.

The cost difference alone can be a total deal breaker but the cap on medication with the J plan is the real issue.

Lose lose.

And yet, roughly 3% of Medicare enrollees were on the J plan recently.

Let's cover the main topics here:

- Understanding what the J and G plans cover

- Comparing the Cost between

J and G plan

- The medication difference between J and Part D

- Can I

switch from the J to the G plan?

- Should I look at other plans versus the

J plan

- What's the best carrier and quote for the G plan if switching from

the J

- Can I go back to the J plan if I leave it?

- How to quote and enroll if switching from the J plan

Let's get started!

Understanding what the J and G plans cover

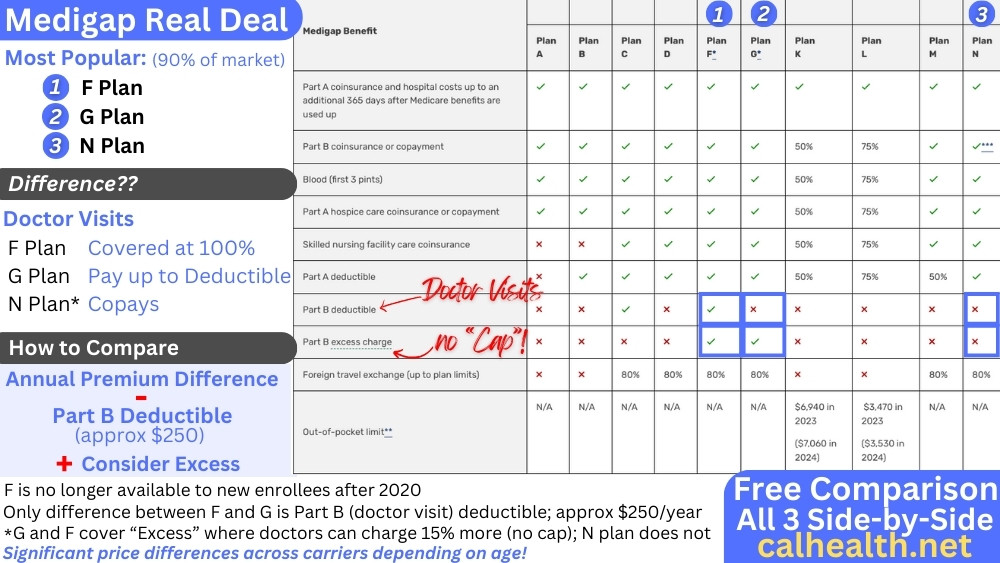

We have big guides on how to compare what current Medigap plans cover or our Insider's Guide to Medicare supplements.

The J plan hasn't been available to new enrollees since 2010 but let's first look at the current makeup:

The G plan is currently the richest Medigap plan on the market.

The J plan was the richest plan on the market till 2010.

So...what are we losing if we switch to the J plan?

There are 4 main differences and we'll walk through all of them:

- Part B deductible - the amount paid per year for doctor services; just

over $240/year

- Preventative benefits up to $120

- At-home recovery

services up to $1600

- Foreign travel up to 100% (instead of 80% with the G

plan)

- Prescription benefits up to $3000

Back in the day, the prescription benefit was the real reason people took the J plan over the F plan.

Oh, how things have changed!

It's wild to think there was a time that we didn't have Part D and medication coverage with Medicare.

So...let's break each of these down before looking at the cost difference.

Part B between the J and G plan

Part B deductible refers to an amount you have to pay first before the plan starts paying.

It's just over $240/month and this only applies to doctor services (not hospital or facility coverage).

The old J plan covers this Part B deductible while the G plan does not cover it. That Part B deductible is the only difference between the F and G plan by the way (see comparing F and G plan).

So...we have about $20/month in potential cost difference there.

Next up...

Preventative benefit difference between J and G plan

The old J plan had a $120 benefit for preventative services.

That doesn't really matter now that preventative has been added to core Medicare since then and it's covered at 100% (no $120 cap) for covered benefits with Medicare providers.

In this case, The G plan preventative benefit is actually better now.

At home recovery services difference between J and G plan

The original J plan had up to $1600 in at-home recovery benefits.

This also doesn't matter as much now that Part A has added an at-home recovery benefit up to $1600 as part of the Medicare Modernization Act of 2010.

Again, much of the J plan was a response to what was missing in Medicare (till 2010!!).

Foreign travel benefit difference between J and G plan

The J plan would cover foreign travel up to a certain limit at 100%.

The G plan covers foreign travel up to 80%.

The current G plan lifetime limit is $50K.

Interestingly, the J plan had a $2000 deductible for foreign travel before benefits kicked in so this was not as rich on the front end.

Now...the big difference.

The prescription difference between the J and G plan

We've been helping people compare Medicare supplements since 1996!

Including many J plans back in the day since it was the richest plan on the market and only it and the I plan would help with medications (a huge deal back then).

The only reason someone would go with the J or I plan versus the F plan was...medication!

Practically speaking.

So...what's the deal there.

The J plan had the richest RX benefit up to $3000 annually.

The G plan does not cover medication nor do any of the currently available Medigap plans.

That's because the Modernization Act in 2010 created Part D. A whole separate section of Medicare that governs RX coverage. We'll look below at how to compare the RX benefit.

Let's now turn to cost!

Comparing Cost between J and G plan

So...how do we take all the differences up above and compare with cost?

This is a little nuanced!

First, you can run a G plan quote here.

Since the J plan hasn't been available since 2010, let's assume a person is 75 or older if still on it.

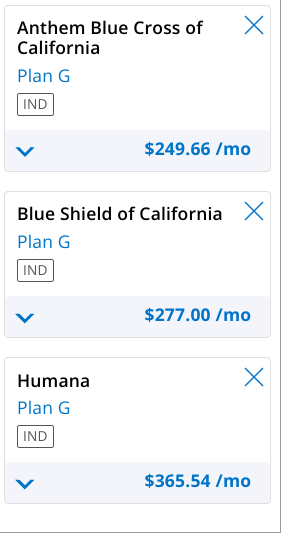

Anthem has the best rate in Los Angeles when we run the quote at about $250/month for the G plan.

So...take your J plan monthly rate and let's multiply both by 12 to get an annual difference.

We looked the few clients we could come across and the J plan rate was about $450/month.

So...$2,400 annually is the difference.

Here's the possible benefit difference:

- $250/year (Part B deductible...changes a bit each year)

- $300/year - Part D plan lower end pricing

The only question mark is foreign travel with the 20% difference. We're not buying Medicare supplements for foreign travel and there are cheaper/better ways to cover that (see foreign travel insurance).

So...we're looking at about a $2K cost difference with the J plan versus the G plan for core benefits.

See why we're surprised!!

Many people hold on to the J plan because they're afraid of losing something or they believe "I must have the best coverage".

We've walked through the difference above so you can now make an informed decision.

The medication difference between J and Part D

The J plan had a medication benefit up to $3000. Then it goes away.

Those were very different times. We remember the explosion on the scene of the antihistamines like Claritin and Allegra.

It was scary...those meds were just short of $100/month and it was exploding healthcare costs because so many people used them. The first blockbuster class of RX (of many to come).

Then came the rheumatoid arthritis drugs at $4K/monthly. We were in uncharted territory and now there are meds at $1million/year!

The old J plan was built for a very different world in terms of RX cost and there's a definite risk to having a fixed dollar benefit of $3K.

It's not unsimilar to the annual or lifetime max that health plans used to have which would seem totally inadequate today.

Learn more about Part D but it doesn't have this benefit cap like the J plan does.

For that reason alone, you almost have to switch from the J plan to a G plan with a Part D plan added.

Uncapped risk or expenses is the #1 reason to have insurance to begin with and many people are on the J plan thinking they have the best coverage.

We're happy to walk you through this comparison for your situation and you can see our reviews here:

So...the big question on everyone's mind...

Can I switch from the J to the G plan?

Yes!

Two ways to go about it.

You can apply to switch or enroll in a G or lesser plan (see how to compare what Medigap plans cover) anytime during the year.

A standard app will require health review but we can generally get approved unless our health is pretty dire.

Since most people still on a J plan are 75 or older, health underwriting may not be an option.

Hello, Birthday rule!

A new rule has since been added which allows people to change plans to an equal or lesser benefit (like J to G plan) once per year around their birthday in California.

Reach out to us and we'll help you with the whole process.

There's no cost for our assistance as California Medicare agents and specialists.

Why look at the G plan? What about the other plans?

Should I look at other plans versus the J plan?

First, if you were on the J plan, you probably wanted the best Medigap plan at the time.

Currently, that's the G plan (most comprehensive of newly available plans).

It's by far the most popular Medigap plan on the market and we explain why here.

The bigger issue versus all the other plans available is Excess.

The J plan covered it. G plan covers it. Other plans don't.

Excess is where Medicare allows doctors to charge up to 15% more than what Medicare allows and still be deemed as Medicare providers.

The doctors in California have taken the financial brunt from the recent ACA plan rollout and we expect more of them to charge this 15% amount.

Here's the issue...there's no cap to this 15% and we don't like uncapped risk (such as with the medication benefit under the J plan).

For that reason alone, the G plan makes the most sense regardless of whether you're coming off of a J plan.

This is not the time to take on healthcare risk:

Okay...what's the best option for the G plan if switching?

What's the best carrier and quote for the G plan if switching from the J

You have to run the quote!

When we looked at the 75 year old in Los Angeles above, look at the price difference for the exact same plan (and network):

Goodness. Same plan. Same network. Huge difference cost.

You also run UnitedHealthcare® to compare as well here:

A quick note if you do plan to switch.

Can I go back to the J plan if I leave it?

The J plan is a closed plan. If you switch from the J plan, you will not be able to go back.

This is part of the reason it's not doing well costwise. It's a closed book!

This means that with time, it's only getting smaller (people switching away) and the average person is getting older which drives costs faster.

We see this with closed plans over the years. It's an eventual spiral from the moment they stop new enrollment as price increases just speed the flight of members to better priced plans like the G plan.

So...

How to quote and enroll if switching from the J plan

Run your free quote here:

You'll see Medicare Supplements including the G plan across major

carriers.

Access to quoting for Advantage plans and/or Part D plans (remember...the G plan also needs a Part D for RX) will be sent to you as well.

Enrollment is online for most of the big carriers and we'll send access to that as well!

Of course, we're happy to help with any questions and definitely reach out to us around the Birthday Rule in California.

We're happy to help and just check out our Google reviews: