California Medicare Options - Is Medigap Being Phased Out?

Is Medigap Being Phased Out?

We actually get this question quite a bit. Usually from people on a medigap plan!

There are some plans which have stopped enrollment for new enrollees so that's probably the driver of this confusion.

Interestingly, there are millions of seniors on these "closed" plans that are paying too much so this is a good opportunity to go through what medicap plans are phased out.

What's available. What makes the most sense in terms of cost versus benefits.

Let's go there!

Here are the topics we'll cover:

- Is medigap being phased out?

- The growth of Advantage plans

- The phase out of the J and I medigap plan

- The phase out of the F medigap plan

- What medigap plan is most popular now

- Should I switch from the J or F plan to the G plan

- How to switch from phased out medigap plan

- How to quote the medigap options available

Let's get started.

Is medigap being phased out?

Medigap or Medicare supplements (both the same thing) are not being phased out as a whole family of health plans.

Check out our Insider's Guide of Medicare Supplements or What do Medigap plans cover.

What most people are hearing is about certain plans which have been closed to NEW enrollees.

Existing members can keep their plans as long as they're available.

Keep in mind that eventually, these plans will slowly wind down since new people can't come on board.

The first phase out period was 2010 when the J and I plans went away.

People primarily picked them to get access to medication coverage but in 2010, Part D was created and there was no longer a reason to have the J or I.

We looked at switching from the J to the G plan since there are still many seniors who have that plan.

We did a full comparison including cost and benefits analysis. The I plan is barely hanging on since it wasn't as popular as the J back in the day.

We're happy to look at your situation. Just email date of birth, zip code, and your current J or I plan monthly premium and carrier.

The next big "phase-out" was the F plan in 2020 and this was a much bigger deal.

The F plan was the most popular medigap plan by far up until 2020 since it was the richest medigap plan without medications.

When the J and I plan left the market in 2010, the F became the de facto king of the market.

We looked at switching from the F plan to the G plan in detail.

In many cases, it's a clear win:

So, we've had two big medigap "phase-outs":

- 2010 - I and J plan with advent of Part D for medication

- 2020 - F plan

There's another piece of the story though.

The growth of Advantage plans

In 2003, Advantage plans came on to the market as re-branded HMO options for seniors.

We look at how to compare Advantage plans and Medigap plans.

They're very different beasts but people are initially attracted to their low or no premium cost even though there's more exposure on the back-end if sick or hurt.

Again, really understand the trade-offs.

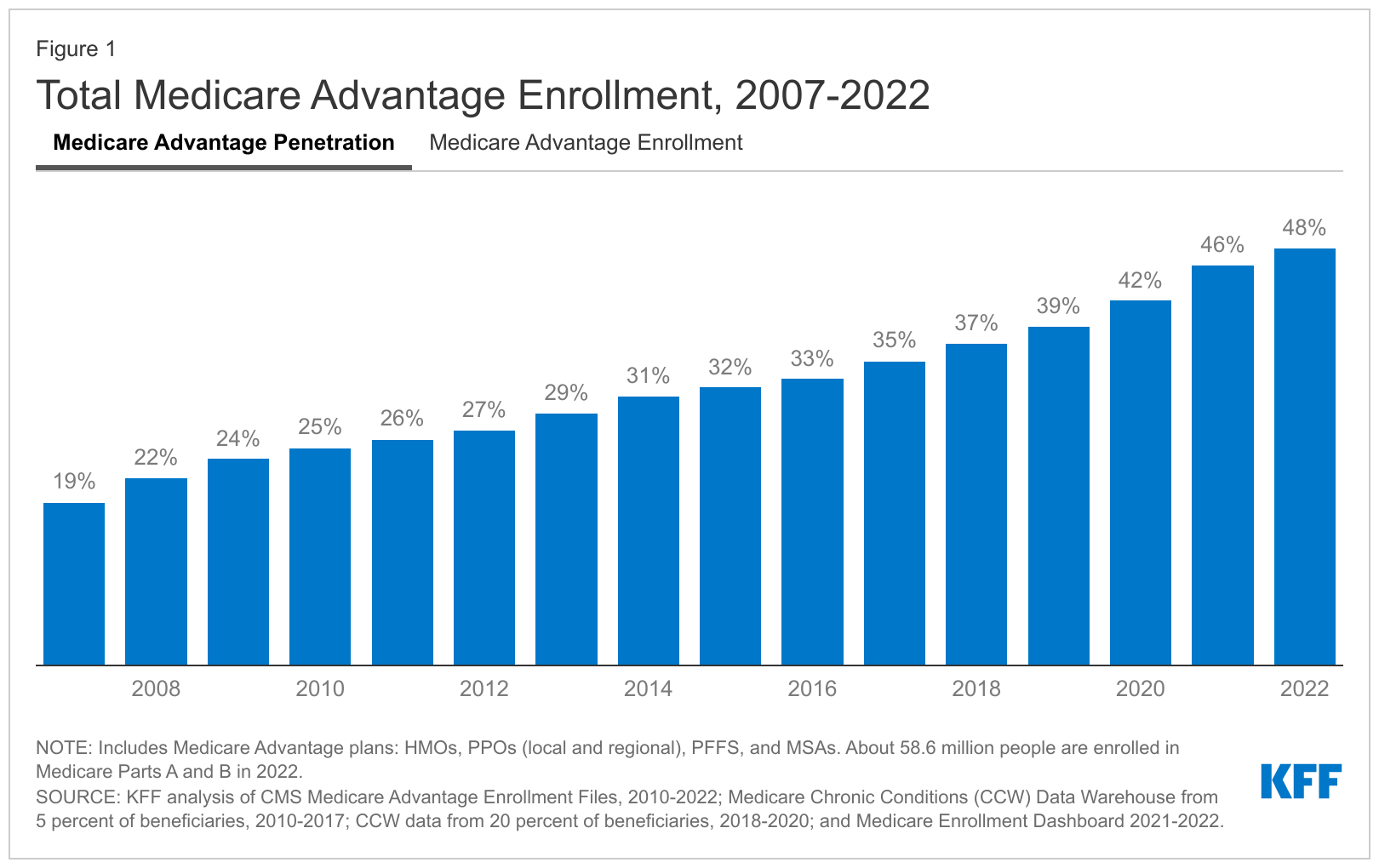

Either way, they've clearly made inroads:

Many people on medigap plans have moved to Advantage plans primarily trading cost for control of health care access and decisions.

Let's touch on the two big phase-outs to see what we're losing and how to play it.

The phase out of the J and I medigap plan

As we mentioned above, coverage of medication was the real reason someone would buy the J or I plan over the F plan before 2010.

In 2010, Part D for medication coverage was added to Medicare so the I or J no longer made any sense.

You would just get an F plan with a Part D separately for medication.

None-the-less, many people stayed on their phased-out plans (primarily the J plan).

There's still about 3% of the medigap market on the J!

When we run the numbers, it usually makes sense to move to the G plan. The enrollees usually already have a Part D so they're essentially paying double.

We'll look at how to compare the costs below.

The F plan phase out is even more obvious in terms of savings.

The phase out of the F medigap plan

If you had an F medigap plan before the phase-out Jan 2020, you are able to keep it.

New enrollees are not able to enroll in the F plan even though it's still active for existing members.

You can switch to an F or G plan if available at other carriers. There can be huge price differences between carriers for the exact same plan so it makes sense to run the quote.

The F plan does not cover medication so a Part D is required alongside it but you probably already have that.

The F plan does cover Medicare Excess which is a big deal since there's no cap to your exposure!

We go through why this is so important in comparing the F or G plan to the other Medigap plans.

The old F plan still has the most enrollees of any medigap plan but that will slowly shrink as the millions of members start to realize they're overpaying against the G plan.

More on how to compare that below.

Let's go there!

What medigap plan is most popular now

Once the F plan was phased out, the G plan took the helm as the most popular medigap plan for new enrollees.

The only difference between the F plan and the G plan is the Part B deductible (around $240+ annually; adjusts a bit each year).

Behind the F and G plan, you then have the N plan followed by the A plan.

The N adds in copays for office and urgent care but does NOT cover Medicare Excess.

The A plan is the barebones plan that covers the 20% coinsurance.

You can run all these options across the major carriers for you here:

This brings us to the question.

Should I switch from the J or F plan to the G plan

We looked at whether it makes sense to switch from the J plan to the G plan or the F plan to the G plan.

The F to G is easier to calculate.

Run your quote and then compare:

Annual premium difference versus roughly $240 (Part B deductible).

We found an average savings of around $750/year (and this assumes you're on the best priced F plan....many are not!).

So worst case, you just got a $500 check from the carrier!

We're happy to walk through your exact situation.

The J to G plan is a little more complicated since the J plan added in a few bonus benefits but generally, it's about the medication.

If you have a Part D with your J plan, that makes it pretty easy. The issue with the J plan RX benefit is that it was capped at $3K.

The Part D is much more comprehensive especially if you find yourself with significant RX costs.

Check out the review for the comparison of both benefits and costs.

Let's say there's significant savings from switching out of a phased out plan. Then what?

How to switch from phased out medigap plan

You can technically apply for a medigap plan anytime of the year, month to month.

The carrier will either approve or decline based on health assuming we don't have some Guaranteed Issue window.

Worst case, we can always move to the same or lesser plan (J to G or F to G both qualify) around our birthday.

It's called the Birthday Rule and you can learn all about it.

This is our safety net in case they decline due to health. Part D has different rules so work with us to coordinate this if you don't already have a part (coming off of J plan).

So...worst case around your birthday. Best case, next 1st of the month!

Let's figure out what we're actually looking at with switching from a phased out medigap plan.

How to quote the medigap options available

We make this easy and free right here:

Quote across major carriers:

We're happy to analyze your situation and find the best rate with just your date of birth, zip code, and current plan/premium at help@calhealth.net

We almost take it a badge of honor to help people switch from phased-out plans if it makes sense for them.