California Medicare Options - How to compare Kaiser California Advantage plans to other carriers

California Medicare Options - How to compare Kaiser California Advantage plans to other carriersHow to Compare California Kaiser Advantage Plans versus other Carriers

This really is the heavy-weight fight in the California Advantage market.

Kaiser's always going to be in the ring across all types of California insurance but Advantage plans are generally HMO and Kaiser is the OG HMO carrier.

We'll go into that below but let's focus on Medicare options for 65 and over between Kaiser and the other big carriers.

It really comes down to network! The doctors and hospitals that you have access to.

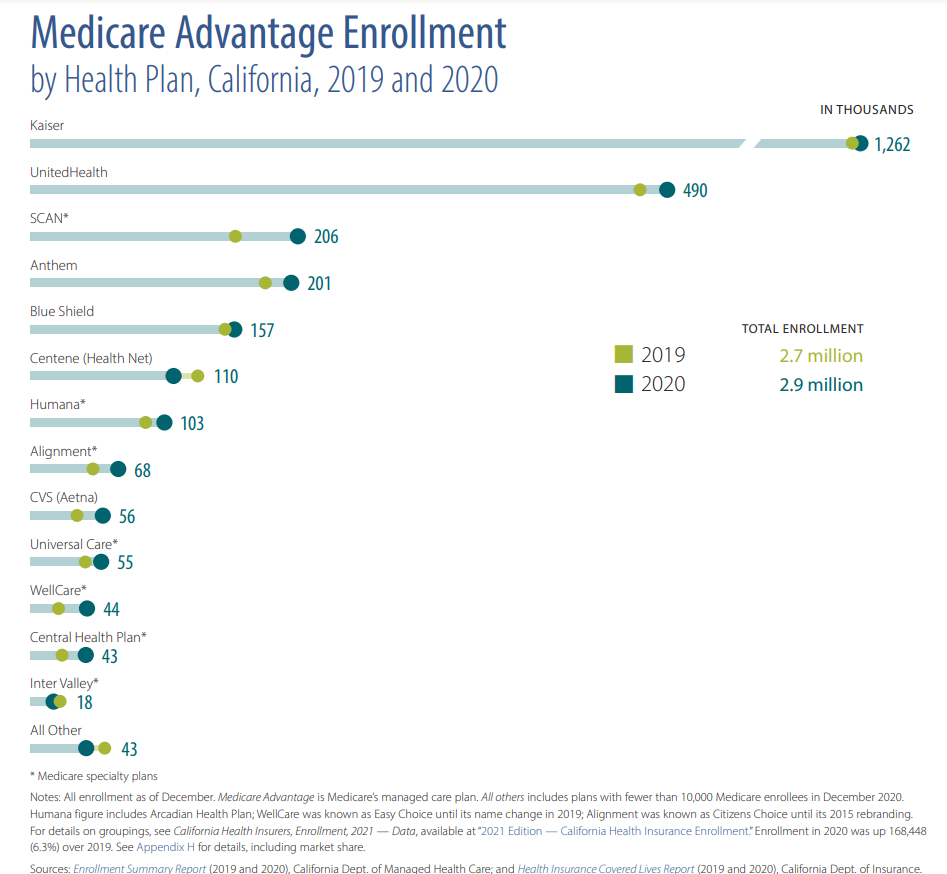

First, to set the stage, we see Kaiser is the dominant Advantage plan carrier in California with UnitedHealthcare® a close second.

So...how do we compare these options?

We'll cover it all along these lines:

- Intro to Kaiser's HMO model and Advantage plans

- Kaiser networks versus independent HMO advantage networks

- Star rating comparison between Kaiser and other carriers

- Why location makes such a difference comparing Kaiser Advantage and other

Medicare plans

- Kaiser Advantage plans versus medicare supplements

Let's get started!

Intro to Kaiser's HMO model and Advantage plans

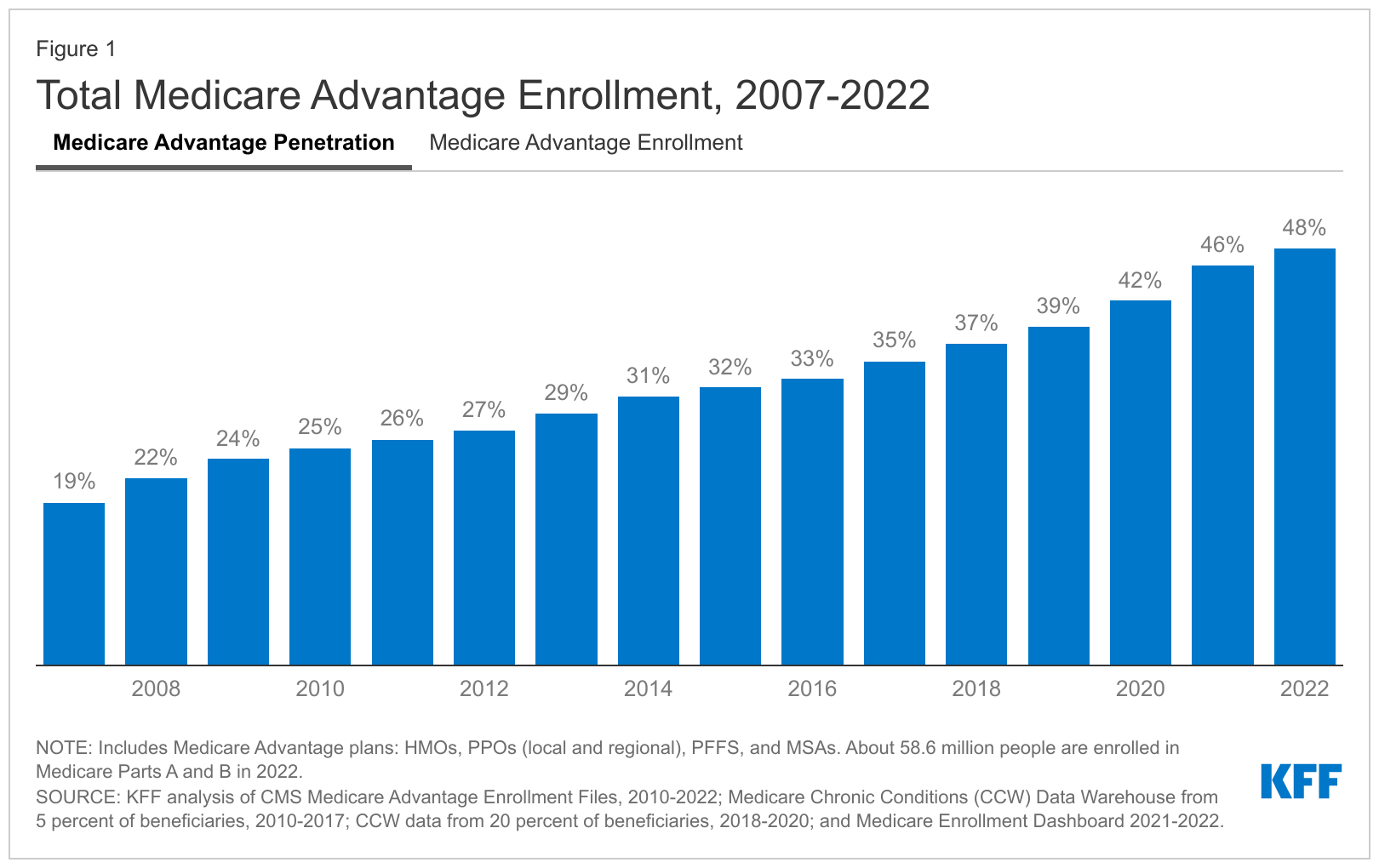

As we can see above, Kaiser is the dominant California Advantage plans and those numbers have only come up since that time period as the model keeps gaining:

We really need to understand the nature of an HMO since that makes up Kaiser's

core business.

In fact, they may be the original HMO in its true sense where the same company both offers the insurance and provides the medical care.

So...what do we lose with an HMO?

It generally comes down to two factors:

- We're restricted to what providers we can use and how that care is accessed

- Financial decisions weight in on medical care along with health decisions

The latter is where people generally have issues with HMOs whether its Kaiser or outside of their network.

People usually have a pretty good sense of whether they like HMOs or don't from pre-65 coverage.

Generally, HMOs work great for the everyday health care needs but run into issues for more exotic or difficult health conditions.

We speak with clients who just love that everythings's under one roof at Kaiser and then we'll hear from others that will not step foot in their facility due to past dealings.

That's the HMO piece! As an HMO, Kaiser is pretty reputable but the model by definition squeezes costs down on healthcare.

Let's explain how and why.

HMOs by definition are like little single payer plans!

A fixed budget is divvied up among the members to cover all health care costs.

This is different from PPOs or systems like traditional Medicare where healthcare decisions are generally made with the providers and the payment system pays accordingly (with some oversight).

Let's give a concrete example that we see quite often with medications.

It's not unheard of for Kaiser to switch medications for a given condition midstream across their network based on cost considerations.

For some people, this may not work as well but generally, that's not going to factor in...it's a cost constraint!

So-called "step therapy" where cheaper options are tried first and pre-authorizations are other examples. This is going to be true for all HMO Advantage plans by the way.

The other piece when comparing Kaiser advantage plans comes down which providers you can see. Let's go there now.

Kaiser networks versus independent HMO advantage networks

With Kaiser Advantage plans, you have to stay within the Kaiser network outside of very rare situations.

So...do you have a major Kaiser center around you? Is it one you want to use? That's a big deciding factor depending on the county you're in.

In fact, it's generally the main reason a person goes Kaiser versus another Advantage plan.

With other carriers like UnitedHealthcare® (they have the biggest Advantage network), you will have a medical group tied to your local area and a specific hospital generally.

For example, in Los Angeles, UnitedHealthcare®and a few others (Shield or Anthem) have Advantage plans that work with UCLA or Cedars.

That's a huge deal if you're in that area since those are two of the premier medical networks in California if not the country!

If you have a Kaiser Advantage plan, you will not be able to use these facilities and vice versa.

It's two separate worlds in terms of who have access to and this is very important with Advantage plans since you have to stay in-network with HMO-type plans (most of them).

What about the Star Rating?

Star rating comparison between Kaiser and other carriers

The Medicare Star Rating is a good way to determine how happy enrollees are with their plan and carrier.

Kaiser's Star Rating is very high across the State so that's a good sign if you want to use their network.

Otherwise, you can run your quote here to check out the other carriers in your area:

Aim for 4 stars or higher and UnitedHealthcare® or SCAN currently have some of the highest

star ratings across the State.

This is part of our "Triple Threat" strategy for picking Advantage plans:

- Low or no premium

- Max out of pocket under $1000 (depending on the area)

- Star rating of 4 stars or higher

Again, this generally pits Kaiser against UnitedHealthcare® which you can quote here.

Location is a big factor here.

Why location makes such a difference comparing Kaiser Advantage and other Medicare plans

There are certain areas where Kaiser is really a powerhouse such as Sacramento or San Diego.

Advantage plans require that you use healthcare providers in your general area (think 30-40 miles from residence).

So...what Kaiser hospitals do you have around you?

In fact, what are the hospitals you want access around you and then work your way back to find the best Advantage plan.

Our quote system will take into account your doctors and medications so make sure to enter those here:

This usually drives the decision on Kaiser versus other medicare Advantage plans since we'll need to stay in that system we decide on.

Again, people know if they like Kaiser or not from prior experience (through employer or individual family plans like Covered California).

What if the HMO Advantage plan model is not the right fit for you (see comparing medicare supplements and Advantage plans)?

Let's look at supplements.

Kaiser Advantage plans versus medicare supplements

We've been discussing Advantage plans between Kaiser and other carriers like UnitedHealthcare®but there's a whole other world out there.

And in some areas, they flat out make sense if you really understand how Advantage plans work.

It's all about the out-of-pocket-maximum and we're finding this really is dependent on where you live.

For example, in our Los Angeles Advantage plan comparison, the HMO model does really well.

We're able to hit all our benchmarks for a good plan:

- Low or no premium

- Star Ratings of 4 or more

- Out-of-pocket max under $1000

That last one is the big one when comparing supplements and Advantage plans.

In some areas like San Diego or the Bay Area, out-of-pocket maxes can be $3-4K!

Don't fall for it it.

Look, a G plan (the most popular medicare supplement) for a 65 year old might be around $150/month depending on the area.

There's no back-end exposure there outside of the Part B deductible (just over $250/year).

So, we're at about $2K worst case each year.

With the Advantage plan, we're banking on not getting sick or hurt and 65+ is a terrible time to take this bet

If we have big bills, a $3000 out of pocket max is the equivalent of $250/month

(think of it like premium).

Again, look at the current trajectory for health care costs!

Now, in places like Los Angeles where we can have an $800 out of pocket max, this makes sense in light of the no cost premium.

We're seeing the higher out-of-pocket maxes in the Bay Area, San Diego, and smaller, more rural areas.

Better comparisons (lower max's) are in LA, Orange county, and Riverside county.

The HMO model just works better with more populous areas!

We're happy to compare your situation to see how it all settles out between Kaiser advantage plans, other Medicare advantage plans, and Medicare supplements.

Here's our Google reviews!

Let us get to work in comparing these plans but now you know how to evaluate Kaiser versus other advantage plans!

It's all about the network!