California Medicare Options - Can I cancel advantage plans and move back to medicare

Can I Drop My Medicare Advantage and Go Back to Medicare?

We get this question occasionally.

There are specific times that you can drop Advantage and go back to Medicare.

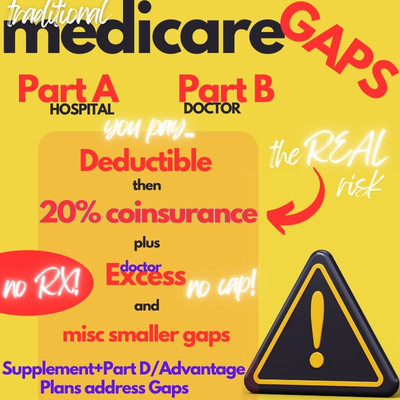

It's really important though to understand the "holes" in Medicare and see if there are inexpensive ways to address those.

We're seeing senior health costs in the millions lately (we'll give examples below).

We'll show you the cheapest way to get away from the restrictions of Advantage plans (see Advantage plan trade-offs) and have Medicare without all the risk below.

As for our credentials:

Keep in mind that roughly 80% of people with Medicare have some type of protection (Advantage or Supplement) so there's clearly a need.

These are the topics we'll cover:

- Can I drop my Medicare Advantage and go Back to Medicare

- When can I drop my Advantage plan

- What's the issue with just Medicare by itself

- Inexpensive ways to address the holes in Medicare alone

- How to quote and enroll in less expensive medigap plans

Let's get started!

Can I drop my Medicare Advantage and go Back to Medicare

Maybe Advantage plans were pushed pretty hard to you. (see why broker push Advantage plans).

Or maybe you got into it and it just wasn't the right fit.

Either way, you want out!

You can drop your Advantage plan and go back to traditional Medicare! You can even get a Medicare supplement and/or a Part D (for medication).

It's a question of when this is allowed to happen.

Let's go there.

When can I drop my Advantage plan

We looked at the key triggers in our Switching from Advantage to Medigap guide.

Here are the big ones:

- Annual Open Enrollment - Oct 15 - Dec 7th of each year; Jan 1st effect date

- Initial Enrollment Period - 12 months when first eligible for Part B to go back to Medicare and even enroll in Medigap

- Open Enrollment - first 3 months on an Advantage plan (usually Jan 1st-March 31st), you may be able to get off the Advantage plan

- An Advantage plan reduces benefits or changes networks mid-stream

Those are the big ones but reach out to us at help@calhealth.net with your situation and we'll research options.. Worst case, we're looking at a year (Annual Open Enrollment).

That's the good news.

Let's really understand what we're taking on and see if there's a more flexible and inexpensive way to address it.

What's the issue with just Medicare by itself

We have a big guide on the problem with Medicare alone.

The big issue is the 20% coinsurance.

The 20% is uncapped! If you get a $100K bill, that's $20K out of pocket.

Unfortunately, $100K is on the low end these days!

We had a client with open bypass (during the Covid mess) and the bill was $5 million!

$250K for each hour his heart was offline.

Bills of $250K consistently come to our attention from clients and those scrambling to get coverage (usually too late!).

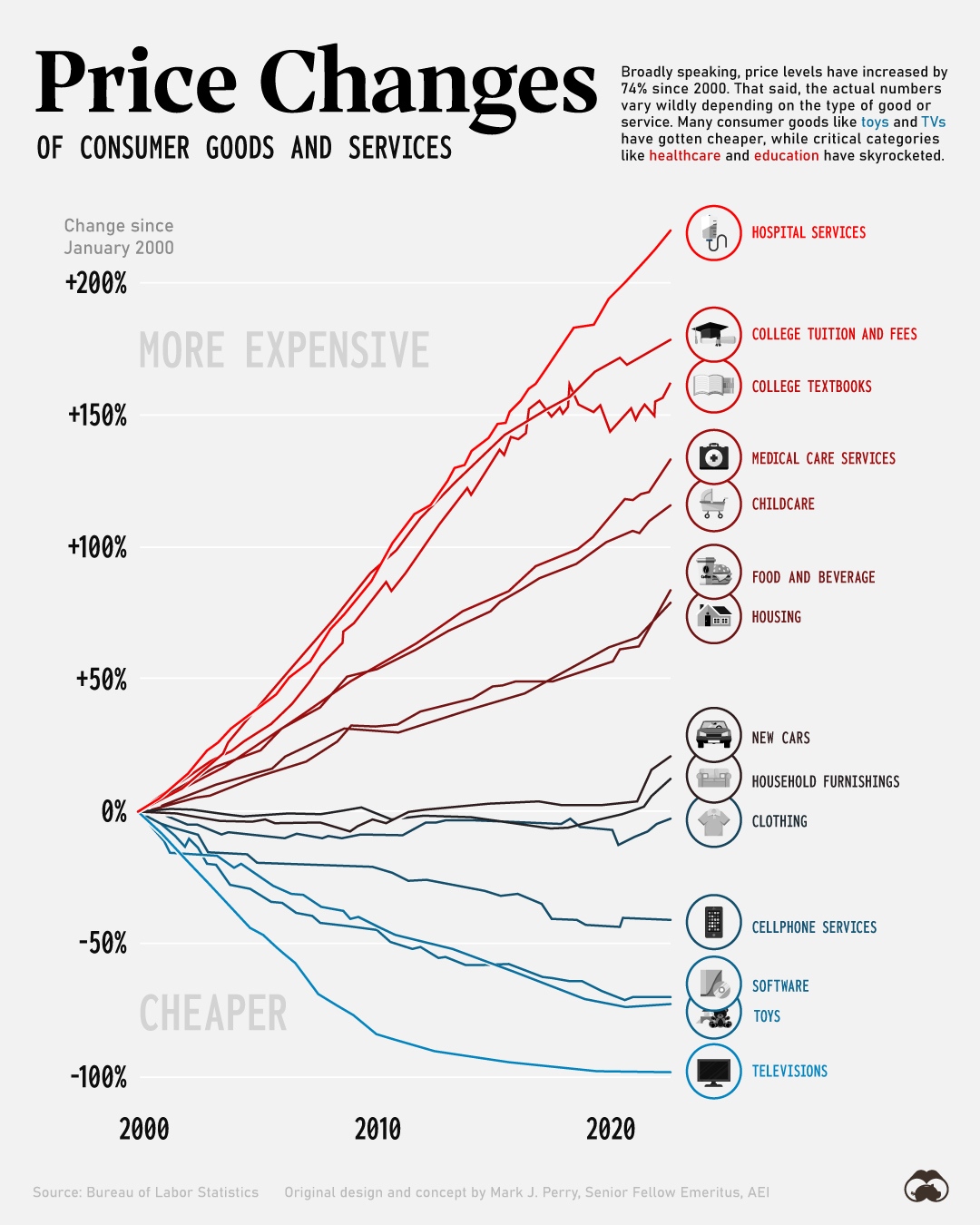

The trajectory is only up unfortunately:

And yes, "I never go to the doctor. I'm healthy".

This is about big ticket items. Injuries. Surgeries. Etc.

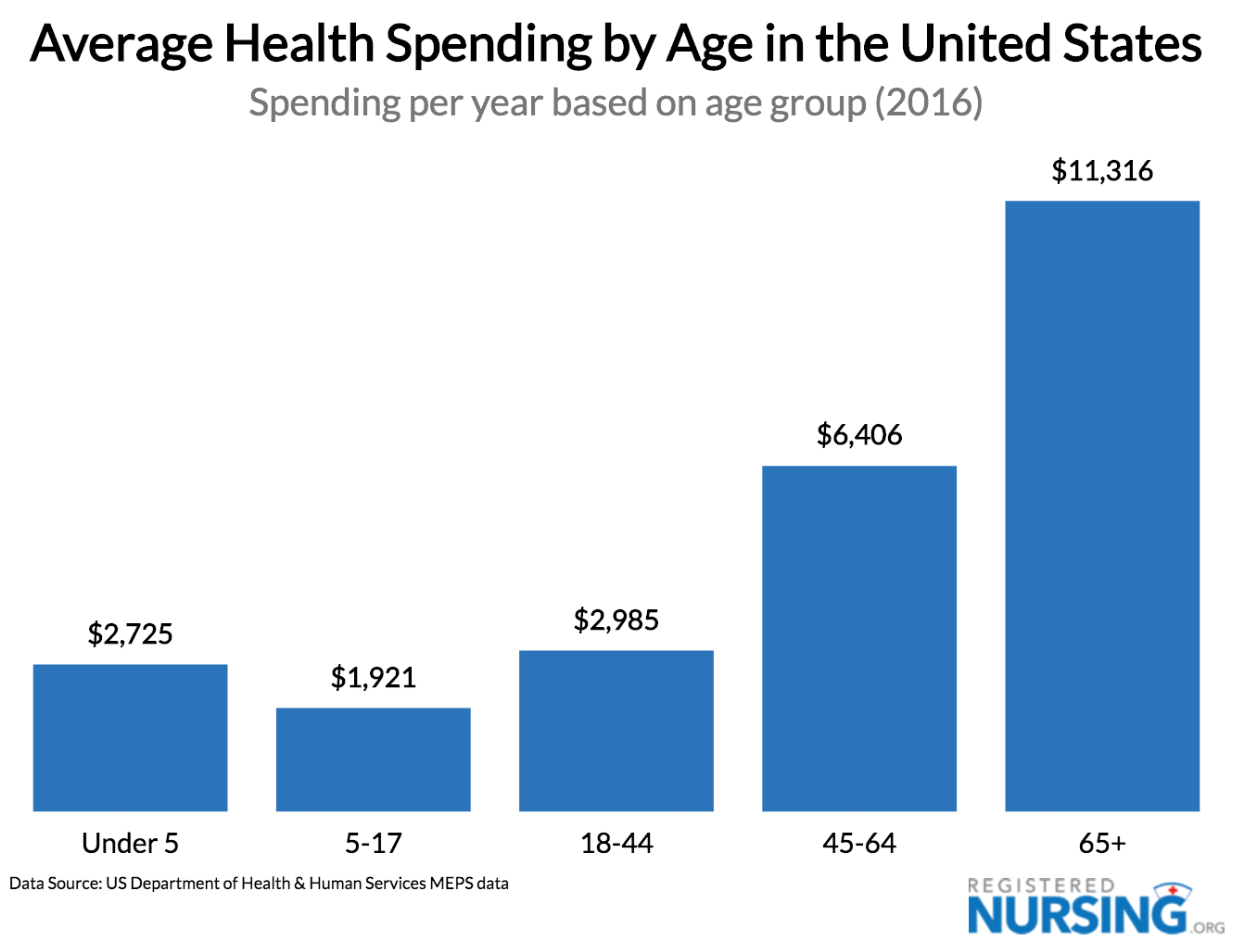

65+ is the absolute worst time to take this risk:

We completely understand not liking the strict rules of Advantage plans.

So...what's the cheapest way to address this 20% unending risk with Medicare alone?

Inexpensive ways to address the holes in Medicare alone

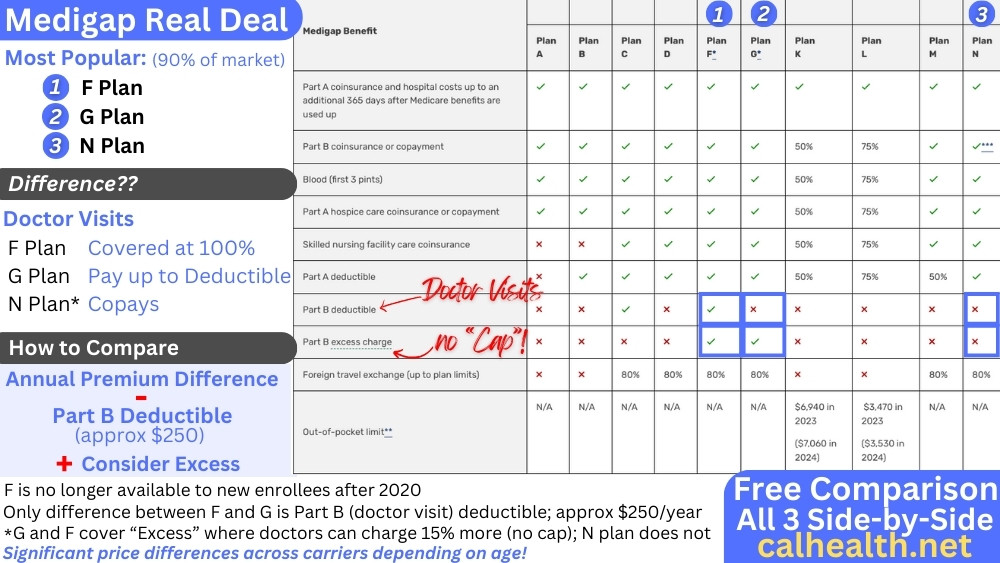

First, if it's not about the money but more about control over who can see and how care is handled, the G plan is the most popular medigap plan.

We go through how to compare how what medigap plans cover.

What if we just want lowest cost options?

There are two ways to go:

- A medigap plan

- High deductible G plan

The A plan covers the 20%. That's it! But that's a lot.

The other "holes" in Medicare alone have a fixed amount (Part A deductible, Part B deductible, etc) or the medigap benefit is fixed.

A addresses this big gap well and usually the cheapest standard medigap plan.

The high deductible G plan can be even cheaper!

This plan functions like a G plan (most comprehensive) but with a built-in deductible of a few $1000.

We still have a cap and know worst case, I'm on the hook for under $3K annually.

There are plans between the A plan and the G plan. N is popular but usually priced just under the G (which is better).

How do you compare the A and high deductible?

First run your quote below and see what the annual premium difference is.

We ran a quick quote in Los Angeles, age 65 and had the following:

- High Deductible G plan - Humana - $79/month

- A plan - UnitedHealthcare® - $140/month

- G plan - Anthem - $172/month

That's the range!

The Humana plan has a $2700 annual deductible.

So our premium difference between the high deductible G and A plan is about $700/annually and we're taking on a $2700 deductible.

It then partially depends on your health expectations.

You'll still have the Part A and B deductible with the A plan!

This is kind of a wash between the two.

Between the A and G plan, it's about $400/annual difference. In that case, we like the G plans since the Part A deductible is $1600!

Granted, this is more for facility based care but even a simple surgery or procedure can quickly hit this amount.

Learn how to compare the medigap plans for more detail.

Also, at least look at a "place keeper" Part D plan for medication to avoid the penalty (1% per month) of not purchasing coverage when eligible.

Part D plans have rules similar to Advantage plans in terms of when you can enroll so worst case, this may put you out to Open Enrollment at the end of the year. Just a head's up but you can check with us for your situation.

So...what about your numbers?

How to quote and enroll in less expensive medigap plans

You'll still have the cost of Part B to Medicare.

For Medigap and Part D plans, you can run your quote here:

We work with some of the biggest carriers on the market!

The whole going back to Medicare or to a Medigap plan can be confusing so reach out to us.

There's zero cost for our assistance and our Google reviews show how much we try to help people.