California Medicare Options - Why are brokers so pushy with advantage plans

Why Do Brokers Push Advantage Plans so Much?

It is a common complaint we hear from Medicare-eligible enrollees.

I'm getting slammed with brokers and carriers pushing me towards Advantage plans...what gives?

We'll get to the heart of it and also explain how to avoid ending up with the wrong plan.

If the agent is really pushing (and we see the horror stories on this side), it's probably about money.

Medicare keeps rolling out new rules and protections to respond the boiler room-type sales activity from some (not all) brokers.

In fact, check out our Google reviews here:

Part of why we have those reviews is that we don't push. We help explain the options, answer questions, if you don't end up working with us...that's okay.

If you want transparency and someone in your corner, there's no cost for our assistance.

To that end, let's really explain why the high pressure sales for advantage plans, how to really cut through the marketing nonsense, and most importantly, how to pick the best plan for you.

Here are the topics we'll cover:

- Why do brokers push Advantage plans so hard

- Protections for you when

comparing Medicare plans with an agent

- What's wrong with Advantage plans

- Signs that the Medicare agent isn't a good fit for you

- Tips to pick the best Medicare plans

Let's get started.

Why do brokers push Advantage plans so hard?

It's money. Sorry, that's the honest truth.

The commission for an Advantage plan can be roughly double that of the most popular Medicare supplement plan and it's paid all at one time.

Now...that doesn't mean that Advantage plans (avoiding the bad ones) are the wrong option.

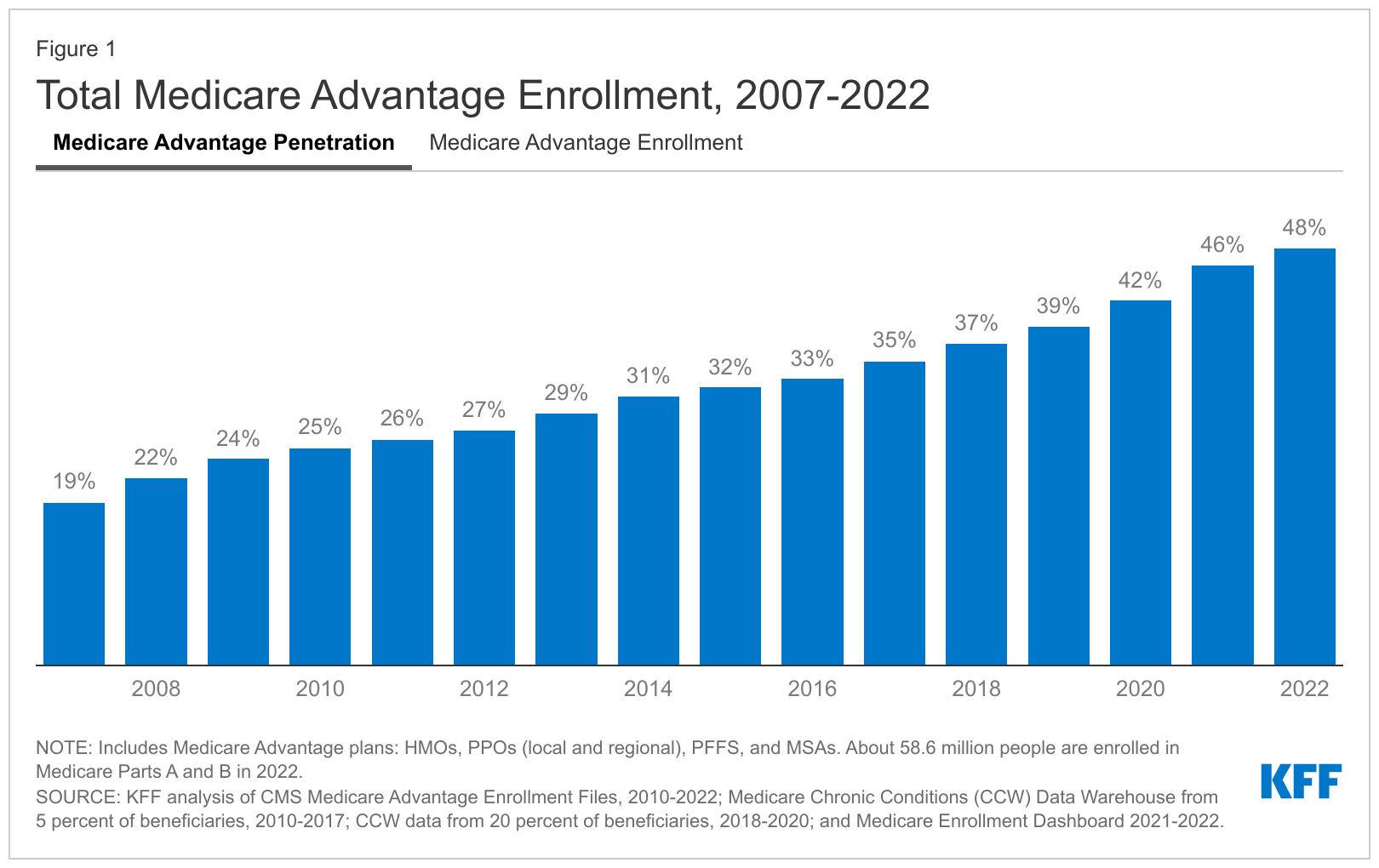

They're chosen by roughly 50% of the Medicare market now in California and that's jumped 10% in 2 years and will likely continue up to 70% by 2020.

The problem is that the plan being pushed isn't necessarily the best one for you even if the Advantage model is the right fit overall.

A given carrier may pay slightly more commission to the agent (although there's a cap set by Medicare) and they may "sweeten" the plans to make them sound too good to be true.

This is usually in the form of smaller benefits and add-ons at the expense of the important aspect of Advantage plans....the out-of-pocket max!

We walk through this whole calculation in our How to Compare Medicare Advantage plans or our Insider's Guide to Advantage plans.

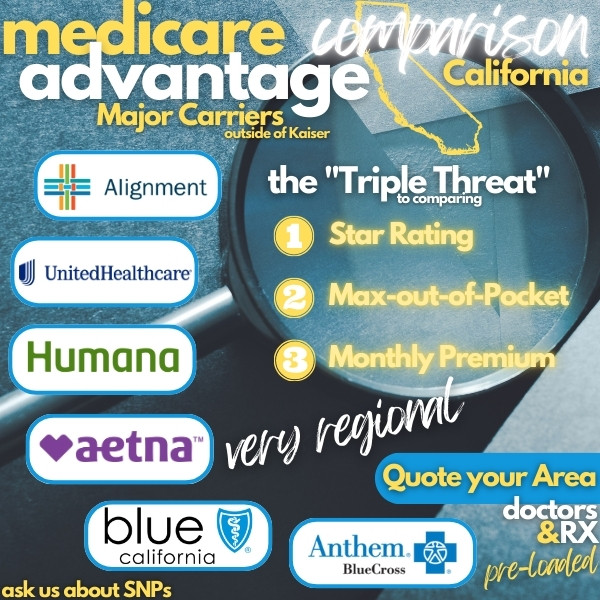

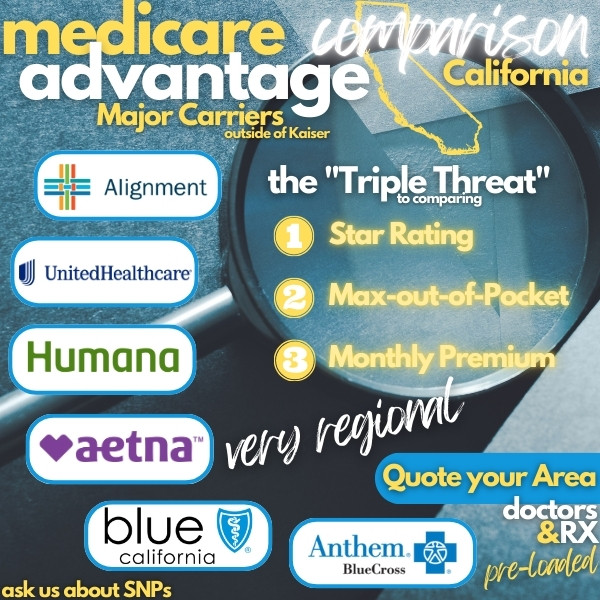

The "Triple Threat" is:

- Low or no cost if available

- Max out-of-pocket under $1000

- Star Ratings of 4 or higher

Again, check out the reviews!

Why would brokers push only select Advantage plans?

Advantage plans require a pretty involved certification from EACH carrier you have a contract with. Annually!

We specifically targeted the "big 6" in California (outside of Kaiser) to offer a rich mix of plans even though it requires much more work.

We can even quote other carriers through our system that we're not contracted with if you need that. Other brokers would think this is crazy since there's no commission but it's the right thing to do.

So....we've shown you the real story behind the scenes of why brokers are pushing so hard.

Quick question...why are carriers so excited about Advantage plans?

Why are carriers so excited about Advantage plans?

The simple truth is...the HMO model is probably going to win.

We're already seeing it on the Covered Ca side with slow progression from PPO to EPO to...HMO since 2014.

Advantage plans (most of them anyway) are the HMO option for Medicare!

HMOs are just better at containing costs and that's going to win as healthcare costs spiral out of control (second behind higher education).

The carrier is not stupid and sees this trend coming and actually gaining traction.

Take a look at it...

Medicare supplements (the equivalent of PPO options) are going become a smaller and smaller slice of the pie aside from maybe higher-deductible or max out-of-pocket options.

We had our big wake-up call when so many of our Silver 87/94 members in Covered California would age into Medicare and go with Advantage plans.

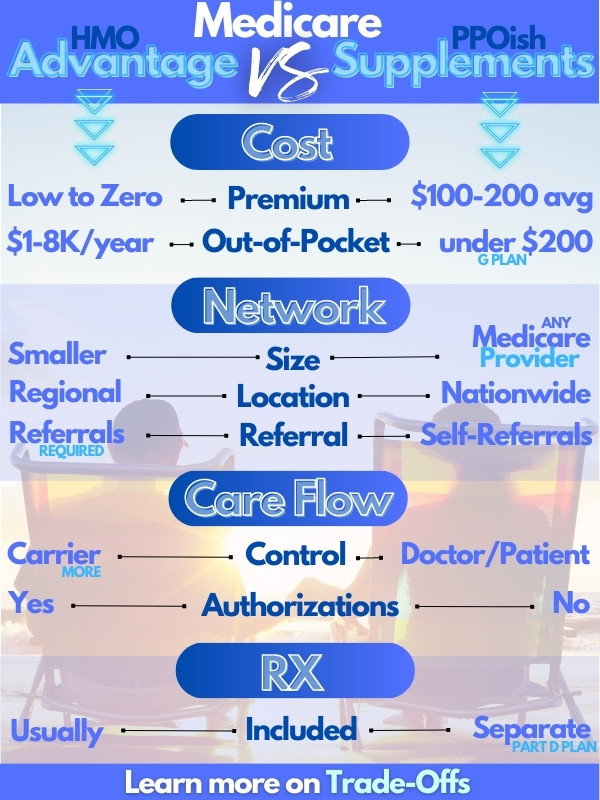

You can see the trade-offs between Advantage plans and Medigap:

Check out our Insider's Guide to Advantage Plans or the Tradeoff between Advantage plans and Supplements.

So...Advantage plans are going to make budget sense for millions of California.

How can we be protected?

Protections for you when comparing Medicare plans with an agent

Medicare has consistently added new protections for Seniors and Medicare-eligible people.

Some of the big ones:

- Calls regarding Advantage plans and/or Part D (medication coverage) must

be recorded now

- An "opt-in" called a Scope of Appointment must be

completed by the customer before anything can be discussed about

Advantage/Part D

- An agent can't cold-call you, go door-to-door, approach

you out in public, or bait-and-switch from other types of coverage (Medigap

for example) without a new scope

- There needs to be a 48-hour gap between

the scope completion and discussion

- The enrollee must understand that

they are enrolling in coverage and it will automatically cancel other

Advantage coverage if active

- Brokers must explain that they do not offer all the plans available (you'll see statement below).

These are just the big ones! There are dozens of other rules around how brokers must behave.

Medicare is complicated! Advantage plans add a whole nother level of complexity!

A good agent can be invaluable during this time so let's look at some warning signs.

Signs that the Medicare agent isn't a good fit for you

You kinda know it when you hear it.

- The person keeps pushing too hard for you to enroll

- The person is not

following the big rules (recording with your approval, scope of appointment,

cold-calling, etc.)

- The person won't let you off the phone without

committing (high pressure sales)

- The person doesn't take into account

your doctors and/or medications

- The person doesn't explain that you're

applying for coverage and existing one may end as a result

- The person keeps talking about bells and whistles (dental, vision, money back to pay for Part B, etc.) without addressing the max out of pocket

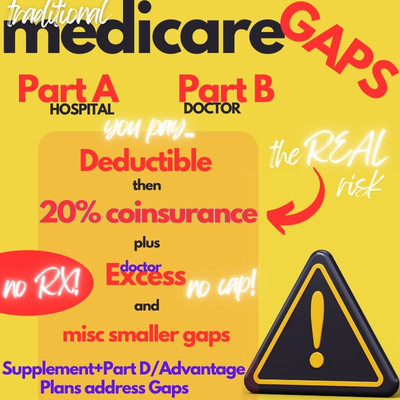

The last one is really the giveaway. We explain why the big risk with Medicare alone is the 20% exposure for big bills!

If an Advantage plan has a max of $4K, $6K, or even $8K (they're out there) that you're responsible for with the big bills, what's the point of gym memberships?

We really walk through this in our What's Wrong with Advantage Plans (and how to avoid them).

Again, you know if the person on the phone generally wants to help you understand if you're just a sales conquest for them.

We've all been there (and it's the worst feeling ever...car purchases come to mind).

That's why we make our Google Reviews available so people can see what type of relationship we offer people and at no cost to you (the Advantage or Medigap plan will be the exact same price with us, another agent, or direct with the carrier or Medicare).

Just run your Medigap quote below!

We can email before the 48 hours and of course, address any questions via phone after that period.

We follow the rules!

So... let's recap on what to look for and avoid when comparing Medicare Advantage brokers.

Tips to pick the best Medicare agent

Here's our checklist of sorts.

It's our checklist as good Medicare Advantage brokers but it's also yours to make sure you avoid a high-pressure sales situation.

- Discussions by phone must be done after the scope of the appointment is

signed (48 hours between - new Medicare agent rule)

- Your doctor and

medication information should be submitted so that the plans shown are those

that work with your providers and drug list/pharmacies

- Focus on the "Triple Threat" - Cost, Max-out-of-Pocket, and Star

Rating of 4 or higher

- Understand your enrollment periods and options

- Understand if you're

eligible for SNP, Special Need Plans such as Medi-Medi or Chronic Illness

plans

- Really understand the max-out-of-pocket!!! This is the

whole point of not just going with traditional Medicare alone

- Know your expected costs! Watch out for an agent who talks about "free" or only focuses on the positives

Look..there's no free lunch in the Universe! You need to know the pros and cons of any Medicare plan you're going to enroll in.

That's really the mark of a good agent...hopefully, you can see from our transparency and guidance that's were always striving to meet that mark.

It's what we would want for parents. Simple.

For more tips:

Probably the biggest complaint we see is from enrollees (or their adult children) that they got notice that their Advantage plan was canceled because some agent enrolled them on another plan without them understanding what happened.

It happens all the time and hopefully, you now have a tip list on how to avoid this type of behavior.

Let us know if we can help in any way. Again, there's zero cost for our assistance, and we really do try to help people.

Above all else....Be well!