California health insurance - Carrier Comparisons - Blue Shield versus United

Blue Shield California vs. UnitedHealthcare®: An In-Depth Comparisonh

Blue Shield of California versus UnitedHealthcare®

This is an interesting comparison.

We have one of the biggest nationwide carriers (UnitedHealthcare®) going against the up and coming regional carrier (Blue Shield of California).

It's really a test of what matters in providing health insurance...size versus nimbleness.

There are pros and cons to both approaches and the we'll find out soon which model works best.

Very soon!

Shield has exploded in terms of marketshare over the last few years.

UnitedHealthcare® is very aggressive on pricing and gaining marketshare.

Here we go!

We usually compare across all three primary markets but UnitedHealthcare® has largely exited the individual/family market.

We'll still look at that market but obviously it will focus more on Shield's current role.

Both carriers are aggressive in Business health plans and Medicare eligible coverage.

We'll look at those closely.

You can jump right to the section here:

Let's get started!

Individual and Family Comparison between UnitedHealthcare®and Blue Shield of California

This is a bit one sided.

UnitedHealthcare®left the California IFP market in 2014.

They came back for a year and then left again.

Since 2017, they're officially out.

This is true for Covered California and off-exchange.

UnitedHealthcare® has never been consistently in the individual/family market even before Obamacare.

In California anyways.

Blue Shield is polar opposite!

They fully embraced the ACA (Affordable Care Act) rollout and have been a dominant carrier since 2014.

Going forward, they may be the only carrier with near Statewide coverage.

That leaves Blue Shield as the last big PPO carrier standing.

This is a huge deal.

Anthem and Blue Shield were the two "PPO" carriers.

Even though Anthem went to the EPO, it still functioned like a PPO in most respects.

Now we have Blue Shield.

If you want a PPO style plan, it's Blue Shield or bust since 2018.

We'll update with each year as we get new information but for now...

We're down to one real PPO carrier.

So let's look at them for our 5 categories:

- Price

- Customer Service

- Network

- Online Services

- RX list

Here we go!

Pricing Comparison for Individual Family plans between UnitedHealthcare®and Blue Shield

Again, UnitedHealthcare® is not currently participating...what about Blue Shield's pricing?

If you want PPO, they're the only option so that's pretty straight forward.

Get more information on PPO versus HMO here.

Blue Shield's PPO is generally higher than the PPOs plans available on the market which makes sense.

It has some of the premier medical groups and hospitals which is a big change since 2014

We expect Shield to eat up 40% of the Covered Ca market now since they're the only PPO.

You can quickly quote Blue Shield's plans here:

Customer Service Comparison between UnitedHealthcare® and Blue Shield

Even when UnitedHealthcare® was in the individual market, Shield had them beat here.

There are strengths to being a large, nationwide carrier and unfortunately, customer service is not one of them.

That being said, all the carriers have suffered in this respect since 2014.

Many carriers have had to aggressively pare back costs and that loosely translates into employee count.

We've seen the customer service side of the carriers drop significantly since the ACA rolled out.

Shield is probably one of the best now (with Kaiser) but it's hard to get excited about any of the carriers when it comes to billing, claims, and changes.

Of course, as a certified Covered Ca agent, we're here to help with any issues.

There's no cost for our service.

Keep in mind that many of the issues originate at Covered Ca and have to be corrected there.

That's where we can really help!

Call 800-320-6269 or email us.

We can take some of the sting out of this new post-ACA customer service world!

Network Comparison for Blue Shield and United

One of the major strengths of UnitedHealthcare® was their network.

They had all the good doctors!

That may be partially why they're no longer participating.

They couldn't afford to offer a rich network AND handle the current cost spiral since 2014.

They now have no network since they're not participating for individual family plans.

What about Shield?

The post 2014 networks have shrunk by about 1/3rd from the old networks or the current employer networks.

There's no way around that.

Blue Shield's PPO network has experienced the same shrinkage.

They made some improvements since 2014 for sure...addition of the UC's being the big one.

When you run your quote below, there will be a "Provider Search" button under each plan.

Use this to see if your doctors are in-network.

Sometimes, we have to call doctors to ask them if they take "Covered California Blue Shield PPO".

There are times where they don't show in the online directory but they are contracted.

That's when it's best to call.

Individual Family Online Services for UnitedHealthcare® and Blue Shield

Since Shield is a smaller, regional player, they've been more responsive here.

In response to cost constraints, they've really invested in their online services.

They are right there with Kaiser for online options including the following:

- Billing history and detail

- Access to personalized provider directory

- Benefit detail

Their online services were completely revamped over the past few years.

RX list for Blue Shield versus United

The RX lists were also pared back after 2014.

- United's originally was pretty robust but that may be why they're no longer in the individual/family market.

- Blue Shield's RX list also shrank but has generally been better than the other carriers still in the market.

We've done countless comparisons for individuals and invariably, Shield had more of their medications.

Individual Family Wrap for UnitedHealthcare® and Blue Shield

Until UnitedHealthcare® comes back to the California individual/family market, this is a short comparison.

We're lucky to have Blue Shield as the last standing carrier with almost a Statewide presence.

Most of the HMO's are only available in certain areas.

We'll update if we get new info on United's participation but it's unlikely for a few years.

Now...on to Small Business comparisons.

Small Business Health Plan Comparison between UnitedHealthcare®and Blue Shield of California

Now we can finally compare the two carriers!

They are both aggressive in the Employer health plan market with very different tacts.

These two carriers are really the two most competitive right now on the market outside of Kaiser and occasionally, Anthem.

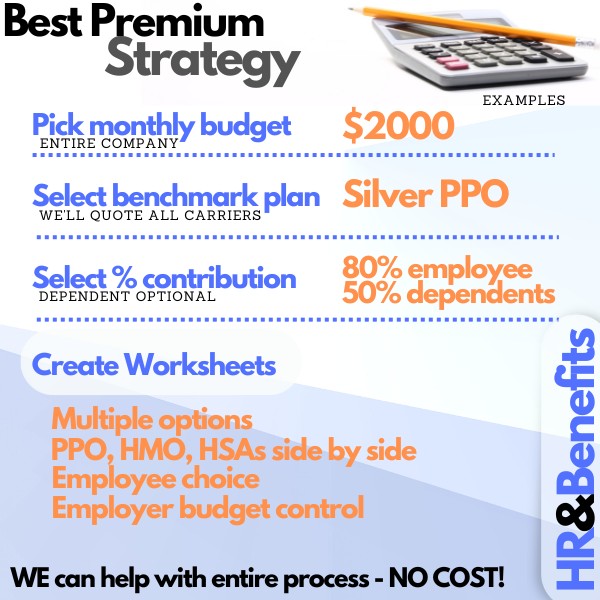

Later, we'll explain how to offer them side by side WITH Kaiser for the best of both worlds!

Right now, let's compare them along the key components:

- Price

- Customer Service

- Network

- Online Services

- RX List

First on deck...Price! (always).

Price Comparison for Small Business Plans Between UnitedHealthcare®and Blue Shield

Carrier pricing tends to ebb and flow over time.

One carrier will be very competitive and slowly slide over a few years.

Essentially, the carriers try to buy up marketshare and then claims comes back with a vengeance a few years after.

We may be there now for United.

Their plans have been priced very aggressively for the full networks.

PPO Plans for UnitedHealthcare® and Blue Shield

They've partially accomplished this with a trick...the Direct model.

They have a suite of plans called Direct on the PPO side.

Basically, they've added a big hospital copay on top of the core benefits.

This appears to have reduced their pricing quite a bit.

They also have narrow network plans suites such as Core that you can offer side by side.

Blue Shield is generally the 2nd best priced PPO plan on the market behind United.

It's important to run your specific quote since demographics can really swing the quotes here:

We'll quote all the carriers side by side to see what's available.

HMO Plans for UnitedHealthcare® and Blue Shield

UnitedHealthcare® has always had a strong HMO presence.

That hasn't changed!

They are consistently priced well for both full HMO and narrow HMO networks.

HMO is not Blue Shield's strength.

They're the de facto PPO carrier on the market right now.

That being said, the biggest HMO is by far Kaiser.

It's their business to give away!

You would use UnitedHealthcare® or Shield's HMO only if you want access to providers, medical groups, and hospitals outside of Kaiser.

Otherwise...a very popular approach is the Kaiser Wrap!

Kaiser Wrap with Blue Shield or UnitedHealthcare®

Essentially, we can offer Kaiser side by side with either Blue Shield or United.

We can even offer PPO and HMO plans with the non-Kaiser carrier along side Kaiser to each employee.

We can even base the employer contribution on a Kaiser plan (since they're priced so well) and let employees pick from Kaiser or United/Blue Shield.

This is incredibly popular since many employees will want Kaiser while many more will have doctors outside that they want access to.

We can quote the Kaiser Wrap with the best priced PPO carrier here:

Please let us know if any questions come up at 800-320-6269 or by email.

Customer Service For Employer Plans with UnitedHealthcare® and Blue Shield

Shield has the advantage here.

Mainly it's a function of them being a regional, more responsive carrier.

UnitedHealthcare® is gigantic.

One of the big 3 nationwide carriers.

The customer reps may very well be Wisconsin and service many markets.

California is very different from most markets.

Companies expect more.

Companies are used to getting more!

Blue Shield is local and their people are in California.

It makes a big difference.

We deal with the carriers day in and day out.

We can tell you there's a difference.

Ultimately though, affordability rules the day now.

If UnitedHealthcare® is much better priced, that dominates the decision.

As licensed health insurance agents, we'll help you with the issues anyway.

Let's look at an important concern for employees...the networks!

Network Comparison for Small Businesses

There's lots of complaining (rightfully so) on the individual/family side regarding doctor networks.

They shrank by 1/3rd roughly.

That's not the issue on the Employer plan side.

Both UnitedHealthcare® and Blue Shield still have extensive employer plan networks of doctors and hospitals.

It's very common to find both carriers accepted by any given doctor or hospital.

This is for the full networks, mind you.

The carriers also have narrow networks which are smaller.

That requires a little research.

We can research any doctors for you or you send over the links of providers for a given plan choice.

When you run the quote below, let us know of doctor/facility names and

cities to check as part of the quoting process.

Online Services for Small Businesses

Let's look at this from two points of view.

The member's online services and the employer's.

From the member' standpoint, both are pretty comparable although Blue Shield has definitely invested heavily in their member portal.

They have the slight edge there.

For the employer, Shield is doing much better.

They allow all types of account information and maintenance from the online portal.

This really makes things easier for companies with a lot of turnover.

We have construction companies with high activity and this really helps.

We always process the changes for our clients but it makes it much easier and faster to manage account and member changes online through Shield's system.

United's is definitely adequate but not up to Shield's level.

RX Comparison for UnitedHealthcare® and Blue Shield Employer Plans

UnitedHealthcare® has a slight lead here when it comes to the list of allowed medications.

Very slight.

Since 2014, the carriers are definitely managing their list of medications more aggressively.

RX and doctor reimbursements are really the only way the can contain costs.

Neither Blue Shield or UnitedHealthcare® went after the group RX list the way Anthem Blue Cross did.

They will probably have to over the new few years if things don't change but for now, they both offer a comprehensive RX formulary list of medications.

Small Business Comparison Wrap

For most companies, UnitedHealthcare® will be the choice due to their price advantage.

They may be a little more difficult to deal with (more so on the enrollment/renewal side) than Blue Shield but cost is king these days.

It's important to check your area's rates specifically for your company since it can vary.

Run your quote here for Company plans including Blue Shield and United:

Our assistance is 100% free to you. Please let us know how we can help.

Learn how to save on Employee Benefits here:

On to Medicare! The real battle!!

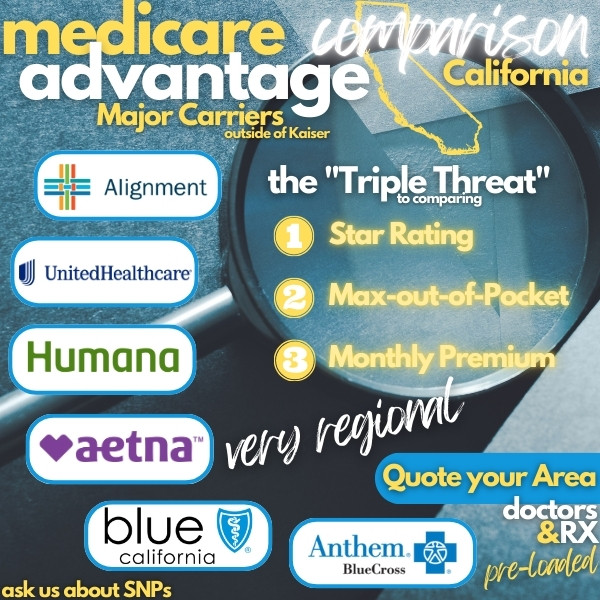

Senior Health Plan Comparison between UnitedHealthcare® and Blue Shield of California

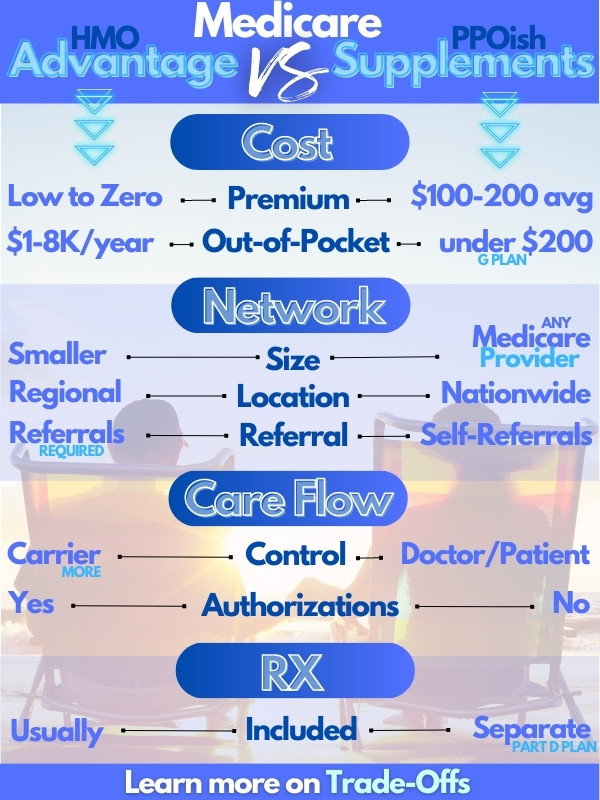

Both UnitedHealthcare® and Blue Shield offer Medicare supplements and Advantage plans in California.

It's important to understand the difference between Advantage plans and Medicare supplements first.

That's critical before comparing the carriers.

UnitedHealthcare® has its own stand alone Medicare plans.

Let's look at the comparison among these priorities:

- Pricing

- Customer Service

- Network

- Online Services

- RX List

First, the most important...pricing!

Medicare Comparison of Pricing for UnitedHealthcare® and Blue Shield

We'll look at both types of plans.

You can run your Medicare Supplement and Advantage Plan Quote here:

First, Medicare Supplement pricing.

Medicare Supplement Comparison

Right now, Blue Shield of California is one of the most competitive carriers in the Supplement space.

They really competed on the G plan which has been very competitive.

The G plan has taken the top spot from the discontinued (for new enrollees) F plan.

United's medicare supplement plans tend to be more competitive in older age bands while Shield is better priced when younger!

Keep in mind that Medicare supplement benefits are standardized.

A G plan is a G plan regardless of the carrier.

Pricing and pricing stability becomes really important.

Right now, Blue Shield wins the Supplement battle.

What about Advantage plans?

Medicare Advantage Pricing Comparison

This is a little more complicated.

Advantage plans are generally no and low cost plans

The benefits can differ from plan to plan so you really have to run your

quote here to see which is better:

Compare the pricing difference against the max out of pocket that you will be responsible for with big bills.

We're happy to help with this comparison.

Net net...UnitedHealthcare® generally leads the pack on pricing! Especially against Shield.

Our assistance is 100% free to you as licensed California agents.

What about customer service?

Customer Service Comparison for UnitedHealthcare®and Blue Shield

This aspect is pretty comparable for the two carriers with Blue Shield having the slight edge on the medigap side.

Keep in mind that Medicare dictates whether something is covered or not with a supplement plan.

The carrier then pays accordingly.

For the Advantage plans, the carriers have more say so.

Here, we need to look at the Star Rating and UnitedHealthcare® has been much better received by members than Shield to date.

See our Advantage carrier comparison or how to use Customer Ratings for Advantage plans.

Medigap is pretty similar between UnitedHealthcare® and Shield but Advantage is quite different.

Customer service differences isn't a big enough consideration to outweigh pricing differences in our opinion.

Network Comparison for Senior Market

For supplements...it's easy.

If the doctor takes Medicare, you're good!

Both carriers will be the same for this process.

They're actually tied into Medicare and will pay according to the benefits of the plan.

Advantage plans are different.

They're essentially HMO by nature.

This means there is a distinct and regional network of doctors you must use.

Care decisions are also partially made by the carrier.

This is the trade-off to the lower pricing of the Advantage plans.

When you run your Medicare Advantage quote here, you will be able to enter your doctor AND RX information. Very important to get the best quote.

Make sure to check it out or ask your doctor what Advantage plan they accept.

Online Services Comparison

Most of the Medicare plans are have pretty poor online services.

This isn't really their fault.

Medicare has tons of rules on what carriers can and can't do.

We partially understand this since they're designed to protect seniors.

We've guide seniors in their 70's and 80's and they definitely need an advocate!

Our reviews:

Over time, we may see more online services available for senior members on supplements and Advantage plans.

We now have online quoting AND enrollment with the major carriers which would have been unheard of a few years back.

Judging by the past, it will be a slow, methodic process.

Which is okay!

RX List Comparison for UnitedHealthcare® and Shield

For Supplements, we're really talking about Part D.

Part D is a separate policy you purchase to address the cost of medications.

Both Shield and UnitedHealthcare® offer Part D plans but they haven't been terribly competitive on pricing.

They're right in the middle of the pack.

With your medications/dosages, we can run a quick report right through Medicare to show the best options for your situation.

Advantage plans are a little different.

Medication may be included in the plan.

This means the plan will have its own list of medications that are covered.

The list will be managed by the carrier for cost effectiveness.

If you have existing medications, it's important to check their availability.

This may dictate which carrier and even which type of plan (Advantage versus Supplement) to go with.

We're happy to help with this comparison! You can run your separate part D quote right through the main quoting system!

UnitedHealthcare® versus Blue Shield Review

So...we have our new regional superstar (Blue Shield) facing off with the nationwide carrier to beat (United).

As you can see, it really comes down to which market you're looking at.

The net net..

- UnitedHealthcare® has pulled out of the individual/family market including Covered Ca. That's easy.

- UnitedHealthcare® is priced aggressively for Group health plans. Hard to offset that.

- Blue Shield is priced better for Supplement plans. Advantage is dominated by UnitedHealthcare® both in terms of Star Rating, premiums, and out-of-pocket max).

You can run your quotes across all the carriers for individual/families or small business.

We're happy to help.

There's no cost for our assistance and we have guided 1000's of Californians through this process.

How can we help?

You can run your UnitedHealthcare® and Blue Shield of California Exchange Quote to view rates and plans side by side from the major carriers...Free.

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!

.jpg)

.jpg)