California Employer Benefits - How

to save on employee benefits

California Employer Benefits - How

to save on employee benefits

How to Minimize Costs on Group Health Insurance

Occasionally, 25 years of experience comes in handy.

In terms of strategies to minimize the cost of group health insurance without causing an employee revolt, it's absolutely essential.

We're going to walk through key tips on how to control health care costs and even reduce them for small companies.

The definition of "small company" is 1-100 employees which is where we'll focus.

These are the topics we'll cover:

- Quote the market often (or let us do it for you)

- The new "discount" -

Alternative networks can offer savings

- HSA plans still work!

- Make sure

to get pre-tax POP plans for employee contributions

- Cap exposure based on

a percentage of a given plan or dollar amount

- Allow cafeteria plans to

employees

- The dependent trick that saves lots of money

- Kaiser wraps when available

Let's get started... there are savings to be had!

Quote the market often (or let us do it for you)

20 years back, a company might stay with a carrier for 5+ years.

The rates did not change drastically between carriers (although they went up each year on average).

In a given year for a specific region, Anthem might be the best value for a long stretch of time.

This is no longer the case!

We see big rate differences now from year to year.

Keep in mind that the benefits are now standardized so a silver plan will walk and talk about the same +/- 2% from carrier to carrier (and even within carriers).

We really need to quote the full market each year now as different carriers will try to "buy" market share and drop their pricing.

Since the plans are standardized, this makes it much easier to quote.

We also come across something quite a bit with existing group plans.

Brokers aren't really shopping them at renewal and so the employer has no idea they're overpaying.

It's a hassle to change companies and smaller businesses (let's say under 50) might not get the full attention of a broker that has many companies (some much bigger).

We're fine doing full reviews right down to 1 employee!

It's our job after all and if you look at our Google reviews here, we take it seriously.

Request your full market quote here.

Another opportunity many groups (new and old) miss out on revolves around networks.

The new "discount" - Alternative networks can offer savings

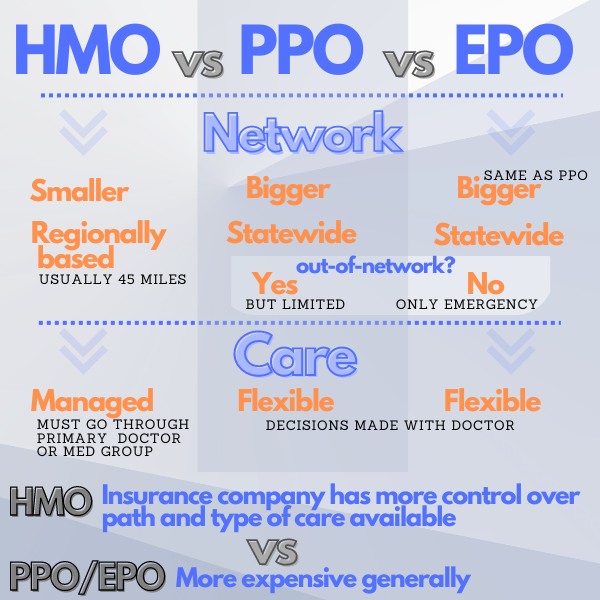

Most people are familiar with the "full" PPO or HMO networks.

In the case of Kaiser, there's really only one network but for other carriers, we can have more narrow provider networks which translate into lower costs.

Occasionally, much lower costs.

Depending on the area, there can still be a robust list of providers in these narrow networks.

There might even be ways to mix and match full and narrow networks to employees and let them pick depending on their budget.

It's all about flexibility! As long as employees have the choice, a percentage of them will choose according to their wallet.

We can check doctors/hospitals for both networks to see if it even matters (in many cases, it won't).

Either way, they have a choice and there are savings for both the employees and employer.

We generally run a quote across the carriers to see who is priced best and then we cost-compare the full and narrow network.

You can also offer PPO and HMO side by side to get the same effect.

Interestingly, we generally a good split on employees choosing one or the other when offered.

There's clearly a preference.

Request your full quote here.

HSA plans still work!

We were one of the first big proponents of HSA for group health plans almost 20 years ago (there were called MSA's back then).

The general benefit still applies.

Essentially, the employer offers a qualified, group health insurance plan.

You can then choose to fund zero to the annual max limit towards a tax-favored account that's in the employees' name.

Whatever you fund is a deduction to you up to that limit.

The employee can use those funds:

- To pay for medical and dental expenses

- Rollover year and earn interest

or capital gains

- Take out but subject to penalty/tax

It's similar to an IRA account from which you can pay for medical and dental expenses with no tax implication.

The theory is this:

We are essentially getting a tax benefit to self-insure the smaller bills.

This works against richer plans obviously like the gold and platinum and potentially the silver depending on pricing and ages of employees.

There's a bigger gap in premium as the average employee age goes up.

We're happy to compare this option versus your current plan or other plans to see if it makes sense.

You can also use the HSA funds for out-of-network expenses which can be a big deal.

Employees can fund HSA accounts as well up to the contribution limit with a personal tax deduction for their portion.

If you don't use HSA funds, they roll over year to year. You don't lose them!

Make sure to get pre-tax POP plans for employee contributions

There are little tricks like POP 125 plans which are cheap and very powerful.

They allow contributions made by employees to be pre-tax to the employee.

This is a huge deal with savings averaging around 10-30% depending on the employee's tax bracket.

The employer also gets to save on payroll tax for that contribution amount.

Costs for POP 125 plans are very low and easily covered generally by the payroll tax savings.

This all assumes that employees are contributing to their premium (very common these days depending on the industry) and/or dependents (even more common).

Which brings up a good point (and strategy for saving)...

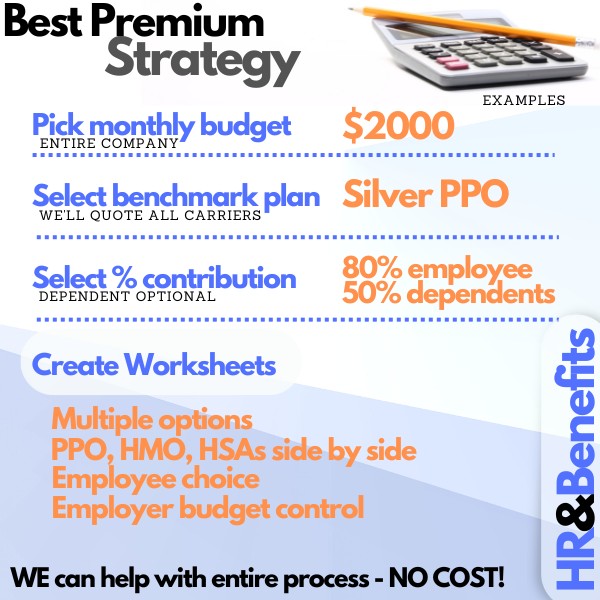

Cap exposure based on a percentage of a given plan or dollar amount

This is a very popular option with small businesses.

Essentially, you can set an employer contribution based on the following:

- A fixed dollar amount (say $100/month/employee

- A percentage (say 50%

over a range of plans)

- A percentage of a specific plan

The latter is generally the best as it levels the field in terms of age/area.

For example, you can set the contribution as 75% of a given silver plan.

The employees get a worksheet with a range of plans (bronze, silver, gold, platinum, etc) and the rate contributed to each is based on that 75% of silver.

This means the bronze will be much lower-priced (more is eaten up by the contribution).

The employee can opt for the gold or platinum based on their health care needs and budget but there's no risk to the employer (capped exposure).

This offers flexibility and control to the employee while protecting the employer's budget.

Remember to wrap this with the POP 125 from above so that employee contribution is based on pre-tax money.

Also, you can set a different %/amount for employee versus dependents.

There's a knock-on effect we can look at next from this setup.

Allow cafeteria plans to employees

Essentially, the cafe plan means that each employee can pick from a range of plans.

This is actually much easier to administer than most employers realize.

We do all the heavy lifting!

First, we create worksheets customized for each employee and they can pick or choose directly from the worksheet based on needs.

The worksheet will show the rates broken out (total, employee, dependent, etc).

It even shows the contribution made by the employer which is very important so they understand just how much value is offered!

Here's the interesting piece in terms of strategies for saving money...

Many employees will choose less rich plans (like the bronze) than you might think!

If they contribute anything and are in good health, you'll see some options for high deductible plans (HSA's can also be offered).

Why does this matter?

Let's say the company is contributing 75% towards the silver option (a very popular benchmark by the way).

If an employee finds it in their interest to get the bronze instead in order to save on their 25%, the employer also saves on their 75%!

The beauty is that you didn't force the employee to a high deductible plan...it was their choice based on their needs/budget.

These mini-cafeteria plans can mix and match a range of options:

- All plan levels from bronze to platinum including HSA options

- PPO,

HMO, and EPO

- Narrow networks with full networks in some situations

- Multiple carrier options (See Kaiser wrap below)

How do we help with this process?

Complete the simple census here (ages, and zips).

We quote the whole market to see who is priced best in your area for your employee demographics.

We then zero down into that carrier and find the best-priced plans at each level and create worksheets for the employees plus a summary level report for the employer.

The summary report is great for establishing our monthly budget.

For example...

If the Silver plan for the group is $2K and we want to spend $1500, we would set the contribution at 75% of the silver (75% of 2K or $1500).

The worksheets will reflect that choice and we're off to the races!

Let's touch base on dependents.

The dependent trick that saves lots of money

An employer can set two different contributions for employees versus dependents.

In fact, a contribution for dependents can run from zero to 100%.

A quick note on that piece especially towards the high end.

You don't necessarily want to cover dependents at 100% unless your industry really demands it.

A spouse may have group health insurance through their employer.

If you're offering dependent coverage at 100%, there's no reason for her not to take it and essentially, she's double covered.

The two group plans will split duties on claims but you're still paying 100% as if you're the only carrier!

The carriers love this by the way...

100% of the premium with half the risk.

For that reason, consider bringing down the dependent contribution to 75-90%.

Anything that makes the employee really weigh whether it's worth it (if insured elsewhere) without punishing employees who don't have this double-coverage option.

Let's wrap with the Kaiser wrap.

Kaiser wraps when available (and CalChoice)

In some areas, Kaiser is the dominant player.

They literally run the local health care delivery system!

Many employees will be life-long Kaiser members and want to stay there.

Other employees (and new additions) may have doctors in other networks and want to keep them.

How do we address this?

The Kaiser Wrap!

Essentially we can offer Kaiser alongside another carrier (even PPO options) in one seamless employee worksheet.

We can even have different levels from Kaiser and the other carrier (like the cafeteria above) with defined contributions as well!

For employers who are budget-conscious (who isn't these days), you can base the contribution on the Kaiser plan which will likely be less expensive.

For example:

Employer contribution based on 75% of Kaiser Silver HMO plan

The rates for the other carrier will reflect this level even though it may be Anthem, Blue Shield, etc.

To the employee, it's all one simple worksheet we created on our side.

There's no cost for this service or our assistance as licensed California health insurance agents with 20+ experience in the market.

How can we help you? Let us quote the options and get to work!

.jpg)