California Medicare Options - Who Qualifies for Medicare Giveback Part B Rebate Plans

Who qualifies for Part B giveback

This is a very common question we get around the Give back Advantage plans.

Are Part B rebate plans only available to certain people?

We have good news and bad news on this front.

We'll cover the full range of questions around eligibility but more importantly...suitability!

First, our credentials:

This is what we'll cover:

- A quick intro to the Part B Giveback plans

- Who qualifies for Part B giveback

- How to compare the giveback plans

- Who is most satisfied by giveback plans

- How to quote and enroll in giveback plans in your area

Let's get started!

A quick intro to the Part B Giveback plans

We have a guide of Part B giveback plans fully explained or even a giveback comparison.

A quick introduction so you really understand your options.

Part B giveback plans will reduce the amount you pay for Part B premium to Medicare (technically Social Security).

This amount averages around $174 (goes up each year) but the amount you pay may differ depending on how much money you made in prior years.

The Part B rebate is a specific benefit for certain Advantage plans that reduce this amount.

Essentially, found money in your pocket!

As we'll see later, the amount of giveback benefit can vary by plan to account for different amounts that people may pay monthly.

We can use this to our advantage against the other aspects of the Advantage insurance plan.

Remember, first and foremost, Advantage plans are health insurance for seniors with Medicare so we need to make sure it meets those requirements as well.

We'll cover that in the comparison section below but first, who qualifies?

Who qualifies for Part B giveback

This is the good news part.

Anyone with an active part A and B from Medicare is eligible to get a Part B rebate giveback plan.

The plans have to be available in your area and that's not the case for every area. You'll be able to quote your specific area below and we'll show you how to see giveback plans are an option.

Otherwise, anyone with Medicare Part A and B can get an Advantage plan if available in your area and a select number of these plans have the additional giveback benefit.

Think of it like an add-on. When you get a hotel room, free breakfast may be an add-on option.

In this case, money towards your Part B may be an add-on option!

It can mean up to $2000/year! That's a pretty nice breakfast.

So...if they're available, how do we compare them?

How to compare the giveback plans

We'll do a quick walkthrough knowing that we have a big comparison of giveback plans explained.

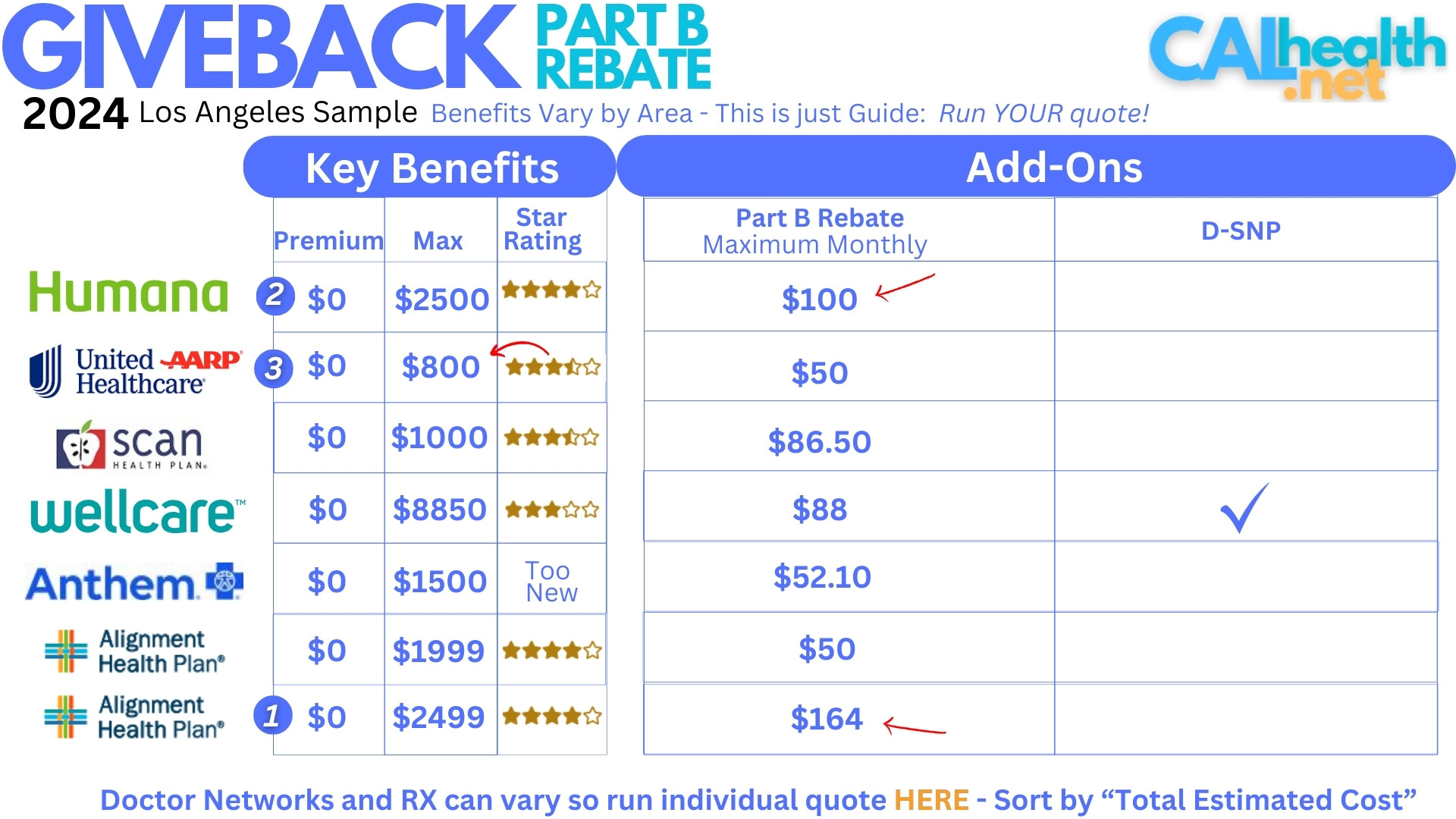

Let's look at Los Angeles as an example on how to compare the Part B rebate plans:

First, the giveback benefit itself. You'll see very different amounts from $50 to $164 per month!

This speaks to the fact that people have different Part B amounts. The giveback benefit can only pay back UP to the amount you owe each month.

Meaning...if your Part B premium is $80/month, there's no reason to get a Part B rebate plan with a $100/month benefit. You'll only get the $80!

That's just the Part B benefit. What about the other aspects?

Focus on our Triple Threat selection first:

- Star Rating

- Premium

- Max-out-of-Pocket

Premium is straight forward and zero in all the cases above.

Star Rating is really our key! How do current people feel about this plan. It's the Yelp review of Advantage plans and we need to lean heavily on Star Rating.

We really want 4 stars if possible. 3 Star is not great!

We can see this figures into our top 3 choices above.

Then there's max out of pocket...how much we're on the hook if we have really big bills in a year.

The calculation becomes a comparison between out-of-pocket max, Star Rating, and Rebate amount primarily.

Finally, the networks can be different so we have to make sure our doctors/hospital is available. We'll show how to do this below.

We're happy to help you compare these options at help@calhealth.net or by chat

Before we look at individual quotes, let's touch on who usually picks giveback plans.

Who is most satisfied by giveback plans

What are we giving up with Part B rebates? Nothing's for free and that's almost $2000 in your pocket per year!

People who choose Part B rebate plans are usually looking for:

- Generally in good health with less medical expenses expected

- Flexible on doctor choice

- Values the extra money from Part B savings

Even if a person has very big expenses, we can still find plans that have a lower max-out-of-pocket.

The UnitedHealthcare® plan is $800. Even if we hit our max with Alignment, it's $2500 but we're saving almost $2000 in part b premium so the real exposure is $500! ($2500 minus the $2000 in savings).

See how the Max versus Part B rebate is key?

Then there's the doctor networks. Are there doctors we like in the network and is this an issue.

That brings us to the next section.

How to quote and enroll in giveback plans in your area

We make this fast, secure, and free!

Tips to get the best results:

- Select "Part B Rebate" on the left

- Under preferences, enter your doctors and hospital

- Enter your medications and dosages

- Enter your preferred pharmacy

- Sort by "Total Estimated Cost" up top

This is critical to seeing your best options. You can enroll right through the quote by adding to cart!

Of course, we're happy to help with any questions at help@calhealth.net or pick a time to chat.

Unless you have $2000 burning a hole in your pocket!