California health insurance -

Health Net versus Anthem Blue Cross

California health insurance -

Health Net versus Anthem Blue Cross

Comparing Health Net and Anthem Blue Cross for California

These two carriers actually share a history!

Anthem Blue Cross is definitely the bigger carrier but Health net has certain niche areas where it does really well.

To some extent, Health net is trying to copy Blue Cross' original path to market dominance.

They're doing this just as Anthem is going a different direction...towards a nationwide carrier.

With the good and bad that entails!

So let's compare the two carriers based on 1000's of clients and 100's of 1000's interactions over 25+ years.

The last few 5-7 years have seen big changes with both carriers.

Since each market segment is different, you can jump to the section that pertains to you here:

Individual and Family (including Covered California)

Small Business (1-100 employees)

Senior (Medicare Supplements and Advantage Plans)

Our credentials are here after 25+ years of working with both across all markets:

First...a quick history lesson and then we'll look at how each carrier operates generally.

This is important because it speaks to the carriers' strengths and weaknesses.

Here's a top level comparison across all markets!

We'll start with Health Net.

Health Net comes to the Market

A few decades back, Anthem Blue Cross wanted to become a public company as opposed to a non-profit.

At that time, the parent company was Wellpoint.

California was their primary market.

The State Department of Insurance required them to split off their HMO business in order to make this change.

The carved out HMO business became (drum roll please)....

Health Net.

A publicly traded company that was all HMO.

That was 1979!!

Health Net flourished as an aggressive HMO provider until the the very model itself ran into trouble.

They saw the writing on the wall and aggressively moved into the PPO market over the past 10-15 years.

Very aggressive!

As of today, Health Net offers PPO, EPO, and HMO plans in all three major segments although the individual/family market has seen more of an HMO focus since 2014 (Covered California).

In an increasingly fragmented and competitive market, Health Net continues to function which is not easy considering their size.

Again...niche markets is where they excel now.

We'll talk about that in the individual sections.

What about Anthem Blue Cross?

Anthem Blue Cross of California

As we mentioned above, Anthem had to split off their HMO business to go public.

Leonard Schaeffer basically transformed them into a dominant powerhouse.

There was a time that Blue Cross of California was just miserable to deal with.

So incredibly difficult.

Leonard Schaeffer righted the ship.

Anthem then became the dominant carrier in California and even went into other States.

They really drove innovation in the California health market.

First online application. First HSA.

On and on and on.

Blue Cross was later bought by Anthem (based in Indiana) and although they still have a contingent in California, decisions have steadily moved to Indiana.

Which we're not big fans of.

They are not as easy to deal with as they used to be.

It's more a longing for the old days when they were awesome!It's more a longing for the old days when they were awesome!

The focus is more on being a nationwide carrier which is good in terms of withstanding all the changes but California is not Indiana.

It's really competitive and California members have certain expectations.

There's definitely a difference now with the power moving to Indiana.

Keep in mind...Anthem is a dominant carrier in California.

Generally one of the top 3 in terms of membership.

Their presence has slipped a bit but they're still strong.

Anthem offers a full range of HMO, PPO, and EPO plans with all ancilliary add-ons such as dental, vision, life, etc.

But health insurance really revolves around the specific market.

Let's get into that.

You can jump to your section here:

Individual and Family (including Covered Ca)Individual and Family (including Covered Ca)

Small Business (1-100 employees)

Medicare eligible

We'll start with individual and family

Individual and Family Comparison of Anthem Blue Cross versus Health Net

We'll break our comparison into these categories:

- PricePrice

- Customer Service

- Network

- Online Services

- RX

A few quick notes on Anthem and Health Net in the individual market.

The big question first.

Do they participate in Covered California?

Yes.

Both carriers currently offer coverage both on and off exchange.

Health Net may not be in every county however so run your quote below!

Until recently...

- Health Net focused more on the HMO model of options on-exchange.

- Anthem focuses more on the EPO/PPO model of plans..

We'll discuss this in the network section.

So the net net is this...

They are both in Covered Ca and the individual/family market but selectively!

Let's get started with the sections!

Price Comparison between Anthem Blue Cross and Health Net - Individual Family

This really depends on which type of plan you're looking for.

Health Net has some of the lowest priced HMO plans available...especially in LA county.

Typically, you'll see Health Net's rates just above the regional HMO's like Molina and LA Care.

Their PPO/EPO plans (when available) are generally cheaper than Blue Shield's PPO, the main competitor or Anthem's EPO if available.

As for Anthem Blue Cross' pricing, the HMO generally only makes sense if your provider only take Anthem HMO.

The pricing has been better with other HMO's.

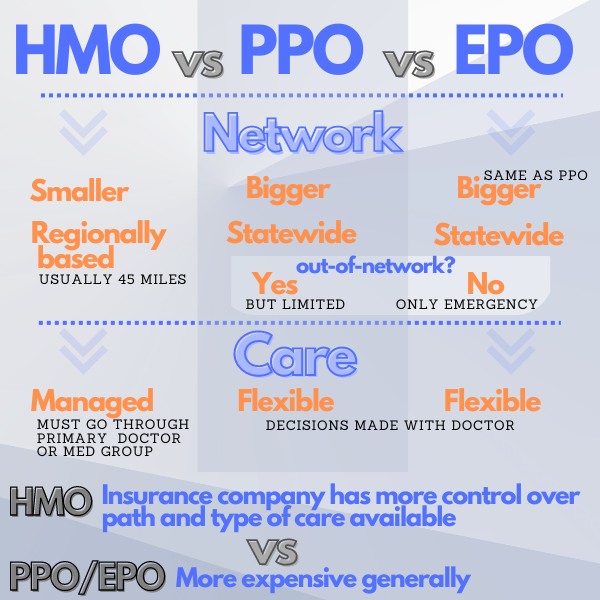

Most of Anthem's individual membership goes with their EPO (learn about difference between EPO and PPO).

In a given area, it has usually been a comparison between Anthem's EPO and Blue Shield's PPO if you need more flexibility or your doctors only take EPO/PPO.

Sometimes Anthem is cheaper. Other times, they're not.

You really need to run a personalized quote here to see how your area is priced:

You can also use our PlanFinder tool to compare the plan levels and options.

It's a great resource!

One note...Health Net's HMO is really competitive in the great San Diego area with a strong network and better pricing than Shield's HMO.

Each area is different so definitely run your numbers and reach out to us for a personalized comparison!

Individual Family Customer Service - Anthem Blue Cross versus Health net

Right now, we're not terribly impressed by either for customer service.

Anthem Blue Cross has become more of a nationwide carrier and that results in a little less access to California clients.

It's just a function of becoming really big and centralized.

Health Net has traditionally focused on pricing aggressively and less on systems to manage membership.

They're pretty comparable in terms of claims, member issues, etc.

We can't get excited about either.

Our thought is this...if pricing and the network are good, that's the deciding factor.

It outweighs having to engage a phone bank now then when there's a mess up on the membership side.

Network Comparison between Blue Cross and Health net for Individual/Family

We mentioned this above but here's a big difference between the two.

First, there's the focus of network type between the two carriers.

Anthem Blue Cross is stronger for PPO/EPO type plans.

That's been their bread and butter since 2014 and even before then.

Health Net is more competitive with the HMO model.

In some areas, they are priced much lower than Anthem's HMO.

Always check with your doctors and ask "what Covered Ca plans do you take" first.

Health Net has pivoted the PPO plans over the last few years but generally, their network is smaller than Shield's so they still compete more on the HMO side of things which is very crowded these days!

Say Covered Ca since the offices all know this branding and there are different networks out there now.

I've seen medical groups that take Health Net's HMO network but not PPO/EPO networks with other carriers which is very odd. The San Diego note from above!

Check there first.

What about size of networks for Health Net and Anthem Blue Cross?

The networks are much smaller now.

This is true across the carriers since 2014 for individual/family plans.

Anthem's PPO/EPO network is about 2/3rds the size of the old network (or current employer network)

Health Net's HMO network is even smaller.

It's typically bigger than competing regional HMO networks such as LA Care or Molina but smaller than Anthem's HMO network (except Southern California but check) and much smaller than the EPO/PPO networks available.

As you can guess...doctor networks are a real issue now.

If there are doctors you must have, it's important to start there and then look as plan levels and rates!

Online Services for Health Net and Anthem Blue Cross

To the member, their online services are pretty comparable.

Both are adequate and functional.

Neither of them shine but that's pretty typical for health insurance carriers.

Anthem might have the slight edge on ease of use but nothing's too easy carrier online systems.

These services are expected with either carrier:

- View claims history/detail

- View billing history and change billing type

- Access doctor list tied to your plan network

- Make payments

- Access benefit detail

RX list comparison for Anthem Blue Cross and Health Net

Anthem used to have a much broader drug formulary than Health Net but that's changed!

Anthem rolled out their Select RX list for individual/family plans (including Covered Ca) which is a pretty skimpy list!

Some real basic drugs are missing off it.

Health Net's drug list isn't terribly robust either.

A big reason for this is that the carriers are scrambling to make the individual/family market work since 2014.

They are trying to cut anywhere they can.

Only two things can give...the doctor reimbursement (smaller networks) and the RX list (fewer covered medications).

This trend will probably not change unfortunately.

We can email over the current formulary for both carriers upon request.

Individual Family Comparison Wrap-up

First, see if Health Net and/or Anthem Blue Cross are even available in your area through our quote tool below.

They may not be!

Secondly, decide on the network type you prefer...HMO or PPO/EPO

Finally, consider the pricing difference between different levels for the two carriers.

I.e. Silver EPO with Anthem versus Silver HMO or PPO with Health Net.

Usually, people have a strong preference regarding HMO versus PPO.

You can compare the two carrier's plans and rates here:

Of course, we're happy to help with any questions as Certified Covered California agents.

Our assistance is 100% free to you.

Now, let's look at Small Business plans.

Small Business Comparison between Health Net and Anthem Blue Cross

Now, we're going to see some competition.

Both carriers are very aggressive in the small employer market and it shows.

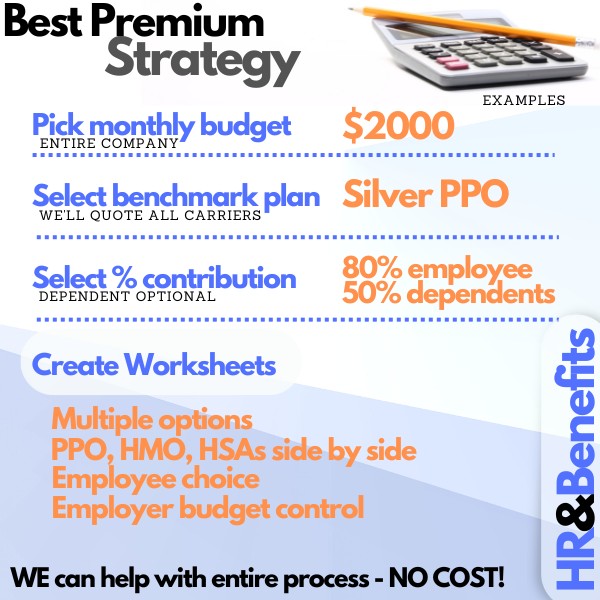

We run 1000's of group health quotes for companies.

The same trends keep coming up.

When comparing Health Net and Blue Cross, it really comes down to type of network you're offering.

Keep in mind that the benefits are standardized.

This means a Silver plan has to walk and talk like another Silver plan +/- 2%.

That then leaves pricing and network.

Focus on those two items when comparing the carriers.

Let's get started with the big one these days.

Pricing!

Pricing Comparison for Health Net and Anthem Blue Cross Small Business

Let's face it...

This is what every employer cares about these days.

The cost of group health coverage has roughly doubled in recent years.

Employers are scrambling.

So how do Anthem Blue Cross and Health Net compare?So how do Anthem Blue Cross and Health Net compare?

Let's look by network type.

PPO Pricing Comparison

Again, we run 1000's of proposals for companies.

Consistently, Anthem Blue Cross has been priced better than Health Net's plans for PPO networks.

Your area and demographic may be different but...

Probably not.

You can request your Group health quote here to find out. We'll run a sample quote across all the carriers including Anthem and Health Net at the Silver level (most popular) to establish who is priced better for comparable coverage.

What about HMO?

HMO pricing between carriers

For HMO, Health Net definitely comes to the table in terms of pricing.

Keep in mind that they won't beat Kaiser but for employees that want their own doctors and like the cost savings of HMO, this is Health Net's bread and butter.Keep in mind that they won't beat Kaiser but for employees that want their own doctors and like the cost savings of HMO, this is Health Net's bread and butter.

We can also offer either carrier WITH Kaiser:

When you run your quote, make sure to request which type of network and carrier.

We can quote them side by side for you.

There are so many plans and networks (new narrow PPO and HMO networks) to quote so any guidance you have on priorities will help.

Run your Group quote here:

Customer Service Comparison between Health Net and Anthem for Employers

Both carriers do a better job for Employer plans than they do for individual/family.

We would actually give Health Net the slight edge here which almost sounds strange to us.

Keep in mind that Anthem Blue Cross led the charge in responsiveness and ease of use up until about 5-7 years ago when Indiana started wielding more control.

Health Net has been able to stay more nimble and responsive as a smaller, regional carrier.

We deal with the carriers daily for membership issues.

Health Net is slightly easier to get things done with.

Edge goes to Health Net.

Ultimately, the feel to the employee will be pretty comparable so pricing and network still dominate the decision before customer service.

If we're your licensed agent, we can take all the headaches out of membership issues anyway.

No cost for our services!

Let's look at the second biggest consideration (after pricing)...Networks.

Network comparison between Blue Cross and Health Net for Employer Plans

The employer market has largely avoided the incredible paring down of doctor networks that individual/family and Covered Ca have seen.

We still have fully intact PPO networks and robust HMO networks.

In fact, on the employer side, the networks haven't changed much through the ACA transition even though the plan benefits and pricing have.

You still want to check on employee's doctors but it's not uncommon to find most medical providers accept both Anthem and Health Net PPOs.

If a provider accepts HMO's, it's pretty common to see both.

Make sure to double check.

When we run your quote, we can send over links to the provider networks for either carrier.

You will always have certain doctors that only take one or the other (or neither) so checking first is a great start.

Online Services Comparison between Anthem and Health Net

The group side online services are definitely getting there but not quite where Blue Shield of California is.

There is both an Employer portal and employee portal.

The Employer portal allows for basic membership detail and changes for either carrier.

The Employee portal allows for claims detail, membership access, and doctor lists primarily (billing not included since employer pays).

The online services are steadily improving but pretty comparable between two carriers now.

RX Comparison between Health net and Anthem Blue Cross

So here's the deal.

Anthem was the first carrier to pare back the group RX formulary list for all plans.

Every carrier did that for the individual family plans but employer plans??

That was a bold move.

Here's the trade-off.

Anthem will have a smaller drug list for employees but their pricing has been better for the plans.

Health net has a more traditional (stronger) RX list for employees but the pricing has been higher.

There's a direct correlation which makes sense since drug prices have driven the fast escalation of health plan coverage costs over the past 2 decades!

Small Business Comparison Wrap

In many cases, Anthem is going to win this battle.

Pricing is just too big of a consideration.

Keep in mind that you can "wrap" either carrier around Kaiser to essentially offer Kaiser and Anthem side by side to each employee.

This may be the best approach so that we have Anthem's PPO and Kaiser's HMO (pricing is hard to beat).

We can quote this option and show you how to make it works seamlessly.

Request quote here for all options:

Medicare Eligible Comparison for Anthem Blue Cross and Health Net

When we're comparing Medicare options, we basically have to look at Advantage Plans versus Medicare Supplements

Advantage plans are the HMO options while Supplements work more like PPO's.

So...

How are Health Net and Anthem for either one.

Let's break it up since they're so different.

Advantage Plans - HMO's

Both Health Net and Anthem offer Advantage plans in certain areas of California.

You can quote the Advantage plans side by side here:

Both have strong offerings in this space.

Health Net traditionally is a strong HMO carrier.

Anthem saw a huge market and went after it aggressively.

They're both in our top list of Advantage plan carriers that we deal with:

Just a head's up...Health Net may offer plans under their Wellcare brand. We have a whole review comparing Advantage plan and carriers.

We'll discuss in the Price and Network sections how to compare the two.

Medicare Supplements

Anthem has always been a dominant Supplement carrier.

In fact, they were leaders in the market for this type of plan.

The benefits are standardized with supplements so a G plan is a G plan.

- The networks are the same as well.

- It's pricing and pricing stability.

- We'll discuss this as well.

We'll compare Health Net and Anthem Blue Cross for these categories:

- Price

- Customer Service

- Network

- Online Services

- RX

Price Comparison for Senior Plans with Health Net and Anthem Blue Cross

Back to our two categories...Advantage plans and Supplements.

Advantage Plan pricing for Health Net and Blue Cross

Okay...this is a little more involved.

The benefits can vary with Advantage plans.

In general, they are low or no cost on a monthly basis.

- That's the monthly premium only.

- What about when you get sick or hurt?

That's where things can be different.

We use our Triple Threat Strategy for comparing Advantage plans:

You can run your Medicare Advantage quote here to compare.

Look at the cost but also look at the exposure for bigger bills.

Especially the max out of pocket.

- It's very easy to hit that number these days when you're over age 65.

- There isn't a clear winner in terms of pricing.

- It differs by area and by person's age.

You have to run the quote.

We have dedicated agents who help you evaluate the options at no cost to you.

Medicare Supplement pricing comparison

You still need to run your quote for your particular situation but in general...

Anthem Blue Cross has been very aggressive with it's replacement, the G plan.

Anthem or Blue Shield (two different carriers) have been price leaders for the G plan (most popular medigap plan)

We're happy to walk through why directly based on your rates.

Run your Supplement quote here:

Customer Service for Medicare clients comparison

Both carriers are equally backwards here but it's not entirely their fault.

There are layers and layers of red tape and protection for Seniors.

The carriers are only allowed to do so much and it shows.

In general, Medicare itself dictates whether a claims are paid and the carrier is tied into their system so that side is streamlined.

On the Advantage side, you'll have an HMO level of "management" over your health care choices.

Learn about the Trade-offs with Advantage plans versus medigap.

That's pretty comparable between the two with Anthem having slightly better results.

In general...they are pretty comparable and most Medicare plans are pretty streamlined.

Network comparison for Health Net and Anthem Blue Cross Seniors

The network for Supplements are very easy.

Does the provider take Medicare?

If so...great.

The supplement pays accordingly.

This is the second biggest consideration behind pricing for Advantage plans.

Since the plans are HMO by definition, there is a distinct network that you must stay within (other than a true emergency).

We make this easy as you can add your preferred doctors and RX to quote plans that will work best for you.

If there are doctors or hospitals you want to stay with, make sure to enter their info when running your quote:

It's really important to look at the network.

In general, Health Net and Anthem's Advantage network are pretty comparable.

Online Services for Seniors

Don't expect too much here.

There's just not a lot the carriers are allowed to do online for Seniors due to strict rules set forth by Medicare.

In time, this may change but it will be very slow. The carriers are pretty similar here for now.

RX Comparison

RX is carved out for Supplements.

You have to get a Part D plan and neither Cross or Health Net dominate that market now.

You can quote/compare the options through online system for free here. (we'll send link to Part D and/or Advantage since they have stricter rules on running quotes!)

Again, there are certain carriers that really run away with that market in terms of pricing and options.

For the Advantage plan, RX may (should) be included in the core benefits.

It's important to look at the list of allowed medications.

In general, the RX lists will be smaller since they are HMO's.

You can quote the Senior plans here.

Anthem Blue Cross versus Health Comparison Review

Okay...two big carriers on the market with an intertwined history.

Depending on your market (individual/family, small business, senior), they can be a top performer in the market.

The market is so fragmented now that you really have to quote them for each given situation.

We're happy to help you compare the two carriers against others on the market.

How can we help?

You can run your Health Net versus Anthem Blue Cross Covered Ca quote here to view rates and plans side by side from the major carriers...Free.

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!

.jpg)

.jpg)