California health insurance -

Understand California health

coverage - HMO versus PPO plans

California health insurance -

Understand California health

coverage - HMO versus PPO plans

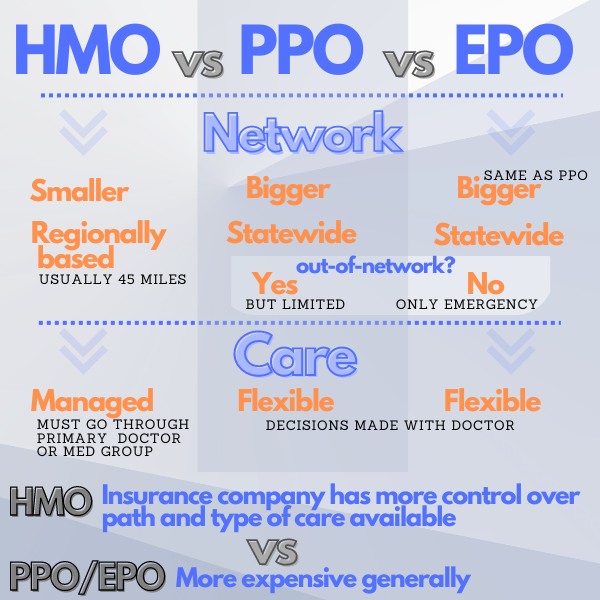

What is the Difference Between HMO and PPO in California?

This really is the first question to ask when you are considering what California health insurance plan to choose.

They are very different in how they work and people typically have a strong preference one way or the other in terms of how they like to access medical care.

Let's define them first in layman's terms. Then, we'll really get into how matters!

We also need to separate out individual/family and employer plans from the new HMO entry in the senior market, Advantage plans!

First a quick lay of the land to get our feet wet.

Basic intro to HMO and PPOs

HMO or Health Maintenance Organizations are a group of doctors, hospitals, and other medical providers that form an association in which medical services will be delivered to enrolled patients on a fixed dollar basis.

For example, the

health carrier might pay the HMO group $500/monthly to provide medical services

for a given enrollee and then the providers manage the care within that amount.

PPO or Preferred Provider Organizations are doctors, hospitals, and other medical providers that agreed to a discounted schedule of re-imbursement with the carrier.

For example, when a PPO member walks in the door, he or she will be charged a discounted PPO rate for a scheduled (and covered) service.

HMO's are:

- More structured in how you access care

- Tend to have richer benefits (less out of your pocket when sick or hurt)

- Have smaller networks of providers that you generally have to stay within (tied to where you live)

PPO's are:

- More flexible in which doctors you can see and how that happens

- Tends to cost-share more of the out-of-pocket with you in the form of deductibles, copays, and co-insurance

- Has a wide range of monthly premium amounts depending on the level of benefits.

UPDATE: The ACA health plans are standardized now so a Silver plan will be similar to another Silver plan regardless of PPO or HMO network

You can quote HMO's and PPO's side by side here within the main markets:

Let Us Go through these various points in more detail for HMO.

"more structured in how you access care"

With an HMO, you choose a Primary Care Physician or designated medical group up front. Referral and decision on health care are made through that provider and services outside of this provider/medical group will most likely not be covered unless a true emergency.

Authorizations for coverage are more common.

You are also limited to the medical group for specialists unless they do not have one that you need (of course, with referral from Primary Care Physician).

The medical group is usually within 45-60 miles of your residence depending on the health carrier.

"tend to have richer benefits"

HMO's typically provide lower copays for office visits, lower deductibles (sometimes no deductible) and much less out of pocket for hospitalization.

This is less true since the ACA law went into effect (2014) for individual/family and Small Business.

NOTE: Since Covered California came to be, there are few if any differences in benefits at a given Metallic level between HMO and PPO.

"cost more in monthly premium"

HMO's used to be much cheaper than PPOs but now that the benefits are standardized, the rates have come up quite a bit.

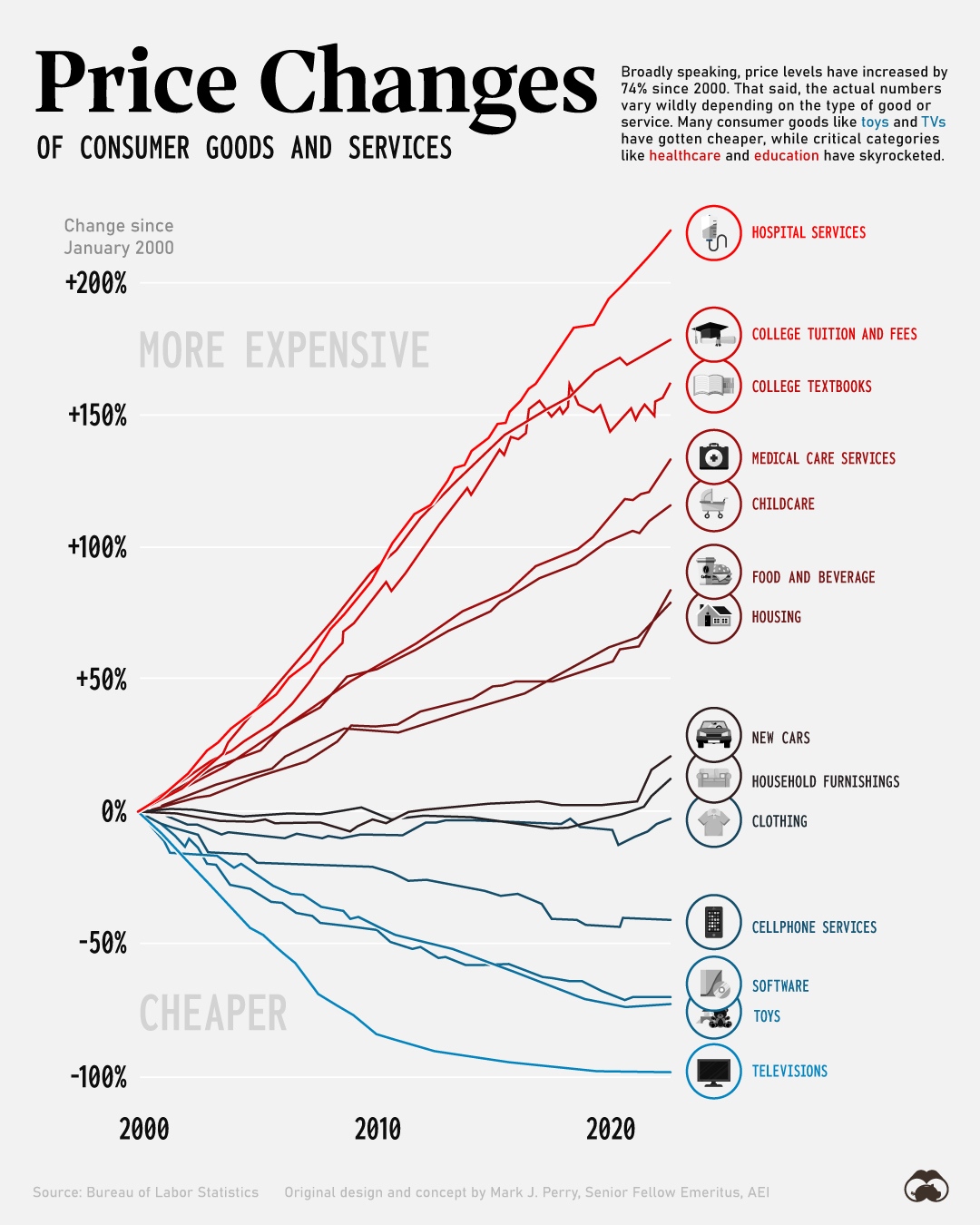

Since the benefits are richer and total medical expenditure has skyrocketed, richer plans are absorbing more of this increase and that gets passed down to you in the form of premiums.

HMO SYNOPSIS...HMO's work for people who would rather pay more over on a

monthly basis but have less out of pocket when a medical injury/illness happens

and can be flexible about the doctors/hospitals they see.

Let Us go through these various points in more detail for PPO.

"more flexible in which doctors you can see and how that happens"

With a PPO plan, you can access any of the in-network PPO providers up and down California.

You do not have a Primary Care Physician and you refer yourself out to specialist. You can even use providers out of State through the Blue Card program (only Anthem's EPO currently has this now. Employer plans will generally have it on PPO plans with Shield or Cross).

You can even see doctors outside the network but you will pay more out of pocket. There are 10's of thousands of doctors up and down the State with the major California health insurance carriers.

UPDATE: The Blue Shield Individual Family PPO plans has not had access to Blue Card since 2019

"tends to cost-share more of the out-of-pocket with you in the form of

deductibles, copays, and co-insurance"

With PPO plans, you are picking up more of the costs when you get sick or hurt.

Copays are higher, deductibles can range from $500 to $5000 and co-insurance usually runs around 30-40% depending on the plan. Some PPO plans such as the HSA Health Savings Account plans apply everything to the main deductible.

This is less true since ACA standardized all plans on individual and small

business level.

"has a wide range of monthly premium amounts depending on the level of

benefits"

PPO's offer many options from traditionally the cheapest California health plans on the market to plans as expensive as the HMO plans. There tends to many different options with varying copays, co-insurance, and most importantly...deductibles.

PPO SYNOPSIS...PPO's work for people who want more flexibility over which

doctors and providers they can see and are willing to pay more when sick or hurt

to obtain this control. PPO's also work for people who just want to cover the

big catastrophic bill and keep their monthly premium down.

So...net net:

- HMO: These days, cheaper coverage but with restrictions on who you can see and what care is approved

- PPO: More expensive but with greater flexibility both in terms of providers and what care is available

Check out our Kaiser versus PPO guide as a prime example of HMO versus PPO!

Now, let's look at HMO versus PPO in the senior market!

HMO versus PPO with Medicare

Medicare supplements are the traditional "PPO-like" plans for seniors while Advantage plans are the new HMO entry for that market.

Very similar contraints and differences like above since the HMO model requires certain restrictions to work.

We have great reviews on how to compare the "HMO versus PPO" natures of these two plans here:

You can quote both of them here and we're happy to help with any questions!

.jpg)

.jpg)

.jpg)