California Medicare Options - Guide and Review to Anthem's California Advantage plans

Insider's Guide to Anthem Medicare Advantage Plans in California

In California, Anthem is a powerhouse across all market segments so the Medicare Advantage market should be no different.

In fact, outside of Kaiser, Anthem is #3 and it's nipping at the heels of #2 (SCAN - see SCAN review).

A recent snapshot:

The enrollment numbers start to drop off quite a bit after Anthem and

we'll explain why that's really important for both pricing and networks

below.

More importantly, we'll dive into Anthem's Advantage offering to figure out the best fit according to our "Triple Threat" approach to selecting an Advantage plan.

Here are the topics we'll cover:

- A quick intro to Anthem's Advantage Plans in California

- Are people

happy with Anthem Advantage plans

- Why is Anthem the top 4 carrier in

California for Advantage plans

- Comparing the different Anthem Advantage

plans

- How to quote Anthem Advantage plans

- How to enroll in Anthem Advantage plans

First, our credentials:

Let's get started!

A quick intro to Anthem's Advantage Plans in California

Anthem is generally known as Anthem Blue Cross of California.

Quick note...it is a separate carrier from Blue Shield of California at the individual level including senior plans like Advantage.

Anthem has a long history in the California market across all market segments and that partially speaks to why it's a top Advantage carrier in terms of enrollment.

Many people will roll over from Covered Ca or employer plans with Anthem directly to Advantage plans with the same carrier.

We'll analyze below whether this makes sense but by being a large carrier, Anthem is able to negotiate for stronger provider networks and this is critical with Advantage plans.

We'll explain more on this below!

This network expertise allows them to offer both HMO and PPO versions of advantage plans which is not true for many other carriers.

They even have SNP plans (Special Need Plans) available in select areas which also shows a certain level of dedication to the model. Again, not true across the board.

Let's cut to the chase...what are enrollees saying about Anthem Advantage plans?

Are people happy with Anthem Advantage plans

For this, we can lean heavily on the Medicare Star Rating which is on a 1-5 scale with 5 stars being best (excellent really).

It's great because the source doesn't come from the carriers so it's a pretty good reflection of how people feel about their plan and/or carrier.

So..how does Anthem size up in California?

A few notes on the Star Rating.

It can vary by region and by actual plan so you really need to run your personalized quote to see how your options compare:

The above quote will show the Star Ratings as reflected by Medicare itself!

The average star rating for Anthem in California is just over 3.7 recently.

The average statewide is around 4.

This isn't the complete story though as Anthem puts it:

For 2022, more than 72% of beneficiaries enrolled in Anthem affiliated health plans are in a plan that received an Overall Star Rating of 4 stars or better from Medicare

This means that Anthem has both some strong plans and maybe some that are not as well regarded.

Remember....it's plan by plan and region by region so it's really important to quote and compare for your particular situation.

In the compare section below, we'll bring up actual quotes from key areas and show how this might happen.

So...with Star Ratings right around average for the state, how is Anthem in the top 3 outside of Kaiser (whole different ballgame)?

Why is Anthem top 4 carrier in California for Advantage plans

First, there's just the Anthem name.

They are one of the oldest and biggest California carriers in health insurance. Point!

Health insurance is still a question of trust and knowing the name from Covered Ca or employer coverage has a lot of pull when you turn 65.

Some of this is warranted as it's hard to be a solid health carrier for decades in a row:

- M. Best (bbb+)

- Standard and Poor’s (A)

- Moody’s (Baa2)

- Fitch (BBB)

With 25 years of experience, we've seen carriers rise and fall as they try to gobble up market share only to eventually plummet back to earth.

Anthem Blue Cross (now Elevance but originally Wellpoint) has been a steady force in the California market since Leonard Schaffer turned the ship around mid '90s.

After all, 47 million members nationwide show some prowess!

On a day-to-day level though, it's probably more about networks. The doctors and hospitals you have access to.

Anthem joins UnitedHealthcare® in terms of network strength and that's a huge deal with HMO (or PPO) plans which make up the core Advantage plan market.

If your doctors work with Anthem Advantage plans, that's going to be a decision maker since we really need to stay in-network to get benefits with HMOs.

Check out our Trade-offs of Advantage plans or How to Compare Advantage and Supplements to learn more.

In terms of plan competitiveness, let's look at actual examples and also introduce their core plans.

Comparing the different Anthem Advantage plans

Okay...let's run some quotes across these key areas:

- Los Angeles (the monster market)

- Bay Area

- San Diego

We'll show you how to run the same quotes for the situation below!

We'll start with Los Angeles...

Here, we can start to see Anthem's strategy.

Their standard Advantage plans are not in the top 10 and it's primarily due to the Star Rating of 3 in LA:

The MediBlue Value Plus and Select both hit 2 of our 3 criteria from the Triple Threat:

- Low or no premium

- Max out of pockets under $1000 (they're at $800)

It's the Star Rating that holds them back.

The differences between the three top choices are subtle and varied.

One will cover a certain benefit stronger while the other will cover another benefit better.

Pharmacy can really vary with Tier 6 not covered on one of the plans. This speaks to why it's really important to enter your doctor and RX info up front in the quote!

Really the differences in the above plans come down to the network (size and depth).

The StartSmart Plus and Value Plus have smaller networks than the Select plan. Their "Caremore" plans which focus more on benefits but with smaller networks.

The StartSmart is Anthem's entry into the "Part B rebate" plan race where they will reimburse money to help cover the Part B premium you pay Social Security every month.

This type of plan is usually in the Top 3 for every carrier and we go through why at our Giveback plans explained.

But remember, the goal of Advantage plans is to provide health insurance!

Remember, the big goal of Medicare plans (Advantage or supplements) is to cover the 20% coinsurance that is uncapped!

Either way, it's a popular option these days as everyone is pushing it. They basically added to the difference to your back end which is pretty easy to hit in today's world.

We're happy to walk through this with you as it's one more wrinkle to consider at help@calhealth.net or via chat: https://calendly.com/dennis-jnw

Now, where Anthem has really embraced the Advantage model is with SNPs.

They offer all three types in our quote example (90023 zip code):

- D-SNPs - people with both Medi-Cal and Medicare

- C-SNPs - people with

chronic diseases

- I-SNPs - people who are in institutional settings (nursing homes, etc.)

We give them props for this! It's a huge undertaking to do this well and Anthem has the know-how and size to do so.

Look what happens when you click "include SNP plans" up top...

3 chronic disease plans (Lung, Heart, Diabetes) and one D-SNP (medicare and medi-cal) jump to the top.

Keep in mind that 22% of Californians are eligible for Dual Plans (called medi medi).

LA County is a big share of this. We even have a full review of Los Angeles Medi Medi. The goal of SNP plans is to coordinate care and offer richer benefits for specific situations (a disease or dual eligibility).

If you're eligible (check with us at help@calhealth.net) this is a definite strength for Anthem. We applaud the embrace!

What about San Jose?

Same with some differences. Remember, every area is different.

We have the Mediblue plus with our preferred premium/max-out-of-pocket mix.

Still 3 stars across the board.

The StartSmart (part B premium rebate) is #2. Again, it's popular since people tend to see saving now at the expense of later and no one's really explaining that to them.

Then there's the coordination plan. A new entry!

This is a plan for Medi-Cal/Medicare who don't meet full "Dual Eligible" status. The whole QMB alphabet soup.

You'll notice the max is super high at $7550 but if you have the correct level of eligibility based on income, the copays should be zero for doctors and hospital care.

If you click on the "Add all Special Need Plans", you'll see the chronic disease plans popup AND the D-SNP plan.

But wait...what's the difference between the D-SNP and the Coordination plan?

D-SNP is for people with full dual eligibility. Coordination is for people who don't meet the full classification of Dual eligible. You can check with your local county office to find out your status.

Important note...changes in this status can give you special enrollment/change periods during the year! Check with us at help@calhealth.net if your status has changed.

Okay...last stop, San Diego.

Top 3:

Okay..so we see some familiar faces.

Select (broader network). Plus (smaller network but with richer copays).

A new addition. Prime!

The Prime has a larger network...that's its real difference (in addition to Essential Extras...little add-on benefits).

Really, it's for people who want a bigger network.

Interestingly, our system isn't bringing up any SNP plans in San Diego (91911 zip code).

Big difference from up North!

Notice that in San Diego, the max out of pockets have come up a lot from say...Los Angeles. At least with Anthem (you can compare all the carriers in a given area through our free quote system).

That makes Advantage plans less compelling than Medicare supplements as we explain in our How to Pick the best Medicare Plan.

It speaks to whether the HMO model is well-fitted to the demographics of the area or maybe just the domination of Kaiser, Scripps, and SHARP down south. You can see all the plans in the quote.

Speaking of which, let's look at your situation?

How to quote Anthem Advantage plans

This is easy.

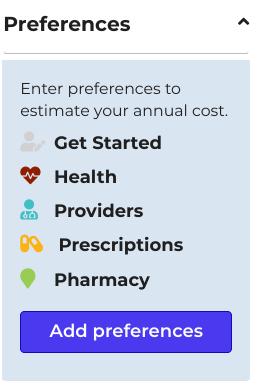

Run your quote here:

Make sure to enter your doctor and medication info. This is really critical to avoid complaint #1 and #2 around Advantage plans!

You can filter for Anthem on the left. You can see all plans (see non-license link up top)...even ones we're not contracted with. It's the right thing to do!

The Star Ratings will show for every plan.

If you're eligible for the SNP plans, you can click on that link up top to show those plans.

It can get difficult to really see the differences even within one carrier like Anthem!

Reach out to us at help@calhealth.net to set up a time to walk through all your questions. There's zero cost for our assistance and our Google reviews show how we try to help people.

We can work with all the major carriers that contract with doctors/hospitals in your area.

Even Medicare supplements (happy to explain the differences).

What about the fun of enrollment?

How to enroll in Anthem Advantage plans

This is super easy with Anthem and most of the major carriers.

The same system above that you use to quote the options will allow you to submit an online application securely for Anthem's plans!

Here's the best part.

At open enrollment each year, you can just update doctors/meds or any other changes and 90% of the work is already done.

Simply quote and enroll/change right from the same system. Even changes in carriers.

No starting all over every...single...year!

For carriers that are not tied into the online enrollment, we can send you over other fast options but Anthem is definitely in the fold which makes sense.

They're one of the top Advantage carriers in California!

Important Disclaimers:

- We do not offer every plan available in your area. The number of organizations and plans available will be specified for your specific quote here. Please contact Medicare. gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

- Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations, exclusions, copays, deductibles, and coinsurance may apply.

- Part B Premium give-back is not available with all plans. Availability varies by carrier and location. Actual Part B premium reduction varies.

- Every year, Medicare evaluates plans based on a 5-star rating system.

- Not affiliated with or endorsed by the government or Federal Medicare Program. Goodacre Insurance Services is an insurance agency not affiliated with the government.