California health insurance - Blue Shield versus Kaiser in California

Kaiser versus Blue Shield of California

In many areas, this is THE title fight!

Kaiser and Blue Shield of California.

This is especially true in areas where Sutter and Dignity Health (the old Catholic Health Care West) are dominant.

There are areas where they are the only real providers available...especially for hospital care.

For certain markets (individual and family including Covered California), that now is a huge factor since Blue Shield signed deals with these providers from 2014 on.

It's less of an issue for Employer coverage and Medicare but Shield and Kaiser still compete aggressively.

Kaiser is the largest carrier in California. Shield is fast approaching #2.

This is a big shift so we need to really understand their strengths and weaknesses when comparing them against each other.

First...some credentials Please!....

Okay....formalities out of the way. Let's get started.

You can always jump to your interested market segment:

Individual

Small and Large Business

Senior

You can run your quote here:

Let's look at a top level comparison of Kaiser and Blue Shield.

Kaiser versus Blue Shield - the Stats!

Before we jump into their very different models, let's look at their footprint in California.

Enrollment comparison:

- Total Market: Kaiser - 6.1M; Blue Shield - 2.4M

- Individual/Family: Kaiser - 607K; Blue Shield - 609K

- Small Business: Kaiser - 712K; Blue Shield - 419K

- Large Group: Kaiser - 4.8M; Blue Shield - 1.4M

Aside from Large group (100+ employees), you can see that both carriers are very popular and place #1 and #2 in the main categories.

We'll go into why this is true for each market segment since it's different for each one but a quick comparison for these categories:

- Pricing

- Network

- Patient control/Flexibility

These are really things that differ now since the plans are standardized in most markets.

That's right!

For individual/family (including Covered Ca), Small Business, and Medicare...the plan benefits are standardized!

A silver plan is a silver plan now....whether Kaiser or Blue Shield.

Small Group might have small variations within a level but by definition the plans can't differ by more than 2% in terms of core benefit exposure.

So let's look at what really matters starting with pricing.

Pricing Comparison of Kaiser and Blue Shield

Kaiser is going to be hard to beat here.

That's true versus all the carriers including Blue Shield.

You will see differences based on market segment but on average, Kaiser might offer a 20%+ discount against PPO plans and single-digit against Blue Shield HMO's.

That being said, Shield has some narrow network HMO options which are competitive now.

Health rates are really driven by age, area, and plan selection.

It's important to run your specific quote based on that info to see if Kaiser or Blue Shield is priced best.

We'll talk about network next but this really affects the pricing comparison.

- Kaiser is all HMO and HMO plans are generally cheaper.

- Blue Shield offers HMO and PPO.

The price difference is really a function of this network difference more than the carriers themselves.

So let's jump into the network models for these two competitors.

Kaiser versus Blue Shield Networks

This is the heart of the difference between the two carriers.

It all comes to which doctors and hospitals you can use.

And...

How you use them!

Let's look at each carrier, how it works, and what effect that has on pricing and you.

Kaiser Networks

Kaiser is an HMO. It may have been the first HMO.

They invented the model.

They also took it an entirely different direction than all other HMO's.

They bought (and then built) the hospitals and they hired the doctors.

- The carrier insures and provides care to members

- Their approach has proven to be very cost effective to date

So...what does this mean for members?

Some aspects flow from being an HMO while others flow from Kaiser's unique take on the model (owning the care providers themselves).

Let's look at the tradeoffs to their network solution.

Kaiser network Pros and Cons:

Pro's:

- Pricing!

- Everything at one shop

- Integrated Medical Records and Coordinated Care

- State of Art Facilities in certain areas

Con's

- Must use Kaiser providers

- Care is more "managed"

Let's dig into this and we'll look at how Blue Shield is different.

As we mentioned, a net result of Kaiser's structure is pricing that's really

hard to beat.

Some of the narrow network HMO's from Shield compete but Kaiser is usually the pricing leader in a given area.

Everything at one stop

With Kaiser, many members like the fact that everything is in one location. They don't have to bounce from doctor to doctor.

Tied in with this is the fact that Kaiser is able to coordinate health care among different doctors, labs, etc.

To round this out, a person's health history and notes are all centralized.

Everyone has access to them.

Anyone who has had a more significant health issue understands how important this is.

When a doctor can pull up a lab or prescription history and jump right in, it's a big deal.

So those are the positives of what Kaiser has created.

What about negatives?

Negatives to Kaiser's Model

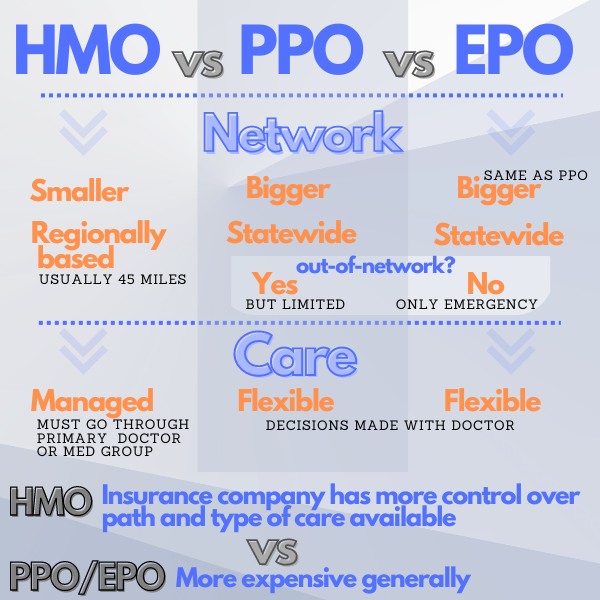

Okay...Kaiser is an HMO. Health Maintenance Organization.

HMO's traditionally are cheaper but there are some downsides.

With an HMO, the insurer and provider (Kaiser is both in our situation) have a financial incentive to manage care.

There's no other way to put it. We can couch it in other language to make it sound better but let's break things down and be direct.

Essentially, an HMO will attempt to find the most cost effective way to address a medical issue.

Many times, this results in the same approach as a non-HMO situation.

But not always.

The key word there is "cost effective".

Let's look a real world example (actually happened with a client).

Let's say someone has severe knee pain. Very common these days (30 years of basketball is not helping my situation).

If the knee pain is significant and the result of loss of "padding" menisicus, etc, there are different paths to take.

They may involve anti-inflamation pain medications, physical therapy, orthoscopic surgery, all the way up to full-knee replacement.

An HMO is likely to to try less intrusive (and less expensive) options first.

Sometimes, that's actually better!

There's an argument that doctors are too quick to jump to surgery. We see it all the time (think prostate surgeries).

BUT (always a but)

There are situations where an HMO might be too slow to move to a course of treatment that is needed or will not go there at all.

Keep in mind that procedures have to be approved by an HMO. They can say no.

99 times out of 100, they're on the same page.

Where we see issues with clients if a person has a more serious issue that involved, complicated, or requires specialists!

Cancer comes to mind.

- With Kaiser, you'll generally have to stay within their network.

- There may a great doctor who specializes in your ailment (or type of cancer) outside of the network.

- This illustrates the two biggest drawbacks to HMO's and Kaiser

Less control over what is done and who does it.

Medications is another key area where this "management" will definitely come into play.

What about Blue Shield of California?

Let's look at their pro's and con's and then we'll jump into the individual market segments.

Blue Shield of California Pros and Cons

Let's look at the contender...Blue Shield.

Blue Shield offers a range of networks including PPO and HMO.

We'll actually break up the Pro's and Con's into PPO and HMO sections since they're so different.

HMO with Blue Shield

Pro's:

- Blue Shield contracts with independent hospitals, medical groups, and doctors

- Pricing is lower than PPO but probably higher than Kaiser except for narrow network HMO's

Con's (same issues with Kaiser for HMO's):

- Less flexibility and control

- Must stay within HMO network

- Cost constraint in health care decisions

So Blue Shield's big difference for HMO versus Kaiser is that they contract with independent hospitals, doctors, and medical groups.

If you have an existing relationship with a doctor in their network, this is a big deal.

Maybe THE deal!

Let's look at the PPO with Blue Shield (Kaiser doesn't really have a PPO)

PPO with Blue Shield

PRO's:

- Much larger network of independent doctors, hospitals, and providers

- You refer yourself to specialists

- You and doctor have more say as to what medical care is provided

- You're not locked into an area and can access providers in other States as part of the Blue Card network

UPDATE: The Blue Shield Individual Family PPO plans does not have access to Blue Card (see BCBS providers in other states) since 2019

CON's:

- Pricing. That's about it. PPO's are generally more expensive.

So what's more important to you when comparing the two networks?

It partially comes down to your area.

Do you have great Kaiser facilities?

- Are the Blue Shield contracted providers dominant in your area?

- Is more control over health care decisions with your doctor important to you?

- Important enough to pay more?

All great questions and sometimes complicated.

We can help you walk through your situation. Our services are 100% free to you.

You can always run your Quote free here:

Let's jump into the 3 separate markets as there are differences in each between the two carriers.

Here are the market segments:

Individual and Family (including Covered California)

Small Business (1-100 employee)

Senior (Medicare eligible)

Individual and Family - Kaiser versus Blue Shield of California

This is the market that is in flux since 2014.

Kaiser and Blue Shield have fully embraced all the changes and Covered California.

In fact, they're the two biggest carriers by marketshare for this segment since 2014!

This includes Covered California business.

Keep in mind that the options are the same in Covered California as off-exchange.

Same plans. Same rates. Same networks.

By law.

Covered Ca just provides a tax credit (if eligible) that can be used towards Blue Shield or Kaiser's plans equally.

With this, we can compare the two carriers on level ground.

So...how do they compare?

Let's look at the core components we use to compare the two plans.

Individual Family Pricing

Kaiser's hard to beat.

In any given area, they're going to beat Blue Shield's plans most of the time.

There are places where Shield is priced better but it's rare.

Blue Shield doesn't have narrow network options available on the individual/family market like they do on the group market.

There's one PPO network and one HMO network.

The pricing reflects that.

Kaiser on the other hand will have HMO as their primary if only available plan.

HMO is usually cheaper than PPO plans since the benefits are standardized.

That brings up an interesting point.

The plan benefits have to match.

A silver plan has to match benefits against another silver plan +/- 2%.

This is also true if we're comparing a Kaiser Silver plan versus a Blue Shield Silver plan.

The first step is to run your individual/family quote here:

This quote can include tax credits based on income and head of household (make sure to select "on-exchange" in the quote.

We're happy to walk through your situation to see what you're eligible for.

If Kaiser is available in your area, it's common to see their rate 10-20% under Blue Shield's comparable HMO plan and 20-30% under the PPO rate.

Individual and Family Network

As we mentioned in the top level comparison between Kaiser and Blue Shield, this is really the big difference (aside from price).

With Kaiser, you will need to use Kaiser facilities exclusively.

With Blue Shield, you can use independent hospitals and doctors that contract with Shield under HMO or PPO models.

So it comes down to this...

Do you want to see doctors outside of Kaiser or do you want to use Kaiser facilities?

That's the question aside from pricing.

Of course, there's the question of how HMO's work themselves.

- If you want more control over healthcare decisions and more flexibility for where and what is the course of treatment, that favors PPO

- HMO is more "managed". There is a cost-constraint for course of care

You can get a great explanation between HMO and PPO.

PPO will allow more choice and flexibility. You're not locked into an area. Decisions are generally made between you and your doctor although there are more pre-authorizations needed these days.

You can search doctors and facilities right through the quote here

Under any plan, you'll see a link for Provider.

Net net...think of your local area and which hospitals and/or medical groups are highly regarded.

If you have both, that's great news!

Individual and Family Customer Service

Let's look at Blue Shield and Kaiser in terms of the user's experience.

Just a forewarning...

Your take on the HMO and PPO way of doing things may affect this.

Kaiser Strengths:

- Integrated medical records and one stop shop

- Strong online account services

- Access to records easily

- Pretty streamlined billing and claims process

Kaiser Weaknesses:

- Slower process through medical care options

- Services can be delayed or denied (it is an HMO)

- Medications can be changed according to sitewide purchasing

So basically, Kaiser has the mechanics down pretty good (claims, records, appointments, billing, etc).

The issues are with the HMO model itself.

You may have to push to get certain labs done or enter into a course of treatment.

That process can be frustrating if you're in the middle of a health issue.

Read above about HMO versus PPO!

What about Blue Shield?

Blue Shield Strengths:

- Claims process is pretty streamlined considering multiple providers

- Online accounts are good and went through a recent upgrade.

- Claims process works well although mental health needs better integration

Blue Shield Weaknesses:

- Blue Shield is updating billing system which is desperately needed. Billing and membership were two separate systems and headaches abounded when they grew very quickly

- More expensive than Kaiser in many areas

We're happy to walk through these two carriers with you.

The best approach is to first run your quote between the two to see how rates compare here.

Our services are free to you at 800-320-6269 or by

email.

Employer Health Plans - Kaiser and Blue Shield Comparison

We run dozens of group health quotes daily.

We first quote across all the major carriers at the most popular plan level (Silver).

Since the plans are standardized, this gives us a good indication of pricing.

These days, Kaiser usually leads with their HMO plans and Shield leads with the full PPO network.

That makes this comparison very important.

Add to that the strength in certain areas (Bay Area and Sacramento for example) of these carriers and you have further reason to compare.

We discussed in the first section how the HMO model of Kaiser compares with Blue Shield but let's get more specific to the group health market.

We'll also discuss the benefits of offering BOTH of them to your employees.

Blue Shield and Kaiser Group health Networks

First, we have to talk about networks (doctors and facilities) since the employer market has different options than individual/family now.

Better options!

Blue Shield Employer Networks

Kaiser is Kaiser so that's easy but Blue Shield has a range of network options available.

First, the full PPO employers networks are about 1/3rd bigger than the individual/family (Covered California) networks.

It's the "old" PPO network and includes most doctors/hospitals in most areas.

This is a big deal since many good doctors are not in the individual/family networks now.

There are also narrow networks available to bring down the cost within Shield.

- For the Blue Shield employer HMO networks, we also have a full HMO network and some narrow network options to bring down costs

- Some of the narrow network HMO Shield plans actually compete with Kaiser in terms of pricing

When you request your employer group quote below, we can provide detail on the networks.

Here's the deal.

If you're in a strong Kaiser area, you're likely to have some employees with lifelong Kaiser participation and some employees with equally important independent doctor relationships.

It's tough to please everyone with just one option.

Luckily, we don't have to!

I'll take a Wrap please!

Blue Shield and Kaiser "Wrap"

We can discuss this option further, but here are the broad strokes.

Kaiser Wrap Bullet Points

- We offer choice of Kaiser and Blue Shield plans to each employee

- We cap the employer's contribution based on a given plan (usually Kaiser)

- Employee picks plan that meets their budgetary and health care needs

- Employer still pays as if they were on the delegated plan regardless

Employee has choice and power! Employer has control over cost.

If Kaiser's in the mix, this is the BEST way to address employer health plans!

Since Kaiser is priced much better usually, there's a cost incentive for people to go that way

BUT

They can go with Shield to keep their doctors and pay the difference.

This tends to put downward pressure on health plan costs to the employer.

You can request your Kaiser Blue Shield wrap below or ask us any questions on how it works.

Medicare Supplement - Kaiser and Blue Shield

For Seniors, Kaiser and Blue Shield are very popular now.

It generally comes down to what carrier the person had before turning 65 or becoming Medicare eligible.

- If they've been with Kaiser for 10 years, they'll probably get Kaiser for an Advantage plan.

- If they use out of Kaiser networks, they'll probably look at Blue Shield.

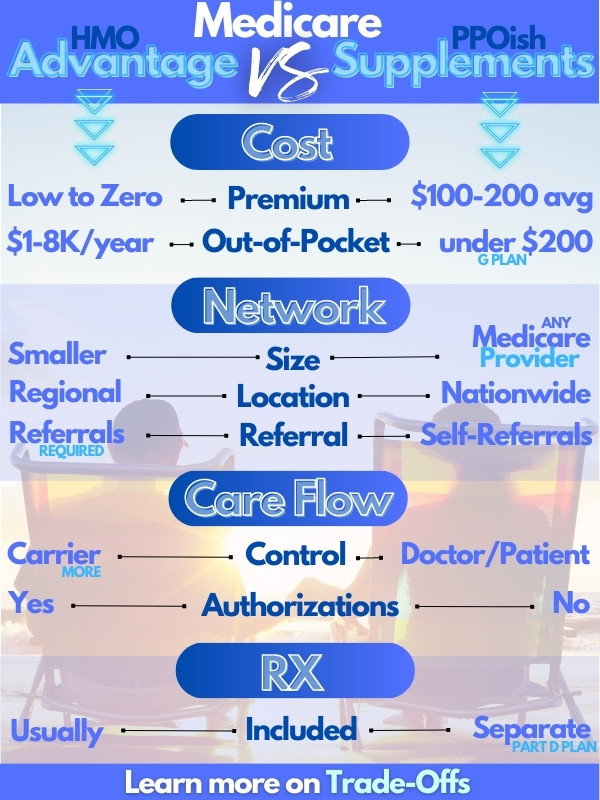

There's also the question of Supplement versus Advantage plans.

We have great guides on the Trade-off between Advantage plans and Supplements or how To pick the best medicare plan.

Supplement versus Advantage plans - The Kaiser - Blue Shield difference

If you want a true Medicare supplement, Blue Shield is now one of the best priced options there.

They even beat UnitedHealthcare® many times.

The Advantage plan versus Supplements is really the first question since Kaiser is an HMO carrier. Shield has both Supplements AND Advantage plans.

You can quote both types of plans here (we'll send link for doctor/RX and "opt-in" required by law to quote Advantage plans):

You can get more info on how supplements are different from Advantage plans.

Supplement Deciding Factor

Since benefits are standardized with supplements, that's really a question of pricing and Blue Shield is dominating there.

Advantage plan Deciding Factor

For Advantage plans, it's a question of who want to see - Kaiser providers or independent doctors/medical groups.

You can quote both options and both carriers below but we're happy to help with any questions.

Kaiser versus Blue Shield Comparison Final Notes!

We've discussed the two very different models for these carriers.

It comes down to Pricing versus Choice of Doctor/Hospital

- In any given segment (except group health where we can offer both side by side), if you want to use Kaiser facilities, it's Kaiser.

- If you want to use independent doctors/hospitals, it's Blue Shield.

The second consideration is HMO versus PPO.

Very different ways of operating to the end user.

We're happy to walk through any questions you have comparing these two leaders. Check out our Google Reviews!

Both are non-profit (which is interesting) and both have strengths and weaknesses.

Hopefully, we've spelled out what's important to consider when comparing the two!

Call us at 800-320-6269 and we can go through any questions or run your instant Quote for Kaiser and Blue Shield including Covered Ca individual and family here. Thanks!

.jpg)

.jpg)

.jpg)

.jpg)