California Medicare Options - When can I change medigap plans?

When Can I Switch Medigap Plans?

You're in luck on this in California.

There are certain times when we can change medigap plans regardless of health but in California, we have an ace up our sleeves!

It's called the birthday rule and we'll show how to use it and which changes it applies to.

We've looked at the F versus the G plan and even the J versus the G plan at how people may be paying millions extra total across California.

To get nothing back! We'll look at how to compare your plan with what's out there and most importantly, get the best rate on the market.

Here are the topics we'll cover:

- When can I switch Medigap plans

- How to use the Birthday rule to

switch medigap plans

- What medigap plans qualify for a switch

- Getting the most out of your medigap switch

- How to quote and enroll in a new medigap plan

Let's get started!

When can I switch Medigap plans?

Technically, we can request a change of medigap plans anytime of the year!

The effective date will always be the first of the month following application submittal.

Medigap plans do not have an open enrollment period like Advantage plans during which you have to make changes.

Once we get outside of open enrollment periods (new Part B, loss of group coverage, move, etc..), changes are then subject to health underwriting.

That means we need to be approved by the carrier for the new medigap plan.

So...what does this really look like?

It's actually not bad. We get people approved all the time with all types of healthcare issues.

The underwriting is generally more concerned with pretty significant situations. We'll see questions on hospital stays, serious health issues, etc.

Reach out to us at help@calhealth.net to get a copy of the medigap application. You'll be able to look at the health questionnaire directly if we're not eligible for guaranteed issue.

One note...even a "yes" answer to the health history questions doesn't mean you'll be declined!

There's no downside to applying for coverage. No application fee. It doesn't affect your existing coverage.

Worst case, they say "no" and then we look at our secret weapon!

How to use the Birthday rule to switch medigap plans

Occasionally, California gets it right!

This is one of those cases!

In California, you're able to change medigap plans around your birthday to a plan with the same or lesser benefits.

We can even move between carriers with this rule. It's a big

deal!

So, what are the most common uses of the Birthday Rule?

Here's what we see usually:

- Move from F to the G plan

- Move from the J to the G plan

- Move between carriers for either F or G plan

Some people also move from the G to the N plan (verified with Shield that they will allow this).

Occasionally, we'll see people move from the G to the G high deductible or different plans to the A plan.

By far, the biggest volume is switching to the G and within carriers for the G plan.

We looked at why at our Should I switch from the F to the G plan.

The savings were around $500/year with no downside! Again, this is just like burning money and millions of seniors are doing it because no one (their carrier or broker) explained to them what's going on.

We've made it our mission to help seniors explore all the options available to them and here are our credentials:

So..are there certain switches we can't make?

What medigap plans qualify for a switch

If we're in good health, we can switch to any medigap plan. Up or down.

The F and J plan are no longer available to new enrollees but an F plan member can switch to the F plan with another carrier.

Otherwise, the trajectory is pretty clear with the standard plants in terms of a "lesser" plan for the Birthday Rule.

Here's what we usually see:

J to G plan switch

F to G plan switch

G to G high deductible

G to A plan

G to N plan

There's some confusion on the market around a G to N plan switch. We reached out and verified with Shield directly that's it's allowed with them.

This is very confusing to many people and to be honest, I'm not sure how to justify why it wouldn't be subject to the Bday rule since the N plan doesn't cover Excess.

It feels more like protecting these new plans as new "pools" from unhealthy people joining.

Just our 2 cents based on about 25+ years of experience!

Reach out to us at

help@calhealth.net with:

- Your current plan, carrier, rate

- Date of birth and zip code

- Desired plan (or we can run the quote for you)

We'll check the market to see who is priced best and note

anything else you can use for the comparison.

Speaking of which, let's look at strategy.

Getting the most out of your medigap switch

Comparing medigap plans, there are two main considerations since the networks are identical and benefits are standardized (a G plan is a G plan).

So...

We need to compare the annual premium difference versus what we're giving up with any downgrade in medigap coverage.

For example, the F to the G plan switch means losing the Part B deductible (around $240+/year).

That's easy! We can then look at our premium difference and we know worse case what to expect (annual premium difference minus current part B deductible).

Again, we can do this for you!

The G to N plan is a little more involved (see our G versus N plan comparison).

We also looked at the J versus G plan.

It's probably best to use our free assistance and 25+ years of experience to really compare these options and save hours (we do this everyday).

Now, between carriers that's easy.

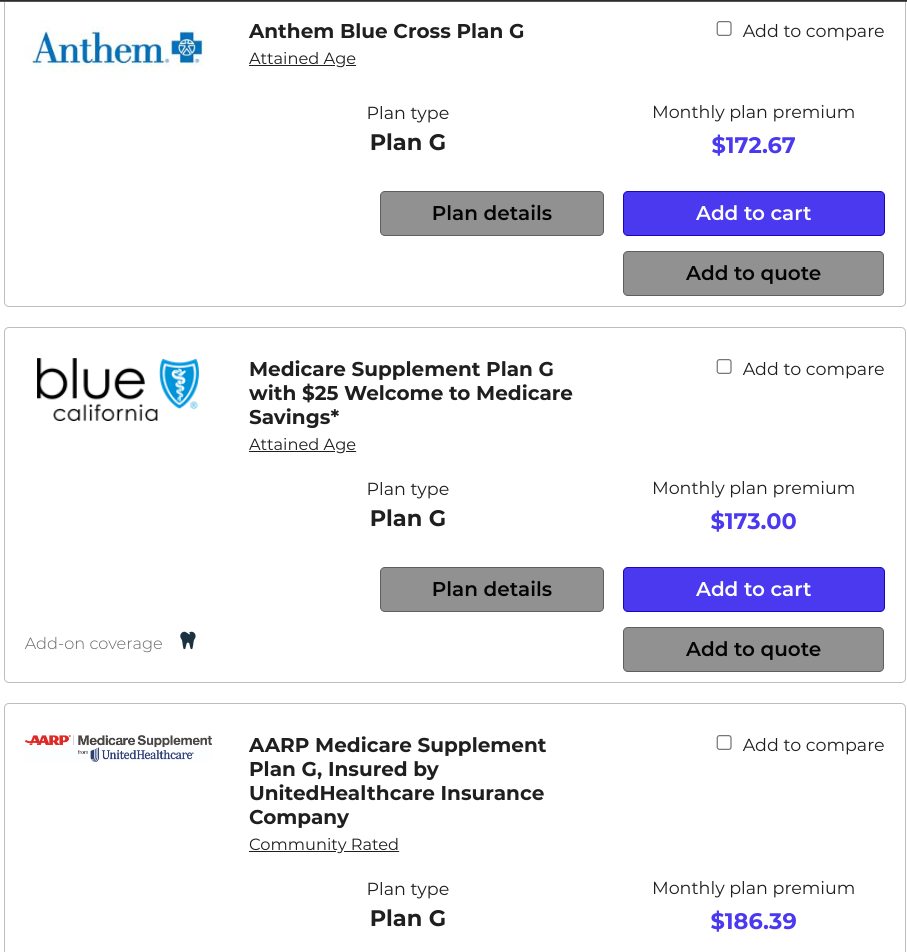

Look at this example from Los Angeles, age 65 for the G plan:

Goodness...those are all the same basic plan! Same network.

1000's seniors are way over-paying for their medigap plan. Maybe for years. Decades even!

Even worse, the best-priced carrier for a given plan at age 65 when we sign up may not be at age 70. Or 75.

You have to re-check it or reach out to us and let us do the hard work. There's zero cost for our assistance.

Check out our review on whether medigap plans cost more as we get older and we give actual examples showing how the best value can really change with time.

Finally...what about your rates?

How to quote and enroll in a new medigap plan

We make this easy.

Run your quote here:

We work with all the major carriers:

You can compare plans and rates across the medigap plans and

we're happy to help with any questions that come up.

Enrollment can be done online or via paper app and we'll send you everything you need and even help with the application process itself.

Part D (for medication) is not affected by switching medigap plans. They're two separate plans and your Part D will continue as is even if you change medigap.

We can also send Part D quote access if you're newly enrolling or coming up on Open Enrollment soon. Learn how to Save on Part D as well.

IIn the meantime, there's the potential to save $100's per year on switching to medigap but make sure you understand what we're giving up.

If the broker or carrier seems super excited about the change, take a step back and get free assistance.