California Medicare Options - Compare F versus G medigap plan

G Medigap versus F plan - The California Showdown

If you look at the breakdown, there are still more Californians

on the F plan than the G plan.

This is insane!

We are talking about 1000's of members and millions of dollars being shipped off to the carriers.

Literally lighting money on fire and we'll explain why below with actual examples.

It's our mission to educate people on the F plan still about this comparison.

Here's our credentials:

Here are the topics we'll cover:

- F versus G medigap plan - the core differences

- How to compare F

versus G plan costs

- Can I switch from the F plan to the G plan?

- How to quote F and G plan rates in my area

- Using the Birthday rule to switch from F to G plan

Let's get started!

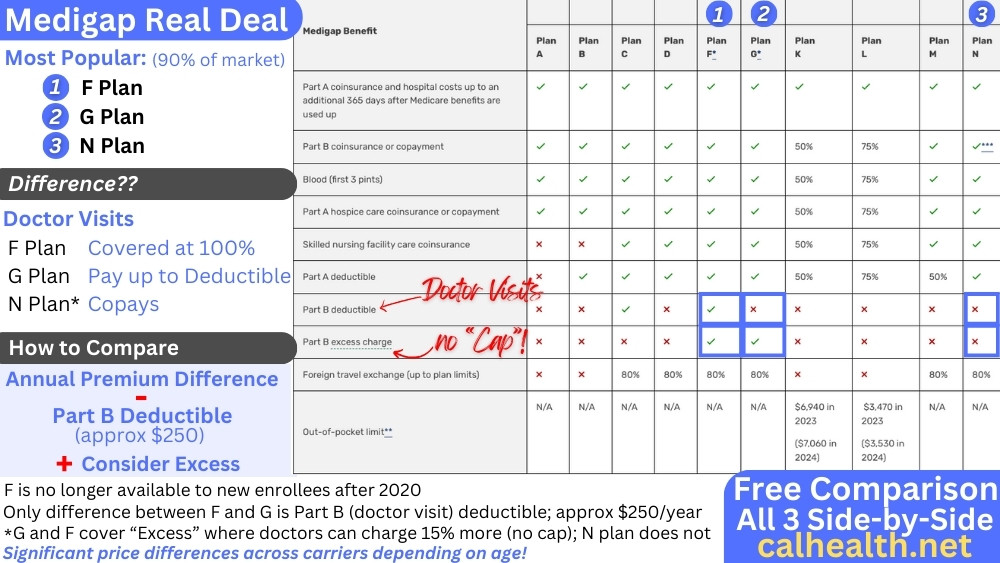

F versus G medigap plan - the core differences

The F plan was discontinued for new enrollees starting in 2020. Members who were already enrolled were able to keep their plan and millions did!

After all, it was the richest medigap plan available till 2020.

As for the comparison with the G plan, this is actually a pretty simple comparison.

There's only one real difference!

First, here's the general chart:

You'll notice one difference:

Part B deductible

This is the annual amount you'll pay for doctor visits before the plan kicks in at 100% (using Medicare doctors).

It's right around $240/year and it goes up a little each year to match inflation rates (CPI).

So...we can think of it as roughly $20/month in difference.

Otherwise, they cover all the big holes of Medicare:

- Part A deductible

- Part A and B coinsurance (the real risk of

Medicare by itself)

- Medicare Excess - so important since there's no

cap. Learn more here.

- Travel medical

It's just the doctor's (and not the hospital's) deductible.

So...what are we paying to protect from this $240+ per year?

Get ready to get angry (if you're on the F plan).

How to compare F versus G plan costs

We're looking at roughly $240/year benefit difference between the two.

What about the premium difference

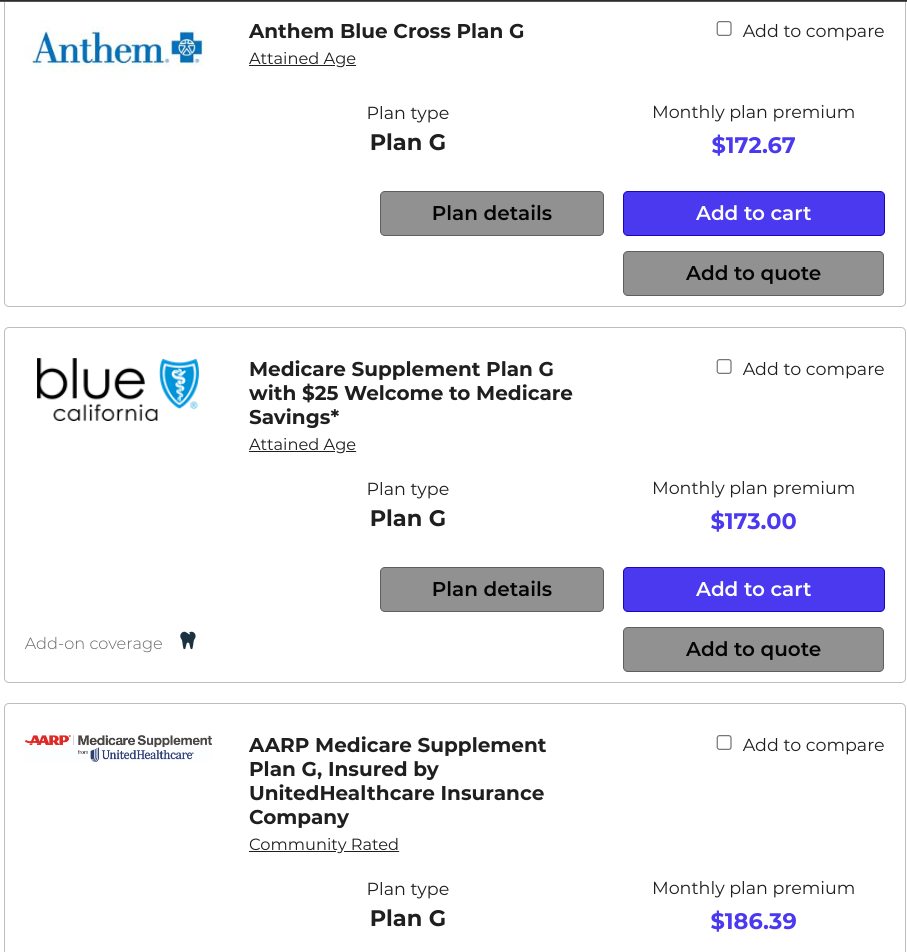

Let's run a sample quote!

Los Angeles; age 70 (assume been on F plan four for roughly 5 years).

First the G plan (the Shield rate is really $198 since the person is past the first year $25/discount):

So Anthem is priced best for the big carriers at $172.

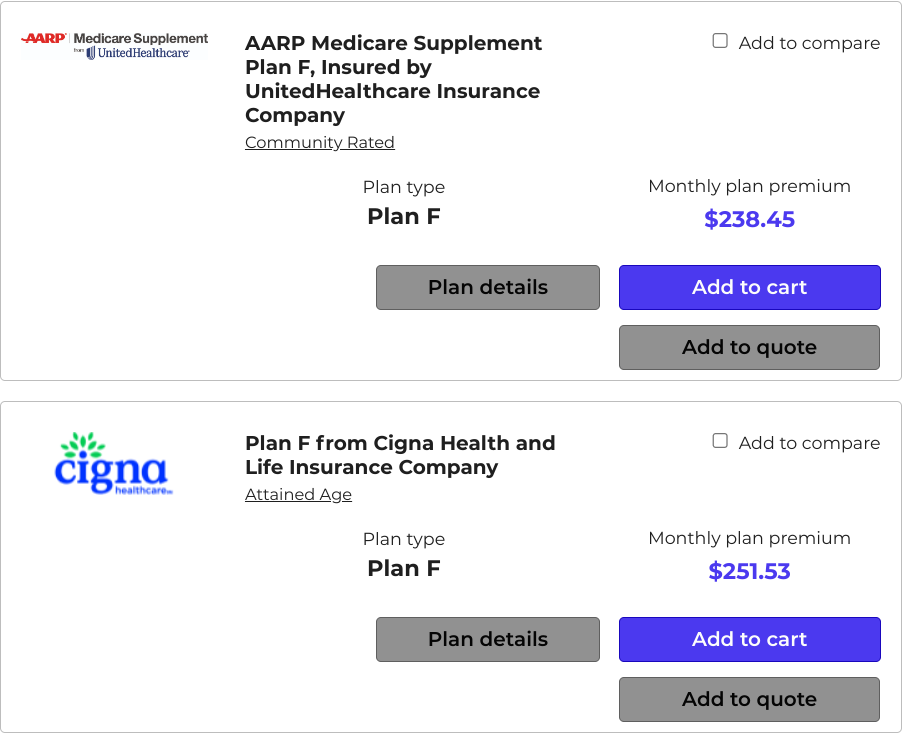

And the F plan?

UnitedHealth (AARP) comes in best at $238.

So...$270 versus roughly $240 or $70/month.

That's over $800/year!

And our worst case risk from going to the G plan? The Part B deductible of $240.

So...worst case, we're taking over $500/year and lighting it on fire!

See why we're on a mission to help people understand what's going on.

Now multiply this by 100's of thousands of Californians.

Millions of dollars are literally being flushed down the toilet and ending up on carrier's profit line.

We're happy to run your specific quote with date of birth, zip code, and current carrier/rate at help@calhealth.net

What can be done if the smell of burning money is starting to irritate you?

Can I switch from the F plan to the G plan?

Yes!

There are two different approaches.

We can apply for a G plan at any time of the year from any carrier. We work with the biggest:

If you're on an F plan, we're probably outside our open

enrollment window (check with us) so the carriers can decline based on

health.

We still see most people get approved unless their health is really impaired.

If declined, worst case we wait for your birthday and use the Birthday Rule in California:

About 2 months before your birthday, touch base with us and

we'll guide you through the process.

Essentially, we're able to move a plan with the same or lesser benefits around our birthday.

This would definitely take into account a move from the F plan to the G plan.

Worst case, you should definitely check to see if you're on the best F plan if you want to stay there (but why???).

It's the same or lesser benefits and we can even change carriers with this rule!

So...how to check your rates?

How to quote F and G plan rates in my area

The above example was only a sample. Rates for G versus F medigap plans are based on area and age.

The savings between the G and F plan may even be more than what's shown above if you're older.

You can run your quote right away here:

We're happy to quote for you and we'll even provide a complete

breakdown and comparison of your rate difference versus benefit

difference while finding the best rate within both the G and F plan.

Let us get to work for you...there's the cost for our assistance!

We have access to online or paper applications so let us know how we can help!

One final reminder on our golden ticket in case we have health issues.

Using the Birthday rule to switch from F to G plan

If we get declined the switch from the new carrier, we just need to wait till our birthday comes around in California.

We'll use the Birthday Rule.

Officially, it starts 2 months before the 1st of the month your birthday is in and ends 2 months from your birthday.

The effective date can be as early as the 1st of the month your birthday is in but will always be after the application is submitted.

So for example, if our birthday is March 15th, we can submit from Jan 1st (2 months prior to March 1st) till roughly May 15th (60 days officially).

If you enroll on Jan 1st, your effective date would be March 1st in this situation!

Again, this is only if we can't qualify based on health and we see many applications go through even with health issues.

Your Part D (for medication) will not be impacted by the F to G plan change even if to a different carrier.

Of course, lean on us the whole way through the process!

That's

what we're here for.