California Medicare Options - Compare N and G medigap plan

Comparing the N versus the G plan

On the surface, this is a pretty simple comparison.

We're actually going to go the extra mile and actually look at how to really evaluate which one might come out the best in terms of cost to benefit.

We'll also touch on one really big difference that most brokers and carriers seem to forget to bring up.

Medicare Excess!

We'll cover these topics in our comparison:

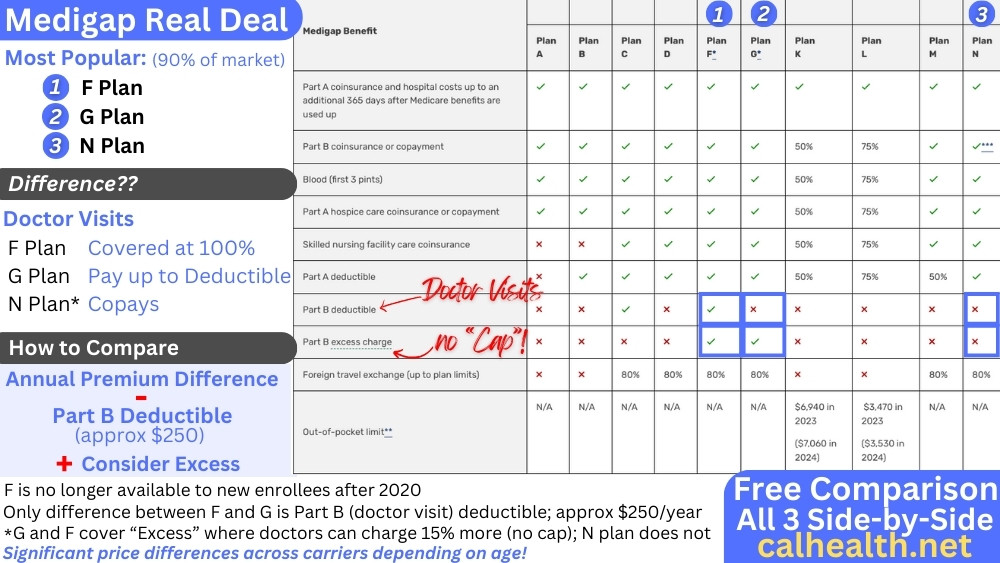

- What's the difference between the G and N plan

- The Medicare Excess

difference between G and N plans

- Comparing the cost difference to

benefits with G versus N plans

- How to quote G versus N

- Can I change

between the G and N plans?

- How to enroll in the G or N plan

Before we start, our credentials:

Let's get started!

What's the difference between the G and N plan

Let's quickly get a lay of the land in terms of what both cover.

Both the G and N plan cover:

- 20% coinsurance

- Part A deductible (the big one for hospitals)

- Miscellaneous benefits for blood, hospice, preventative, etc

Here's the basic chart:

So...two areas stand out with the N versus G plan.

- Office copays (and urgent care)

- Medicare Excess

The first one is pretty easy and that's where most people focus.

The G plan essentially has the Part B deductible before office copays are paid at 100%

This amount is around $240/year and goes up a bit with inflation.

The N plan takes a different route and applies copays that you'll pay for office visits and urgent care.

- $20 for office visits

- $50 for urgent care

That's easy enough.

It's the other piece that seems to be missing from the conversation so let's go there.

The Medicare Excess difference between G and N plans

Most seniors are unfamiliar to Medicare Excess. It's not something we run into with pre-65 plans.

Essentially, there's a provision in Medicare where a provider can charge up to 15% more than what Medicare allows and still be considered "in-network".

Here's the issue...there's no cap to this 15%!

A $10K bill may result in you paying $1500.

We have a big review on Medicare Excess but it's a main reason the G plan is the most popular medigap plan.

How common is it that doctors would charge this extra amount?

It's really hard to get a good estimate and we've reached out to CMS, local California agencies.

Nada.

The rough estimate is 4% nationwide but we're guessing it's closer to double that in California since our costs of operating a doctor practice is so much higher.

Couple that with the fact that doctors got slammed by the ACA (as opposed to hospitals and pharma) since 2014 in terms of reimbursement and more and more people are Medicare eligible.

Just look at the trajectory!

You're likely to see the better doctors start to charge this Excess

going forward in California.

Unfortunately.

Okay...those are the two differences in the G versus the N plan.

We have a giant guide to the N medigap plan and a review of why the G is the most popular.

Obviously, there's a cost difference! Let's go there now.

Comparing the cost difference to benefits with G versus N plans

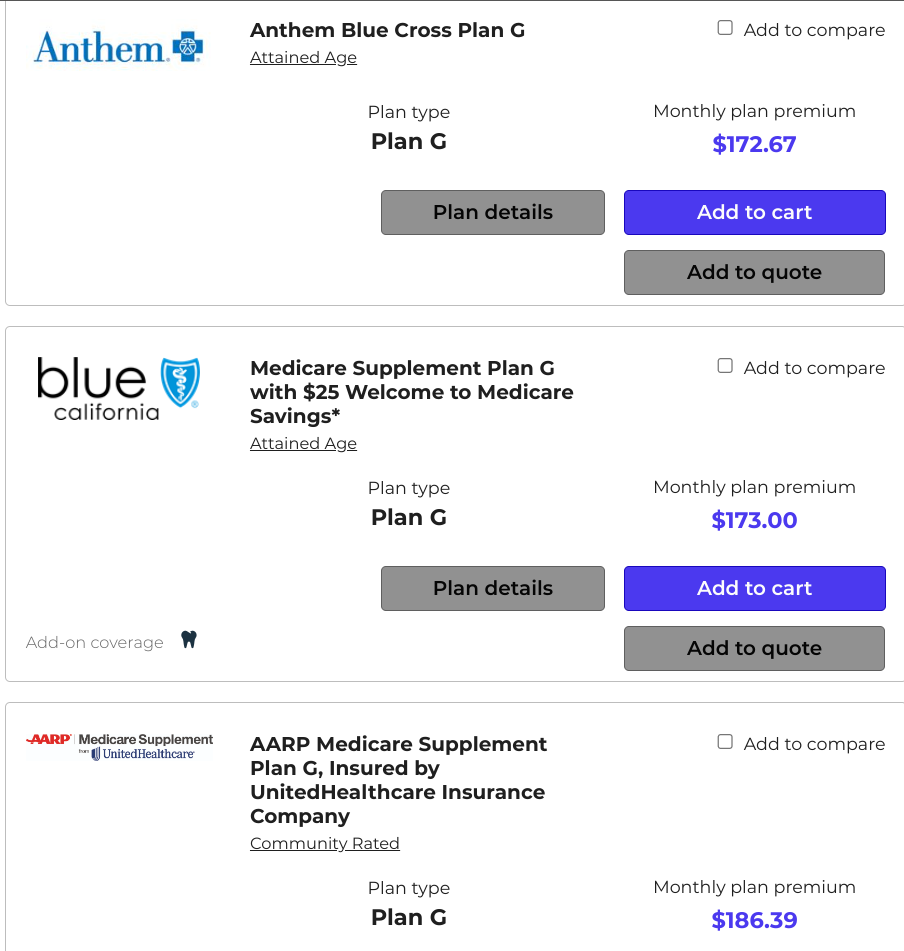

Let's look at Los Angeles (one of the most expensive), age 65.

First, the G plan:

Okay..so around $170/month for Anthem. UnitedHealthcare®, Blue Shield, and Anthem Blue Cross tend to be the top carriers for the G plan.

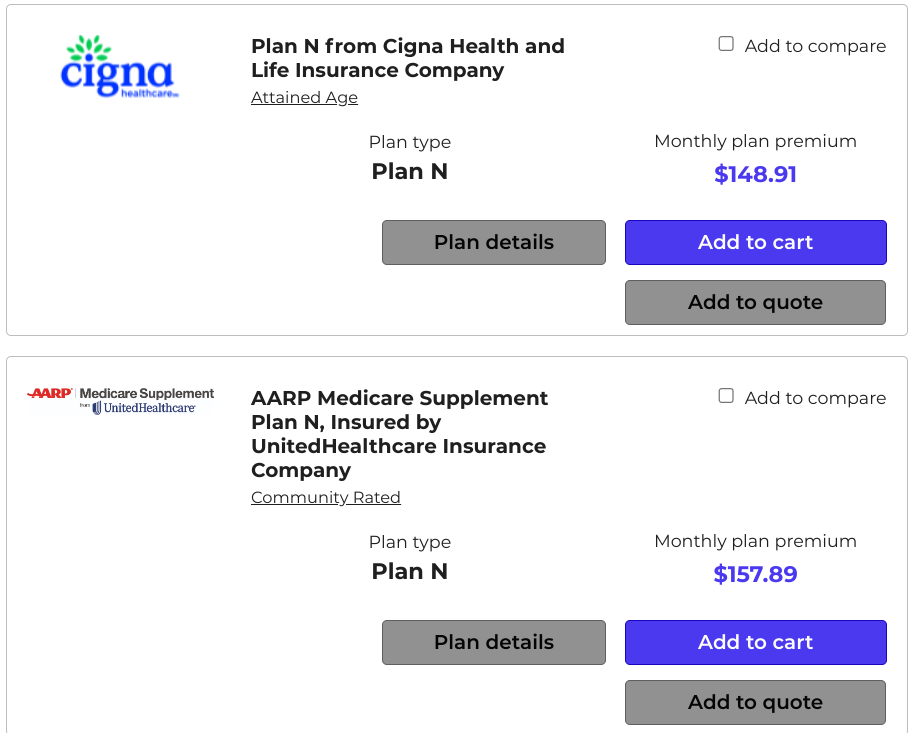

And the N plan?

Cigna at around $150/month.

So roughly $20/month difference at age 65.

$240/year . Interesting...that's just about what the Part B deductible is that we'll with the G plan.

So...in terms of office visits, up till around 12 visits per year (not including preventative), the N plan has a slight advantage.

That price advantage decreases with every office visit. How many do you expect over an average year?

What about the Excess piece.

That's tricky. If we use doctors who don't charge it, there's no impact with the N plan.

If however, that anesthesiologist happens to charge Excess during a procedure and the bill is $1000, that's $150 extra we'll pay with the N plan.

It's usually the ancillary doctors that get us with this. Similar to pre-65 with PPO plans where a side doctor is out-of-network even if we checked on the main doctor.

Again, our biggest issue is that the Excess charge has no cap. It's hard to really put a "cost" to that in our comparison.

We're happy to run numbers for you and see how it stacks up at no cost to you! Just need date of birth and zip code to help@calhealth.net

Every area and age is different in terms of this comparison. What about yours?

How to quote G versus N

We make this easy.

You can run your quote across the major Medigap carriers here:

We work with all the biggest carriers so you can get the best rate:

You'll be able to see the G plan rates, N plan rates, and even other

options side by side across carriers.

Part D quotes are also available since it's separate from the core medigap selection.

Let's get to some logistical questions that come up.

Can I change between the G and N plans?

Many Medicare subscribers want to switch between the G and N plan...not necessarily in one direction.

Once we're outside guaranteed enrollment periods (see guide here), we'll need to qualify based on health to make changes between these two plans.

Unfortunately, we can't use the birthday rule to move from the G to the N plan. It isn't considered a true downgrade in coverage.

That being said, the medical underwriting isn't too strict and we see many people get approved even with health issues.

The carriers do not increase medigap rates based on health so there's no downside since California does not have application fees from applying.

Speaking of enrolling.

How to enroll in the G or N plan

We have online application for most of the Medigap carriers right through the quote tool:

Switching plans would require the same application as a new enrollee.

Make sure your Part A and B are both active.

We can apply for medigap plans anytime during the year! The effective date (if approved) will always be the 1st of the month following completed app submitta.

The online process is much better and faster but we're happy to send hard copies as well at help@calhealth.net

Of course, lean on our 25+ years experience for any questions

comparing the N and G plan or getting help with making changes.

There's zero cost for our assistance!