California health insurance -

Kaiser versus PPO

California health insurance -

Kaiser versus PPO

Kaiser versus PPO - The Battle for the Future of Health Insurance

It was probably coming all along.

The health insurance version of the game of Risk.

The ACA law definitely sped up the pace.

What might have taken 10+ years could be determined in just a few.

What's at stake?

It's nothing short of the delivery of health care and how it's paid for.

We're starting to see a winner since 2014 so let's take a look at the Game of Thrones in health insurance.

The players..

Kaiser versus Everyone else!

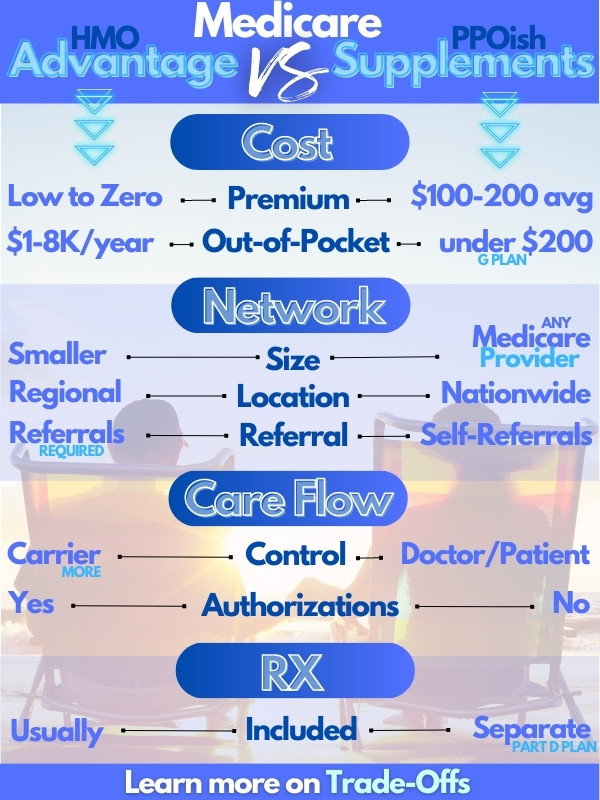

We'll also look at the Senior market and the Advantage plans versus Medigap comparison.

We'll explain why and what it means to you.

First, the Kaiser versus PPO Battlefield

We'll lump in HMO as well because what we really mean is Kaiser versus carriers that contract with independent doctors and hospitals.

Let's understand the difference and why it matters.

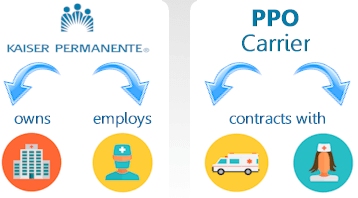

The Kaiser Model

Kaiser has been unique in the market.

They put everything under one roof.

They own the hospitals, employ the doctors, and administer the insurance.

This model has been very successful in terms of keeping costs down.

What's the alternative?

The traditional health insurance carrier (think Anthem Blue Cross, Blue Shield of California, United Healthcare®, etc) are pass through entities.

They pay 3rd party providers (doctors, hospitals, labs, etc) and collect premium from subscribers to cover these costs plus the cost of their business and any profit margin (which is now capped by law).

One note...the usual margin for health insurance carriers is around 2-4% and some (such as Blue Shield of California) are non-profit.

Very different models.

Kaiser has a great deal more capital investment but they also can control costs more.

They manage care more. This is true for all HMO's but they've got it down to a science.

The other model (we'll call it the Traditional Model) relies on it's contracting power with doctors/hospitals.

This is why the "just open up Stateline markets and everything will be fine" doesn't really mean anything in the market.

We already have big nationwide carriers that work across Stateline and it hasn't done much to keep costs down.

But....within a State, the carriers can have sizable power to contain costs via their re-imbursement rate to providers.

That's the "PPO discount" or negotiated rate you see when you go to an in-network provider.

Okay...that's the lay of the land.

Who's winning and what does it mean for your pocketbook?

You can find out for your situation with an instant quote for Kaiser or PPO providers here:

Enter the ACA in our Kaiser versus PPO Battle

The Affordable Care Act took affect Jan 2014 and it's had a huge impact.

It's put cost containment in the driver's seat.

Primarily because cost of the underlying health plan (not including tax credit) have roughly doubled to tripled since then.

That's only getting worse:

Carriers are panicking. Members are panicking. Heck, as a health insurance agent, I'm freaking out!

We can't keep going up like this.

It's getting to a point cost-wise where people will have to go with the lowest priced option just to keep coverage.

We're pretty much there.

One option is typically Kaiser so let's evaluate the pro's and con's of Kaiser versus PPO coverage.

How to Compare Kaiser versus PPO plans

The biggest difference between Kaiser and PPO plans has to do with the doctors/hospitals and how you access them.

With Kaiser, you generally must stay within their network of providers.

Kaiser tends to offer comprehensive health care in one location.

There is generally a large medical center with your traditional Hospital services (ER, surgery, lab, etc) as well as more traditional physician services (general practice, specialist, etc).

This can be convenient. Everything's in one place and your medical record is accessible across the enterprise.

Those are all good things...are there downsides?

For one, you must stay within the Kaiser network.

It is very difficult to access specialists outside of Kaiser and extremely rare.

If there's a doctor at UCSF who specializes in a rare cancer or surgery, that provider may not be available to you.

For this reason, Kaiser is extremely good at 99% of health care needs.

It's the 1% that can be tricky.

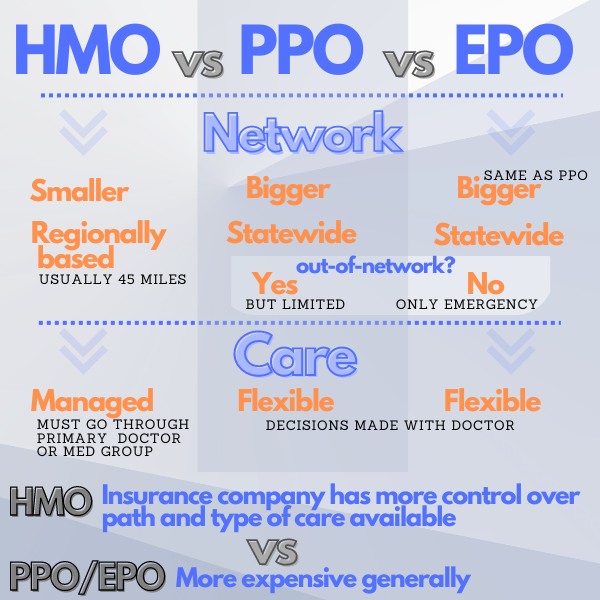

What about doctors/hospitals through PPO plans?

You can see any doctor and if you use doctors in the PPO network (generally much broader than HMO plans), you'll get negotiated rates which can discount services by 30-60% on average.

You're generally not locked into an area and depending on the carrier (Anthem Blue Cross or Blue Shield of California), you may have access to providers out of the State as well.

So how do we evaluate this?

It comes down to whether you have relationships with doctors or if you want flexibility and access to care.

That's an individual preference.

There's another piece to the comparison which is equally important.

The HMO model itself.

HMO versus PPO - the Kaiser Consideration

Kaiser is generally thought of as an HMO type of plan.

What does this mean?

We'll skip the behind the scene workings of HMO's and PPO's but here's the net net to you as the insured.

WIth HMO's, you must stay within your network and care is more managed.

What is "managed"?

It means that decision on health care needs will be jointly made by the insurer (Kaiser in this case).

Let's look at a real-world example.

Let's say you're on a medication for cholesterol. Kaiser might make a decision to switch the prescribed medication for cholesterol based on cost, efficacy, etc. Cost is a key constraint there.

They may switch your cholesterol medication and that's probably the end of it.

Now, if the cholesterol works just as well and has no side effects for you, great.

If not, well...that's an HMO.

Care is managed, and in this case it's Kaiser (the insurer and the care provider).

Now, ideally, decisions are made based on long term efficacy and there is an underlying cost motive there (which is good).

We're not naive enough to believe that there isn't also a cost motive there but this also, may be in your long term favor.

Why?

Guess who ultimately pays for the cost of care.

That's right, YOU do!

In the form of health insurance premium and out of pocket costs.

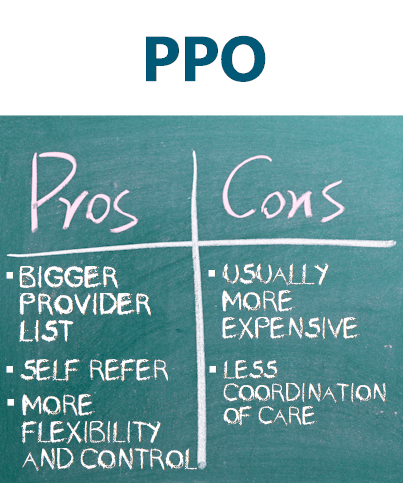

PPO Plans and Care

With a PPO plan, the doctor/hospital dictates what is medically necessary and advisable.

The PPO health plan pays accordingly.

In most cases, anyway.

Decisions are made between the doctor and the patient in terms of ideal care.

There's a little more pressure now since the ACA law to contain costs so you'll still see some pressure on care.

For example, the list of formulary drugs keeps shrinking. This is not that different than Kaiser managing the medication you're on.

So what's our take on the "managed" care and network requirements?

It may not matter what we think for much longer. Here's why.

The Ultimate Consideration between Kaiser and PPO plans

Apples and apples, we like PPO options because they afford the most flexibility and control.

Problem is, it's starting to look like Apples and Watermelons...in terms of pricing.

If Kaiser is able to contain costs better than PPO plans, you get into a spiral effect where it all shifts towards that model.

We just ran a renewal for 2017. A couple in their 50's. Blue Shield PPO was $1585. Anthem Blue Cross EPO (works like a PPO but you have to stay on the network) was $1410.

Kaiser was $1010.

How much is flexibility of care choices and doctors worth to a person.

$5K/year??

The more that gap grows, the more Kaiser will probably gain on PPO types of plans.

Here's the other Gorilla in the health insurance room.

The PPO plans may all be heading towards HMO's anyway.

Anthem Blue Cross changed most of their individual/family (including Covered Ca) PPO plans to EPO starting Jan 1st, 2017.

In many areas, Blue Shield is the only PPO left.

That probably won't stay that way for long.

Costs is absolutely crushing the market right now and anything that will offset....will WIN!

Maybe not now. Maybe not next year. But Eventually.

At this pace, the luxury of being able to afford a PPO plan may be only available for a small percentage of the market.

If that segment shrinks too much, it eventually goes away all together.

Health plans need large pools of people to work.

We saw this with the death of "indemnity" plans in the late 90's.

Indemnity plans let you go to any doctor and paid the same regardless.

They priced themselves out of the market under the relentless beatings of the new HMO's and PPO's on the market (what comes around, goes around??).

Pool shrank. Plan disappeared.

If things (ACA law) stay the same, we'll likely see the same demise for PPO's. At least on the individual/family market.

That's a feather in Kaiser's cap since they're already there and they do it pretty well.

You can quote Kaiser versus the PPO plans here:

Now, what about the senior market?

Kaiser versus Medicare Supplements

A similar effect but difference because Medicare is now picking up 80% of the bill!

Meaning, the price difference between a Kaiser Advantage plan is not as extreme versus a Medicare Supplement G plan (or N plan, etc).

This comes down to the Mediare supplement versus Advantage plan comparison.

Learn about the Trade-offs of Advantage plans to get a feel. Keep in mind that the traditional carriers like United Healthcare®, Anthem, Humana, etc also offer Advantage plans (HMO) that contract with private networks.

We can even get UCLA or Cedars with Advantage plans!

You can run both types of plans here:

Or course, we're happy to walk through your situation to see what works best. p>

OuOur services are 100% FREE to you as licensed health agents with 25+ years of experience in California.

Call us at 800-320-6269 and we can go through any questions or run your Kaiser and PPO plan quote. Thanks!

.jpg)

.jpg)

.jpg)