California Medicare Options - Which Medicare Advantage Plan Gives Money back to Social Security

Which Medicare Advantage plan adds money back to Social Security?

We get this question quite a bit these days and it seems to be increasing.

In fact, the plan in question called a Part B Giveback plan has grown from 2% to over 13% of the Advantage market in just a few years.

We'll see why below but more importantly, we'll look at the other aspects to make sure it's a good fit for your situation.

First, our credentials:

We'll cover these topics:

- Which Medicare Advantage plan adds money back to Social Security?

- How to compare the Advantage Giveback plans

- How much money can you get back to Social Security

- How to quote and enroll in the plans that give back money to Social Security

Let's get started!

Which Medicare Advantage plan adds money back to Social Security?

Inflation is crushing everyone these days and any amount back to us helps.

To that end, there is a type of plan that can actually add money back to Social Security.

It's a Part B Rebate or Giveback plan and it's a kind of Medicare Advantage plan.

We have big reviews on Advantage plans generally to understand how they work but let's zero in on the money back part.

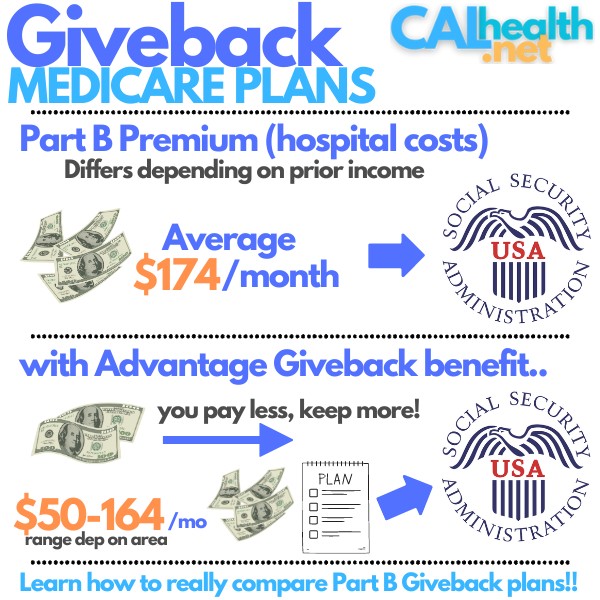

With Medicare, there are two parts:

- Part A - Hospital costs; usually no cost since you paid all your life

- Part B - Doctor costs; requires a separate Part B premium you pay monthly or quarterly

It's this second part where we can get help.

The standard Part B premium now is $174/month. That's over $2K annually!

It's important to have it since doctor costs can run high fast. This is not the right time to take this "I'm healthy" bet:

For many seniors these days, $2K annually is a high burden to pay especially with food, etc. going through the roof.

The Giveback benefit is offered by certain Part B rebate plans to offset this premium you pay to Social Security.

The range differs from plan to plan from $50 - $164/month currently and not every plan may be available in your area.

One note...it doesn't make sense to get a plan where the Giveback plan is more than what you actually pay to Social Security.

For example:

- You pay $80 to Social Security every month for Part B

- You pick a plan with a $100 Giveback benefit

In this case, you only get the $80 paid to Social Security. The other $20 doesn't come to you!

Learn more about the Part B Giveback plans explained or our guide to California Giveback plans.

Alright...we have a basic lay of the land but that's only half the equation. How do we compare the options if available in our area?

How to compare the Advantage Giveback plans

We'll point to big reviews of how to Compare the Giveback to Social Security plans but let's get the basics.

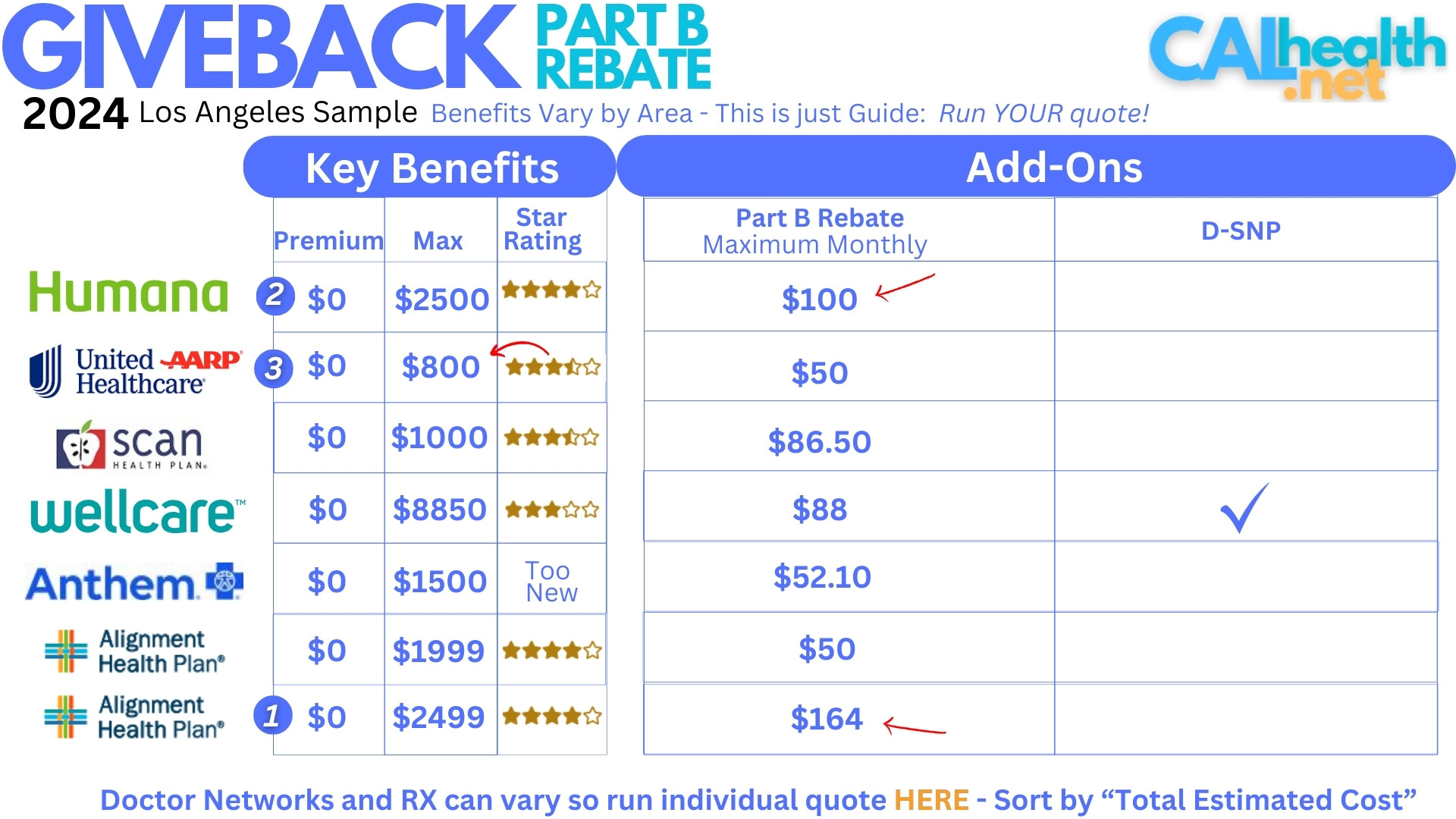

Let's run a sample quote in Los Angeles (we'll show you how to quote your area below):

This is health insurance after all so we want the best options in ADDITION to money back to Social Security.

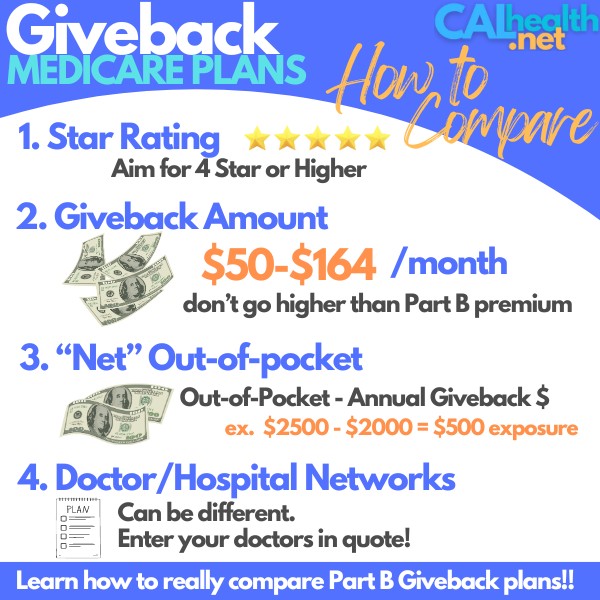

Focus on these items:

- Amount of Giveback money to Social Security

- Star Rating

- Out-of-pocket Maximum

- Doctor Networks

So we see the range of $50 to $164/month. That's quite a swing but remember that people pay different Part B amounts to Social Security depending on their prior year's income!

$164/mo benefit doesn't make sense (all other things being equal) if you're only paying $100/mo for Part B.

Then there's Star Rating. This is like a Yelp rating managed by Medicare that shows how satisfied actual members are with that plan.

We want 4 Star ideally and each ½ star makes a big difference. 3 Star is pretty lackluster.

Out-of-pocket max is the next big item. It's your exposure in a year if you have really bad health care costs.

Think of this a little differently. Subtract the annual giveback amount to Medicare from the max.

So the Alignment plan in the example above is like $2500 - $2000 (roughly) for real exposure of $500 in a bad year.

After all, we're getting the giveback benefit which means real cash in our pocket from reduced part B premium.

Finally, we want to make sure our doctors are in-network. If we're flexible then great. We'll show you how to check this in the quote section below.

We have a big review on how to compare Medicare Giveback plans for more guidance.

Recap:

Let's just clarify how much we're talking about.

How much money can you get back to Social Security

Everyone's area will be different. Some might not even have Giveback plans. Others may only have one option!

In the Los Angeles example, we have multiple examples.

The range of money back to Social Security is from $50 to $164.

That's per month so roughly $600/year to just under $2000/year.

We noted the three popular options being:

- Alignment: $164/month; 4 Star, net $500 max (after giveback is subtracted)

- UnitedHealth: $50/month; lower star rating but lowest max of the Givebacks

- Humana: $100/month; better Star Rating and blend between the other two

Keep in mind that the doctor networks will be different so we need to take that into account.

Off the bat though, we're looking at $600/year up to almost $2000/year in money back to Social Security which means more money in our pocket with a Part B.

So...what about your situation?

How to quote and enroll in the plans that give back money to Social Security

We make this free, secure, and fast for you here:

A few notes to get the best quote for you:

- Filter for "Part B Giveback"

- Under Preferences, enter your doctors and hospital

- Enter your medication/dosages

- Enter your preferred pharmacy

- Sort by "Total Estimated Cost" which looks as RX out-of-pocket

If this all sounds like a pain, let us do the work for you at no cost!

Email us at help@calhealth.net or pick a time to chat.

Remember, we can't get more than what our Part B premium is. Star ratings really matter. This is a health plan after all!

Make sure your doctors and hospital are in-network if that's important to you.

The Alignment giveback plan has been very popular due to the high Giveback amount to Social Security and 4 Star rating.

Again...reach out with any questions! We want to really educate people on the options available to them.