California Medicare Options - Is Medicare Giveback Benefit Legit?

Is Senior Giveback Program Legit?

It's a question we get often.

"What gives??"

Everyone in the Medicare world is old enough to know that you don't get anything for free.

With giveback benefits up to $2000/year (see giveback comparison) PLUS health benefits that must meet the Advantage plan requirements...is this legit??

We'll explain the mechanics of it and more importantly, show how to avoid any bad plans. This is health insurance after all and it needs to work.

One thing for certain...they're very popular these days growing from 2% of the Advantage market to over 12% is a few short years.

Go figure with the price of everything these days.

Our credentials here:

We'll cover these topics:

- What is the senior giveback plan and is it legit

- How to compare and choose a good giveback plan

- How to quote and and enroll in a senior giveback plan

Let's get started!

What is the senior giveback plan and is it legit

A quick intro is required.

The senior giveback plan is a type of Medicare Advantage plan.

We have a big guide to explain Advantage plans and even compare advantage plans but these are mainly HMO plans to cover healthcare costs for people with Medicare.

The giveback is a specific add-on benefit to the core healthcare benefits on select Advantage plans.

So in addition to doctors, medications, and hospital benefits, you get the giveback benefit.

This giveback benefit reduces the amount you pay to Medicare (technically Social Security) each month for Part B.

This amount averages around $174 this month but can go up or down individually depending on your past income.

The giveback plan will go towards this monthly premium so you'll get more cash in your pocket as a result!

How much more and which senior giveback plans are legit?

How to compare and choose a good giveback plan

Check out the Giveback plan comparison but a guide to the different options.

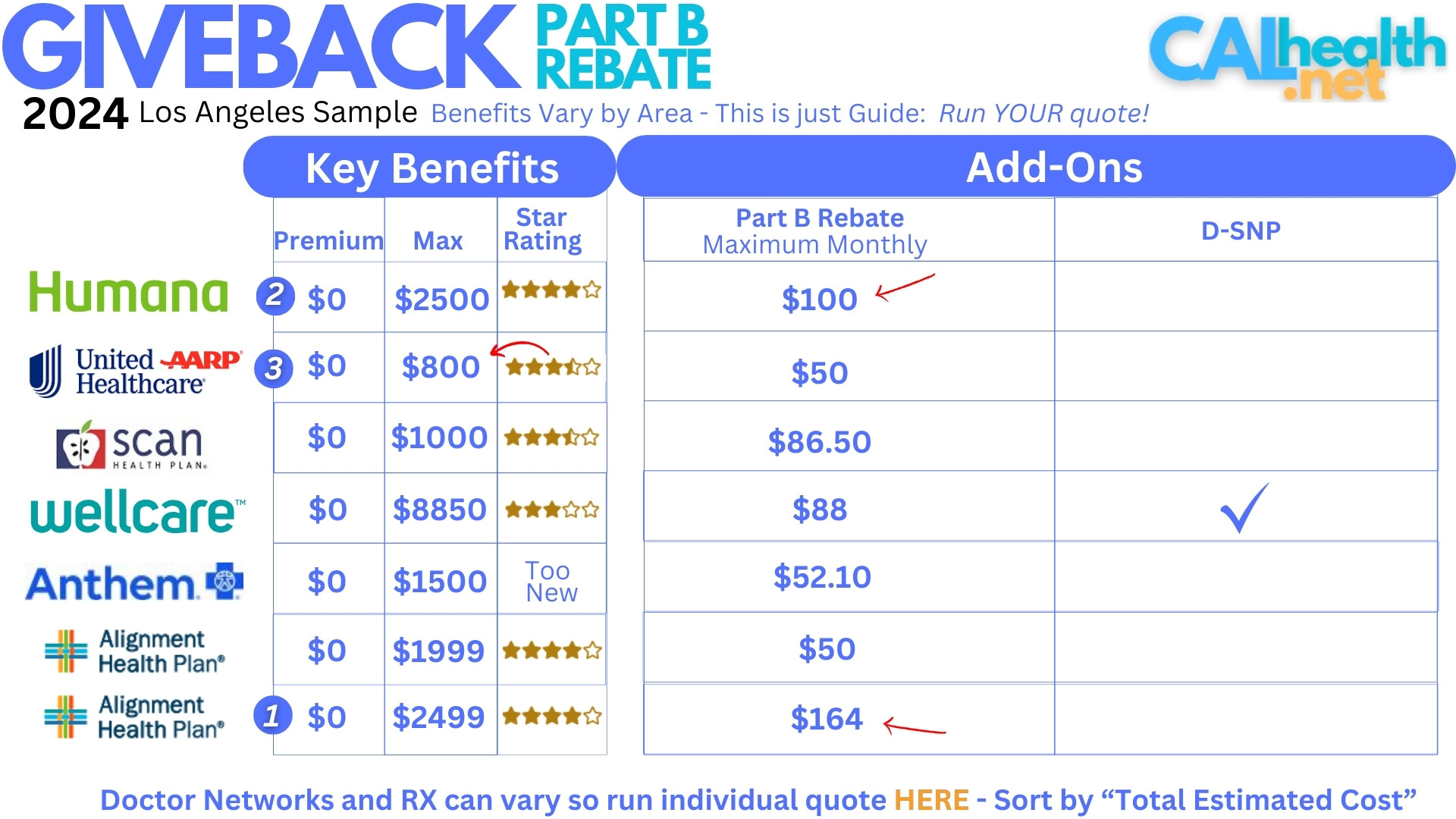

First, here's a same comparison for the Los Angeles market (yours will likely be different...more on that below).

First, we can see that the senior giveback benefit really varies by carrier and plan.

From $50 to $164/month!

This matches the fact that people have different Part B premiums based on their prior income.

You can't get more benefit than what your Part B premium runs. Meaning, if your part B premium is $50, a $100 benefit doesn't really help you. You'll only get $50 max!

We can see that Alignment's plan is $164/month which is fantastic. That's almost $2000/year which many seniors enquire about ($2000 back from Medicare plan).

But...is the Alignment plan....legit?

If we take the senior giveback benefit off the table, how do we compare the plans?

We lean on our Triple Threat selection:

- Star Rating - the Yelp review of Advantage plans

- Premium - how much do you pay each month

- Max-out-of-Pocket - your exposure in case of really big bill in a year

The Star Rating is really the key since a bad plan doesn't offset the giveback benefit.

4 Stars or better is what you're aiming for. Each ½ star really makes a big deal.

Premium is zero across the board so less of an issue.

Out-of-pocket max then becomes the other big factor. We can see big differences there.

This can really differ by the area with greater LA having the lowest max's on the market. This figures into our favorite three (Humana, United, Alignment).

- Alignment has the biggest giveback benefit at almost $2000K annually

- UnitedHealthcare® has the lowest out of pocket max

- Humana is a nice blend between both of them

If you qualify for Medi-medi, Wellcare has a plan that offers a giveback benefit AND the DSNP plan designation.

Otherwise, we're not very impressed by the Star Ratings for the other plans. We really want that around 4 Stars to make sure the plan IS legit when it comes to healthcare and satisfaction.

The other consideration is network. It's a big one!

What doctors and hospitals you can see with a given plan since there can be differences between carriers and even plans within a carrier!

Let's speak to that now.

How to quote and and enroll in a senior giveback plan

We make this fast, secure, and free here:

Select "Part B Giveback" on the left to see the senior giveback plans in your area.

Make sure to add under preferences:

- Your doctors/hospital

- Your medications/dosages

- Your preferred pharmacy

Filter by "Total Estimated Cost" up top.

If this all sounds like too much, we can do it for you (free service) at help@calhealth.net or by chat: https://calendly.com/dennis-jnw

You can apply right through the quote system by "Adding to Cart".

Again, we're happy to help and there's zero cost for our assistance. The giveback benefit is exclusively an Advantage plan option so that needs to fit well for your healthcare needs.