California Medicare Options - Senior Give back program for $2000

Senior Give Back Program for $2000 in California

Seniors are hearing from friends about a plan that can give around $2000 back to them but they're not sure of the name.

Let's fill in the pieces shall we! Groceries are not exactly going down.

We'll also look at how it works, who works best for, and how to quote and enroll if it's the right fit.

As the so-called Giveback Part B Advantage plans, it's growing significantly in the last few years.

From roughly 2% of the Advantage market to over 13% from 2019 to 2023. That 600% increase!

First, our credentials:

Here's what we'll cover:

- What plan gives seniors $2000 in California

- Is the $2000 giveback plan a good option for California seniors

- How to quote and enroll for the $2000 giveback plan

Let's get started!

What Plan Gives Seniors $2000 in California

We'll connect the dots now. The plan that seniors are referring to is the Alignment Smart Choice Advantage plan.

Giveback plans are a type of Advantage Medicare plan that will pay part of your Part B monthly premium up to a certain amount.

This amount can vary significantly depending on the carrier.

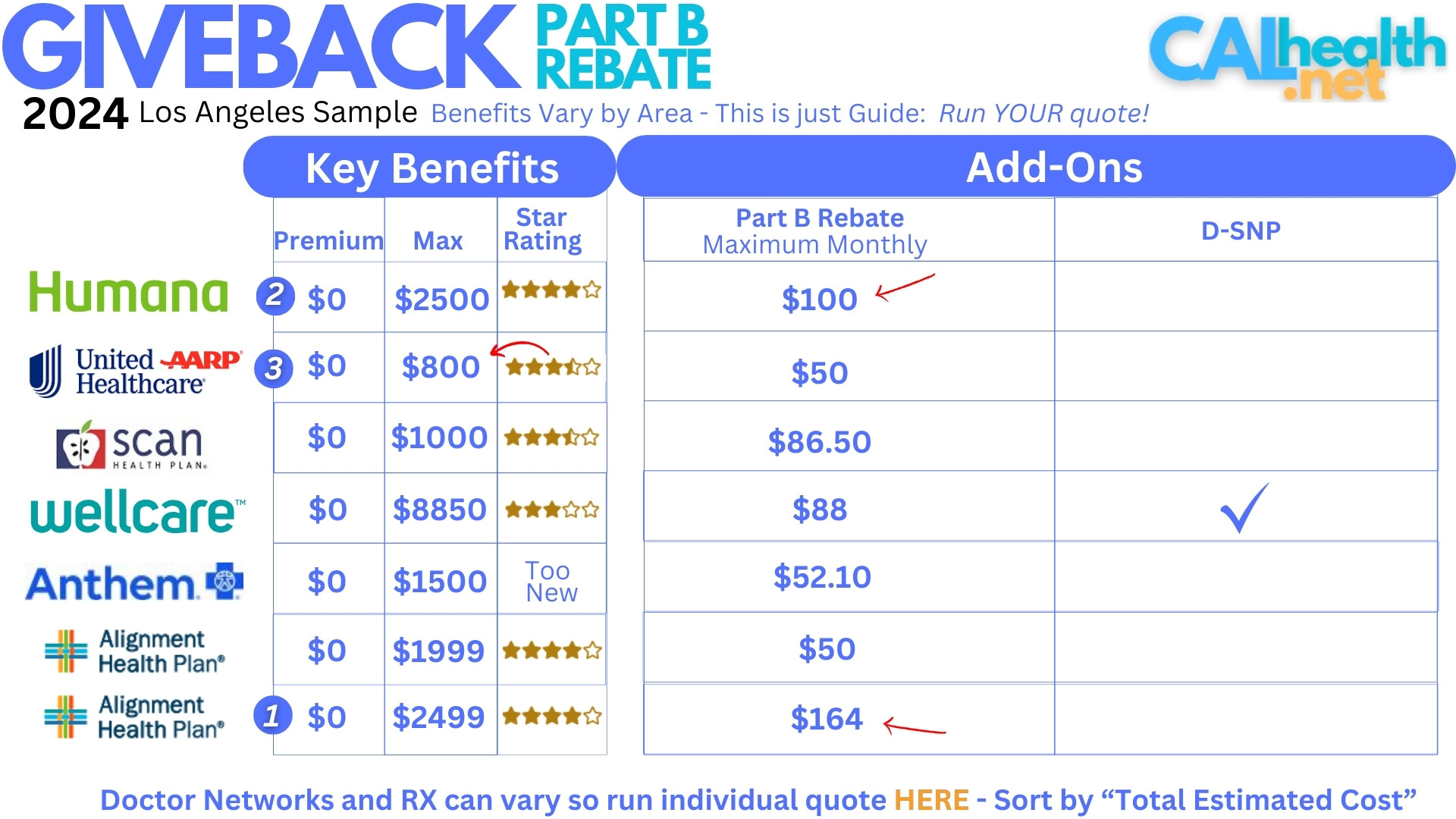

Here's an example from Los Angeles:

You don't get cash directly to you but the plan will pay your Part B premium that you're responsible for monthly so it winds up being the same.

Essentially, your Social Security (how most people pay their Part B) will be higher each month.

We look at why it's important to have Part B at all here. Part B is the section of Medicare that covers doctor costs. It's a big deal.

In order to have an Advantage plan or Medigap coverage, you have to have Part A (hospital) and Part B (physician).

Part B requires a monthly premium that averages around $174 (can go up or down depending on your income).

That's where the Giveback plan comes into play. It will pay up to your Part B premium for you!

For example, if your Part B is $150 based on your prior income, the plan may pay up to $150/month.

In the comparison above, we can see lots of different levels.

Alignment's SmartHMO will pay up to $164/month...the highest in the LA market (and most of California).

$164 x 12 is $1968 per year! Let's call it $2000 since it's easier to remember.

We have a big review on the Alignment Giveback plan or Giveback plan reviews but let's cut to the chase...

Is it a good option outside of the almost $2000 we can definitely use in our pocket.

Is the $2000 Giveback Plan a Good Option for California Seniors

The Giveback $2000 benefit doesn't matter if it's a bad health insurance. Everyone here is 65+ and old enough to know there's no free lunch.

So...how does the plan stack up as...health insurance?

For that, we focus on our Triple Threat of plan selection:

There are three big requirements we look at:

- Star Rating

- Premium

- Out of Pocket Max

The Star Rating is really REALLY important for our consideration.

It's a reflection of how the actual members feel about the plan in terms of satisfaction. Think of it as a Yelp or Google review of the plan but administered through Medicare.

We can see the SmartChoice plan has a 4 Star rating which is pretty fantastic. It's one of the 2 best on that LA Giveback plan chart.

3 Star is really average (not great) and each ½ star means quite a bit in terms of how happy you can expect to be with the plan.

There's zero premium and zero deductible.

What about the out-of-pocket max? We have a big review on how to evaluate this but here's the skinny.

- We're saving almost $2000 off our Part B premium (the Giveback benefit depending on how much your premium is)

- We have roughly $2500 exposure on the back end if we get really big healthcare costs in the year

So...in a bad year, it's equivalent to a $500 out of pocket max.

That's not bad considering that $800 is pretty standard in Los Angeles.

This is only an issue if you have pretty big bills with Advantage plans.

Again, the Star Rating is more what we focus on since that's the day-to-day satisfaction with the inner-workings of the plan.

The only caveat is that the SmartHMO Giveback plan has a different doctor network so you'll want to run your specific quote and make sure to enter your doctors.

Let's go there now.

How to Quote and Enroll for the $2000 Giveback Plan

We make this fast, free, and easy. Run your quote here:

Important points.

Under the Preference section, add the following:

- Your doctors and hospital

- Your medications and dosages

- Your preferred pharmacy

Next, check "Part B Giveback" on the left to filter these plans.

Finally, sort by "Total Estimated Cost" up above. This takes into account your medication out-of-pocket costs.

You'll see the other Giveback plans as well in your area.

Focus on the Star Rating.

We can do the work for you! Just email us:

- Date of birth

- Zip code

- Part B premium

- Doctors and hospital

- Medications/dosage

- Pharmacy of choice

The last piece that is important if your actual Part B premium is less based on income.

For example, if your Part B premium is $80/month, then we may look at the Humana or UnitedHealth plan.

We can evaluate all this for you.

Reach out with any questions at help@calhealth.net or pick a time to chat: https://calendly.com/dennis-jnw

Unless of course, you can't think of anything to spend the $2000 on! Didn't think so.