California Medicare Options - What Does N Medigap Plan Cover?

Insider's Guide to the N Medigap Plan - What Does it Cover?

The N Medicare supplement is quickly coming in third in popularity

behind the F plan (discontinued for new enrollees) and the

G plan (current

most popular plan).

A lot of carriers and brokers are pushing it as a way to get existing F and G plan members to switch to them so they get the premium/commission (our jaded side).

Did they mention the Uncapped Excess charge?

We think not!

Let's really go through the core differences between the F/G and N plan ot make sure we understand both the pros and cons.

Plans aren't cheaper for no reason!

We'll also do some detective work on the price to benefit comparison as well to understand how it might really shake out on average.

Here are the topics we'll cover:

- A quick intro to what the N medigap plan covers

- N medigap versus F or

G plans

- The issue with Excess and the N plan

- How to compare costs

between N and F/G plans

- Getting quotes for N medigap plans in your area

- How and when to enroll or switch plans

Let's get started!

A quick intro to what the N medigap plan covers

First, Medicare by itself.

Essentially, it's an 80/20 plan with deductibles built in for hospitals (Part A) and doctors (Part B).

You then pay 20% of the charges after the deductible is met. Forever!!

That's the real "gap" in Medicare alone:

Especially in today's world.

The medigap plans all fill in keyholes with different mixes of

benefits.

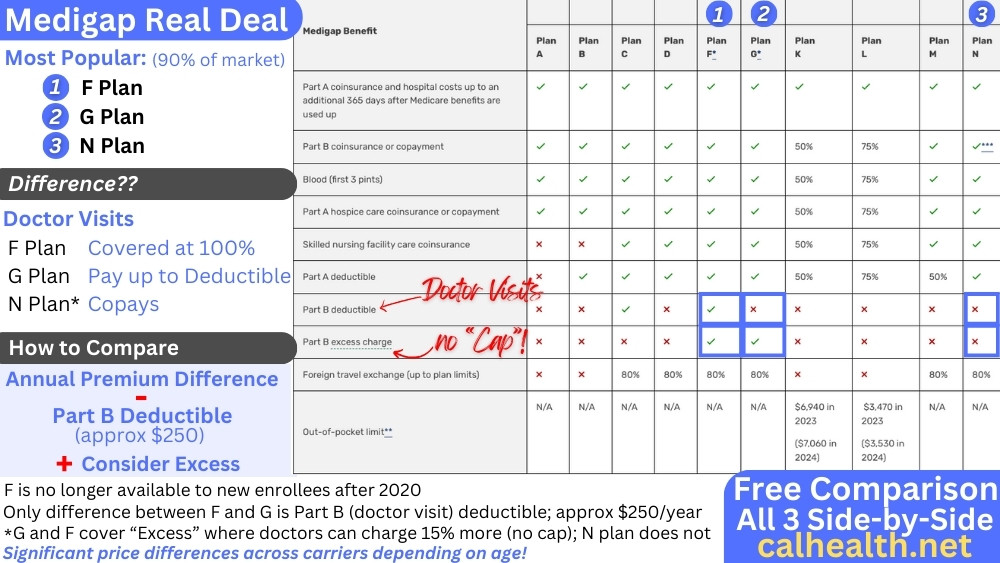

Here's the chart but we'll go through the N plan specifically:

So, some quick notes.

The N plan covers the Part A or hospital deductible (roughly $1600+/year) but it does not cover the Part B deductible (roughly $240+/year) for doctors.

Most importantly, the N plan covers the 20% coinsurance after deductibles are met. Again, this is the real risk of having Medicare by itself.

Foreign travel is added to some of the other minor benefits (blood, hospice, preventative, etc.).

So...there are two distinctions between the N versus the F or G plans. Let's go there now.

N medigap versus F or G plans

We mentioned that the F plan was the richest plan before 2021. The G plan is now the richest plan.

The N plan covers what the G plan covers with two distinctions:

- Copays for office visits and urgent care

- N does not cover Medicare Excess

The copays are not terribly bad to take on as an expense unless you

have lots of doctor visits. We'll look at how to really calculate the cost

of this below.

We're not big fans of having Excess hanging out there and here's why.

The issue with Excess and the N plan

The Medicare Excess is a different deal.

Medicare excess speaks to the ability of a doctor to charge up to 15% higher than what Medicare allows and still be considered "in-network".

Here's the issue...that 15% is uncapped!

If it's a $10K bill, you're on the hook for $1500 extra out of pocket.

We're not big fans of uncapped risks since the whole point of insurance is to cap our exposure to big bills.

Otherwise, what's the point of insurance?

So how likely is this?

We've tried with multiple agencies to get good info (CMS, California agencies, etc.) and it's tough. No one seems to want to track this!

It's estimated at 4% of providers (assume you have better doctors) but California is probably higher since the cost of running a doctor's practice is under extreme pressure.

Our guess is 8-10% in California. They got slammed by the ACA law in terms of reimbursement (while hospitals and pharma skated by).

Did the brokers/carriers explain this all to you in the cheerleading of the N plan?

So...how do we figure this all in?

How to compare costs between N and F/G plans

Okay. Doctor/urgent care copays and Medicare excess versus monthly savings versus the G plan.

Let's run some trial numbers and see how to compare.

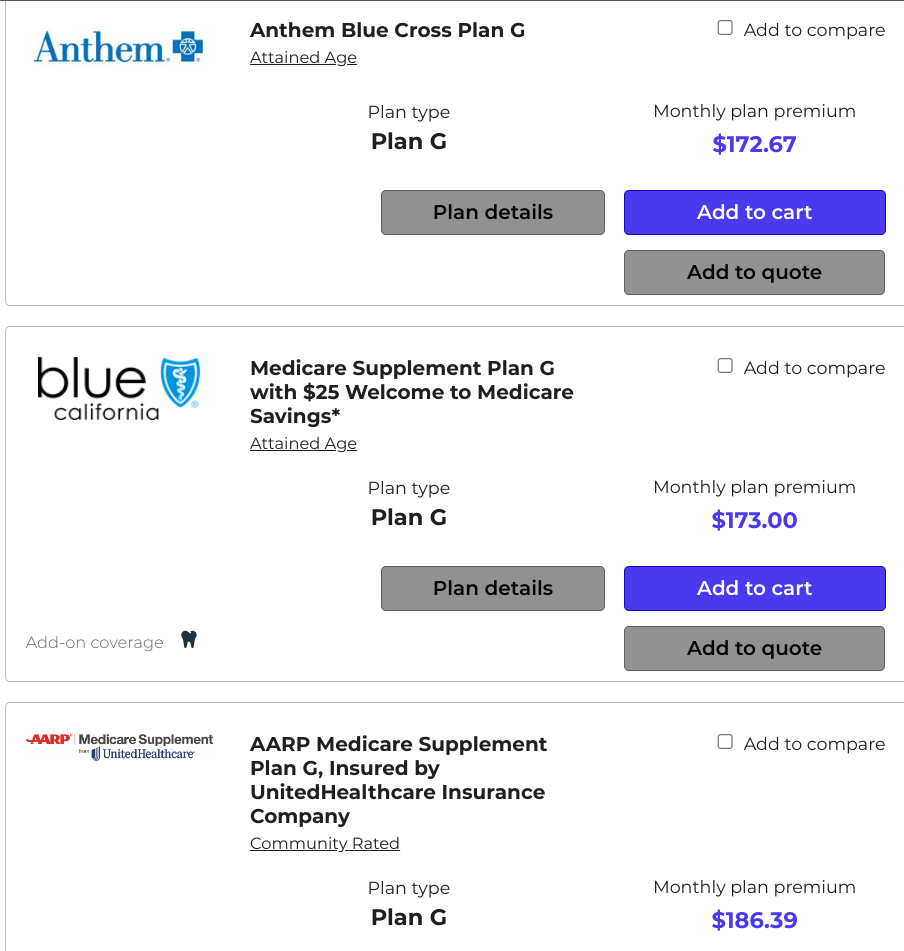

Here's Los Angeles, age 65 - G Plan:

So the G plan is running around $172/month.

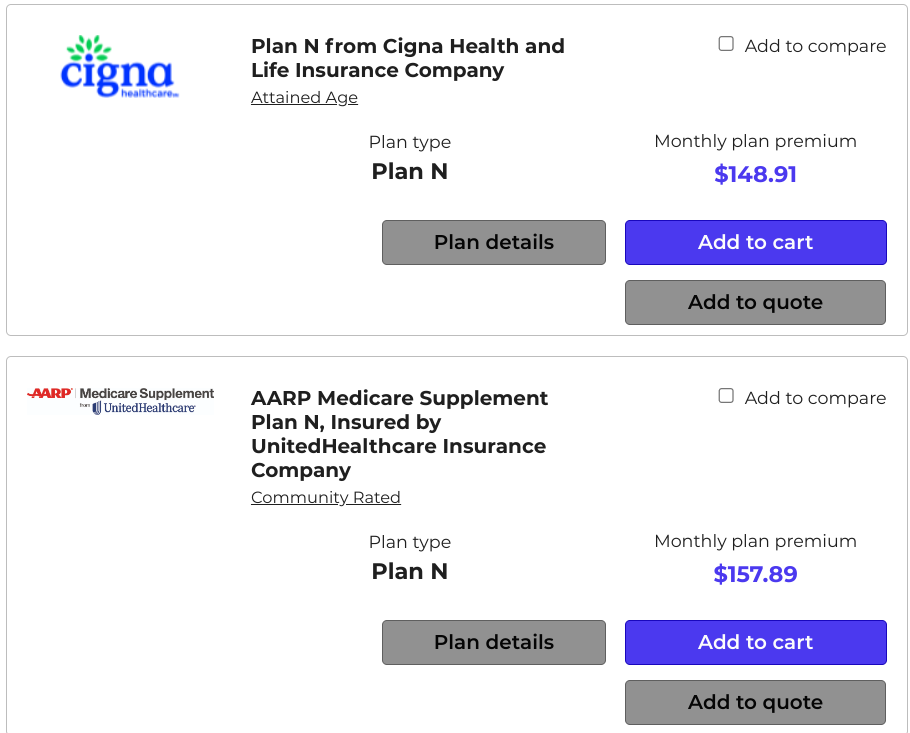

Here's the N plan:

So the N plan is running around 150/month.

Net net...

- N plan - approx $150/month

- G plan - approx $170/month

So about $20/month for a 65 year old

Run your quotes below to check your situation since area and age can really affect pricing.

So...let's try to figure out what we're losing.

With the N plan, we have copays (outside of preventative) that don't result in hospital entry:

- $20 for office visits

- $50 for urgent care

Remember that the G plan has a deductible for office visits of approx $240/month (changes year to year). Around $20/month is you break it out that way!

So, after about 11 office visits per year, the G plan starts to save money. Before 12 visits, the N plan is saving you under $20/month.

This is kinda 6 versus half a dozen. Kind of a wash!

If you have more than one visit a month, it's hard to argue for the N plan since our savings are wiped out by copays.

Now...this doesn't take the Medicare Excess piece into account.

Hard to measure this. It could be $100's or $1000's each year if you use doctors that charge more than what Medicare allows.

It's an unknown. The % of doctors that charge excess is also low so we really don't know.

Let's say there's a $10/month "ghost" charge to address this risk over time.

So...you have a rough sketch of how to compare the N and G plan. We already have a big review on the F versus the G plan.

The F plan just exaggerates these comparisons since it's more expensive than the G but it covers the office visits right away.

It's really about the G versus the N plan!

If all this is ridiculously confusing, lean on our 25 years of experience!

Our reviews:

Enough of trial quotes...what about yours?

Getting quotes for N medigap plans in your area

This is easy...and free! We want to make all available information directly accessible to you here:

We work with all the biggest carriers for medigap:

Of course, we're happy to help you with any questions or we can even

run the quote directly for you at help@calhealth.net with a full comparison.

Just need the date of birth and zip code.

Part D for medication is separate from the Medigap plan so you can change medigap and keep your Part D.

Let's look at logistics now.

How and when to enroll or switch plans

What if you want to enroll or switch to an N plan?

No problem. We have online applications for most carriers available right through the quote above.

If we're in a Guaranteed Issue window (new Part B, moving, losing employer coverage, etc.), we can enroll right away.

We can always apply to enroll or switch medigap plans anytime during the year after that but it's subject to health underwriting.

Unfortunately, we can't use the Birthday rule to move from the G to the N plan but reach out to us with your situation and we'll see what we can do.

Again, no cost for our assistance!