California Medicare Options - Compare the F and C medigap plans in California

Comparing the California Medicare G plan versus the C plan

What a difference one little benefit can make.

That's literally the difference between the Medicare Supplement G plan and the C plan.

Medicare Excess.

Turns out it's a doozy though and we'll explain below.

This speaks to why the G plan is the most popular Medigap plan while the C is pretty lean in enrollment and in fact, many carriers don't even over the C plan.

Let's zero in on the difference along these lines:

- What the C and G plans cover

- The big difference between C and G plans - Medicare's Excess

- Alternatives to reduce the cost of the G plan

- How to quote and enroll in the G or C plan

Let's get started!

What the C and G plans cover

We covered the big holes by going to Medicare alone already.

Our big concern is any "uncapped" risk. Meaning...some expenses that you may have to pay and pay and pay.

The big examples of this are the 20% coinsurance (amounts you pay after the

deductibles are met) and...Medicare Excess.

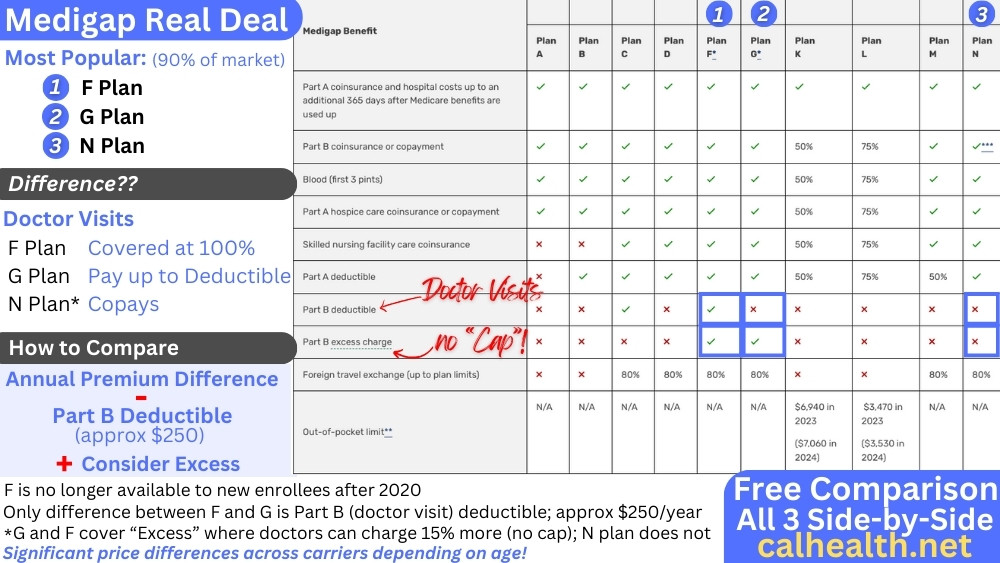

As for the G and C plan core benefits, you can see they're very similar here:

The big items:

- Deductibles for hospitals (Part A) and doctors (Part B)

- Coinsurance - the 20% you pick up after deductibles

- Miscellaneous bits and baubles

The G plan is currently the most comprehensive Medigap plan on the market for

new enrollees (old members may still be on the

F plan or higher).

The only core Medicare gap that the G plan doesn't cover is the part B (doctor) deductible of just over $240/year.

That's "manageable". We know our exposure.

As for the C plan, it covers all the same benefits except for one. Let's go there now!

The big difference between C and G plans - Medicare's Excess

So...what's the big deal about "Excess"?

Doctors are allowed to charge up to 15% more than what Medicare allows and still be considered "in-network".

This is called Excess. We have a whole review on Medicare Excess.

Here's the issue...Medicare is under tremendous financial pressure to make its budget work going forward and this is only going to accelerate (Baby Boomers, falling birth rate, etc).

Just look at the trajectory for healthcare costs!

Think of the ACA (Affordable Care Act) as the trial run for how to deal with this cost.

Basically, the doctors got walloped in California. Hospitals and Pharma did okay.

You'll see the same thing with doctors and Medicare going forward which means that more and more of the doctors are going to charge the Excess.

It will essentially be like a two-tier system or network (similar to PPO or HMO now) where the better doctors and more of them basically require that you get a G plan that covers Excess.

Right now, the % of doctors that charge excess is estimated at 4% (hard to get the data for California which is probably much higher due to the cost of living for doctors). Our guess is closer to 10% for California.

The problem of course is that the 15% is not capped.

A $10K bill can mean you're responsible for $1500 out of pocket!

There's no cap! It's unknown!

The whole point of any insurance is to "cap" our exposure and for this reason, the G plan is a much better option than the C plan.

The cost difference (when available) can generally be small and in fact, when we run a quote in Los Angeles, the only C plan (United Health AARP) is much higher!

What gives?

Again, not many carriers offer the C plan (it's just never been popular) and as a result, it has a "shrinking book" essentially.

This means the number of people all together in the rating band is getting smaller and as a result, the healthy people jump off and you're left with the unhealthy people who can't move (except for the Birthday Rule).

This shows in the claims and eventually the premium. The same thing is happening with people switching from the old F plan to the G plan.

Okay...what if we want other ways to reduce our G plan cost?

Alternatives to reduce the cost of the G plan

There are a few ways to go.

First, the next most popular plan to the G plan is the N plan.

The N plan adds in copays for office and emergency which isn't a bad way to go. It doesn't cover Excess though so we have the same issue as the C plan.

There are high-deductible G plans where a $2500 deductible is added into the mix of a traditional G plan.

This gives us the cap we want but if you compare the premium versus a straight G plan, it's harder to go this way since we're probably going to have healthcare costs in our 60s and beyond.

There are also Advantage plans (see

Advantage versus Medigap) but they function

more like HMOs generally meaning...you have to stay in-network and care is more

managed.

So...how do we quote all these options?

How to quote and enroll in the G or C plan

This is easy.

Run your personalized and free quote here:

The Medicare supplement tab is the 4th one over. You'll need to enter a few

items having to do with our eligibility (Part A and B start dates, etc).

On the left, you can filter by plan type (G or C for example). You can also filter by carrier.

We look at how to really compare the Medigap plans in detail.

You can even enroll right online from the biggest carriers including Blue Shield, Anthem Blue Cross, and United Health (AARP) which dominate the G and C plan landscape Statewide.

Reach out with any questions at help@calhealth.net or request a time to talk.

Check out our reviews here: