California Health Insurance Options - Top 10 Tips to Save on

Covered California

California Health Insurance Options - Top 10 Tips to Save on

Covered California

Top 10 Tips to Save on Covered California

Did you ever call an insurance or your cell phone company and come out $500-$1000 years richer from little changes you didn't know about.

You're all proud of yourself till it dons on you..."I've been paying extra for the past 5 years!"

Little bit of good news/bad news.

Still a win though so let's see if we can do the same thing with Covered Ca.

We have enrolled 1000's of people in Covered since 2014 and our reviews are solid:

So let's share the biggest threats to savings we see on a daily

basis. Of course, we're happy to help with newly enrolling or even existing

Covered Ca accounts.

Zero cost for our assistance.

Here are the Tips we'll cover:

- The income piece with Covered Ca

- Understanding the household

- Unraveling the plans

- The two bronze plans

- Enhanced Silver options -

look no further

- Self-employed income - net net

- Changes during the year

- Don't slouch at Open Enrollment

- Max the preventative benefit

- Splitting plans among family members

Let's get started. With the most important piece!

The income piece with Covered Ca

This is everything now.

We just had a family of four whose income estimate dropped from $150K to 100K. Their premium went from $1600/month to zero.

Yes..zero.

Let's hit the highlights first:

We're trying to estimate our AGI on the 1040 tax form (plus tax free interest, untaxed SS, and foreign income)

This is probably the biggest issue we see when people self-enroll. Their income estimate is completely off!

Usually to their detriment.

The period of time is this year (period we're insuring) so next April's tax filing.

What if your income bounces around a lot? Average it out over a year's time.

We see people enter in their income THIS MONTH and it throws them into medi-cal even though they'll be over the annual limit.

Here's the issue there. It takes medi-cal a good 30 days minimum to figure out that you're not eligible. We see people get very frustrated with the "process" to clean this up.

Ideally, you take your annual income estimate and enter it that way staring the 1st of the year.

We can help with the income. Designate us (no cost to you as Certified Covered Ca agents) and we'll look at the account and see if the income or other issues on the app are going to trainrwreck your outcome.

That's only the first of about a dozen errors we see on apps every day. Get a professional once-over to make sure everything looks good.

Let's talk about the "who" now.

Understanding the household

This is another big driver of paying too much.

The household according to Covered Ca is everyone that files together on a 1040 tax form for the CURRENT year (next April's filing)

Regardless of whether they're enrolling!

The size of household affects the tax credit for the people that are enrolling.

$40K for 2 people is very different than $40K for 1 person.

You have to include household income (that AGI on the 1040 from above)

A married person can't just list their income and they must file jointly to get the tax credit.

Otherwise, you may find you're paying it all back when file taxes the next year!

Changes in household can have huge effects (kids not being claimed, marriages, divorces, births, etc) so reach out to us if your household is in "flux".

We can help guide both the change (Covered Ca's system is finicky at best) and strategize the best course with any household change.

Changes in "number" such as marriage can have a huge impact on costs!

Let's turn to the plans.

Unraveling the plans

We have a handy PlanFinder that walks through the basics but a few pointers.

- The bronze, silver, and gold all have similar max out of pockets.

That's how the plan treats the big bill

- As you get older, the annual

premium different probably matches the potential benefit difference!

- Copays for office and RX start with the Silver plan and up

- Income amounts can affect the "flavor" of silver that you're offered with huge implications (more on this below)

So...always compare your annual premium difference versus the deductible first.

That's a pretty good way to find the sweet spot.

The tax credit goes up as we get older so some plans will have zero cost depending on the income level.

Use the PlanFinder but worse case, touch base with us at help@calhealth.net We know the plans inside and out (it's sad really).

A note..the plans are standardized so a Gold plan will have the same benefits from carrier to carrier.

That being said, there can be huge price swings within a given plan.

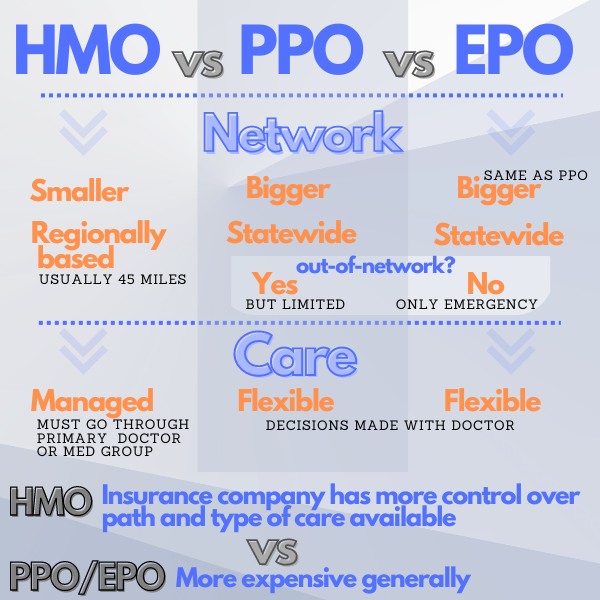

- PPO (especially Shield which has the last legitimate PPO network) can be

much more expensive

- The big carrier HMO's generally are priced best and it's hard to justify some of the smaller regional HMOs these days

So beyond price, it's really about network. HMO versus PPO versus EPO

And size of network. How many doctors are there and are the

hospitals you want to use in-network.

You can ask your doctor "What Covered Ca plans do you participate with" or use the Provider lookup in the quote here:

Again, happy to help with questions.

Let's touch base on the more catastrophic plans and confusion there.

The two bronze plans

There are generally 2 bronze plans available:

- HDHP Bronze - HSA qualified plans

- Bronze 60 - the standard bronze plan

Usually, the HDHP is the better choice even if you don't want to fund an HSA (more on HSA plans here).

- The HDHP has lower max out of pocket

- The small premium savings generally pays for the few copays you get with the standard bronze

We're happy to compare but the HDHP usually comes out ahead.

One note...you pay the coinsurance % until you hit the max out of pocket so it doesn't go on forever with covered benefits, in-network.

Preventative is covered at 100% on all plans (in-network).

Let's turn to where most people end up.

Enhanced Silver options - look no further

In California, if your income is in certain ranges, you'll get different versions of the silver plan for the same rate!

- Silver 73 - 3% richer; not that big of a deal

- Silver 87 - almost a

platinum level plan; really rich benefits

- Silver 94- 4% richer than the platinum plan; hard to get now with new income range

Many people get the 87. Our PlanFinder has the current rate chart.

Look..if you're being offer the Silver 94 or 87, stop looking.

Just find the best carrier and network for your situation (doctors, hospitals, and care decisions) and you're off to the races.

It's really hard to beat these plans! It's even hard going down to the Bronze when your risk exposure is so much better on the 87 or 94.

We're big fans of high deductible plans but not when we're subsidizing a Platinum plan!

The quoting tool will show you what version of silver you get and you can play with the income up top when you run the quote here:

Next topic.

Self-employed income - net net

Another big issue we see is with self-employed people listing their income.

Again, the AGI (1st page of the 1040 tax form) should capture all relevant income including what comes from self-employment.

If you're just starting your business or this year's income might be quite different (up or down) to your last tax filing, a few pointers:

- Use your net business income; gross income minus business expenses

- Health insurance premium is deductible for self-employed UP to your net

income

- 1/2 of the self employment tax comes off the number above

- HSA funding may also be deductible if you have that type of plan and fund the account

The bulk of this decision is your gross self-employment income minus business income.

We're happy to walk through your situation.

Remember the drop from $1600/month to zero in premium above from an income change?

Changes during the year

If you have big changes during the year including:

- Income estimate for the year

- Tax household changes (kids aging off,

marriages, divorces, new borns, deaths, etc)

- Moves

Then...you want to update the system!

Their system is very finicky.

For example, putting in a change at a certain time can cancel the coverage for that month!

We can help with this process but there's a huge reason to update with bigger changes.

- First, you may get more help if your income estimate is going down.

- Or, you avoid having to pay back extra tax credit at tax time if your estimate goes up

Changes in family make-up (remember....the 1040 form is their guide) also can have huge repercussions.

We can run quotes on your after situation to see how it will impact you (say from a marriage) and help you strategize how best to handle all this.

You may be able to change plans if the change is big enough and we need to reevaluate plans and rates.

We do this all the time! Either enroll here or designate us here.

Let's talk about the big change.

Don't slouch at Open Enrollment

I have a great idea for the incredibly stressful Holidays...let's do health insurance!

Said nobody ever.

Look...we get it. You would rather pull teeth than have to dive into all the health insurance stuff but it's so important.

For one, we're now estimating for the next year! Any big changes (especially income) expected?

We want to see if that gives us more tax credit or the richer Silver plans!

Also the carriers and plans can change rates, networks, and more.

That plan you have now might not be as competitive as another carrier. To the tune of $1000/s per year.

Or the rate may have exploded higher for the next year and you need to either downgrade the plan type (say Gold to Silver) or to a different model (say PPO to EPO or HMO) or different carrier.

So let's take the pain out of this.

Let us do the work for you at no cost to you!

Just designate us as your Covered Ca agent and we'll run the numbers come November at your request.

We don't push. We don't sell. Look at our reviews. We just help people zero in on the best value.

We can take a nasty Saturday afternoon of a few hours and boil it down in to 10 minutes. Seriously!

Apparently enrolling 1000's of Covered Ca members builds some expertise.

Email us at help@calhealth.net (best during busy open enrollment to pick a time to talk) or call 800-320-6269.

We attempt to return all calls the same business day and we're usually processing apps/changes late into the night before deadlines.

Let's look at a practical bonus with any of the plans.

Max the preventative benefit

All Covered Ca plans cover preventative at 100% (in-network, covered benefits).

Take advantage of this!

It can be worth 100's of dollars per year since the labs are also included.

A few notes.

Make sure you book the visit as a preventative check-up (not tied to a defined issues).

The doctor needs to code it as preventative for it to be covered at 100%

Sometimes, they forget to this and people just go ahead and pay the bill (so frustrating).

The labs are really where the cost is!

You can do this one time per year and the savings can be from $300 to $1000's depending on the labs side of things.

Again, in-network and make sure they code it correctly. If they don't, have the office recode it.

Side note...Covered Ca doesn't cover vision but the new retinal scan benefit with VSP (quote and enroll anytime here) is fantastic!

It's a literal snapshot of your internal cardiovascular system!

They can see diabetes, dementia, arterioscherosis and an ever-increasing list of serious issue YEARS before they become an illness.

You can do things about it then. Get one annually. It's simple and the VSP plan covers it.

Finally.

Splitting plans among family members

Most people don't realize it and Covered Ca doesn't exactly advertise it but you can have different family members on separate plans and still get the tax credit!

Let's say a spouse has really big health care costs and the other just wants a high deductible to keep the cost down.

You can do that! Bronze for the high deductible and maybe Gold with no deductible for the other spouse.

The total cost may resemble a Silver level with the average.

There are ways to strategize how to group the family members and we're happy to walk through situation on this front.

It can mean $1000's in savings as well per year!

One final note on that.

There's a different income threshold for kids under 19 to get Medi-cal. It's quite a bit higher.

Some families don't mind medi-cal for the kids while others need them on a standard plan to see certain doctors.

There's a way to enroll the kids separately if offered medi-cal so they can have the full networks but we won't get a tax credit for them.

More on kids being offered medi-cal here.

We can run these quotes for you or for any other situation here:

Use our expertise. It's free and 25 years in the making!

.jpg)