California health insurance - Kaiser versus UnitedHealthcare®

UnitedHealthcare®Versus Kaiser Permanente

It's time to call in the big guns of California health insurance.

Especially for Employer based plans and Medicare.

Depending on the market, you're talking about #1 and #2 in marketshare for the California health insurance landscape.

Who's better?

When does UnitedHealthcare®shine and where does Kaiser win?

Great questions and we're going to get to the answers.

As licensed California agents with 25+ years in direct health insurance experience, we've enrolled 1000's of members in both carriers.

First...some credentials Please!....

We've seen the good, the bad, and well...the completely frustrating.

We are independent agents so we are happy to help you with any California carrier but these two require a thorough analysis.

Here's the game plan.

We'll break up the comparison of UnitedHealthcare® and Kaiser by market since they're very different situations in California.

Here are the three key markets:

Individual and Family under age 65 (including Covered

California)

Small Business (1-100 employees)

Senior (65 and over with Medicare)

You can jump right to the market that's right for you with the links above or request your quote right away below.

First, it's probably a good to understand how Kaiser and UnitedHealthcare® are

different.

Lot's to cover there but it may well help you find the best fit for your healthcare needs.

Let's get started.

How Kaiser and UnitedHealthcare®Model Differ (and what it means to you)

The two carriers are taking completely different tacts to the goal of providing health insurance (and health care for that matter).

It will affect your options, choice of providers, and most importantly...your

pricing!

Let's look at each.

Kaiser Model in California

Kaiser is unique in the health insurance market.

They own the hospitals and employ the doctors. The health insurance carrier also provides healthcare.

It's all under one umbrella. This is very different.

Kaiser's model has definite advantages and disadvantages when compared to UnitedHealthcare® (which we'll explain later).

First of all, Kaiser may be the original HMO (Health Maintenance Organization).

The HMO models puts certain limitations on the member with the goal being cost containment (and lower rates!).

With Kaiser, you need to remain in the Kaiser network. You generally have a fair amount of freedom within the Kaiser network but you will need to stay with them (outside of very rare situations).

- Keep in mind that in a true emergency, you'll be taken wherever is closer to get you patched up.

- Beyond emergencies, you need to stay within Kaiser (except for very specific situations).

This then becomes a question of area.

Kaiser has definite focus points for health care. The new facility in Roseville is beautiful.

In some areas, Kaiser doesn't offer coverage at all.

You can run a quote below to see if Kaiser is even available in your area.

What about UnitedHealthcare®?

Let's take a took at their model.

UnitedHealthcare®Care Model in California

UnitedHealthcare® operates in the traditional role of health insurer.

Essentially it's a middle person between the healthcare provider (think doctor or hospital) and the member.

They essentially "finance" the cost of healthcare.

Rather than get hit with a $25K ACL repair, you pay $400/monthly in premium and share the $25K with everyone else. That's traditional health insurance.

Enough with high-level insurance speak.

What does this really mean for you?

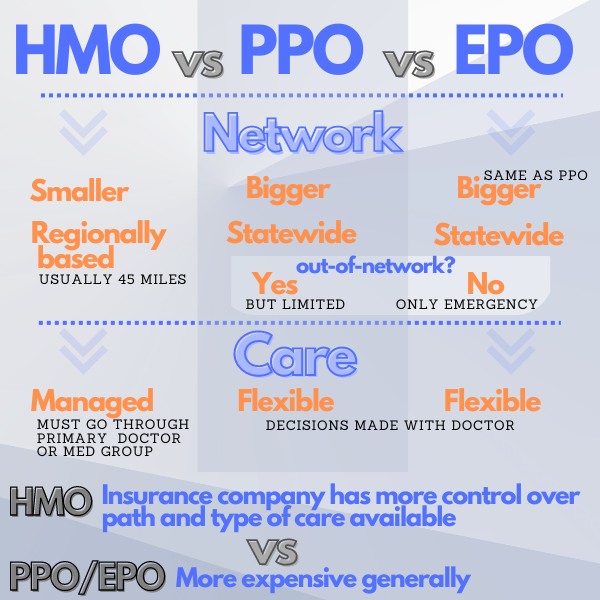

UnitedHealthcare® HMO or PPO Option

With UnitedHealthcare®, you generally have a choice of HMO or PPO models.

The HMO option depends on your area and market.

HMO's generally require more populous areas to thrive.

Let's break down each model before we compare to Kaiser.

UnitedHealthcare® HMO versus Kaiser HMO

UnitedHealthcare® contracts with independent doctors, hospitals, and medical groups for their HMO plans.

You will not be able to use Kaiser facilities if you have UnitedHealthcare® and vice versa, you can't use UnitedHealthcare® contracted doctors/hospitals if you have Kaiser.

It then comes down to which providers you want to use.

- If you have existing doctor relationships outside of Kaiser, UnitedHealthcare® may be the better choice.

- If you like the Kaiser facilities around you, that might be the option. In terms of core HMO functioning, they will be comparable in terms of managing care although Kaiser might manage a bit more on that front.

A quick note on this much maligned "managed care".

What does it really mean with HMO?

Basically, it means that a more prudent (cough cough...cost effective) course of care will be followed in case of a given health issue.

Usually, this is fine. In fact, it may be a less costly approach with better results considering how fast medical providers are to rush to extremes (think medication and surgery).

There are times when people can be frustrated with the hurdles or delays

in trying certain types of care.

Again...this isn't an UnitedHealthcare®or Kaiser affect. It's the HMO model in general.

HMO isn't the only option with UnitedHealthcare® however. What about their PPO?

UnitedHealthcare® PPO versus Kaiser HMO

UnitedHealthcare®is one of the largest carriers in the nation (if not the largest). They offer a full range of options generally when they participate in a market.

UnitedHealthcare® has a strong PPO network in most of its markets.

California is no exception.

With UnitedHealthcare®'s PPO options, you have traditionally one of the strongest PPO list of doctors and hospitals available.

They even navigated the ACA law impacts on networks that we've seen since 2014.

We'll discuss this below in the specific market segments.

By definition, Kaiser can't really offer a PPO since you have to stay within their network.

Call it what you will...it's an HMO...and they're good at it.

Kaiser and UnitedHealthcare® will also offer the full suite of options such as HSA compatible plans, dental, vision, etc.

What about pricing between these three options.

Pricing comparison between Kaiser and UnitedHealthcare®

This is why they are two of the dominant carriers in the most competitive health insurance market.

The are generally two of the best priced carriers in a given area!

This is especially true of the HMO options between the two when available.

Outside of regional HMO's like Western Health Advantage, SHARP, or LA Care, Kaiser and UnitedHealthcare® will generally price better than most other carriers.

Okay...each segment of health insurance is really different so let's look

at the specific strengths and weaknesses of Kaiser and UnitedHealthcare® in the following:

- Individual and Family health plans (age 0 to 64)

- Small Business and Large health plans

- Medicare Supplements (65+) and permanently disabled

You can jump right to your preferred segment.

Individual and Family Comparison between Kaiser and UnitedHealthcare®

This is going to be a pretty short comparison in California right now.

UnitedHealthcare® has largely decided not to participate in the individual market including Covered California.

They briefly came into the market after 2014 and subsequently left the following year.

Make sure to run your quote here to see if there are updated UnitedHealthcare®options off or on-exchange but as of this writing, UnitedHealthcare® is not available to individuals and families.

Kaiser on the other hand is a dominant player in the individual market. Roughly a third of this market!

They also fully embraced Covered California.

Kaiser's place in Covered California

Kaiser is one of the top three carriers on and off-exchange in California.

Anthem Blue Cross and Blue Shield of California round out this group.

Since the plan benefits are standardized now due to Obamacare, it becomes a question of pricing and network.

Kaiser is one of the leaders in terms of pricing on the individual family market.

In a given area, they are usually hard to beat aside from regional HMO's such as Western Health Advantage, Sharp, Molina, and LA Care.

That brings us to the second piece...where Kaiser is very different.

The Network

As we mentioned above, Kaiser is an HMO which means you must use their doctors and facilities.

- There is generally no coverage outside of this.

- As an HMO, the care is generally more managed.

This means that the carrier helps make decisions on what health care is provided and how.

So how do individuals decide on whether Kaiser is right for them?

Key considerations:

- Do you have doctors/facilities outside Kaiser that you want to continue to see

- Do you want more say so in what course of treatment you will take in consultation with your doctor (EPO or PPO then maybe??)

- How much flexibility do you need when travelling both within California and throughout the US

All these factors are really a function of the HMO model more than being specific to Kaiser.

You can quote Kaiser plans against UnitedHealthcare® (once they come back on the

market) side by side here:

Let's look at Small and Large Business comparisons of the two carriers.

Business health insurance comparison for Kaiser and United

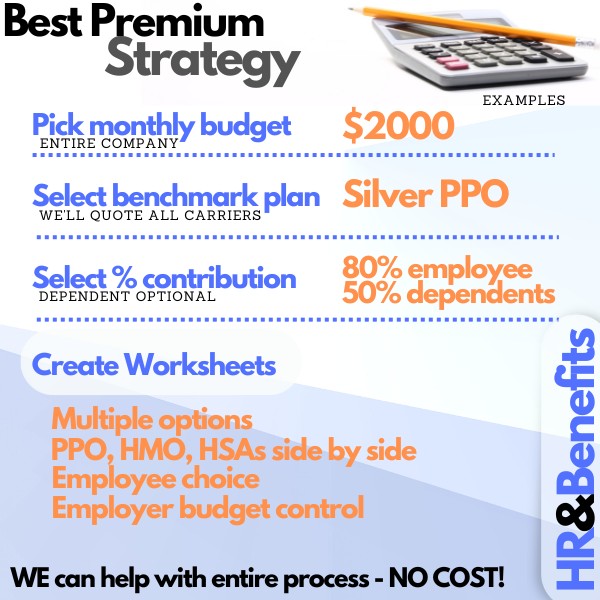

We'll first compare the two carriers but a quick note...we may not have to choose!

We'll explain this later.

Small business (1-100 employees) and large business (100+ employees) is where these two carriers really go head to head.

They are both top 3 carriers in terms of marketshare and competition is fierce!

Let's look at the two of them by these categories:

- Pricing

- Network

- Customer Service

- RX

We'll start with what's on everyone's mind. Pricing!

Pricing

There's a reason these two carriers are so dominant for business health insurance.

They both offer some of the best pricing to employers consistently.

In a pure head to head, Kaiser is going to be hard to beat.

UnitedHealth generally comes in second in cost behind Kaiser for HMO.

If cost is our only driver, Kaiser is probably the winner.

With the state of health insurance costs, there are many employers in this boat...or the boat sinks!

So for HMO, Kaiser is cheaper (generally) although UnitedHealthcare® does have some narrow network HMO plans which are right there in terms of pricing.

For PPO, UnitedHealthcare® is the only real option since Kaiser is primarily an HMO provider.

You can find more information on how to compare HMO's and PPO's.

You can also get your free personalized Kaiser and UnitedHealthcare® Group quote

here:

That brings us to the big differentiator...network!

Kaiser versus UnitedHealth group networks

Here's where the two differ materially and this may be THE key deciding factor.

With United, you can offer PPO's and HMO's side by side which contract with individual doctors, medical groups, and hospitals.

For certain areas, Kaiser's not even an option because they don't facilities/doctors there.

You'll find this is more common in rural areas.

HMO's need big populations to work correctly.

In that case, UnitedHealthcare® is the clear winner since they will contract with doctors and hospitals in your area.

Let's now talk about our secret weapon.

The Kaiser "Wrap"

This is very popular. For good reason!

We can essentially offer Kaiser and UnitedHealthcare®options side by side!

We can even base the funding on a given plan in the Kaiser suite.

Let's think about this.

- For employees that want Kaiser or who are very price sensitive, they can pick Kaiser.

- For employees that have existing doctors that they want to keep, they can pick United.

We can actually offer a suite of plans from each carrier to EACH employee.

That's the employee's side and it's great news.

What about the employer?

Even better.

We can base the employer's contribution on any plan from either carrier.

Why does this matter?

Kaiser is generally cheaper (although United's narrow HMO network is real close).

Let's look at an example.

- Employer A bases their contribution on 70% of the Kaiser Silver HMO plan.

- Employee A chooses the Silver plan (from a list of different options preset by employer) with Kaiser.

That's easy...he/she pays 30% of the Kaiser Silver plan (pre-tax if we set up POP 125).

- Employee B choose the Silver plan from UnitedHealthcare®because he/she has a life-long doctor in their network.

- The UnitedHealthcare® plan is $50/month more than the equivalent Kaiser plan.

No problem.

The employer's contribution is still based on what the Kaiser plan would have been.

The employee pays 30% of the Kaiser plan plus the additional $50/month for going with United.

In this case, it was more important for the employee to pay $50 more and keep their doctor.

Everyone wins.

The employee has choice. The employer has budget control.

We highly recommend the Kaiser Wrap with UnitedHealthcare® for many employers...especially as a company grows.

It's hard to please everyone with a larger group of people.

We're happy to walk through all the various options and ways to save regardless of carrier including tax credits, pre-tax employee contribution, and more at 800-320-6269 or at help@calhealth.net

You can request your Employer quote for both UnitedHealthcare® and Kaiser group plans here.

Medicare comparison for UnitedHealthcare® and Kaiser

Medicare gets a little interesting when comparing these two giant carriers.

It's important to understand the difference between Medicare Supplements and Advantage plans first.

We'll give a quick review but you can always find out more information on Medicare supplement versus Advantage here.

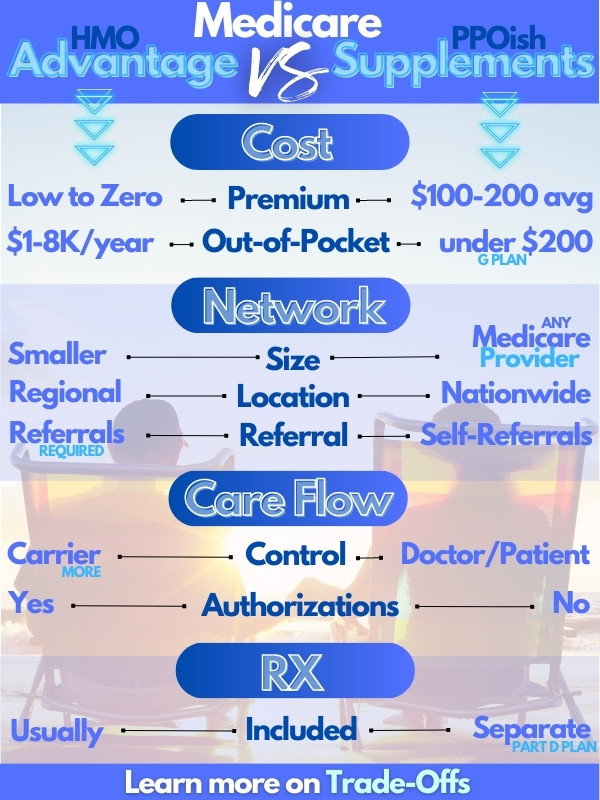

Advantage versus Supplement

- Medicare supplements are best thought of as the PPO of the Medicare world....Any Medicare provider nationwide

- Advantage plans are the newly repackaged HMO for Seniors.

Here's a quick bullet list comparison:

Why is that important in the Kaiser vs UnitedHealthcare® comparison?

Kaiser is an HMO and therefore, their senior plans are primarily in the Advantage category.

Again, it comes down to whether you want to use Kaiser facilities exclusively.

If so, Kaiser Advantage can be low or no cost options.

If you want flexibility in who you see and to have access to Medicare doctors anywhere in the US, supplements work better and that would be UnitedHealthcare® (between these two carriers).

UnitedHealthcare® also has its own Supplements and Advantage plans private labeled.

So...how do we compare with all these interesting little twists and turns.

Here a simple approach:

- Network - Are you okay only being in Kaiser facilities? If not, that answers the question.

- Pricing - Run your quote for either Supplements or Advantage plans here. You'll likely find that they are comparable in pricing. We can run a separate UnitedHealthcare® quote which requires some additional info (smoking, etc). Request UnitedHealthcare® quote here.

- Flexibility - If you want more control over medical choices and doctors can see, supplements will be the better option.

You'll see that many of the considerations between Kaiser and UnitedHealthcare® are really proxy decisions between Supplements and Advantage plans and/or choice of providers outside of Kaiser.

This makes sense!

The two product types are very different and people generally have a strong preference for one or the other!

Medicare can be complicated!

The Advantage plan versus Supplements is really the first question since Kaiser is an HMO carrier. Shield has both Supplements AND Advantage plans.

You can quote both types of plans here (we'll send link for doctor/RX and "opt-in" required by law to quote Advantage plans):

You can get more info on how supplements are different from Advantage plans.

Advantage plan Deciding Factor

For Advantage plans, it's a question of who want to see - Kaiser providers or independent doctors/medical groups.

You can quote both options and both carriers below but we're happy to help with any questions.

Kaiser versus UnitedHealthcare®Comparison Wrap Up

So we've looked at two of the dominant California carriers side by side and for different market segments.

You'll see a recurring theme in each market.

NETWORK!

Kaiser owns the facilities and employs the doctors.

Aside from pricing, your thoughts on their facilities and the HMO style of health plan usually swing the decision between the two.

For Individual/Families, it comes down to pricing versus flexibility and doctor choice.

For Employers, we don't have to pick! We can have the best of both worlds!

For Seniors, it comes down to Supplement versus Advantage plans and choice of doctors.

In the end...is pricing versus network.

That's a good approach to comparing these two.

Of course, we're happy to walk through the finer points (and there are plenty) between these two carriers for Californians.

It's fast, easy, and free to you since we're Covered Ca Certified Agents.

In the meantime, Happy Comparing!!

Call us at 800-320-6269 and we can go through any questions or run your instant Quote for Kaiser and UnitedHealthcare® individual and family here. Thanks!

.jpg)