California Medicare Options - How to Compare Alignment Advantage plans

How to Compare Alignment Health Advantage Plans in California

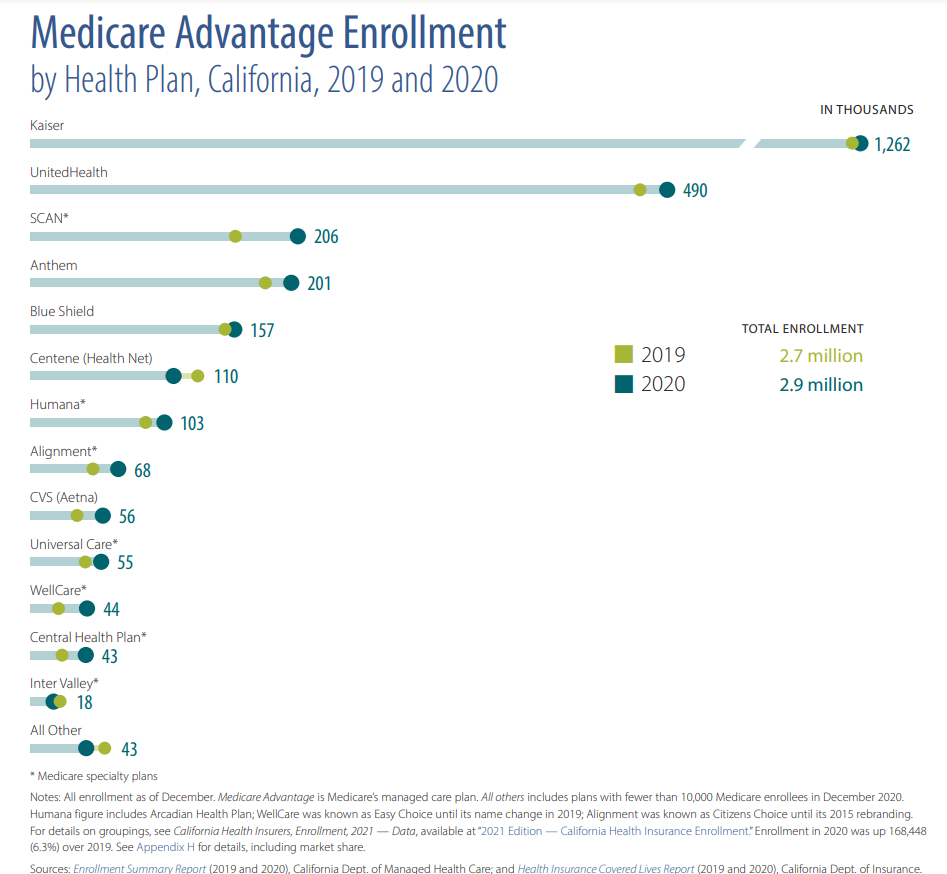

As we discussed in our Alignment Review, they're quickly making waves in California!

We work with most of the big Advantage plans but they are one of our favorites just because every interaction we've had with them has been smooth.

This shows in their Star Ratings with clients as well.

The bigger driver of their success also seems to be driven by the networks they've managed to attract.

Whether it's Optum down in LA or PAMF and Sutter up north, it's impressive and speaks to a level of trust these large networks have in them as an up-and-coming carrier.

First, our credentials:

So...how do we compare all their plans?

Let's get into it with the following:

- A quick introduction to Alignment plans

- The Platinum+ Instacart plans from Alignment

- Part B Rebate plans with Alignment

- Alignment Heroes plan for veterans

- One+ RiteAid Alignment Plan

- MyChoice versus MyChoice Calplus

- AVA PPO Alignment plan

- ESRD, Heart, and Diabetes Alignment plans

- How to quote Alignment's plans

- How to apply for Alignment's plans

Let's get started!

A quick introduction to Alignment plans

First, we need to understand that all parts of California are not the same when it comes to healthcare delivery. LA county is not the Bay Area and neither are San Diego. Alignment understands this and has offered specific plans targeted to different areas.

For example, they have a specific plan just designed for Sutter health up north (more on Alignment health for Sutter). This is a huge deal for PAMF and Bay Area over to Sacramento where Sutter is a powerhouse.

In other areas, you'll see specific add-on plans to their core offerings, and not all plans are available in every area. We'll focus on the most competitive area which has their core plan offerings. Keep in mind that you should run your specific quote to see plans available in your area.

So...let's use Los Angeles as our template.

See...we really do want to help people understand this stuff and get the best value. We ranked those by popularity and cost value with a few exceptions we'll discuss below.

Let's walk through them in this order. A few quick tips to really get the most out of it:

- Star Rating is critical and aside from the PPO plan, they all have 4 stars which is fantastic.

- The max is really important if you have very large bills; keep an eye on it.

- Instacart is a grocery delivery option if you have chronic illnesses.

- Part B rebate means the plan will contribute towards your Part B premium made to social security; 2 different levels.

- Doctor networks can be different so it's very important to put your doctors AND medications/dosages in the quote and then sort by "Total Estimated Cost".

- The max for the C-SNPs is a bit confusing. Although it may say $8850, there can be sharing of this exposure with Medi-Cal on the 039 plan.

- They all have a FlexCard benefit which allows you to buy over-the-counter items - very popular! Up to $215/quarter of found money!

- Some plans have up to $300/year in caregiver assistance.

Let's get to it!

The Platinum+ Instacart plans from Alignment

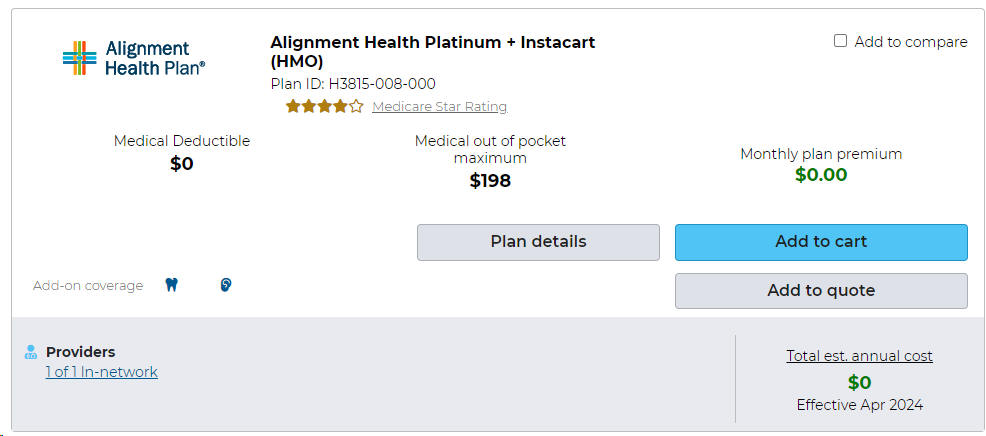

First off, we see the Platinum+ Instacart. This is their most popular plan!

"Instacart" gives it away - it has a very popular grocery delivery add-on benefit. Here are the details:

- Qualifying chronic conditions include: congestive heart failure, chronic obstructive pulmonary disease, dementia, diabetes, and stroke. Other chronic conditions may apply.

- $100.00 limit every 3 months (no rollover) through Instacart.

So, grocery delivery at $400/annually if you meet the requirements for chronic illness. This is a huge benefit and very helpful for seniors who have trouble getting to the grocery store!

Especially in today's world where groceries are through the roof.

The bigger draw for us is the zero premium and $198 max-out-of-pocket. That's one of the lowest (if not the lowest) on the market. Anywhere in the State.

You know from our Triple Threat selection guide this is 1/3rd of the decision.

Part B Rebate plans with Alignments

This is basically found money and for people with a higher Part B premium (paid to Social Security either by auto-deduction monthly or usually quarterly) can be a huge savings.

You have to compare that against the higher max out of pocket!

Meaning if you expect very high healthcare costs it may not pencil out versus the Platinum+ Instacart or MyChoice (plan #1 and 2).

The smaller rebate is $50/month so roughly $600/year on the AVA+ Instacart.

But our max is going up to $2K with the AVA+ Instacart. Add in the $400/year in groceries though. Starting to look good if we have okay health costs expectations.

One note—the AVA speaks to Alignment's push for telehealth benefits first. It's short for Alignment Virtual Application.

The goal of AVA is to anticipate care needs so that members don't end up having bigger problems and we'll watch to see how it works over time. May be a game changer with AI tech coming online.

We can also change end of each year to better fit ongoing health care needs.

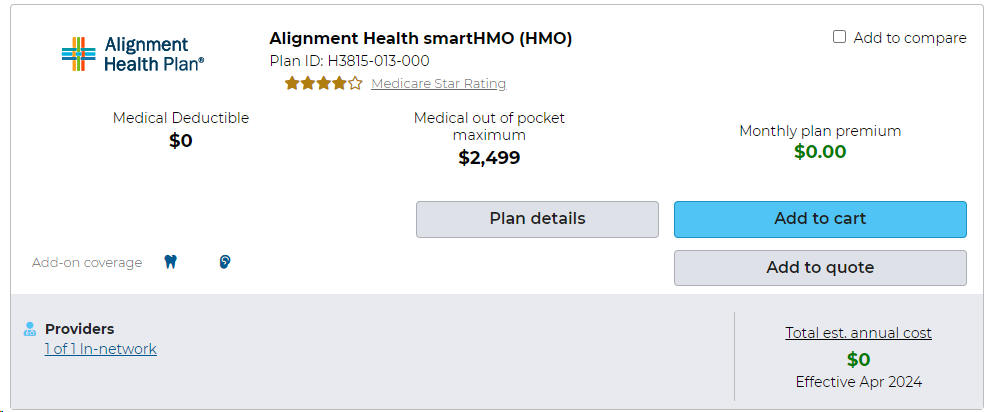

The second most popular plan though is the SmartHMO which has a $164.90/month Part B rebate. That's almost $2K/year!

Compare that versus the difference in max IF you expect bigger bills. For many people this is a good fit.

IMPORTANT NETWORK NOTE:

Most of the Alignment plans have the same networks but the SmartChoice network is smaller.

Some groups like Optum, Heritage, and Regal will not participate with the SmartChoice for now.

Run your quote below and enter your doctors!

Next up...for our veterans (Thank you in advance; there's no U.S. without you!)

Alignment Heroes plan for veterans

This plan is not one of our favorites for sheer benefits.

On one hand, some benefits are richer if you have veteran status but you really need extra help status (Medi-Cal or LIS) and/or chronic illnesses to get the most out of it.

These extra rich benefits offset the max-out-of-pocket IF you have that status.

If you don't get extra help (LIS) or don't have chronic illnesses, we like some of the other plans better. Just our 2 cents!

One+ RiteAid Alignment Plan

This is an enhanced plan based on a relationship with RiteAid.

Basically, if you use RiteAid for your pharmacy with this plan, you'll get richer RX benefits!

This is critical if you have a heavy medication burden (who doesn't these days).

Make sure to enter your exact medications/dosages and preferred pharmacy of RiteAid to see how this swings your "Total Estimated Cost". You should see this plan rise to the top as a result of the pharmacy selection.

Just a head's up...this isn't a terribly popular plan with that higher max out of pocket. Platinum+ or SmartChoice feels better to us.

MyChoice versus MyChoice Calplus

So what does the "CalPlus" mean in a plan title?

This basically speaks to getting extra help. LIS or Medi-cal.

If a person has this eligibility they can qualify for richer benefits.

The max-out-of-pocket is higher but this can be offset by the additional help which speaks to the $3000 versus $498 (MyChoice Calplus versus MyChoice).

We'll look below at how to quote these plans correctly to get the best rates.

You'll notice "CalPlus" is in the Veteran plan title as well.

AVA PPO Alignment plan

This is Alignment's attempt at offering a PPO style Advantage plan.

The AVA tells you it's a plan that pushes telehealth first so just a head's up.

The Star Rating is a crusher there. It just goes to show that PPOs don't really work well in the Advantage world.

You're trying to get a duck to walk like a cat (terrible analogy but you get the picture).

People are better off with a Medicare supplement if they really want the flexibility and control of a PPO (see Advantage versus Medigap).

Sure, we can get halfway to a PPO plan with no premium but our max exposure for big bills is much higher and it's not really going to feel like a PPO. By definition, Advantage plans are best suited for HMOs.

Haven't seen a carrier do one well yet according to the Star Rating which reflects what their members actually feel about the plan.

Finally, the CSNP plans. Chronic illness.

ESRD, Heart, and Diabetes Alignment plans

These are plans that have richer benefits and coordination if you have chronic health issues.

The Star ratings are high which is a good sign (people are happy with how they work).

You'll notice the "CalPlus" has a much higher max out of pocket. Isn't that a big no-no in our world?

Actually, this plan (and Veterans plan) assume additional help from medi-cal for people with chronic illness so this the max is less of a concern.

When you run your quote, you can click on:

This will show you the plans for chronic illness and medi-cal richer benefits.

Alignment in other areas (Northern California being a big one).

We looked at LA county specifically and Alignment shares some of these core plans across the State but they're sharp.

They'll add in plans specific to the area and some of these are really popular.

Their Alignment Sutter plan is a very popular option!

PAMF and Sutter networks across the Bay Area over to Sacramento can be the game in town (outside of Kaiser) for healthcare.

So...Alignment built a plan...just for Sutter. More on the Alignment Sutter plan. This speaks to their rising reputation for Sutter (a powerhouse network) to allow this relationship.

It's not called Aetna Sutter!!

So...run your quote to see what goodies might pop up in addition to the key plans above. Of course, we're happy to walk through it.

Goodness. We did it and we're only mildly confused now!

That's where we come in. There's zero cost for our assistance and we do not push or sell. In fact, we'll give you the ability to quote all these options (alongside other dominant carriers like UnitedHealthcare®) below with no hassles.

We don't even hound you on the phone but you can always set up a chat to go through questions here:

https://calendly.com/dennis-jnw

Enough of our jabbering. Let's get to your quote.

How to quote Alignment's plans

You can run your personalized Alignment plan here (we don't even "capture" phone numbers). You're in control here.

A few notes to get the best quote:

- You can "filter" for Alignment on the left or keep it open.

- Filter up top by "Total Estimated Cost". This looks at both premium and your medication costs.

- Enter your exact medications/dosages.

- Enter your preferred pharmacy. If available, select RiteAid to see if that helps with that specialized plan.

- Enter your doctors so that the system will rank these higher.

- If you have Medi-Cal or get additional help OR if you have chronic illnesses, select the "Add All Special Need Plans" up top.

That's it! The system will rank the plans by total expected costs.

Need extra help from a Google 5 Star Alignment agent? Hello. How can we help?

help@calhealth.net or set up a time to ask questions and not get bullied into a plan that doesn't work for you: https://calendly.com/dennis-jnw

Seriously...there's enough of that nonsense out there already.

What if you know what plan you want?

How to apply for Alignment's plans

This is easy, from the same quote system and link here, just "Add to Cart" and enroll!

It's all:

- Online

- Secure

- Free

It ties directly into Alignment's enrollment system so you'll get the fastest processing with a simple interface.

We're most impressed with how easy Alignment has made their enrollment application.

This matches everything else we've seen with them and that speaks to this! Among giants.