California Medicare Options - How to get $144 month back from Medicare

How do you get $144 a month back from Medicare

This is a question we get often and luckily there's an answer we have for them.

This question usually refers to a specific type of Medicare Advantage plan called a Giveback plan.

We have a big guide of Giveback plans explained but let's give a quick explanation to the $144 a month question.

Our credentials are here:

Here's what we'll cover:

- How do you get $144 a month back from Medicare

- Comparing how much back different plans give

- Are the Giveback plans legit

- How to quote and apply for the $144 back plans

Let's get started!

How do you get $144 a month back from Medicare

Let's explain how this really works.

Medicare Giveback Advantage plans have an additional benefit where the carrier will pay part of your Part B premium up to certain amounts.

Part B is the premium you pay each month to Medicare (Social Security technically) to cover doctor costs.

This amount goes up each year and runs around $174/month. It can differ depending on your prior year's income, up or down.

Part B is incredibly important since there's no cap to the 20% that Medicare doesn't pick up for doctor costs. We looked at the downside to only having Medicare.

So how does the process actually work?

You would usually pay (let's assume the full amount) of $174 to Social Security. It's either deducted monthly from Social Security (most common) or you get a quarterly bill.

If you're on a Giveback plan with let's say $100/month benefit, your Social Security bill would be reduced by maximum of $100.

So...

- Part B premium = $174

- Giveback benefit = $100

You'll see a deduction of $74 instead of the $174 if you're getting the monthly deduction.

Still money in your pocket even if not being sent directly to you!

Why the $144? Part B goes up each year with inflation and the $144 refers to the original amount when these plans came on the scene.

In 2024, we're not at $174.70 (and it will continue up each year).

Are there plans that cover the full Part B premium? Let's go there now!

Comparing how much back different plans give

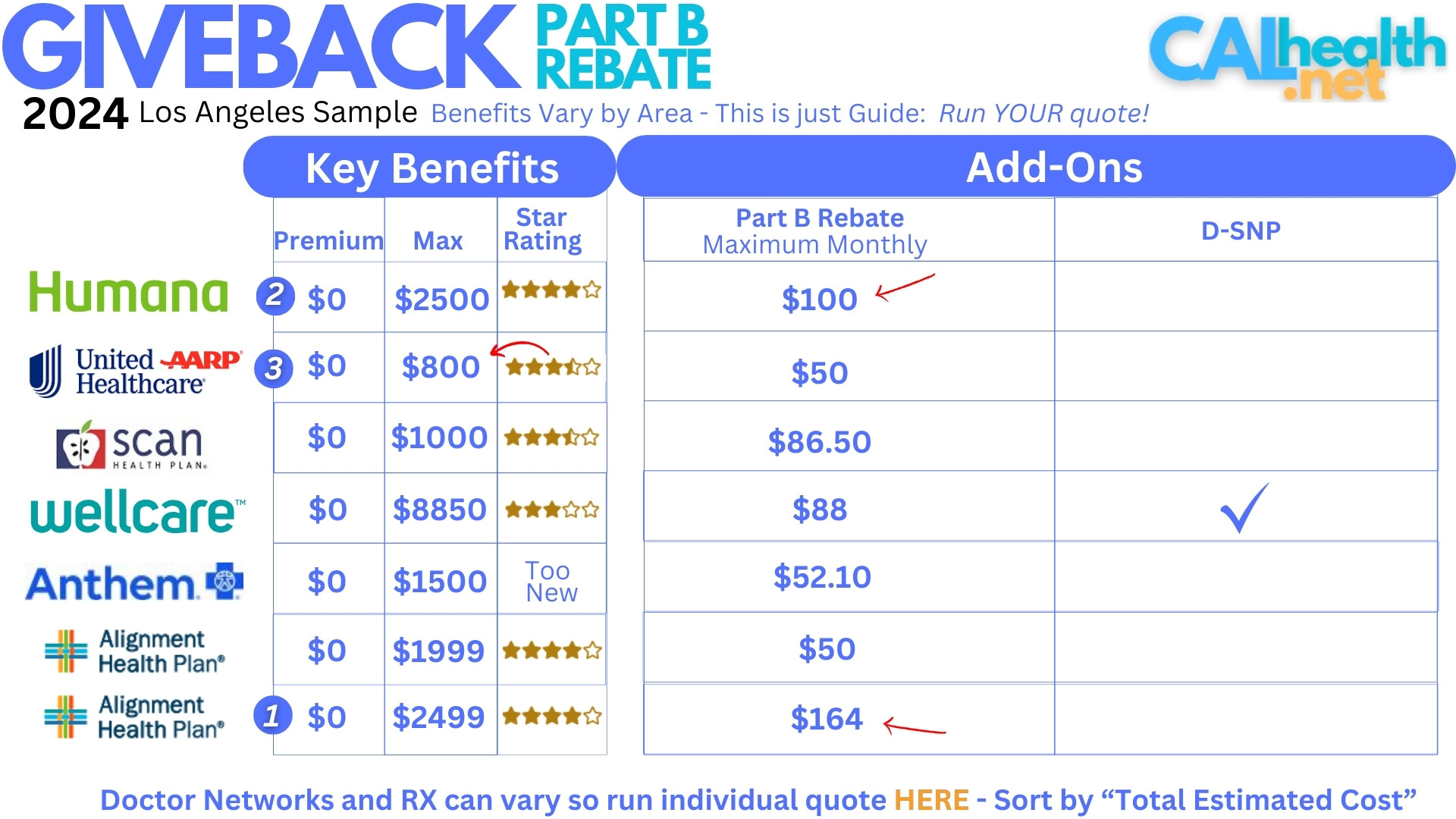

We have comparison of Giveback plans with more detail but let's take an example from Los Angeles:

You see a wide spread of actual Giveback benefits from the different carriers.

The monthly range is from $50 to $164

This makes sense since the Part B premium can differ quite a bit based on income.

If you're only paying $50/month in Part B, it doesn't make sense to go higher than that aside from other considerations (which we'll discuss below).

You do not get the extra giveback benefit above what your Part B is.

We can see that Alignment has the highest giveback benefit at $164/month which is just under $2000/year!

That's a big reason it's so popular these days but we need to still consider the other important aspects of a Medicare advantage plan.

What's the point of getting money back if it doesn't work well for actual healthcare.

Let's turn to another question we get.

Are the Giveback plans legit

The Giveback benefit is great but what about everything else?

After all, Advantage plans are health insurance plans first and foremost.

We have a huge guide to Advantage plans and how to Compare advantage plans.

To simplify things, we can rest on our Triple Threat strategy:

- Star Rating

- Out-of-Pocket Max

- Premium

Really, the Star Rating is our key factor. How do current enrollees feel about their plan.

It's on a scale of 1-5 with 5 being the best. 3 is pretty average and a ½ a star difference can really matter.

We can see that the Alignment plan above is 4 star which is very solid.

The other piece that really matters is networks! What doctors and hospitals you're able to see. That same Alignment plans has a smaller network which is the trade-off.

In that case, Humana or UnitedHealth might be a better option even though the Giveback benefit is lower.

We're happy to walk through the Giveback options at help@calhealth.net or via chat here: https://calendly.com/dennis-jnw

How do we check our doctors and medications for that matter?

Next stop.

How to quote and apply for the $144 back plans

We make this free, secure, and fast here:

To see the Giveback plans where you get money back from Medicare, select "Part B Rebate" on the left.

Then, under preference, add the following:

- Your doctors and hospital

- Your medications and dosages

- Your preferred pharmacy

Sort up top by "Total Estimated Cost" to take into account your medications.

We can help compare the different facets:

- Giveback benefit from Medicare

- Out-of-pocket Max

- Networks

There's zero cost for our assistance and hopefully we've shown you how to get $144 (or more) back from Medicare in a time we can all use the extra money.