California health

insurance

-

California Group health insurance

-

Does company have to offer benefits?

California health

insurance

-

California Group health insurance

-

Does company have to offer benefits?

Does a Company Have to Offer Health Insurance in California?

It's a good question and there's plenty of confusion.

10,000 pages of the new ACA law requirements do not help matters.

So what are the requirements for California companies when it comes to offering health insurance to employees?

We'll look at what is required.

What makes sense.

And what you should absolutely avoid doing (unless you love lots of IRS attention).

First...our credentials please:

Of course you can always quote all major carriers side by side here at no cost to you!

Let's get started.

California employer requirements for health insurance

Under the current ACA law, there's a dividing line based on the size of your company.

First, a note on how to calculate your "size".

The law speaks of "full time equivalents".

This means that we add up the # of full time employees (30+ hours per week)

PLUS

The equivalent # of part-time employees.

For example, if we have two part time employees who work an average of 15 hours, that's the equivalent of 1 (ONE) full time employee.

What does this mean?

For one, you can't drop all your full time employees down to part time and avoid requirements.

Also, you could have a lot of part-time employees and still trigger the requirements for coverage (but only for full-time employees). We'll discuss this later.

Net net...part-time employees matter towards our total calculation.

Find more info on what options you have for part time employee health insurance.

So what's the magic number?

50 Full time equivalent number for health insurance requirements

If you have fewer than 50 full time equivalents as an employer, you do not HAVE to offer group health insurance.

Before you breath a sign of relief, let's look at some reasons why you may WANT to offer health insurance to employees if under 50.

The vast majority of companies that offer group health benefits do so not because they have to.

They see the benefit in doing so and there are tricks to keep the costs down.

Before we get into the requirements for 50+ employee companies, let's look at the key reasons most companies offer coverage.

It's tax deductible!

This is a huge advantage to group health coverage. The employer can write off the premiums paid.

With a POP 125, employees can pay with pre-tax money for their share and the employer can save on payroll tax.

You can generally cannot deduct employer contribution towards an employee's individual health plans.

In fact, there can be huge penalties from the IRS for doing so.

$100/day/employee up to $36,500 per year.

Read that again!

It's definitely a message from the IRS that they mean business.

UPDATE: We can structuree the group plan so that it doesn't mess up Covered Ca tax credits for employees that are eligible AND their dependents! Check with us on this strategy here

Many California employers still contribute to employee's individual plans without a QSEHRA exemption and they're running a risk by doing so.

It's highly valued by employees

Even if a company is only paying 50% toward the Bronze level plan, the employee feel taken care of.

The cost to vet, hire, and train employees is a significant cost.

More so than the health insurance premium paid.

And here's what I heard from one of our clients about offering insurance.

"I can't afford to lose my most important employees...the ones that really care about their work. They're the ones that can move to another company for benefits...and they WILL!"

The goal is to attract and keep the best employees. We all know they're hard to find.

Employer health benefits are essential to this end.

Bad healthcare can affect moral, productivity, and business success

If your employee can't get physical therapy after a accident or needed meds to prevent a large health issue in the future, that's going to affect your day to day business.

Almost every employer has a story.

We won't spend to much time on this but you can see the core reasons that employer offer group health insurance even when they are not required to.

Let's look at what the law says about employers with 50+ full time employee equivalents

Requirement for California companies with 50+ employees

This is where we actually have some new requirements.

It's more a question of avoiding a penalty but the penalty plus the tax deductibility of health insurance definitely makes it advantageous to offer coverage.

Under the new ACA law rules, a company with 50+ full time equivalents has to offer ACA compatible coverage to full time employees or face a penalty.

The penalty for not offering coverage is $2K per eligible employee.

A few notes:

- Coverage is not required for part-time employees (under 30 hours weekly)

- Coverage is not required for dependents

- The coverage must meet the Bronze level at a minimum or other penalties apply

- The employer is required to fund at least 50% of the employee's premium

- The penalty generally applies after the 20th employee

- Requirement to offer ACA health plans to Employees

What if you offer a scaled down health plan, sometimes called a MEC (Minimum Essential Coverage) plan?

In this case, there's a $3000 penalty for each employee that gets a tax credit from the Exchange since your plan is not ACA compliant.

What makes the most sense...offer a MEC, ACA health plan, or no coverage (and pay the full penalty)?

It completely depends on your company's situation.

We can run the quote for your situation here:

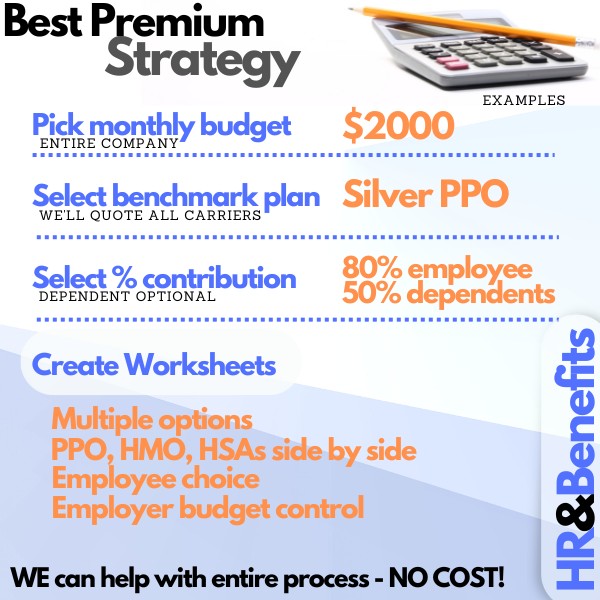

What we consistently see as the best outcome financially and in terms of employee morale is the following.

Best option if you have have to offer health insurance to employees

A couple of considerations before we jump into the option.

- Group health insurance is 100% deductible to the Employer

- A POP 125 cheaply allows employee's contribution to be pre-tax

- A company can fund just 50% of the Bronze plan for the employee only or $100/month

Okay...so based on those three points, here's the plan.

We first run a quote across all carriers at the Silver or Bronze level to see who is priced best for your company's situation.

There are even skinny network options which can reduce premiums by 10-15%.

- Once we have the best priced plan at a given level (say Bronze), we can run worksheets for each employee.

- The worksheet will show the cost to them based on employer contribution of 50% towards bronze plan.

- The employee can then pick and choose from any of the levels and pay the difference with pre-tax dollars.

Here's the deal...

50% of the bronze plan averages about $200/month for the employer depending on age/area.

That $200 is fully tax deductible so based on average of 25% bracket, let's say the real cost after tax is $150.

That's not bad. $150/month/employee to offer ACA compliant coverage.

Furthermore, if we were subject to the penalty, that's $180/month in penalty ($2K annually).

Now we're actually saving money by offering coverage!

Your company's situation will be different but the same mechanisms apply.

Let's look at the employee's point of view.

They will pay $200 if they stay on the Bronze.

but...

They will pay with pre-tax money with the POP 125.

Average savings of 25% (and the employer saves on payroll tax) so the real cost is $150 for the employee. They avoid a separate penalty for not having coverage of 2.75% of income.

At $40K salary, that's $1000/year or $80/month.

We're now paying roughly $70/month for full coverage ($150 - $80).

Here's the beauty of the setup.

Let's say an employee has significant health care costs and wants a richer plan.

Fine. They can go up to the Silver, Gold. or even Platinum level coverage.

The employer's contribution remains based on the Bronze ($200 in our example above) and the employee pays the difference with pre-tax money.

Of course, they're only going to do this if it makes sense financially to them.

This is the best of both worlds.

Employer caps exposure for health care costs while the employee can pick according to his/her health care needs and budget.

If an employer has to offer health insurance, this is the way to do it!

We can offer this mini-cafeteria plan for small and large companies.

Related Pages:

Small Business Health Quote With Tax Credit Calculations

Individual Family Plans for Employees without Group Health Plan Quote

Call us at 800-320-6269 and we can go through any questions you have. It's what we do all day long. Thanks!

.jpg)

.jpg)

.jpg)

.jpg)